24option Review 2023

24option has been managed by Rodeler Limited, a Cyprus-based Investment Firm. It is regulated and authorized by the Cyprus Securities and Exchange Commission. They have included both CFDs and Forex trading to their offering and extended their client service to manage the large investing portfolios. Even though they continue to offer existing customers binary trading, their attention is currently on CFD and Forex trades. This incorporates Bitcoin forex sets as well.

What is 24option?

-

24option was established in 2009 as a mainly binary options broker, and it is based in Cyprus and Belize currently. 24option provides its traders access to Forex currency pairs, stocks, CFDs, indexes, and commodities for trading.

-

When it was established, one of the main products offered by the broker is binary options. Currently, this broker has its focus on CFDs and several other ranges of assets, which include major, minor Forex currency pairs, major stock market indices, US technology, and bank stocks.

-

Traders who are used to forex trading by using Metatrader 4, can use this platform to trade currencies. 24option also owns a trading platform and an excellent mobile app for the traders to use trading interface options. Moreover, this broker offers a leverage ratio of 400:1 for forex pro traders and provides several currency pairs.

-

This broker offers 4 different types of accounts and a wide range of account sizes for trading and service needs. The account managers need to evaluate the type of account that will suit the client’s needs and offer them.

Few of the pros and cons are discussed below –

| Pros | Cons |

|

|

|

|

|

|

|

|

Features

- This broker offers CFDs, FX trading to seasoned traders and beginners and offers education to trade successfully. This broker was established in 2010, and it offers traders comprehensive training, faster account verification, 24-hour support, quick record check, and individual account managers.

- This broker provides more than 100 assets to trade, which includes CFDs, currency pairs, popular stocks, Binary options, major commodities, cryptocurrencies, and indices. Additionally, the site and client support is multilingual and is accessible on a 24/7 basis, where they solve any trading problems.

- The brand is a universal business, which provides multilingual help in different languages such as English, Italian, and Spanish.

- This site has a wide range of educational training resources taking into account traders at all experience levels. These incorporate updates in regular markets, eBooks, educational videos, and the trader manual for beginners to get started.

- Furthermore, 24option permits Copy trading to follow the trades executed by the winning traders.

- This broker provides the traders the opportunity to trade anytime, anywhere through their innovative platform named Scipio, or MetaTrader 4 or either through the desktop or through the downloadable application; furthermore, it also offers traders a 24option application to make sure they are constantly connected.

- After registering on the platform, and after completion of the financial knowledge questionnaire, the traders can now have access to a 10K funded demo account that exhibits all features accessible on a live trading account.

- 24option min deposit is 250 dollars; also, they offer competitive spreads and hold leverage options up to 400:1. Moreover, the minimum investment they accept is 24 dollars. Trade types offered are one touch, high/low, no-touch, 60 seconds, and boundary.

- 24option uses a third-party trading platform, TechFinancials. It gives maximum returns up to 88 percent. Nevertheless, this broker does not acknowledge traders from the US and Australia.

- 24options provide a demo mode for new traders. There are different types of accounts, such as Basic, Gold, and Platinum, VIP accounts, depending on the amount deposited by the trader and the features they need. 24option offers client support through live chat, telephone, and email, in English, and thirteen different languages. Some of the features are –

- 24options minimum deposit is 250 dollars

- Minimum Investment is 24 dollars

- Maximum returns are 88 percent on the stake

- Bonuses can go up to 100 percent

- 24option’s other distinguishing features include automated trading or back-testing certain trading strategies, which are accessible through the MetaTrader 4 platform, yet not through the desktop platform.

