MultiBank Group Review 2023

Overview

Founded in 2005, MultiBank Group is a Forex & CFD broker situated in Hong Kong. With its several offices located in Australia, Germany, United States, Spain, Austria, UAE, Vietnam, Cyprus, and the British Virgin Islands, it is one of the most experienced names in online trading. They offer a trading platform that provides a wide range of assets that help in achieving trading objectives. The various products that they trade are indices, spot metals, Cryptocurrencies, individual stocks, commodities & Forex pairs. Being a proud sponsor of BMW M Motorsport, the company has several jurisdictions in various developed countries like the Virgin Islands, Germany, and the Cayman Islands.

MultiBank Review – Overview of Platform

MultiBank Review – Overview of PlatformIt is a worldwide brand that is composed of global CFD and FX brokers. MultiBank Group is a global financial company that owns companies that generally fall into the category of resource management. The brokerage service functions under the supervision of lawful bodies that are controlled by Australian ASIC and other financial regulators. In this review, we use MultiBank as a name for brokerage purposes. The website is considered secure as it is regulated by the top-notch ASIC and has an immense history, which dates back to 2005.

Disclaimer: CFDs are complicated appliances and are displayed at an immense risk of generating monetary losses on a huge basis due to its market viability. 74-89% accounts of venture capitalists have lost finances when conducting trades CFDs with this offer. You should conclude whether you are aware of how CFDs function and if you have the ability to take massive risks by tolerating monetary losses.

MultiBank Review – Get Extra Bonus

MultiBank Review – Get Extra Bonus- MultiBank Group and its subsidiaries are controlled by the Financial Market Authority (“FMA”) of Austria, the Federal Financial Supervisory Authority of Germany, Australian Securities and Investment Commission (“ASIC”), and Financial Services Commission (“FSC”)

- In 2018, the Group accomplished an abstract turnover of more than US$ 1.68 trillion in monetary offshoots with an expectancy of making effective moves into the corporate markets via top-notch financial liquidity and white tag solutions for financial institutions, brokers, money, and trading bodies in the upcoming future.

- For maintaining preferential accounting quality, supply chain finance programs require uncommitted funding lines from Banks. This indicates that the monetary bodies chosen to fund the program can lessen its financing and increase estimates or, in the most unfavorable case, even stop financing at any time during the lifetime of the program.

- A supply chain finance program is a long-term commitment, and once in place, your suppliers will depend on it for the constant flow of early payment to ensure the ongoing supply of goods and services purchased. If the funder stops funding, buyers may increase the risk of disrupting their supply chain as well as negatively impacting their relationships with key suppliers.

Benefits of a MultiBank platform solution:

~ Risk: Funding options for supply chain finance programs are not guaranteed, and hence credit lines of funders can be lessened, pricing can shoot up, or funders can stop financing at any time. A MultiBank solution contains a lower risk as buyers can simply replace one influencer with another, securing the present scenario of the growth of the supply chain program. A single Bank solution will require the risk of the whole facility to shut down. Ultimately buyers would love to handle funding lines with assurance in order to sustain relationships with suppliers.

~ Price, transparency and leverage: Competition and transparency in a MultiBank platform help lower prices from financiers. Buyers can bring additional finance for their programs if the existing financer’s price is too high. This provides the buyer with an advantage in influencing the funder’s tactics, and in the end, this changes relative pricing. Buyers lose track of control on entering in a single Bank program as the lead Banks control syndicate pricing and demand participation charges.

Large suppliers supply to a buyer who can attain pricing much lower than the supply chain finance rate presented by a program that can leverage their profile to a much lower supply chain finance rate or introduce extra funders to the program itself. This also keeps prices as low as possible and helps in maintaining transparency between the financiers.

~ Control: Choosing its exchange option helps the buyer in attaining full control of the Banks in which they want to function with and the flexibility in introducing several funders for meeting liquidity shortfalls as the current funders generally lose credit appetite in a supply chain finance scenario.

