Saxo Bank Review 2023

Introduction

Saxo Bank is a licensed bank from Denmark. Saxo Bank Group has its HQ at Philip Heymans Alle 15, 2900, Hellerup, Copenhagen. It provides online trading and investment bank facilities to the users. It was founded in 1992. Several worldwide financial authorities such as the Danish FSA and the UK FCA have acknowledged Saxo Bank.

Saxo Bank caters to global customers and has its authorized subsidiaries across the world in the form of legal entities. It has a large base of clients and client assets. It has operated since a long time through its subsidiary Saxo Capital Markets UK Limited and Saxo Capital Markets Pte Ltd. The services offered and the fees might vary subsidiary to subsidiary depending upon the services and products available to trade across. This Saxo Bank review will try its best to cover every aspect of Saxo Bank along with its fees and offerings.

Saxo Bank Reviews – Overview of Platform

Saxo Bank Reviews – Overview of PlatformSaxo Capital Markets has been in the market for over two decades now, and it certainly has a reputed market position. It is considered as a safe forex trading platform as it is supported by known and reputed financial authorities like the Australian Securities and Investments Commission (ASIC), Monetary Authority of Singapore (MAS) and many more.

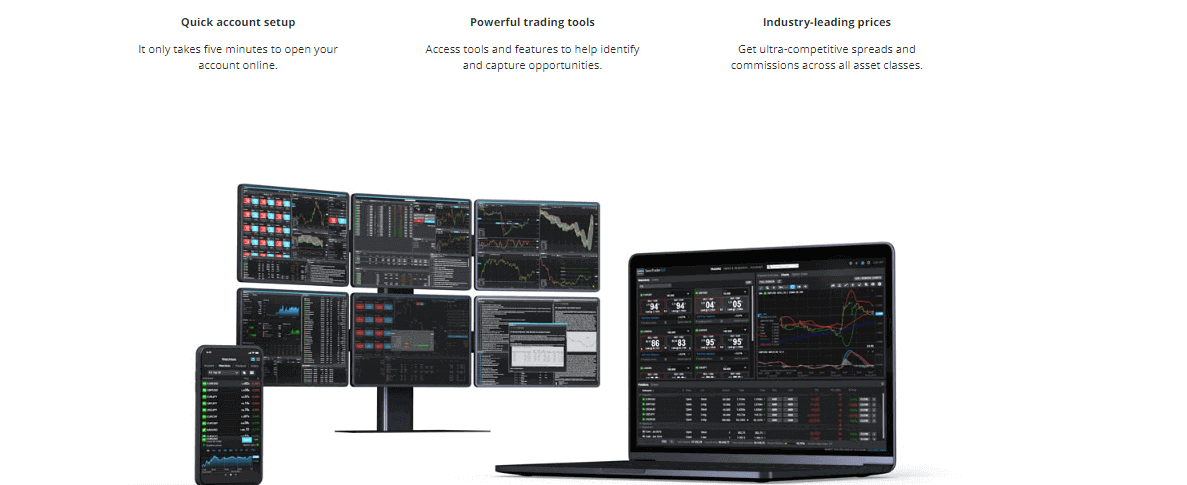

Saxo Capital Markets has a long and credible track record and is recommended by industry participants as well. It is user friendly with its easy UI/UX design, easy trading tools, demo account feature (so that you do not end up losing money due to lack of knowledge), a wide array of products including forex, currency pairs, and web platform, mobile trading and trading via desktop platform (Windows). It has a competitive spread on multiple asset classes. It does not endorse or recommend any products or services, which creates a link to a third party website.

Client funds remain protected as Saxo Bank is authorised and regulated by tier 1 regulators. Saxo Bank A/S Netherlands is registered by the Bank of the Netherlands (Registration Number: 34357130). Saxo Capital Markets Hong Kong Ltd. is licensed by the Securities and Futures Commission in Hong Kong (Registration Number 1395901). Saxo Bank has a representative office license granted by the Central Bank of the UAE.