Comparison with Other Brokers –

| Features | 24 option | IQ option | Binary Mate> |

| Assets | 110 plus | 500 plus | 90 plus |

| Minimum deposit fees | 250 | 10 | 250 |

| Regulation | IFSC, CySEC | CySEC | No |

| Demo Account | Yes | Yes | Yes |

| Bonus | Free signals | Free demo account | Up to 50 percent |

| Options Payout | 70 – 88 percent | Up to 91 percent | 75 – 90 percent |

| Trading platform | Scipio | IQ option | Binary mate |

Trading Accounts

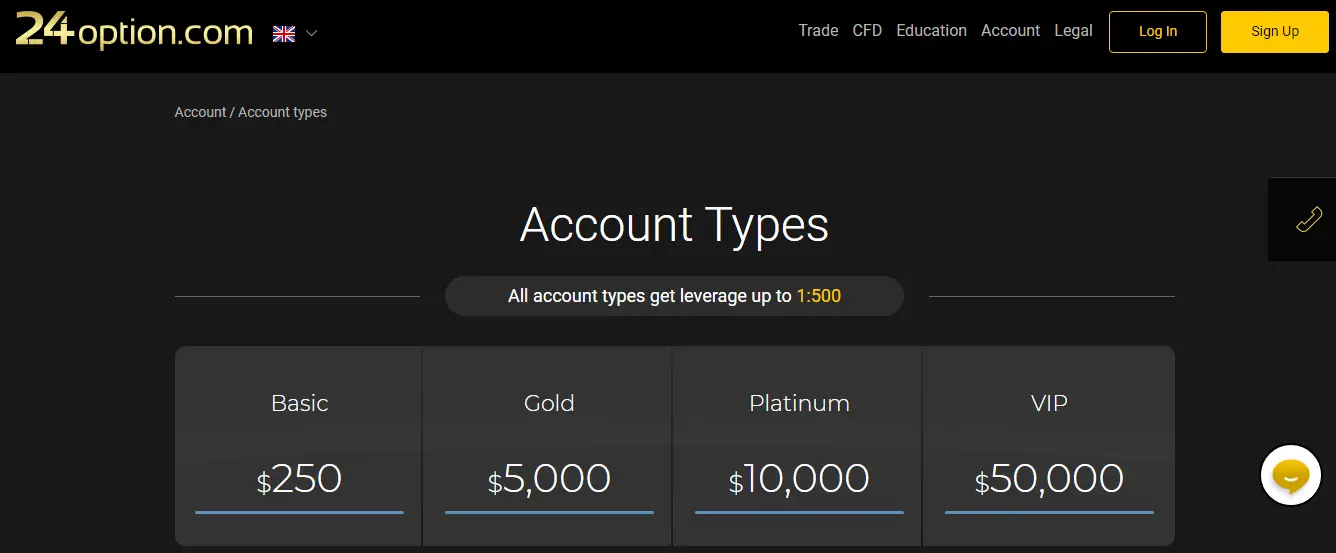

There are 4 unique kinds of trading accounts accessible at 24option for traders to choose from. Over and above, the trading accounts are classified into Basic Account, Gold Account, Platinum Account, and the VIP Account (earlier Diamond). Each account offers fairly better terms, including tighter spreads and more lessons.

Instruments

- 24option earns money through the spreads; moreover, the spreads featured by this broker are steep; hence it does not charge commissions apart from this.

- The services offered by the 24option is for free of charge even though this broker does not charge a commission on withdrawals done by the trader. However, this does not apply to the VIP account holders. Different types of account holders can make any amount of withdrawals, commission-free at any time.

- The withdrawal fees range from 0.9 % to 3.5%, depending on the trader’s method.

- Additionally, 24option charges an inactivity fee or significant dormancy fee. For one month, these inactive fees are not charged, and later, after one month, the trader needs to pay 80 Euros. If the trader does not use this account for over a year, they need to pay 1000 euros as inactivity fees.

Stop-loss

24option provides new types of trades, which also includes the option to set up stop-loss levels; while trading carries huge risk, and when they are using leverage, the fx stop loss order feature is the most advantageous. The users can manage their risk levels by using this stop-loss; they can also select the level of risk level with leverage to be used.

Instruments

At present, the firm has a wide range of basic assets for their customers to choose from. Altogether, there are over 130 different kinds of hidden assets. These are divided into 4 main asset classes such as –

