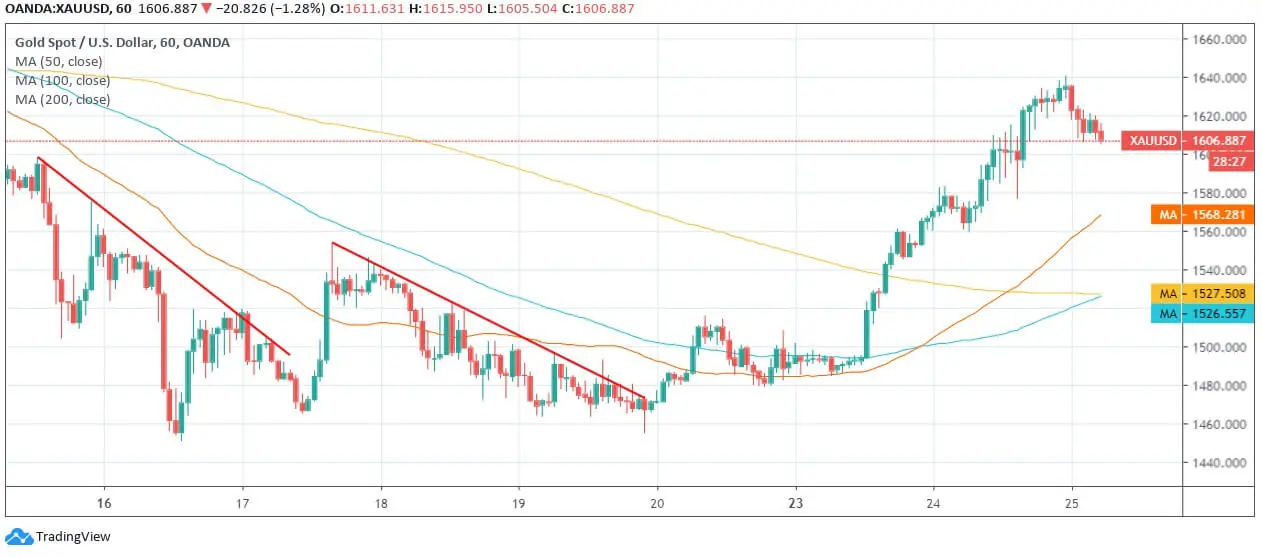

Gold/USD Analysis: Gold Experiences an Intraday Pullback Yet Remains Above $1,600

- Gold reverses a 3-day bullish crossover as it fell below $1,640 in the early Asian trading hours and is slaying around $1,606.941, at the time of penning down

- Impressively, the safest haven tried to regain its position as it spiked by 10.5% from $1,484.714 to $1,640.514 in a period of 2 days

- A move below $1,600 can create a massive sell-off as the last resort tumbles

Gold continues to extend its fall against the US Dollar and hits below a two-week resistance at $1,640 in the early trading hours on Wednesday. The downtrend was quite imminent in the previous week when the yellow metal tested support at $1,450 on March 16, 2020. This week opened with a bang for the safe-haven investors as it drew a 10% hike and regained support from 50-day, 100-day, and 200-day moving averages.

Nonetheless, the other investing avenues are also attempting to turn green as Wall Street and Asian markets rise marginally. This remarkable after 2 weeks of ugly crossovers is due to the US Federal Reserve’s announcement to take unprecedented measures to support amidst the ongoing global crisis which has reeled from the coronavirus pandemic.

However, the intraday turned up to be a loss-making spot today in the early hours as the liquidity prioritizes to combat the ongoing situation. Moreover, the experts predict that Gold is likely to remain volatile in the upcoming weeks as the series of unconventional policies will continue to roll-out to fight the global pandemic—Coronavirus. Alongside, there are many countries that are facing a complete lockdown which is rightly hitting the trading volumes and demand as “Cash Remains the King.”

However, the intraday turned up to be a loss-making spot today in the early hours as the liquidity prioritizes to combat the ongoing situation. Moreover, the experts predict that Gold is likely to remain volatile in the upcoming weeks as the series of unconventional policies will continue to roll-out to fight the global pandemic—Coronavirus. Alongside, there are many countries that are facing a complete lockdown which is rightly hitting the trading volumes and demand as “Cash Remains the King.”

Amidst all the volatility that the world is facing, we cannot ignore the winning streak of Gold in the global markets as it rose above $1,450 and $1,550 range. A persistent stay above $1,600 is yet so bullish until it pulls back to test support at $1,600 or below. We also cannot ignore the fact that Dollar is becoming the most demanded asset in lieu of liquidity which is leading to a selling pressure of the liquid metal.

With this a Goldman Sachs analysts, with a 12-month price target of $1800 an ounce, said,

it is about to change, thanks to the Federal Reserve’s aggressive bond purchase plan unveiled on Monday, in which the U.S. central bank said it would buy as many Treasury’s and mortgage-backed securities as needed to keep financial markets running smoothly.