Buyers can assist several other local Banks or discuss funding with no relationship Banks for keeping existing credit in the market. Many buyers have the objective of generating relationships with Banks in order to carry out business anytime in the near future. Single funders are risky as they can alter their credit appetite for the purchaser or even the industry in which the buyer functions. Funders can re-evaluate their business tactics, exiting the business leading to the closure of the supply chain finance curriculum, and the buyer is left without financial support.

Is MultiBank Group Safe?

Since it has got a stamp of the safety certificate by the top-tier ASIC, MultiBank exchange is very safe, and another reason behind this is that it was incepted way back in 2005. Further, the customer service of the MultiBank Group is highly efficient and helps online traders in generating a lot of money.

MultiBank Group Reviews – Is it Safe?

MultiBank Group Reviews – Is it Safe?What is the minimum deposit for the MultiBank Group?

There is no fixed value for minimum requirements on deposits or even withdrawals, and there are various pathways to deposit funds in a MultiBank Group account, which makes it a very easy-to-use and secure platform. The customer service of MultiBank broker is superb as they offer you an option of choosing from 8 base currencies. These eight base currencies are-

- GBP

- EUR

- USD

- JPY

- CHF

- AUD

- CAD

- NZD

Further, there are multiple deposit options available for Bank transfer, Credit/Debit Card, & Electronic Wallets. The number of base currencies is maximum on this website, as compared to XM & XTB, or in fact, any other trading platform. Forex Trading carries a high level of risk, which may not be suitable for all investors. So, always check market fluctuations before trading with any Forex brokers.

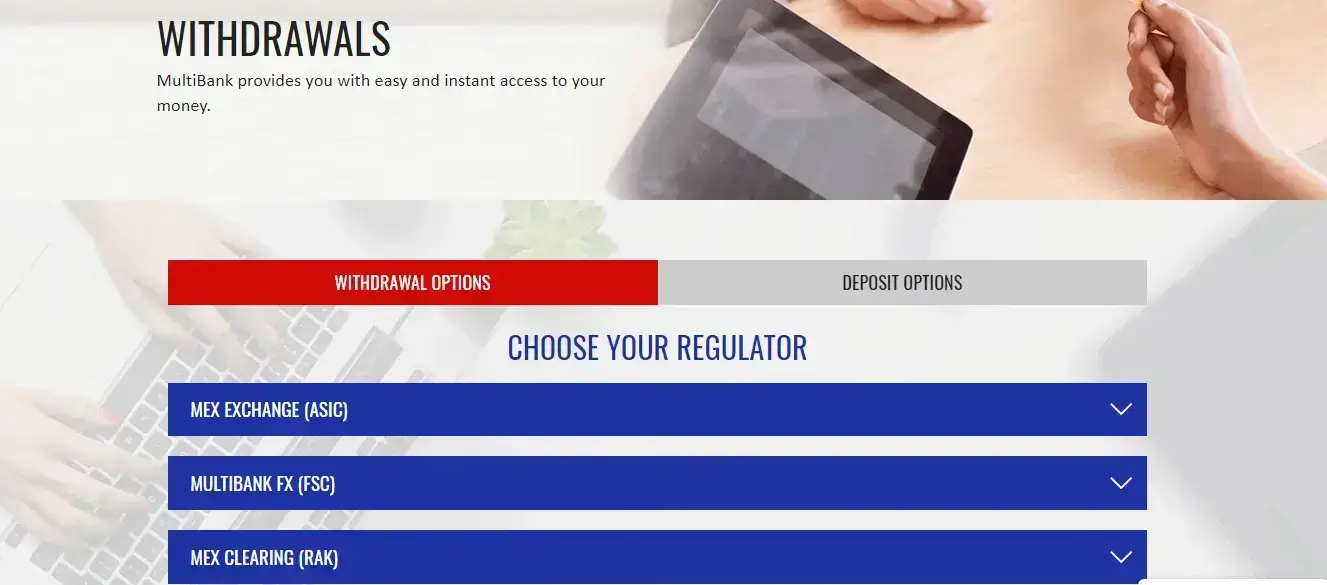

How to Withdraw MultiBank Group Bonus?