- Commodities – 11 types

- Currencies – 34 sets

- Market Indices – 25 indices

- Stocks – 61 companies

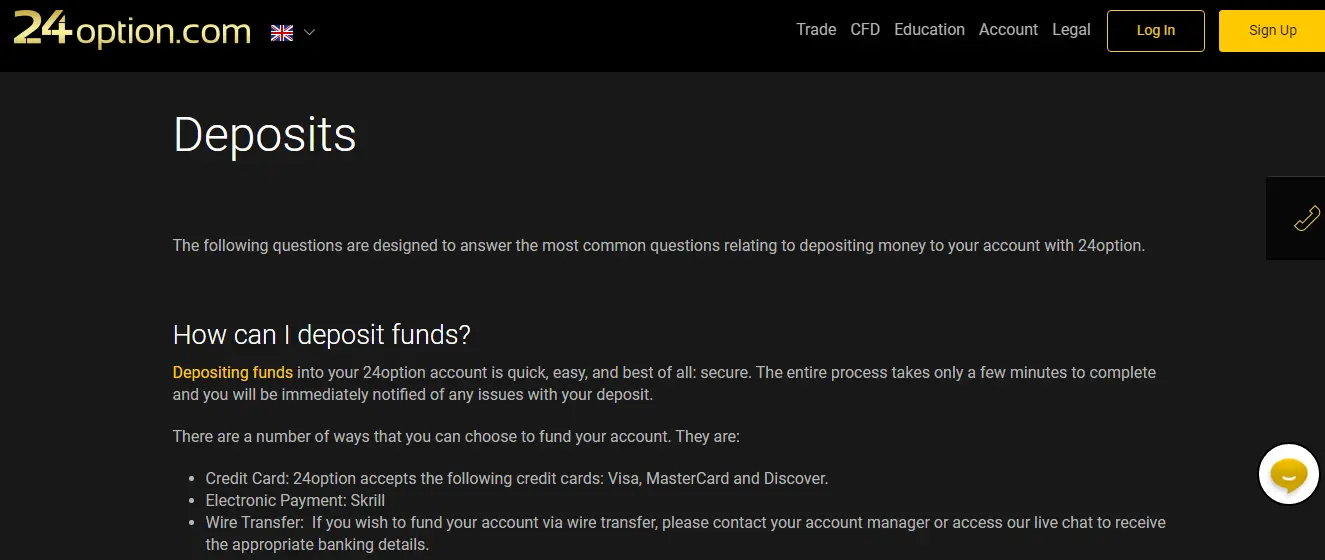

Supported Methods of Payment

For Depositing and withdrawal of funds at 24 options, there are various methods available for the traders to use. The supported methods of payments in 24option are VISA, Mastercard, Diners Discover, Switch, Skrill, JCB, bank wire transfers, and Neteller.

Accepted Countries

24option acknowledges traders from the following countries, such as Thailand, United Kingdom, Singapore, Germany, South Africa, Sweden, Hong Kong, Denmark, Norway, Italy, United Arab Emirates, Kuwait, Saudi Arabia, Qatar, Luxembourg, etc. Some of the countries where 24option are not supported are Belgium, China, Iran, Japan, Israel, France, Canada, Australia, India, Brazil, United States, Nigeria, Switzerland, Bosnia, and Herzegovina.

CFDs

- Recently, 24option had reported that CFDs (Contracts for Difference) had been added in their platform. It also offers Marijuana stocks to trade. The trading area has now been restructured in-house (as opposed to the earlier TechFinancial platform), and they have improved their platform by adding the option of trading CFDs.

- The difference between both the CFD and Forex platforms is that the traders can use leverage. Levels up to x200 are accessible. This is a major change for anybody used to the fixed risk nature of binaries. Also, the platform provides stop-loss tools, which is a must-have for additional risks with leverage.

Account Types

24option trading provides four kinds of accounts and the trader can choose the one that best addresses their needs.

- Basic Account

Basic accounts incorporate introduction of the platform, a devoted account manager, full access to seminars and webinars, market brief daily, introduction to the financial markets, and a demo mode account with 100,000 for the users.

- Gold Account

Gold account customers can receive up to 84 percent of the payout. As indicated by 24option, the Gold account is the most popular trading account among all the other accounts. In this account, the traders can use all the features that are added in the previous accounts and it has the same policy such as one free withdrawal in a month for users along with an account manager. If there is a problem with the withdrawal process, the clients can have their money back into their account. Further, Gold account customers will receive instant SMS & Email Alerts. The updates are sent in real-time and they have all major economic events which are sent directly to the trader’s email or phone.