Saxo Bank A/S Czech Republic is registered by the Czech National Bank (Registration Number: 28949587). Saxo Bank Securities Ltd. is licensed by the Japanese Financial Services Agency (Registration Number: 239). Saxo Bank Switzerland Ltd is regulated by the Swiss Financial Market Supervisory Authority (FINMA). Saxo Banque (France) SAS is licensed as a credit institution by the Bank of France (Registration Number: 483632501 R.C.S. Paris). Saxo Capital Markets Pty Ltd and is registered as a Capital Market Services provider and an Exempt Financial Advisor with the Monetary Authority of Singapore. BG SAXO Società di Intermediazione Mobiliare S.p.A. is licensed by Italian Market Authority – Consob (Albo SIM – Registration Number: 296). Saxo Capital Markets Australia Pty. Ltd is licensed by Australian Securities and Investments Commission (ASIC).

Saxo Bank Pros and Cons

Its experience is smooth, easy, and driven by a well-streamlined trading platform which makes it popular among others. Forex fees as well as fees for stock index CFDs and mutual funds are low. Fees for ETFs, real stocks, stock CFDs are average. The research hub is embedded with research features and provides high quality research material and research tools that are better than other online brokers. Its customer service is active via phone calls; also high-quality research team regularly provides trade feeds. Our experts found that it provides traders with an extensive product portfolio, currency pairs so that each Saxo trader gets a product to trade as per his/her needs.

If there are many advantages of having an account and trade through it, there are a few disadvantages too. Such as, it charges high trading fees on bonds, options, and futures. Know more about other best forex brokers charges here. The minimum deposit that needs to be made to open a live trading account is relatively high (ranging between $600-$10,000 depending upon the account type and country). The deposit amount depends on the country of residence of the user. Plus, live customer service through chat is not 24*7.

While mostly there are satisfied reviews in wellknown review websites by users of Saxo Bank, some user reviews also highlight the disadvantages. A user commented,

“Saxo Bank is a big lie. Initially they even gave me a Christmas card and promised me bonus points. It charges huge forex fees and does not live up to its claims. It assured that if I face severe losses, my cash funds may be compensated depending on the amount of loss and market conditions. Nothing of this sort happened.”

Our review of Saxo Bank, however, is quite positive and we consider it a reliable platform.

Here is the Given List of Pros and Cons:-

| Pros | Cons |

| Credible trading platform | Comparatively higher minimum deposit requirement |

| Deep and wide research | No live chat and 24/7 customer service |

| Wide array of products (like forex, over 19,000 stocks, etc) and currency pairs | High fees on trading bond, options, and futures |

| Demo account facility | High inactivity fees |

| Traders can place stop loss limits |

Saxo Bank Advantages

Saxo Bank AdvantagesSaxo Capital Markets:

- Saxo Capital Markets is an industry leader and has been trusted for over 20 years.

- Regarding access to global markets, Saxo Bank is one of the world’s first online trading platforms to make money available to everyone.

- Saxo Capital Markets is an award-winning platform with an institutional-grade execution and powerful trading features.

- It has over 860,000 clients with 120 partners who place around 125,000 trade/day.

- Saxo Capital Markets provides 24/5 customer support from 18 local offices spread across multiple countries.

- The account opening process is secure and safe. Traders have a facility of demo accounts to brush up their trading skills, trade ideas, trading strategies and stand less chance of losing money during live trading. It does not endorse or recommend any products or services, which create a link to a third-party website.

- Has a stringent data validation process that ensures a minimal error rate with each trade that is executed on its platform.

Saxo Bank Market Analysis

Saxo Bank Market AnalysisBenefits of Using Saxo Bank:

Saxo Bank, A popular and leading trading platform, has more than 10 subsidiaries across the world. It is supported by market makers in the finance industry. With facilities like demo accounts and research materials, it is liked by many traders as a good medium to make money.

This trading platform provides a wide product portfolio to traders looking to invest in the financial markets. Customer service is available in multiple languages.

Traders can also place stop loss limits. These stop loss limits help keep a check on the losses on short as well as long term positions. Beginners should definitely opt for the stop loss limits.

Traders can get access to real time market data and trading signals from different exchanges like the London Stock Exchange, NYSE, NASDAQ etc.

