XM Review 2023

XM is an online trading website and broker that enables its customers to trade with a wide range of assets. XM.com is a division of the XM Group. The company was established in 2009 and has since developed to become one of the leading investment venture firms around the globe. The XM platform prides itself on having traders in 196 nations with over 1.5 million customers around the world. Negative Balance Protection ensures that traders dont lose more than the balance on their account & NBP supports balance protection & it is good for traders. The risk of losing money involved in forex trading is why XM applies NBP to all live accounts. XM offers risk management features like price alert, stop loss, limit orders, and NBP. You can stop loss and you can also make money from trading forex or investing in forex.

XM Features

- XM forex broker offers an advanced platform for trading and flexible trading conditions to suit a wide range of global customers. XM’s expertise originates from the in-depth knowledge derived from its experience in the worldwide financial & forex markets.

- Trading platforms XM supports stocks, trading of forex, equity indices, commodities, valuable metals, cryptocurrencies, and energies.

- XM is committed to offering skillful service. To materialize this, it has planned and hosted many seminars for the benefit of its traders.

- XM offers and organizes an impressive range of its research tools that includes Market Overview, News, Trade Ideas, XM Research, and more; which can be accessed by users.

- XM offers learning opportunities for its traders of all levels. A portion of this is hosting workshops around the globe. The objective is to provide the traders with the required skills expected to make improved trading choices.

- For overall Forex market hours, XM is accessible 24 hours. It is available to trade on the phone and the XM trading hours are Sunday 22:05 GMT to Friday till 21:50 GMT. It also provides price alerts for various trading option.

- Depending on where the user is based, XM also offers some signup rewards, including a no-deposit bonus.

XM Review – Features

Pros and Cons of XM Trading Broker

PROS

- It offers an advanced platform for trading amid flexible trading condition.

- XM platform supports stocks, financial instruments, trading of forex, equity indices, commodities, valuable metals, various currency pairs or forex pairs, and energies.

- XM is committed to offering skillful service.

- XM brand offers learning opportunities for its traders of all levels to earn huge money from crypto trading along with platform tutorials. The platform is designed with easy-to-use features and therefore it does not need any previous experience for working on this platform to earn money.

- Low min. deposit.

- Languages – XM platform available in more than 30 different languages including Arabic, French, German, traditional Chinese, Bahasa Malay(Malay), Korean & more. You can select any language according to your preference.

- There are different investment products available in XM Group for example Currency pairs (Forex Pairs), CFDs, Social trading/copy trading, Spot trading, Cryptocurrency trading & more.

- Trading platforms like the XM group of brokers allow mobile trading which makes it easier to trade forex assets and financial instruments from their mobile phones themselves. For this, they do not need to sit before their laptops the whole day to monitor how the trades are being executed. A strong internet connection and a web browser are enough to gain access to the XM group of brokers.

- XM platform also offers Islamic account and swap-free accounts option.

CONS

- Though this Broker seems to be perfect there are some drawbacks which we have inferred from our review, that somehow mar the popularity of the broker to some extent.

- Customer support is only accessible from Monday to Friday, therefore even if the trades can be placed any time of the day if some issues arise the traders need to wait for at least 2-3 days to get them solved; otherwise, if they don’t want to wait they can continue at their own risks, no one else is responsible but themselves.

- Though the XM platform offers traders to execute a trade with the XM zero account rejections, the absence of diversity between the various account types gives a less customized feel to trading on this platform.

- As per our review & other user reviews on the XM metatrader5 platform, we inferred that the XM regulated by CySEC, ASIC, FCA, and International Financial Services Commission (IFSC) for XM Global Limited offer increasingly distinct offerings for their trading accounts. It also assures that you will not be losing money while trading on XM, So changes of trading losses are less. Due to this, the users often find the metatrader5 platform a bit confusing, especially when they are using the platform for the first time.

- PayPal deposits are not presently supported, which can be a problem for a few users, especially when they do not use any other mode of exchange, for depositing or withdrawing money. For this reason, they sometimes back off using the XM MetaTrader 5 platform.

- Trading XM is not available to users settled in the USA, the Islamic Republic of Iran, and Israel which is a major disadvantage for forex traders residing in these nations.

