Firstrade Review 2023

Firstrade is an online trading broker that offers the capacity to trade Stocks, Mutual Funds, ETFs, Options free of cost. This broker offers good features compared to other trading platforms, such as zero minimum balance and commission-free trades. Firstrade can be a good choice as per the Firstrade review for traders who are looking to invest in stocks or mutual funds at a very low cost. Further, this broker offers various trading options, like Navigator, the Options Wizard which also includes a mobile application for the benefit of its options traders.

What is Firstrade?

- Firstrade started its operations as First Flushing Securities in 1985. The company was renamed Firstrade Securities in 1997, and its first online trading platform, firstrade.com, was launched then.

- By offering investment products, this broker offers tools, calculators, and educational resources. This also includes an intuitive and easy-to-use user interface and the proprietary trading technology which are offered to its clients. Besides, this broker does not require any account minimum deposit. It can be described as one of the leading trading platforms for self-directed investors and also for small and new investors.

- When compared to other brokers like e Trade, Firstrade provides free trades for its users, but unlike other discount brokers, Firstrade offers free trades for mutual funds. Further, there are no contract fees for options trades, which is the most advantageous feature for experienced investors.

- Firstrade day trading is quite popular. A day trader can trade with ease and assurance as all day trading rules are properly applied.

- Stop limit, market limit, and trailing stops for options trades, are available as per the industry standard.

Few Pros and Cons of This Broker Are Discussed Below

| Pros | Cons |

|

Zero contract fee on options trades |

No Forex, crypto, futures options trades or futures trading |

|

Mutual funds are commission-free trades |

Limited functionality in web and mobile platforms |

|

Commission-free trades for stocks, ETF, and options trades |

Customer support is not available 24/7 |

|

Customer support for traditional and simplified Chinese and English accounts |

Firstrade login is not secured |

|

Streamlined trading experience |

Can trade only in US markets |

|

News streaming/ analysis from Briefing.com, Morningstar, and Benzinga not accessible in the mobile app |

Background

As per our Firstrade review, First trade started its journey from the area of Flushing, Queens, New York. It was a discount broker and has stayed consistent throughout its options trading, contracts, trading costs, and its fees. It has a different fee structure for the multiple asset classes that are available on its platform.

Features of Firstrade

- As per our Firstrade broker review, it also offers a wide range of accounts, which includes various types of IRAs, and also joint taxable and individual taxable accounts, custodial accounts and Coverdell Education Savings Account (ESA). Also, the user can have access to Morningstar stock reports, among other useful research tools, so that the trader can get insights on picking up the right investments.

- As per our Firstrade reviews, one of the main advantages offered by this platform is the “Firstrade Securities Lending Program.” Investors looking for additional income simply need to lend the stocks to other financial establishments, which could lead to bigger profits if they have bigger accounts. Also, there are no restrictions currently on the account holders; the trader can sell their stocks anytime.

- Firstrade also offers zero commission charges practically on all trades, which comprise of stock, ETF, options, and mutual funds. Even though there is a large number of products available such as stocks, ETFs and mutual funds, bonds, funds, and options trades, the trader cannot trade futures, futures options, forex, and cryptocurrencies.

- This broker offers education tools and research; the traders can get the most use from Navigator and Options Wizard. Further, Navigator requires the trader to set up a Firstrade Premier account, which requires a 10,000 dollars minimum account balance. Regarding margin trading, Firstrade offers tutorials to understand the technicalities of a margin account and ways to maintain the margin requirements.

- Firstrade accounts are protected by the Securities Investors Protection Corporation (SIPC) for up to 500,000 dollars in cash or/and securities. Firstrade goes beyond and offers Firstrade Online Protection Guarantee for its traders. The organization will cover 100 percent of any loss the trader experiences because of unauthorized activity in their online trading account.