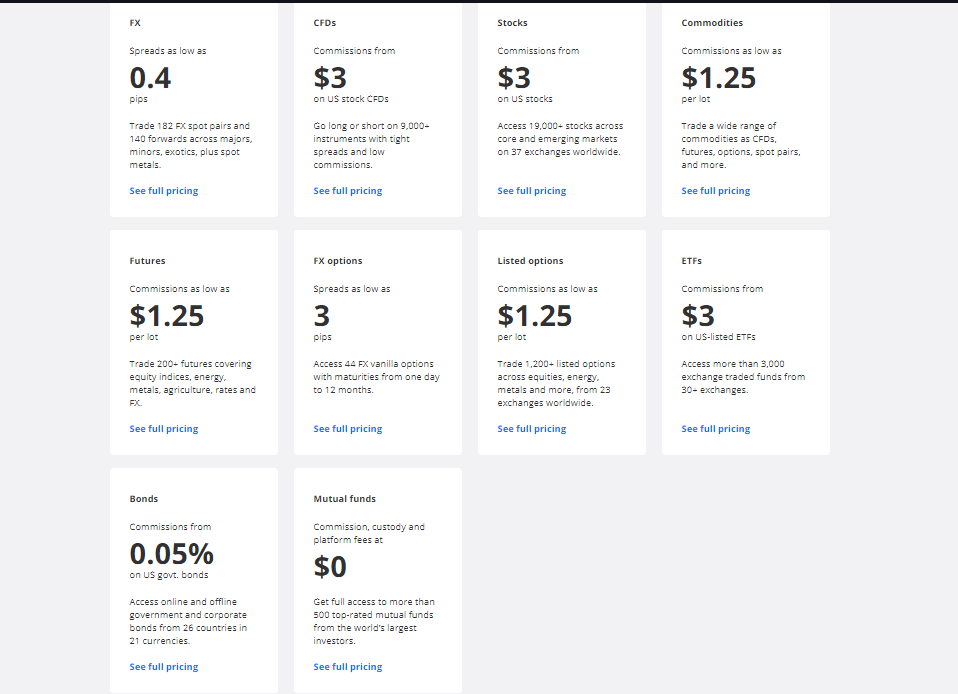

Spreads & Commission Structure:

Trading costs vary from instrument to instrument. It charges high trading fees for stocks. The US stock trading of $15 is the highest. The trading fees on other investment services like equity, forex, equity, or trading CFDs of the average range. If you are trading futures, bonds, and options, the trading costs are quite high when you trade in fewer volumes.

Commission charges at this web site vary as per the volume of trade and trading frequency. In the case of forex trading on Saxo Bank, you will have to pay a lesser commission if your trading volume is higher. A typical commission 0.005% on the first $50 million tradings in that month. Stock fees are 0.01 USD per share with 3 USD minimum and Forex spreads are as low as 0.4 pips.

Fees Structure at Saxo Bank

Saxo Bank Prices

Trading Fees:

- Fees of Saxo Bank vary from country to country, but France, the UK, Norway, Australia, Denmark, Singapore, the UAE(all Middle East countries), Russia and Hong Kong have similar fees.

- It has a transparent and typical fee structure. Clients can easily understand it.

- Its fees vary based on the types of accounts. A Saxo account is for those who are looking for higher services in return for higher fees.

- Volume-based fee structure. Low account minimums. Different margin requirements depending on the product. If traders wish to trade in stocks on margin or short sale basis, trading CFDs is a better option.

- Saxo Bank’s fees on mutual funds are zero. It does not charge anything to trade with mutual funds. However, traders will have to pay the regular annual maintenance fees charged by the issuer of the fund.

- Saxo Bank trades in mutual funds in specific countries only – Poland, Germany, and Denmark.

- Its bond fees are on a higher side. Traders have to pay 0.2% fees and commission based on trade volume and a minimum fee of €80. Options fees & future fees are high too. CFD fees at Saxo Bank are average. Then there are crypto fees and SaxoSelect fees.

Non-trading Fees:

- Apart from the trading fees mentioned above, it charges non-trading fees too.

- There is a high inactivity fee. The inactivity fee varies from country to country.

- If you have UK based accounts, you might have to incur a minimum fee of £25 if your account was inactive during the recent quarter. In case you have an ISA and SIPP account, that is not chargeable.