Some gateways to withdraw MultiBank Group Bonus are Skrill, FasaPay, wire transfers, and Neteller. This process of funding can be conducted using either credit cards or even debit cards. The method of withdrawal is straightforward as the whole platform works on automated trading.

MultiBank Review – Withdrawal Options

MultiBank Review – Withdrawal OptionsThe withdrawal process of MultiBank can be carried out by following the below steps-

- Log into My MultiBank

- Visit the Withdrawal tab

- Choose the trading account

- Provide the reason for the withdrawal

- Implement the addition of the withdrawal method

- Start withdrawing money from the MultiBank Group

MultiBank Review – Account Forms

MultiBank Review – Account FormsMainly, the MultiBank Group has three different accounts-

- ECN Pro

- MultiBank Pro

- Maximus

The ECN Pro account helps the users in trading in typical market conditions and also helps in generating a lot of commission. The starting point of this account is 0.1 pips, and the help desk of the ECN Pro type is highly effective. Another example of a report is MultiBank Pro, and it operates at a floating rate of 0.8 pips in typical market scenarios. Further, the MultiBank Group can be accessed through the MetaTrader 4 platform.

The third type of account is the Maximus account, and it has an exceptional quality of exhibiting trade in the most difficult of the market conditions. Under several typical market conditions, the Maximus account helps in trading at a speed of 1.4 pips under different market scenarios. Another USP of this account is that it helps in trading without commission and is fully STP along with being available on the MetaTrader 4 platform.

MultiBank Reviews – Different Platforms

MultiBank Reviews – Different PlatformsThese three accounts can also be accessed through mobile trading, and each one of them provides a demo account for achieving trading objectives through Forex trading. The ratio of maximum leverage quality of these three accounts is 250 to 1 in metals. Also, there is a tremendously high-risk scenario to get the rights reserved of the account shareholders

These accounts are straightforward to use & their framework, along with their working mechanism, is easy to comprehend. The reports are built with the quality of being transparent, and they are equipped with significant differentials in several spreads of the platforms. The minimum trading capacity of all accounts is one micro-lot. (0.01 full lots).

All the top-notch Forex & CFD brokers are very keen to invest in the demo accounts of these trading platforms. A total of 45+ Forex currency pairs, 1,000+ shares, 17 indices, 5 different commodities, and 4 different Cryptocurrencies can be efficiently traded with the website.

Features of MultiBank Group

With unique abilities in offering high liquidity and unparalleled access towards automation trading, the most prominent feature of MultiBank Group is that it doesn’t require restrictions on trading scenarios. Further, a wide variety of offers are available for the businessmen to help the community of traders in attaining trading objectives.

The trained advisors and the lawful communities of this platform can help the traders in trading for at least 10 seconds, and the MultiBank Group can gladly claim that the traders can function without any requotes and strategies. The most potent claim is that “Stale Trading” impart a trendy lucrative alternative, and on the positive side, MultiBank Group can work on the MT4 platforms.

MultiBank Group Review – Features

MultiBank Group Review – FeaturesSome reliable aspects of the MultiBank organization are that they provide immense transparency and zero impositions on trading objectives. Automation trading and sledding are likely to occur in the presentation. Several varieties are presented in conditions of account categories. This helps the traders in selecting the offering opportunities, relying upon how much and how often they do business, as ECN will function better for several traders than others. They also help the requotes or hedging, and this is a strong claim that several brokers can initiate.

This account has a seamless & fast account opening, and from Bank transfers to electronic wallets, the several choices for deposit & withdrawal are that there are several opinions for deposit and removal, and they are not charge costly. Customer service provides speedy and quick answers.