- Platinum Account

As per our 24option review, Platinum accounts are particularly customized to the users and will be able to receive up to 86 percent payouts. Platinum account customers can make as many withdrawals they want and will not be charged extra fees. 24option Platinum account traders have the opportunity to trade on both CFDs and Forex. Apart from all features that are mentioned in earlier accounts, Platinum traders are allowed for a Live trading session. Besides, Platinum account users have unlimited access to trading central with various tools and analysis features at their disposal.

- VIP Account

VIP accounts have standard features that permit individuals to trade using all types of binary options, like high-yield options, boundary options, touch options, and high or low options. There are no restrictions regarding the resources on the platform. VIP account holders have access to endless customer service from 24option.

Demo Account

Demo accounts have all the functionalities that a trader can expect on the live account, and it comes without the risk. Nonetheless, 24option will give the trader €100,000 demo funds when the trader signs up for this account. By using demo funds, the trader can trade as though they were real-time conditions. Also, it does not appear as though 24option has set time limits on the demo accounts.

Asset Coverage

- 24option provides a wide options of assets, with an emphasis on CFDs and forex. CFDs, or contracts of difference, are subsidiary products that make it easier to trade on the difference between closing and starting values without needing to own the asset.

- This kind of trading likewise takes into consideration a much lower initial investment from the trader. If a customer needs to trade on the CFDs on 24option, they need to anticipate the asset market’s movement.

- The other significant kind of asset available for the users to trade through 24option is forex.

- Since there are tremendous volumes traded daily on forex, this market has exceptionally high liquidity, particularly on account of the major currency sets. Like CFDs, it is possible to invest funds into forex with a small amount as the initial investment.

Investment Products

- 24option provides a variety of options in investment products as per the 24option reviews. While the site has marginally fewer currency sets than other brokers, they do give wide coverage in cryptocurrency trading, which includes currency pairs with major currencies Bitcoin/USD, Bitcoin/GBP, Bitcoin/EUR, and several more. All rights reserved with Copyright by the broker for the features and functionalities of the platform.

- Also, 24option offers trading in more than 160 individual stocks forex and CFD, which is a distinct advantage for a trader wishing to participate in such activity. Some of the other trading products, such as gold and oil, are standard, and the platform provides trading in commodities as other brokers who are focused on competitive spreads.

Cryptocurrency trading

- Even though there are many Forex brokers who offer cryptocurrency trading, 24option offers exhaustive cryptocurrency offerings. It prides itself on offering a wide range of assets and cryptocurrencies. Moreover, this broker offers binary options and CFDs trading for major cryptocurrencies, which include Bitcoin, Litecoin, and Bitcoin Cash and Ethereum.

- Furthermore, 24option provides educational resources for the users who trade in CFDs and the strategies to trade cryptocurrency, and several more. It helps the trader sharpen their trading strategies to ensure that the trader makes a profit through trading.

- 24options minimum deposit for Bitcoin trading is $250, and the minimum amount for withdrawing is $10. Deposits can be made in GBP, USD, EUR, RUB, and JPY. One should take note that the trading currency cannot be changed once it is set. So the trader needs to choose their deposit currency very carefully. 24option is a regulated broker that offers safe and reliable cryptocurrency trading.

Deposits

- There is an extensive list of min deposit approaches with 24option, with slight differences depending on the country. 24option supports debit and credit cards, which include Visa, Master Card, and Discover card. Users can likewise make a wire transfer or Fast Bank Transfer./li>

- Some of the other deposit methods consist of AstroPay, Diners, Neteller, Switch, JCB, Skrill, iDEAL, Sofort, Neosurf, Qiwi, GiroPay, PostePay, and PaySafeCard.

- 24option min deposit depends on the funding type. For electronic payments and credit cards, the minimum is $100, €100, £100, R1200, or ¥10,000. Moreover, wire transfers have little bit higher minimums of $1000, €1000, £1000, R1200, or ¥10,000.

- Also, there is a maximum deposit amount based on the payment method. There is a daily limit for credit card deposits like $/€/£ 10,000 or ¥100,000, and there is a monthly limit of $/€/£40,000 or ¥4,000,000. 24option reserves the privilege to modify those values, for both minimums and maximums, any time without notice.

- Furthermore, deposits made through electronic payments and credit cards are credited as soon as the broker gets the payment. Also, wire transfers may take up to five business days before the accounts receive the funds.