- For traders out of the UK, the charges will be $100 for keeping the accounts inactive for six months.

- Those who trade in bonds, stocks, or ETFs, have to pay custody fees. 0.12% will be cut annually on the open trade positions or a €5/monthly as the custody fee. In case your trade assets are in different denominations than your account currency denomination, you are subject to currency conversion fees.

Saxo Bank Review: Main Features and Highlights

Saxo Bank Features and Highlights

It serves these regions: The UK, Singapore, France, Japan, Denmark, Switzerland, Australia & SA. Operating in multiple countries, Saxo Bank has more than 10 subsidiaries operating from multiple locations. All these subsidiaries are authorized. Saxo Bank has a representative office license granted by the Central Bank of the UAE. Saxo Bank does not offer its services in the United States, South Africa. This would have given it a red flag, but because it is regulated by prominent regulatory bodies even from the U.S., like CFTC, NFA etc. it was not given a red flag.

Traders have to pay fees for being inactive. Almost every trader has to pay fees for keeping accounts inactive for one quarter of the year. Fees vary depending upon the country of residence, and the type of account. It has no withdrawal charges.

The min deposit amount at Saxo Bank is $600 for a classic account. For VIP accounts and premium/platinum accounts, the amount is different. Opening an account at Saxo takes 1-3 days (including verification process)

Deposit options available include credit card, debit card, bank wire transfer; electronic wallets are not accepted. It supports 19 base currencies. A demo account is available (so that you do not end up losing money due to lack of knowledge).

A wide product portfolio and currency pairs including ETF, Mutual Fund, Stock, Bond, Forex, Futures, CFDs, Options, Crypto, SaxoSelect. There are some regions where Mutual funds services are not provided by it. In some cases, you have to pay a custody fee.

~ SaxoSelect: SaxoSelect is for those who do not want to trade or manage portfolios manually. SaxoSelect is a blend of mutual funds and Robo advisory. Traders can choose strategies and portfolios. Here the account minimums of $20,000 is required to initiate live trading. Traders have to face fees ranging between 0.5% to 1%.

~ Deposit and Withdrawal: Withdrawal and deposit are user-friendly on Saxo Bank. Plus, it is free of charge. There are no fees for withdrawals submitted via the Online Cash Withdrawal Module.

~ Research Material: This online broker has a huge knowledge base on its trading platforms. Registered users have access to it. Traders can access it from web-based, desktop platforms, and mobile apps too.

It also runs a separate page named tradingfloor.com. This page provides traders with latest market news articles, real time market research, market analysis, market insights, and statistics instead of outrageous predictions from around the world. You will find news, equity research, performance analysis, opinions, recession watch, Saxo Bank broker reviews, trade signals, etc.

Saxo Bank Education

Saxo Bank Education~ Account Opening: The account opening procedure of Saxo Bank is completely digital, easy, and user-friendly. Traders need to share their name, email address and phone number. However, the account verification process of Saxo bank may take longer as compared to other trading platforms. Saxo Bank serves in almost every country. Go to the official Saxo Bank website and register yourself to know if you are eligible or not (if Saxo Bank serves your country or not).

Saxo Bank does not endorse or recommend any products or services, which create a link to a third party website.

How Much Should I Pay Minimum as a Saxo Bank Deposit?

In the United Kingdom, the min deposit amount required for a classic account to start is $600. Premium/platinum or VIP accounts may have different deposit criteria; again, it depends on the country of residence too.

Minimum Deposits

- The minimum deposit amount has to be $600. It varies as per the country though.

- In the case of Denmark, there is no minimum deposit amount.

- For the United Kingdom, the minimum deposit amount is 500 GBP

- In Singapore, the traders have to deposit a minimum amount of 3,000 SGD

- For Malaysia, it is SGD 3,000 Platinum account minimum.

- Australia based Saxo Bank trading account will have to deposit a minimum of 3,000 AUD.

- If the trader has an account in China 2,000 Renminbi has to be deposited.

- A Hong Kong based Saxo Bank trader will need to deposit 2,000.