XM Trading Platform

XM provides two trading platforms that are open to real and demo accounts. XM does not have its own trading platform but it uses third-party platforms like Meta trader 4 and Meta Trader 5. Moreover, the multi-award-winning MetaTrader 4 platform is typically an online forex trading platform that supports multiple order types like limits, stops, trailing, and market orders. XM MT4 is available for MAC, Android, PC & Web and it also offers a variety of features for the traders like EA (Expert Advisor), Social Signal trading, one-click trading with inbuilt news functionality, 3 chart types & more. XM platform offers access to 20 exclusive tools which includes feature-rich trade execution & management programs, messaging facilities & more. Further the multi-asset trading platform, MetaTrader 5 provides access to stock indices, stocks, and valuable metals. MT5 is released in the year of 2010 & it also allows the use of trading robots and copies trading. Features like additional timeframes and advanced charting tools can give you a benefit in the financial markets. XM MT5 app will offer you a complete & seamless access experience to the trading account with full account functionality. These two platforms are accessible on Android and Apple devices, which makes it an easy and simple mobile trading experience, along with the web trading platform. The best forex trading app to trade can make a significant and huge difference in trading performance in 2023.

XM Forex Broker Reviews – Trading Platform

XM Trading Tools

XM provides its customers access to a big list of algorithmic trading instruments and track record. These incorporate River Indicator, Ichimoku Indicator, Bollinger Bands Indicator, Ribbon Indicator, ADX, and PSAR Indicator. These are Avramis Indicators. The user can use any by reaching out to their trading account manager. These support the algorithmic trading tools which are already incorporated with XM MT4 and MT5. The trading point of financial instruments is also benefited due to this MetaTrader platforms -MetaTrader 4 and MetaTrader 5.

XM Spreads

- XM utilizes variable spreads similar to those spreads that are followed by the interbank forex market. By presenting variable spreads, it can do away with the requirement for an insurance premium; spreads prove to be an alternate option for insurance premiums.

- This would be important for fixed spreads because they are mostly higher than the variable spreads. Additionally, it is confined to the fact that several best trading brokers limit their spreads trading close to news publications, as a result, the required insurance premium gets useless.

- By providing variable spreads, XM can restrict the above issues for traders. Moreover, there are no limitations for spreads identified with trading.

- Trading cost or fees occurs when you trade something & they can be spreads, commissions, financing rates and also the conversion fees. Trading costs like commissions, spreads, and overnight swap rates are vary depending on the kind of account opened.

- EURUSD average spread is as low as 0.1 pips, which is the lowest in the world. 2.6 pips is the average spread cost during the peak trading hours and 1.7 pips is the Standard account’s average spread cost during the peak trading hours. XM’s group minimum spread across all accounts is 0.1 pips.

XM Trust Score

XM Group is considered as an average-risk, with a general XM Trust Score of 78 out of 99. XM Group is not traded in an open market and does not work like a bank. Besides, XM Group is approved by two tier-1 regulators of high trust, one tier-2 regulator of normal trust, and zero levels 3 regulators, which is of low trust. Further, XM Group is approved by the level 1 regulator such as The Australian Securities and Investment Commission (ASIC), and The Financial Conduct Authority (FCA), discussed above. Therefore, even if the traders are asked to share their account details, they are absolutely safe on the XM platform. All the data of the clients are stored in encrypted forms so that they are not accessible to hackers.

Commissions & Trading Fees

The commissions and trading fees provided by XM Group rely on the type of account selected, So, fee structure will depend on the account types. There are three main accounts to choose from: commission-free account: Micro account and Standard account, and commission-based XM Zero Account. Also, there is a fourth account, the XM Ultra-Low account; however, it is not accessible to all the members. XM offers different options of payment methods that include credit card and debit cards, bank wire transfer, local bank transfer, electronic payment method & more. Western Union payments, China UnionPay and Moneygram are also accepted.

XM Demo Account

One of the advantages of opting for the XM platform is the demo account that the XM group offers to its users. Users can open an account with a virtual balance of 100,000USD. The XM demo account is an exclusive benefit given to its users, which offers the same market conditions as real trading. There are no time limits on how long the user can use this demo account. The demo platform makes the trading point of financial instruments much easier, as it gives an opportunity to the traders to practice trade tactics without having to lose money; they can use the virtual money in placing trades and therefore do not lose money when trading which is a great relief. One can directly sign up for the demo feature just after his registration is successful for opening an account on the XM forex broker trading platform. To open a demo account you need to fill an application form and you may also need to add your email address, telephone number, your postal address & other information. You also need to fill trading account details in which you provide information on trading platform type(MT4 & MT5), leverage, account type (standard & XM ultra-low standard), investment amount, & account base currency (EUR, ZAR, USD, SGD, & more). To make it more feasible for your trading experience you can select any option according to your preference.