Deposit Bonus

As per our 24option reviews, this broker currently offers a deposit bonus called the First Deposit Trading Bonus Scheme. The trading bonus is equivalent to 25 percent or 50 percent of the first deposit or minimum deposit of 500 dollars, whichever is the lower of the two.

Withdrawals

- 24option has the same withdrawal methods as a deposit. As compared to other brokers, 24option has the policy of handling all withdrawals back to the original payment method.

- This is to give protection against illegal tax avoidance. In situations where the amount of the withdrawal is more than the deposit sum made by credit card, the rest of the amount is transferred through a wire transfer.

- 24option’s minimum withdrawal amount is 10 dollars, and the maximum limit is the funds that are available in the trader’s account. The trader can make withdrawal anytime, yet, 24option processes the withdrawal requests during business hours.

Withdrawal Fees

24option withdrawal fee varies depending on the account type with all withdrawals; Platinum and Diamond accounts are free. If the trader withdraws through wire transfer, there will be a charge of 35 USD, 35 GBP, 35 EUR, or 4,000 JPY. Withdrawals through credit card accompany a 3.5 percent fee expense while Skrill withdrawals have a 2 percent fee, Qiwi has a 3.5 percent charge, Webmoney has a 0.9 percent charge, and Neteller has a 3.5 percent charge. Additional fees are also charged by Intermediary banks.

Inactivity Fees

As per our review, 24option additionally charges inactivity fees for accounts that do not do transactions for a time of two months or more. Furthermore, transactions incorporate withdrawals, deposits, and trades. The charges for a few months of inactivity are 80 EUR, which increases to 120 EUR for three to six months and 200 EUR for over six months of inactivity. Moreover, 24option charges monthly maintenance charges of 10 EUR. If the trader is charged with inactivity charges, this will replace the maintenance charge. Besides, 24option does not charge any fees or commissions, deposits, or financing.

Trading Platforms

Regarding the trading platform offered by 24option, the broker had earlier used the binary trading platform, which was supported by TechFinancials. Nevertheless, to expand its product offering, 24option presently utilizes a proprietary platform called Scipio to offer CFDs and forex trading services.

MetaTrader 4

- As per our 24option review, like most broker 24option, dealers can download and utilize the MetaTrader 4 (MT4) platform. This platform is on par with industry-standard and allows advanced charting analysis. Traders who do not want to use this feature can use the desktop platform of 24option, which is also a good option.

- Apart from the Scipio trading platform, 24option has also integrated the MetaTrader 4 trading platform for traders looking to trade the spot forex Binary options and CFD markets. The MetaTrader 4 platform’s main feature is the advanced trading tools that have been incorporated into the platform.

- So, the traders can use any one of the platforms, where each one provides different qualities. MT4 Forex brokers are more complicated to use, yet it includes more analysis tools and automation options. The traditional platform is simple to use.

- Traders can also leave conditional orders and have stop-loss and take-profit trading possibilities that might allow them to hedge. Moreover, 24option displays other traders positioning so that traders know how different traders feel about any instrument.

Mobile Trading

- 24option provides a free mobile trading application for android and iOS (iPhone and iPad). The applications are available for download both on Google Play Store or Apple’s App Store. The application delivers all the functionality of the website, which also includes all account management features. The application takes into account each platform’s strengths, android, or iOS, to augment the functionality on each device.

- The application uses a simple interface, with each phase of the trading procedure spread out in a simple procedure. Screens are large and effectively usable. This decreases the risk of mistakes due to the usage of the wrong buttons. The application can likewise show the trading history and can open trades.