- Norway based trading accounts will need a min deposit of 10,000 NOK. In the same way,

- United Emirates – 10,000 USD

- France – 2,000 EUR

- Czech Republic – 10,000 USD

- Slovakia – 10,000 USD, and

- Netherlands – 2,000 EUR.

Account Base Currencies

Saxo Bank allows traders to choose from 19 base currencies. Traders can open several sub-accounts to trade in different currencies. This is a unique feature by Saxo Bank. This feature is important to avoid conversion charges. Those who wish to trade in multiple currencies can open multi-currency bank accounts at a digital bank.

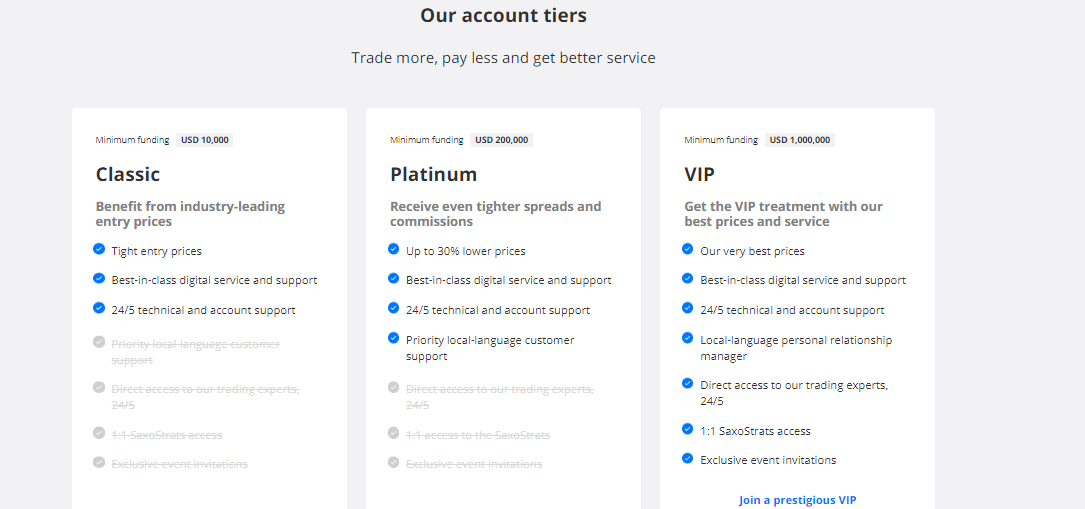

Account Types

Saxo Bank provides its traders with an account tier as per their preferences: Classic, Platinum, and VIP accounts.

- Classic account – where a minimum of £500 deposit has to be made.

- Platinum account– a minimum of £50,000 deposit amount has to be made.

- VIP account– £1,000,000 of the minimum deposit has to be made.

Saxo Bank Account Types : Classic, Platinum, VIP

Saxo Bank Account Types : Classic, Platinum, VIPPlatinum and VIP accounts allow traders to enjoy a more friendly pricing layout, and traders can consult with their dedicated customer service person. If you are from the United Kingdom and you hold ISA/SIPP accounts (which are tax-efficient), you do not have to pay any charges for Platinum and VIP accounts. Saxo Bank also provides facilities for corporate accounts and professional account.

Account Overview:

How to Open Account With Saxo Bank

Opening an account with Saxo Bank is easy and completely digital, hence user-friendly. Online registration on this platform hardly takes 10 to 15 minutes. However, account verification may take longer.

Saxo Bank traders can open an account it in the following three steps:

- Submitting an online application

- Approval from the platform

- Funding

While registering on Saxo Bank, the user will also submit his/her identity proof authorizing his residency status and personal information.

Saxo Bank: Account Opening

Saxo Bank: Account OpeningOnce Saxo Bank approves your accounts, you will have to fund the account so that you can start trading live. The process of funding might take around one to five working days depending upon the method of payment of financing.

~ Different Account Types: Saxo Bank Has Four Types of Accounts:

- Classic Account: Deposit amount varies as per country

- $500,000 Platinum account minimum deposit has to be made

- VIP: Deposit of minimum of $1,000.000.

- Premium: From the Saxo Bank reviews, we found that for a Premium account minimum of $100,000 deposit has to be made. Premium account allows users access to free news and research material.