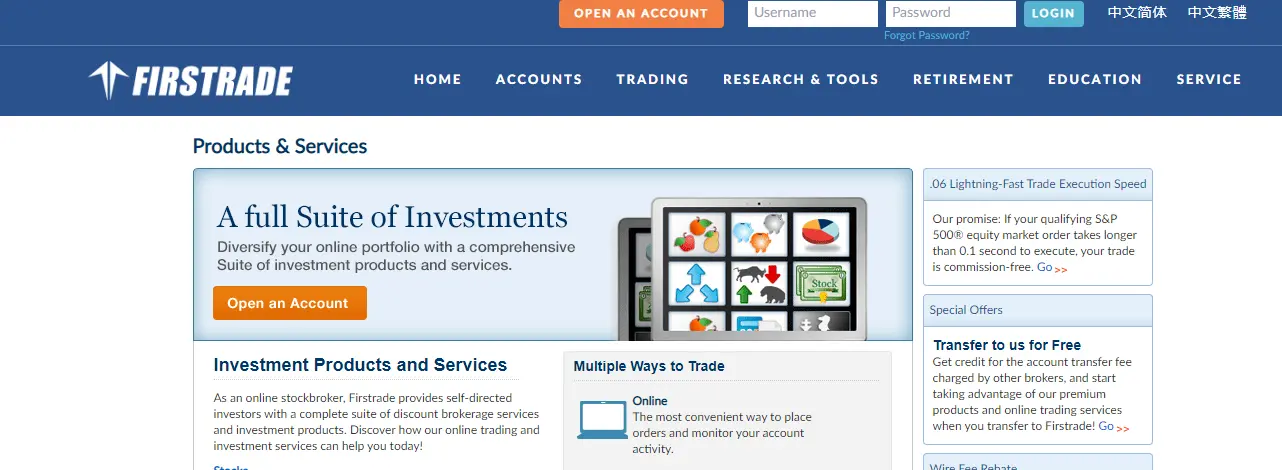

- The trader can indulge in trade executions on stocks, bonds which include corporate bonds, U.S. Treasuries and agencies, and certificate of deposits. They can also trade exchange-traded funds along with over 11,000 mutual funds.

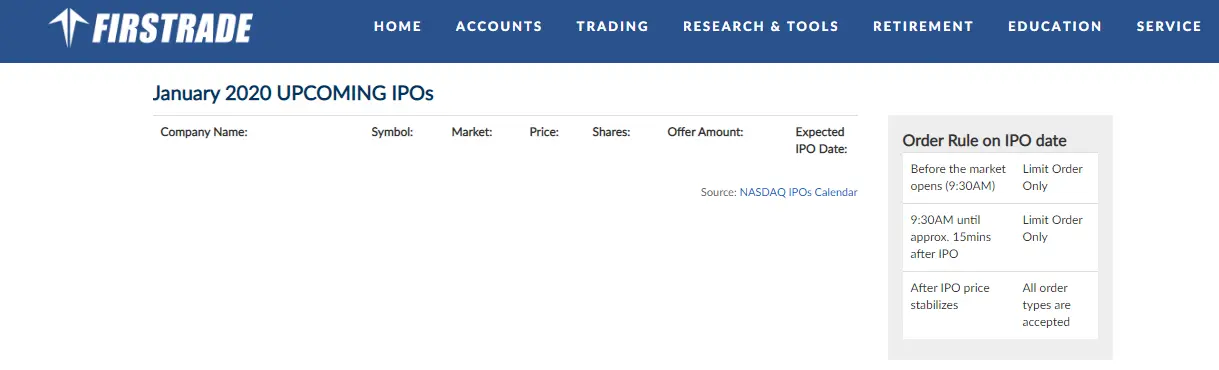

- As per our Firstrade broker review, it offers an exclusive service called Upcoming IPOs. This service provides the trader with a monthly list of forthcoming IPOs. The monthly list includes the organization and symbol, the market it trades in, price, number of shares, expected IPO date and the offer amount.

- It does not allow money transfer through credit cards or debit card.

- All rights reserved by the platform for its features and functionalities offered by Firstrade.

Advantages of Firstrade

- As per our Firstrade review, Firstrade is a leading broker that offers commission-free trading in stocks, options, ETFs and mutual funds. Earlier, Firstrade was the only commission-free broker to offer retirement accounts. Firstrade does not charge any contract fee for an options trade, which is rare among online brokers.

- Several top trading brokers have a selection of mutual funds without having to pay any transaction fee, yet they charge somewhere a transaction fee in the range of 5 dollars to 49.99 dollars for purchasing or selling shares of funds that are not on their list. Firstrade does not do this. It does not charge trade fees or transaction fee on any of the several mutual funds it offers.