XM Account Types

There are account options offered on the XM platform, namely, Micro, Standard account, XM Ultra Low, and Shares accounts. All these different account types offer exceptional trading conditions unlimited access to XM MetaTrader 4 or MT4 platform. Apart from these, there are also XM Zero Accounts that too have exclusive features. The trading point on Financial instruments depends on what each of these accounts offers to the traders. Each account permits up to 200 open or pending positions per customer. Users can open a trading account on XM platform and the minimum deposit to open a trading account varies because of account type.

XM Review – Account Type

- Micro Accounts

Micro accounts utilize EUR, USD, CHF, GBP, HUF, AUD, and PLN as the base account currencies and can be started with a low minimum deposit – 5 USD. Moreover, one micro lot is 1,000 units of the base currency.

- Standard Accounts

Standard accounts use USD, EUR, GBP, HUF, CHF, AUD, and PLN as the base currency. Traders can begin with just 5USD. One standard lot is 100,000 units of the selected base currency.

- XM Ultra-Low Account

This is available with account base currencies like USD, EUR, GBP, ZAD, AUD, or SGD. There will be no commissions, deposit bonuses, or trading bonuses allowed on this account, but hedging is allowed. XM Ultra-low account offers lower average spreads and the minimum deposit amount required in this account is $50, and the account can be Standard Ultra or Micro Ultra depending on the provisions availed. For Standard Ultra the minimum trade capacity is 0.01 and for Micro Ultra, the maximum trade capacity is 50 lots per ticket.

- Shares Account

This requires a minimum deposit of $10,000 but it is not available to all the registered members which is also a downside. There are no deposit bonuses and hedging is also not allowed. The contract trade size for this account is 1 share with a minimum trade volume of 1 lot, up to a maximum position of 50 allowed for the registered clients. There are a lot of restrictions imposed per ticket depending on the shares. However, some clients can avail customized accounts but those are available only for trading forex and no other financial instruments.

- Zero Accounts

Lastly, XM Zero accounts use EUR and USD as the base currency. Traders would need a minimum deposit of 10USD in the XM zero trading account. Similar to the Standard account, one standard lot is 100,000 units of the selected trading account base currency. These accounts offer Intra-Day market updates regularly with analysis and multilingual customer support, that are managed by personal account managers.

Leverage

Based on the instrument, the leverage can go from 2:1 to 30:1. This is adaptable, and XM offers its customers the opportunity to deal with their very own leverage risk. Moreover, margin requirements stay steady consistently throughout the week and never extend at night or during the weekends.

The platform gives a risk disclaimer to its traders that trading with leverage come with a high risk of losing your money, but it is also true that with a high risk of losing comes more opportunities to earn money. It does, however, also increase the potential rewards from trading. To help clients manage real-time high-risk exposure, XM offers the ability to monitor your margin. You can use this option if you can take the high-risk.

Deposits and Withdrawals

- Both the deposit and withdrawal procedures are very simple and therefore even a novice can operate on this XM platform without facing any hassles. As per our review on the XM platform, it appeared to be absolutely legit and this can be inferred from the easy withdrawal procedures. Has it been a scam broker, the withdrawal procedures would not have been so easy as the deposits, it would take forever to process a single withdrawal request, which has never been the case for the XM group.

- Under customary KYC guidelines, the user should provide a colour copy of authorized identification documents like a driver’s license or a passport. They additionally need to give current utility bills, dated from the last three months as verification of address. The users however do not need to share and IDs or bank statements.

- After registration, 5 dollars is the minimum deposit fees for Standard and micro-accounts; at the same time, an XM zero account requires a minimum deposit of 100 dollars. Moreover, deposits can be made using any of the preferred modes of exchange & many deposit options like credit/debit cards, bank wire transfers or wire transfer, electronic payment methods, local bank account transfer, and several more. If one is using a debit card or credit cards for depositing money, he needs to share the card details like the debit/credit card number and the date of expiry; this is meant only for establishing the authenticity of the traders.

- Besides, deposits could be made in any currency and it will be naturally changed into the currency that the user selects as their base currency during the account opening process. All XM withdrawal are handled within 24 hours and withdrawal amount transfer to respective bank accounts; there are no withdrawal fees to withdraw from the e-wallet.

Regulation and Licensing

The XM Group of online brokers helps the traders to trade on various financial instruments amidst a peaceful environment, which cannot be achieved if the online broker were not regulated. XM Group has earned licenses from the International Financial Services Commission, Belize, Australian Securities and Investments Commission (ASIC), and Cyprus Securities and Exchange Commission (CySec).