The stock CFD and inactivity fees are high. Moreover, the product portfolio covers only Forex, CFD, and Crypto asset classes. The research and educational tools are fundamental too.

This broker provides four trading objectives that are all set for customers to use. The highly renowned and trustworthy MetaTrader 4 software is highly considered as their appropriate MultiBank position. Expert advice can be implemented with the help of the MetaTrader 4 option.

MultiBank Group Reviews – Wide Range of Instruments

MultiBank Group Reviews – Wide Range of InstrumentsIt has to be accepted that though scalping is highly possible, MultiBank Group does not allow any trading with a minimum time limit of fewer than 10 seconds, which has been termed as “Stale Trading.” Despite the fact that scalping is not defined, as opposed by trades that last more than 2 minutes but not greater than 10 seconds in comprehension, as main businesses help in more than 25% of all granted companies, the broker has access to differentiate these trading strategies. A sensible trading group, this broker has been utilizing MT4 scenarios; since its initiation in 2005, containing a comprehensive plan of data centers and servers, the trader’s opinion indicates that they possess perfect implementation on their software due to the high pricing which helps in attaining an excellent option for online traders.

In addition to the enormous possibility of customers available for trade, the MT4 platform allows trading on a Multilingual platform, instant implementation, and built-in help manuals for MT4 and MetaQuotes Language 4, an all-round technical operation package that includes a wide variety of in-built indicators and charting mechanisms, various manual indicators and time-lapses and more.

MultiBank Reviews – Company Updates

MultiBank Reviews – Company UpdatesAutomated trading is also presented through the Metatrader 4 platform, where traders can establish and justify their automated trading strategies by using the MetaEditor, Strategy qualifier, and Compiler strategies within the MT4 interface.

With this manual trading system, customers may promote Expert Advisors, software executive’s help in enabling traders to supervise the markets correctly. Custom Indicators assist traders in determining future price fluctuations by generating past and current money information. And the notepad helps in providing traders the chance to set up an automatic reception of several operations like closing all openings with a single keynote.

~ Metatrader Mobile: MetaTrader 4, along with its sophisticated applications, can be utilized on iPhones, iPods, Multi-Terminal, and several Android customers.

~ MultiBank Commutation Software: Cutting edge Exchange is an effective trading platform that creates the best cycle in online business.

Financial bodies, interchanges, and ECNs have been interchanged and classified into Multiple engines for proceeding with most bid/best offer impeccable exchangeable rates and high-class supervision in FX, CFDs, and Options are promoted inside the platform precisely to the MultiBank Exchange software.

~ MultiBank Review of Users: Did you create a solid reputation with this platform? A good one? Explain to our leaders and traders existing all across the world about the issues in our User Portals tab. Your email id will not be visible.

Kindly ensure that your remarks are likable and that they are not associated with services or products, political organizations, campaign substance, or ballot proposals. Remarks that have the abusive language of any form will be shut down. Comments including actually, inappropriate or promotional links will also be abolished

~ Standout Strengths of MultiBank; Several outstanding strengths of this broker’ offerings are-

A comprehensive option for account types that includes several market-maker and ECN-type platforms, along with an extra Islamic account option. A choice to utilize the most in-demand trading platform in the industry: MetaTrader 4, along with its proprietary platform.

An unusually wide range of instruments available for trading: all the major and minor Forex currency pairs, along with several exotics; also, a highly comprehensive range of global equity indices, along with some commodities, individual equities, and Cryptocurrencies made as CFDs. Controlled by an industry point of center (Australia, Germany, Austria, UAE, and the British Virgin Islands).

MultiBank Group Reviews – Standout Strengths

MultiBank Group Reviews – Standout StrengthsThe business generating type of accounts can be opened with either fixed or variable spread schedules. In terms of standout qualities, the main strengths of this broker’s offerings are:

Recent Updates

- The financial strategies of this deal have not been updated, but the customer base in mainland China of AETOS is analyzed by tens of thousands of customers. The CEO of the marketing company, Draco Ng, is joining the firm along with a vast number of other employees, including developers, sales, and support teams.