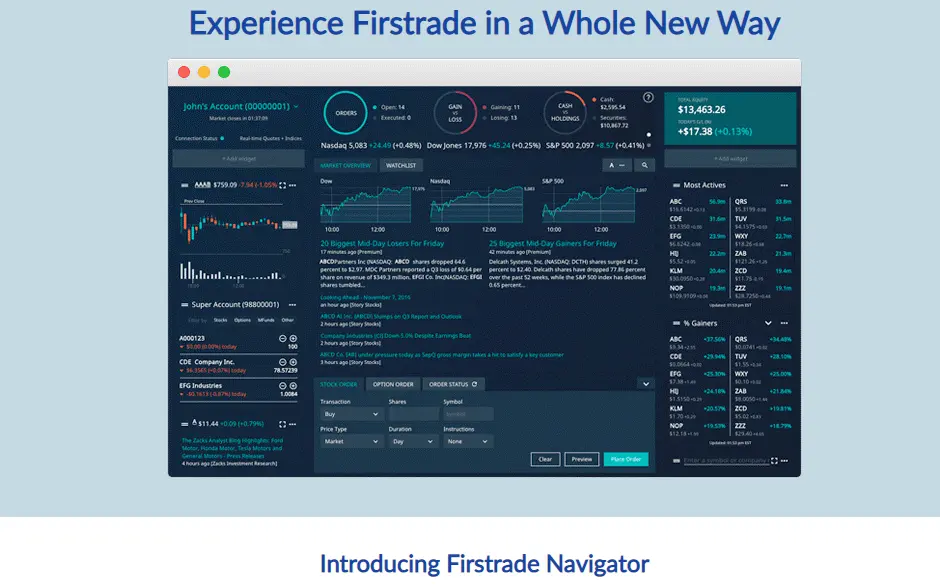

- Firstrade Navigator enables the trader to see their positions, their balances, and trade all on one screen, with drop-and-drag customization of market-related data points, tracking, and charts.

- Additionally, Firstrade offers its traders extended hours of trading like Premarket, regular hours and aftermarket trading for its traders.

- Furthermore, we found from Firstrade reviews that a restructured advanced screener helps in narrowing down the investment decisions by categorizing high-yielding quality stocks, Large-cap development stocks, small-cap funds, in-depth analysis of stock markets, current market trends, and several others. Options Wizard permits advanced analysis of potential gains and losses (both long term and short term) from options trading and over 40 complex options trading techniques.

- For online trading, Firstrade offers multiple investment choices and commission-free trading for options, stocks, ETFs. When the price war broke out in 2019, $0 trades were made industry standard. Firstrade was the only commission-free broker that provided retirement accounts to its users.

Why Choose Firstrade Brokerage Over Other Trading Platforms?

Let us discuss some of the benefits offered by the user-friendly Firstrade platform –

- Firstrade offers a quick bar tool that helps the trader to trade without leaving their current brokerage tab.

- By offering $0 stock mutual fund and ETF transactions, Firstrade becomes one of the brokers that provide completely free options trading.

- It offers information in English and Chinese. For Chinese speakers who focus on exclusive trading, Firstrade is appreciated by the native. Its research information pages are also available in simplified and traditional Chinese.

Who Should You Choose Firstrade?

Firstrade is the best choice for investors looking to manage their investments. It allows them to pay a very minimum amount as trade fees to trade securities.

Several online stock brokers charge 3.95 dollars and more for stock trading, and offer a very limited number of no-load mutual funds or commission-free ETFs. This broker does not charge any commissions on ETFs and stocks, bonds. Besides, a trader can trade any mutual fund at no cost as long as they don’t incur a short term redemption fee of 19.95 dollars, if they sell the fund in less than 90 days after purchasing it.

Firstrade does not offer a Robo advisor option, hence the trader needs to be aware of their investment strategies. Also, the trading platform does not offer rich features when compared to its rival discount brokers.

Get the Benefits of Firstrade Trading Platform

- According to the Firstrade review, this trading broker is one of the best and affordable online brokers that are available in the market currently. Further, they do not charge any minimum deposit and the trader need not pay any commissions to trade on their investments which include top mutual funds, options, ETFs, and stocks. Few brokers charge for trades and they offer a restricted number of commission-free no-load mutual funds and ETFs.

- Firstrade offers research tools for its traders that includes, several stock reports from morning star, video commentary from trade analysts. They also provide a broad overview of the trading markets so that it is very useful for the traders. They also offer screening tools which help the traders to narrow down their investments to add to their portfolio.

- The traders are eligible for a refund if they incur a fee to transfer the funds to this broker. Moreover, Firstrade offers $200 as a rebate for transfer fees, when the traders switch from another broker and $25 in rebate for wire transfer fees when the trader wires an amount of 25000 dollars or more. This helps the trader not to go out in search of another brokerage firm for better offers.

Credits

In recent news, Firstrade had received high ratings from Kiplinger’s Personal Finance, which named Firstrade as the best online broker for 2019 for active traders because of their low commission fees and other low cost services. In option, Firstrade added NICE Actimize SaaS to safeguard its platform to protect against illegal tax avoidance.

Security

Firstrade protects its investors with a balance of 500,000 dollars and it is regulated by the SEC and FINRA. However, the trader will not receive notifications for negative balances and Firstrade is not listed on the stock exchange. This broker has only one step authentication for login, which implies there can be a cybersecurity issue since most of the online trading platforms use two-step identification factors.