When the XM broker was founded in 2009, in Cyprus, it was regulated by the European Union like the Cyprus Securities and Exchange Commission (CySec) under the license number CySEC 120/10 & it also maintains an Investor Compensation Fund (ICF). It was then registered in the name Trading Point of Financial Instruments Ltd. Next in the year 2015, when the XM forex brokers laid its foundation in Sydney, Australia, it was regulated by the Australian Securities and Investments Commission (ASIC), under license number 443670 for trading Point of Financial Instruments Pty Ltd. In the same year, the XM group of forex brokers obtained regulatory status in London, under the FCA (Financial Conduct Authority) regulation license number 705428, and started operating in the name of Trading Point of Financial Instruments UK Ltd. The organization is located in the City of London, United Kingdom, and is subject to local licensing and regulations.

Education Section

Besides offering educational videos and training materials for its users and conducting forex webinars for beginners and experienced professionals, the platform has also published much technical analysis and research reports along with trading strategies & trading ideas.

Research

XM Group’s research offerings offer content produced by an in-house group of experts, which includes everyday market recaps, technical and fundamental analysis, etc. Also, there is an economic calendar provided by Investing.com. This economic calendar houses immensely useful market information when it comes to forex trading.

- Trade Signals

As far as manual trade signals or trading signals are concerned; XM Group offers its trade signals to live account holders where clients can get signals over ten instruments produced two times daily. On the other hand, trade signals that are automated right now are constrained to the signals market, accessible within the MetaTrader platform. From these trade signals, you can get an idea about the market volatility.

- Technical Analysis

XM provides Tradepedia, which is an educational CFD and Forex content that includes technical analysis by using common indicators like Bollinger and Ichimoku Bands. Tradepedia includes beginner and advanced video content.

- Video News Analysis

XM Group has created daily forex news recordings with market analysis, market commentary, investment recommendation, markets overview, and advice, so well in a TV interview format at XM TV.

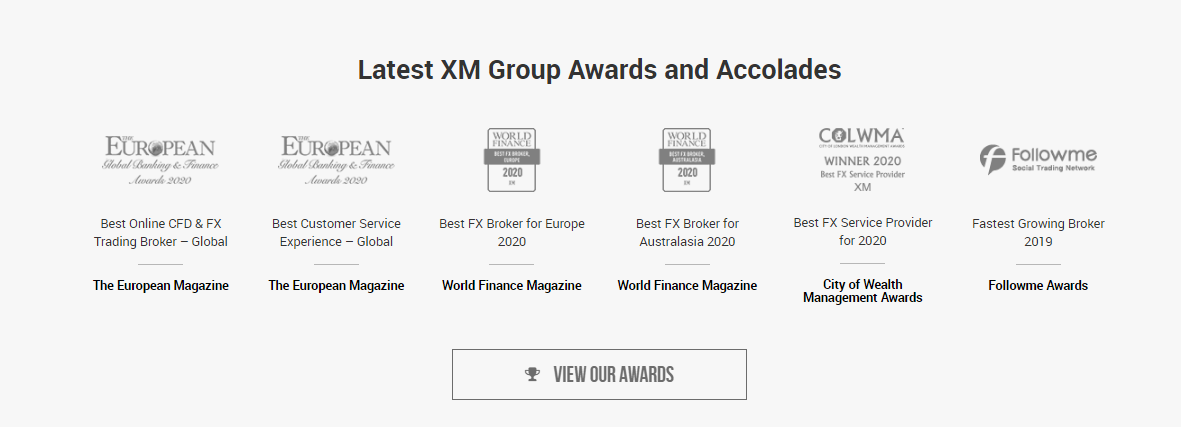

XM Awards

- Additionally, third parties have shown their approval for XM through accolades and awards. XM segregates its wide array of awards into three main categories: Forex Services Awards, Forex Broker Awards, and Forex Platform Awards. Some of the recognitions that XM has earned in 2019 include:

- Best Customer Service Global 2019 by Capital Finance International Magazine (CFI.co)

- Best Market Research and Education Global 2019 by Capital Finance International Magazine (CFI.co)

- Best FX Service Provider by City of London Wealth Management Awards 2019

- Global Forex Broker of the Year, Global Forex Awards 2019

- Most Trusted Asian FX Broker, Global Forex Awards 2019

- Best Broker, FinTech Age Awards 2019

- Best FX Broker for Australasia, World Finance Magazine, World Finance Forex Awards 2019

Customer Service

For overall Forex market hours, XM is accessible for the traders all day long. It is available to trade on the phone support via live chats, emails, etc and the trading hours are Sunday 22:05 GMT to Friday till 21:50 GMT, 5 days a week, and 24 hours a day. XM provides multilingual personal customer support managers to help users with both real and demo accounts. As per our review on this XM broker, we found that more than emails, the live chat option is mostly used by the traders to connect to the customer service team, as it resolves the trader’s issues then and there.