Platinum and VIP accounts holders enjoy advanced customer support, IP address linked logins, more secure and tighter spreads.

~ Different Payment Methods:

It accepts multiple payment methods like credit cards, debit cards, bank wire transfer but not wallet payment. Bank transfers can take between 1 to 5 business days. The majority of European clients need to transfer money to a Saxo Danish account to perform an international bank transfer. If you are using a credit/debit card, the money will be credited to the traders’ accounts instantly. However, you will have to pay charges of around 0.5-2.5% to the card operator.

Stock transfers are done through the transfer of a stock portfolio. This process might take more time as it has to be processed by the current portfolio holder of yours.

In terms of withdrawals, it sends an amount either to your bank accounts or a broker account. Withdrawal is free of cost.

~ Saxo Bank Withdrawal:

Withdrawing from this forex broker is as easy as depositing in it. Withdrawal at Saxo Bank is free of charge, and users can withdraw only through bank transfers.

How Long is the Withdrawal Process of Saxo Bank?

As we have seen above, an account holder can withdraw from Saxo Bank account balance only through bank transfer. And it should not take more than a couple of business days to get the amount reflected in the accounts.

~ Portfolio and Fees:

This forex broker provides a transparent portfolio and fees to its users. One can download these reports from the dashboard. Reports will talk on your profit/loss statement, account balance amount and charges paid, fees incurred etc. Saxo Bank does not charge a withdrawal fee.

~ Login and Security:

As mentioned, it has only a one-step login system. But, if you hold VIP accounts, a more secure login process can be enjoyed where your IP address is linked to the Saxo Bank login path. We have to accept that if Saxo Bank provides a two-step account login to the users, it would be more secure.

~ Search Feature:

The search function available on the platform functions quite well. On searching for a particular keyword or word, one gets all the relevant data and answers related to it. The search box also has a dropdown button on its right side to make searches more accurate and access to data subscriptions.

~ Web Trading Platform:

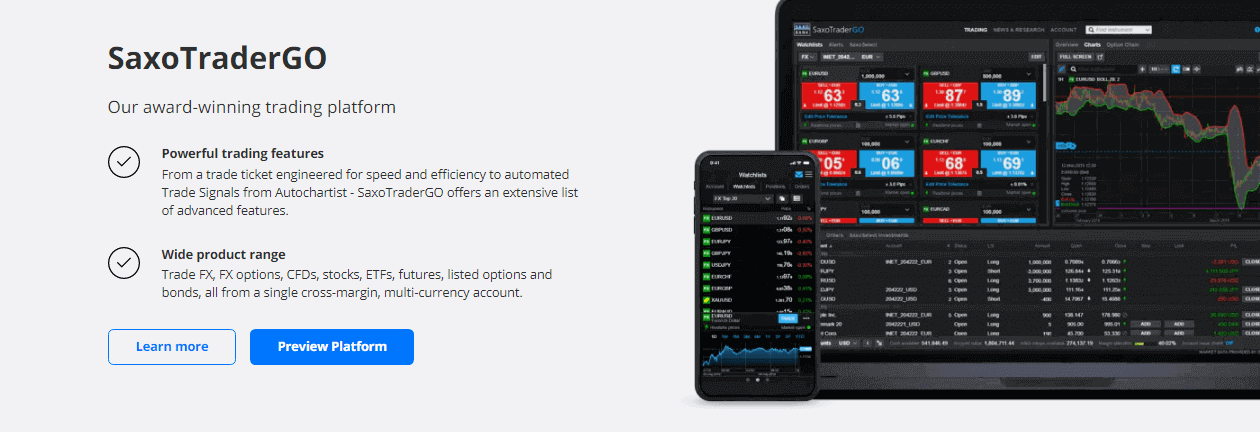

Its flagship platform SaxoTrader GO is a user-friendly web trading platform that provides features favored for professional trading such as advanced order panels. One distinctive feature of this web platform is the trade ticket which is adorned with advanced options like switching between futures, forex CFDs, forex options, or forwards.