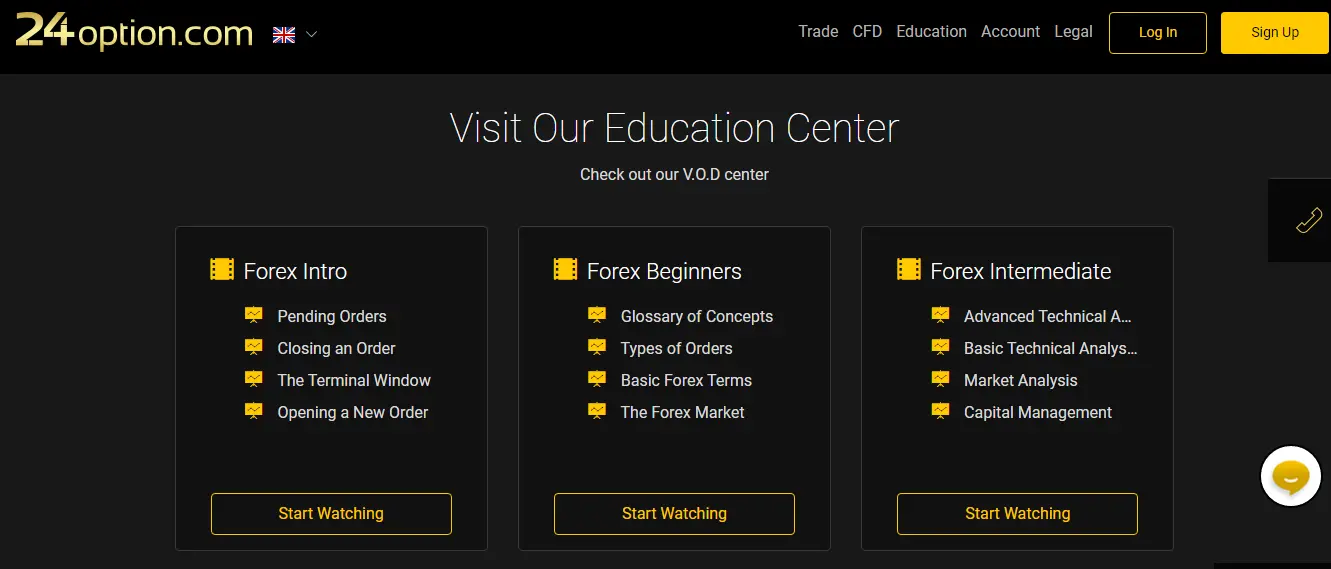

Educational Materials

- Even though 24option offers trading strategies for CFDs and forex, 24options additionally offers a glossary for CFDs. Also, there is a guide for cryptocurrencies, including a concise history of most widely recognized cryptocurrencies. This guide includes quick 24option reviews of the cryptocurrency market and trading cryptocurrencies.

- Educational materials offered by 24option are okay, which also includes videos. The topics covered in the video include pending orders, risk management, trend analysis, calculating pips, resistance trading, and support.

- Webinars are hosted 10 times every month, with basic and intermediate technical analysis. There is a different segment related explicitly to forex trading with its exclusive concepts with key terms related to CFD trading.

Research Tools and Insights

As per the 24option reviews, this broker has a wide range of research products. Further, the broker 24option has collaborated with Trading Central to offer specialized technical analysis starting with entry and exit points, positioning, and trading charts. Suffice to say, market calendars and videos are accessible to assist traders with their decisions.

WebTrader Charting

Regarding charting, it is functional. On the chart, the sentiment indicator is seen. This will let the trader know about the general market perspective on different traders on the platform like it is bullish or bearish. If the trader is looking for technical analysis, then they can find plenty of charting tools and features.

Daily Market Reports

- These reports are available on the trading platform; it offers information regarding the advance market analysis. Internal investment research professionals of 24option create them.

- The report will cover various markets and will incorporate potential recommendations for trade setups. Traders can also have these reports sent to them through SMS.

- Furthermore, the economic calendar is also included along with the daily market report. This contains a report of some of the most significant upcoming dates during the week, which might affect the business sectors.

Ebook

24options provides an Ebook, which is an important guide that covers the most relevant topics in trading. This is initiated not only for beginner traders but also for intermediate-level traders. Furthermore, it covers various topics, like capital management, trader psychology, fundamental and technical analysis, etc. Additionally, they have tests after each topic, where the trader can test the information which they have recently covered.

Videos on Demand

As per our 24option reviews, this broker has added various handy Videos on Demand (VODs) where the trader can learn about some of the topics that are incorporated in the eBook.

Webinars

24option hosts regular webinars where the trader can gain live knowledge from a trading professional. These webinars practically run almost every day and are joined by a large number of traders around the globe. The webinar schedule has quite several interesting topics such as Risk Management, Pattern acknowledgment, algorithmic, CFD trading, and gold trading.