- The deal comes at a period when traders in Australia have been putting on a lot of pressure on the account of the local processor which has assigned firms in accepting legal remarks that explain the fact that they are allowed to operate in China and more countries apart from Australia. Discover the Barcelona Trading Conference – A Top Tier Crypto Trading Event

New Clients & Employees

-

- The traders of AETOS in China have been relocated to the MultiBank association by the most recent division with the title of MBG. Ng will be serving on the profile of the CEO in the most recent branch. The functions of the target company outside of China are not a part of the deal.

- In a statement shared with Finance Magnates an AETOS official elaborated: “After connecting our communication with ASIC and the professional links from various leading law firms, the group of directors of AETOS have decided to release the statements of financial services to clients who are present in mainland China and officially cancel its operation in mainland China in an orderly sequence from 15th June, 2019.”

MultiBank Reviews – Company Updates

MultiBank Reviews – Company UpdatesClients Transfer Next Weekend

- The transfer of customers between the companies has been anticipated to occur in the upcoming weekend that follows the shutting down of financial markets on the 8th of June 2019 (Saturday). The new companies will continue to be functioning in China via the FSC-licensed subsidiary of MultiBank Group called MultiBank FX International.

- The inheritance by MultiBank Group arrives after a relevant expansion of the Group’s operations globally after the setting up of MEX Asset Management in Frankfurt, MEX Wealth Management in the Cayman Islands, MEX Fintech in Hong Kong, MEX Spain in Barcelona, MEX MENA in the UAE and MEX Capital Markets in Mexico.

- Commenting on the matter, the Marketing Executive of MultiBank, Sophia Barnes, said: “The Group has now decided to proceed with further extension in England, USA, Philippines, Malaysia and South Africa, all of which have been envisioned to be functional in 2019. This extends the allround worldwide ability of MultiBank Group to several offices in a global market.”

Wrap Up

MultiBank provides a handy platform that helps the traders in deciding whether they shall function with their desktops or by utilizing mobile trading devices. Further, fake news, which conveys to us that the platform is vulnerable to damage, can often disturb the trader from achieving his/her objective. Following its dream run by minting profitable trading revenues for its customers, the website is still facing stiff competition in the market by several highly developed Bitcoin Trading Platforms. But, at the same time, the traders shall be fully aware of the pros & cons involved in trading with Bitcoin Future.

The company’s core business lies in its advanced trading platforms, which can trade a wide range of financial products such as Forex, shares, metals, commodities as well as indices CFDs. MultiBank Group also provides asset management services. The company has a daily trading volume of above US$ 6.2 billion, involving 320,000 customers from 90 countries.

FAQs

1. Where are the places from which MultiBank Operates?

It is located in more than 15 jurisdictions, and its main areas of operations are Europe, Australia, and the British Virgin Islands.

2. What are the sources through which MultiBank generates money?

The main sources through which MultiBank Group generates money is through online trading and by the commissions garnered from ECN trades.

3. What is the procedure for depositing money in a MultiBank Account?

The motive of depositing money in MultiBank can be accomplished by using several payment gateways like credit cards, Neteller, online transfers, Skrill, FasaPay, and International Bank wires.

4. What is the least amount that can be deposited in MultiBank?

The minimum amount to deposit in the live MultiBank account is just $50.

5. What is the highest value of leverage that can be obtained in MultiBank?

The maximum value of leverage that can be used in MultiBank is 1:500.

6. What is the procedure for opening an account on MultiBank?

In order to open an account on MultiBank, the user has to first fill an online form present on the internet and subsequently select the appropriate moderator for opening an account.

7. Does MultiBank rely on MetaTrader?

Yes, It does offer the MT4 & MT5 platforms for fulfilling objectives pertaining to online trading. Also, the MT4 is used in promoting the ECN solution through a bridge.