In the web version, traders can opt for many order types and order time limits. Order types like Stop limit, Market Limit, One-cancels-the-other (OCO), Trailing stop, etc., can be opted for. However, the platform doesn’t have a two-step login, which is crucial in terms of safety.

In terms of look and feel for trading, yes, SaxoTraderGO is a great platform equipped with all risk management tools along with economic calendar which ensure the protection of the bottom line and in turn gives a rewarding trading experience. It is a user-friendly, interactive, and customizable platform. Both beginners and professionals can use this platform with equal ease.

Traders can also use tools like charts with current trade signals, technical indicators, trading ideas and technical analysis from TradingView, a social trading platform. The charting tools and social trading features of TradingView are one of the best in the market. Traders can also access other third-party trading tools like Dynamic Trend, OpenAPI for Excel portfolio management, MultiCharts, and use their drawing tools. Just like SaxoTrader GO, its flagship desktop platform is SaxoTraderPRO. Both SaxoTraderGO and SaxoTraderPRO are very popular among traders. Both platforms support multi-languages; you can change platform languages by going to software Settings > Regional.

Saxo Bank SaxoTraderGO

Saxo Bank SaxoTraderGO~ Mobile Based Trading Platform:

It has a mobile app too. When it comes to mobile trading, yes, Saxo Bank is as easy and interactive as its web-based platform. Even the look and features of the mobile and web-based platform are almost similar. Its mobile app has OS compatibility and can be run on iOS or Android operating systems (just like any other mobile app). In the case of mobile trading platforms or mobile apps of Saxo Bank, you get an extra security layer of biometric authentication though it does not make it more secure as compared to two-step verification.

The Desktop Trading Platform:

Saxo Bank Trading Platform

This market maker’s desktop-based trading platform is quite popular among others in the market for its intuitive design, ease of navigation, easy charts and watch lists, drawing tools, customized trades as per the trading conditions, etc.

The desktop trading platform of Saxo is called SaxoTrader PRO, and we found from Saxo Bank reviews that it appears just like the web version and mobile version. Compared to other desktop trading platforms like Interactive Brokers, SaxoTrader PRO desktop platform comes with extra features and advanced settings and customizations, including watch lists, streaming Level 2 order book, time and sales module, order ticket, and charting package with moveable trend lines. Using drawing tools, you can be setting up trend lines that help develop indicators regarding when to buy and when to stop; also, it can use for the order books.

With PRO, traders can create their trading ecosystem, and run six different trade platform windows simultaneously and make fair use of the Level 2 order books along with time and sales data.

Markets and Product Portfolio

Saxo offers offers a wide range of products to the trade. It provides a broad selection of options in complex investment asset classes such as options, forex, and trading CFDs. Saxo offers an equally competitive range of trading products in traditional asset classes such as stocks, ETFs, bonds, forex, CFDs, etc. However, it needs to improve its crypto and mutual fund asset classes.

Risk disclaimer: CFDs are complex instruments and come with high risk of losing your money. Many retail investor accounts lose money when trading CFDs with this provider. Consider whether you understand how CFDs work and have the required risk appetite. Initiate trade transactions in CFDs only when you understand the risks involved and can afford to take the high risk of losing money rapidly due to leverage.

Forex: Saxo offers one of the currency pair selections in the market with 182 fx pairs available for trading forex.

Stocks and ETFs: Saxo Bank traders have an open ground when it comes to trading in the stock market. Saxo Bank traders can deal in both big and small stock markets/exchanges.

Funds: Mutual funds are a recent addition to the Saxo Bank portfolio. Saxo traders from selected countries can trade in them, not all. And even the numbers of mutual funds to trade are less as compared to the trading platforms. Saxo allows its accounts to invest in funds published by credible market names like Pinebridge, BlackRock, etc. It has a total of 17 mutual fund providers.

Options: For FX options, Saxo Bank traders have a huge market available. They can trade in CBOE or Euronext, along with stock exchanges like the SEHK. Options trading on forex, stock options, or contracts is done. It provides around 23 forex options markets. FX Options have a minimum ticket fee of €/£10 for positions below 50,000.

Futures: With this, a large portion of futures markets allows you to trade assets from any asset class like bond, commodity, index, currency, commodity CFDs, stocks.