Advanced Market Analysis

Traders with access to Trading Central get the chance to use Advanced Market Analysis for authentic and real-time information that can assist brokers with discovering patterns and trends. The database in Trading Central has over 8,000 assets, which includes forex, Binary options, commodities and stocks, all with description and information. The trader can set up alerts for updates on a specific asset, see detailed technical analysis reports, and utilize Japanese candle signals and indicators.

Bonuses and Promotions

Even though an offering of promotions and bonuses has been limited for brokers located in Cyprus by CySEC guideline, currently, 24options offers two legacy promotions. Anybody joining as a customer while downloading the mobile application receives a tradable bonus of 24 dollars. Moreover, discretionary money rewards might be paid from time to time especially to active traders.

Customer Support

- Good customer support is offered to its clients. When having an issue, the traders can reach customer support through live chat, email, live visit or through the phone. Below given is the list of nations where local phone support is available –

- Belize, Brazil, Chile, Colombia

- Peru, Russia, Saudi Arabia, Singapore

- Malaysia, Mexico, New Zealand

- Ukraine, United Arab Emirates

- According to 24option reviews, online chat is accessible for both new and existing customers, and 24-hour customer support is additionally available through telephone or email 5 days per week.

- After office hours, Robo customer service can be accessed. This can answer several questions and is easy to deal with. Moreover, this broker has a list of the most essential FAQs on their site. Social media support is accessible through Twitter, where a few valuable daily market briefings can be seen.

Drawbacks

- Additional fees that are being charged by this broker are unnecessary and excessive. Not many brokers will charge withdrawal fees nowadays and considerably few brokers will charge a “maintenance fee.” Also, it appears to be very unfair to traders who are not using their accounts to get slapped with inactivity fees.

- 24option is behind its competitors in segments like streaming news or fundamental research, which are helpful in the long-run. This is a major disadvantage by not offering these services.

- Because of legal guidelines in different regions, this broker does not offer services to traders in Switzerland or the European Economic Area. Moreover, it will not operate its services in the United States, British Columbia in Canada, and several other areas.

- The order functionality on the web-based platform is very fundamental. This makes it very hard for the more experienced traders.

- One of the major disadvantages regarding the mobile app is the lack of price alerts or news feeds. Currently, other forex trading brokers are offering these features for their traders, while 24option does not have this feature.

Wrap up

After the 24option review 2023, we conclude that it offers its very own trading platform through mobile or web devices and works with MetaTrader4. They center on cryptocurrencies, forex and CFD, offering CFDs for a wide scope of assets, which includes various digital currencies. The trading platform is very much structured and offers good customer service. What makes it stand out amongst others is that any type of trader, like a beginner or experienced, has no difficulty exploring it and making their trades. When trading with CFDs, the trader should employ a trading strategy as it is possible to lose money when using leverage.

FAQ’s

1. Is 24option legitimate?

24 options is a popular and leading online broker that offers commodities, forex currency pairs, major indices, and stocks; and it also offers binary options for several major assets. Besides this broker supports Metatrader 4 and it also offers a mobile app and an exclusive trading platform for its traders, all these features offered by the brokers show it is a legitimate broker.

2. Is 24option regulated?

24option is a reliable and regulated broker and it is regulated in several jurisdictions. It is regulated under two regulatory bodies; for carrying out operations within Europe, it is regulated by Cyprus Securities Exchange Commission, and to carry out its operations outside of Europe, it comes under the jurisdiction of the International Financial Service Commission of Belize.

3. How do I withdraw money from 24option?

24option provides several withdrawal methods, where the trader can use credit cards either MasterCard or visa, and discover; wire transfers and e-payment methods such as in Neteller, or Skrill. Even though 24option has a minimum deposit limit, it does not offer any limits when the trader is making a withdrawal, except when they are using a wire transfer. Further withdrawal fees range from $2 to $30 depending upon the withdrawal method used by the trader.

4. What is 24option all about?

24option provides a user-friendly platform based on 24option reviews that can be used for easy trading; and it also offers a mobile trading app. Users can select from several trade types and assets. The asset returns will vary according to the asset performance, yet the platform does offer low spreads, which means it offers competitive trading costs.