For emails, the traders have to check their mails every now and then, to see whether the customer care executives have come up with any kind of solutions to their trade-related issues. In a live chat, the traders can explain the issues to the customer care expert advisor on a one-to-one basis which becomes more relevant. Depending on where the user is based, XM offers some signup rewards, including a no-deposit bonus & credit bonuses. You can contact & reach at email support XM.com on [email protected]

Overnight Positions with XM

Concerning overnight positions, XM reveals on offering transparent and competitive swap rates. The rollover strategy is that XM will debit or credit the retail investor accounts and takes care of rollover interest. Moreover, this relates to any position held open after 22:00 GMT. However, rollovers do not occur on Saturdays and Sundays because the business sectors are closed.

Thoughts of Concern about XM

- Even though XM Group offers more than 1300 instruments along with 57 currency pairs, it still lags behind other best forex broker UK who offer a few thousand tradable symbols.

- In comparison with other MetaTrader brokers, considering all the variables, XM Group is positioned at the “average” level.

- XM Research instruments are restricted as no fundamental information and news are given.

- Finally, a monthly inactivity fee of 5 dollars is collected following 90 days of inactivity.

Drawbacks

- Few users complain that customer support is only accessible from Monday to Friday.

- The absence of diversity between the different account types gives a less customized feel.

- Different brokers offer increasingly distinct offerings for their accounts, yet the Micro account, Standard, and Zero accounts are practically identical.

- PayPal deposits are not presently supported, which can be a problem for a few users.

- Inactivity fees are concern about the irregular traders.

Wrap up

To sum up, XM is a global broker offering its customers access to over 1,000 instruments over seven asset classes. XM has high liquidity, no re-quotes, or dismissals of orders. There are four account types to choose from, in addition to customizing an account with XM. Even though these are excellent features, one needs to do their very own thorough research before indulging with any such brokers. XM platform offers an advanced forex trading web trading platform with flexible trading parameters to accommodate a wide range of global clients. The trading point on financial instruments comes from in-depth knowledge of global financial instruments. Whether it is for trading currencies, Precious metals, CFDs, energies, or equity indices, the XM broker is known for offering superior services. You can take expert advisors to trade forex. EAs are used for forex trading.

The XM group of trading platforms prioritizes gaining the clients’ loyalty by offering superior services and not just for earning profits; the platform believes that credibility and reputation go hand in hand. In order to gain credibility, the XM platform should work towards attaining recognition in terms of services offered.

Risk Warning: CFDs are a complex instrument and come with a risk of losing money and assets quickly with leverage. 78.04% of retail investor accounts lose some money when trading CFDs with this provider. Trading CFDs is defined as the buying and selling of CFDs, with CFD understand as a contract for difference. You should analyze and consider whether you understand how CFD works and also understand whether you can afford to take the risk or not.

FAQs

1. Does XM Offer Virtual Private Server to their clients?

XM likewise offers VPS services (virtual private server) by helping to increase the speed of trades. This VPS can be accessed from anywhere and anyplace and it is available 24×7. They guarantee that it can be accessible all over the globe. XM additionally offers commission and expense-free withdrawals and deposit accounts.

2. Are there any Mobile Apps for XM?

XM is accessible on various Apple and Android devices, which include Apple iPad, Apple iPhone, Android phones, and Android tablets. The user can download their applications from the Google Play Store or the Apple App Store. They are completely functional and allow monitoring trades from anywhere and anytime. Moreover, the desktop platforms for Mac and PC with any operating systems; both allow single-click trading options. XM Group is a MetaTrader-only broker, the android and IOS versions of the MT4/MT5 mobile applications are both accessible for download.

3. In which countries XM is accepted?

XM is a market maker & it acknowledges traders from the United Kingdom, Australia, Thailand, South Africa, Hong Kong, Singapore, Germany, India, Sweden, France, Denmark, Norway, Italy. XM also acknowledges traders from middle east countries like United Arab Emirates, Kuwait, Saudi Arabia, Qatar, Luxembourg, and several other countries. Traders from countries like the United States, Canada, Israel, Iran, and Belgium cannot use XM.

Disclaimer: This website contains news and information related to cryptocurrency and other news related to different domains. XM has grown a large and well-established international investment firm; it also provides forex, CFDs, real stocks for all the users & clients but asset class like a bond, real ETFs are missing. XM has low stock CFDs and withdrawal fees.