Bonds: Saxo Bank allows trades in both government and corporate bonds and the range goes up to 40,000 bonds.

CFDs: CFDs are a type of complex instrument product and they come with a high risk of trading. As per the Saxo Bank reviews and reports on the internet, 72% of retail investor accounts on this platform tend to lose money when trading CFDs. Trade if you can afford to take the high risk of losing your money on your trading accounts. You must understand how CFDs work before taking high risks as your capital is at risk in the financial markets.

Cryptos: It can trade cryptocurrencies like Bitcoins and Ethereum via ETN instruments.

Saxo Bank Trading Products

Saxo Bank Trading Products~ Customer Service: Its customer service is active through emails, and phone support, in multiple languages. The trading platform gives a positive trading experience in this area too. There is a chat bot which can be used for contact support, however, it is not available 24*7.

~ Education: If you’re a new Saxo user, the platform has a huge knowledge base to help you understand its functioning and trading with Saxo Academy’s help. The Saxo Academy helps enhance trader education and learn new trading ideas; they can also join client webinars, watch informative videos, attempt a demo account, etc.

Demo trading account is to practice your trading habits or strategies and check your level of expertise before you start live trading. Third-party trading signals, technical indicators, and analysis tools available. You can get trade signals for yourself with a free 20-day demo trial.

~ Regulation and Licensing: As we have seen above, it has 10 subsidiaries spread across the world. All these are authorized by the respective local bodies. It is a reputed brokerage company in Europe.

Why Choose Saxo Bank?

Why Choose Saxo Bank?~ Safety: Saxo Markets UK Limited is authorised by tier 1 regulatory body Financial Conduct Authority (firm reference number 551422). It has a banking license with protection against negative balance situations. It is not listed on any stock exchange, be it Hong Kong or the United Kingdom.

Saxo Bank Review: Bottom Line

Saxo Bank is a trading platform serving multiple countries across the world since the last two decades. Saxo Bank provides a very good trading environment for trading forex. The ease of use and market reputation adds to its popularity which becomes evident from its wide number of site visitors.

As per Saxo Bank review 2023, Saxo provides complex trading services and high-risk trading options through a simple trading platform. Saxo trading allows users to trade in a number of portfolios with active customer service and easy withdrawals. Plus, it provides a competitive spread on a multi asset class.

As per Saxo Bank review 2023, Saxo Bank does not endorse or recommend any products or services, which create a link to a third party website.

FAQ

1. Is Saxo Bank regulated by credible authorities and is it safe?

Ans. Yes, it is. Danish Financial Supervisory Authority (FSA), the United Kingdom Financial Conduct Authority, Swiss Federal Banking Commission, Japanese Financial Services Agency support this trading platform. Each subsidiary of Saxo is authorized.

2. How am I protected at Saxo Bank trading?

Ans. Trading in any market is subject to high risk due to market volatility. However, the platform one trades on has to be credible. It serves globally via 10 different subsidiaries. Saxo offers offers retail trading accounts from the European Union with negative balance protection for FX spot and CFD trading. Particularly popular with retail traders, Saxo is an old platform with a good market reputation.

3. Explain Leverage at Saxo Bank?

Ans. In the brokerage industry, forex is typically traded on margin products, where every brokerage firm has its own leverage and margin requirement. It leverages based on a tiered margin methodology. It has a maximum leverage of 1:30. It complements the other regulated online brokers in the EU. Any margin call can be executed on a subaccount/subaccounts.

4. Does Saxo Bank provide a bonus?

Ans. SaxoBank offers a loyalty program SaxoRewards. This helps traders earn reward points for every qualifying trade they place. This can later be utilized for account upgrades.

Saxo Bank has a competitive spread on multiple asset classes, and it does not allow the platform to give active bonuses. This is applicable significantly to forex trading as it is commission-based.

5. What are the safety and security measures taken at Saxo Bank?

Ans. When compared to other forex brokers, Saxo Bank’s web-based platform comes with high-security features. Traders share their crucial data on the platform while opening an account. This data has to be stored with the utmost security. According to Saxo Bank review, Platinum and VIP account holders enjoy advanced customer support, IP address linked logins, and more secure and tighter spreads.