Trading Instrument Option Available at Firstrade Trading Platform

- As per our Firstrade review 2023, the Firstrade trading platform covers a wide range of investment options. The organization offers an easy to use interface and extended hours of trading. The tools and resources offered to new investors by the company are very helpful for beginners and active traders.

- Firstrade customers will not have the option to trade forex, cryptocurrencies, futures, and futures option trades on its platform. Also, there are advanced features for options trading permitting the traders up to four legs for every spread.

- Investment products of Firstrade comprise of –

- Dividend Reinvestment Plan (DRIP)

- Exchange-Traded Funds (ETFs)

- Stocks, Options, Bonds, CDs, fixed incomes

- Margin trades

- Mutual funds

- Securities Lending Income Program

Opening an Account

At Firstrade, new investors can open a brokerage account online, but it sometimes takes time to set up. Moreover, it might take up to 3 days to open an account because of the slow verification process. All US customers can open an account, but with a few restrictions. For US customers, they need to give verification documents of their citizenship and residency for setting up their brokerage accounts.

Account Types

- Regular investing

- International accounts

- IRAs

- Business accounts

- Custodial accounts

- ESA educational planning

- Cash management account

Firstrade Cash Management Account type helps traders trade and spend money all in one account. Firstrade’s Premier accounts offer selective advantages to the individuals who qualify. In case if the trader is a Firstrade investor with large investments, they will qualify for below accounts –

- Blue (10,000 dollars or above)

- Gold (50,000 dollars or above)

- Platinum (100,000 dollars or above)

Besides, targeted representative assistance is the best advantage of Firstrade’s Premier accounts. Savings accounts, home equity lines of credit, mortgages are not offered.

Premier Services

- Our experts get to know from the Firstrade reviews that Firstrade Gold Account is a service-based account for traders whose account balances are 50,000 dollars or more. Further, it includes the features of the basic service. Firstrade charges reduced rates for internal asset transfers, offers dedicated customer support, copies of personal checks, account verification letters, and stop payment orders.

- Platinum Account service is for account minimum balances of 100,000 dollars or more. Some of the features are its dedicated customer service, waive fees for internal asset transfers, copies of personal checks, account verification letters, and stop payment orders.

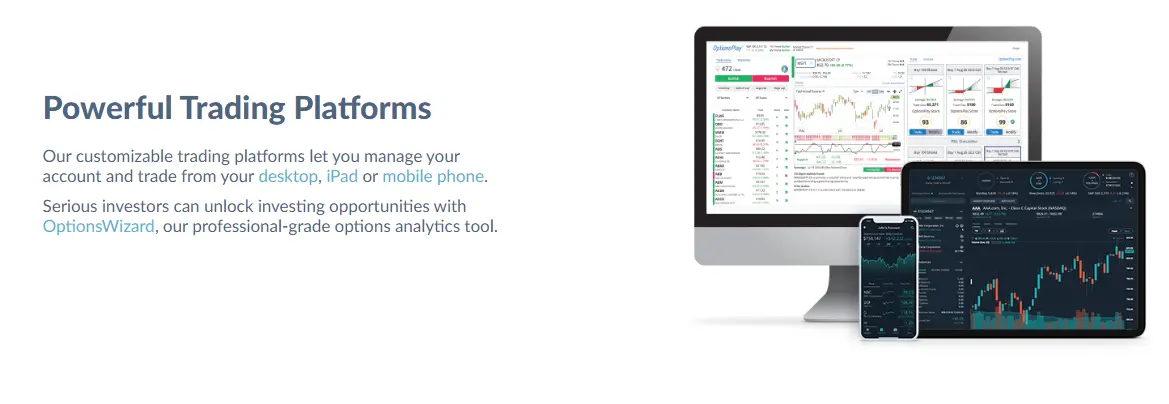

Platforms

Firstrade’s platform delivers simple, easy to use trading experience for its traders. Firstrade’s online trading platform, Firstrade Navigator, is accessible only to Firstrade Premier Clients, which means the trader should have an account minimum balance of 10,000 dollars.

Indeed, even without Premier status, clients can access the platform’s streaming present quotes, watchlist through the web site. Even though the streaming list is easy to use, there is no optional field to customize the account management and trader experience. All rights reserved by the platform for its features and functionalities offered by Firstrade.

Trading Technology

According to Firstrade review, recently this broker has developed its trading platform, Firstrade Navigator for active investors. Firstrade Navigator is accessible for users of the desktop platform who are applying through their email address. The procedure to get access to the platform is a bit difficult, yet users on an iPad can access it through the App Store without the application procedure. Real-time data points and streaming quotes are accessible on online Navigator and mobile platforms. Firstrade is the best choice for smaller traders if their essential concern is to keep commissions and trading costs as low as possible.

Firstrade comes with some pros, cons.

| Pros | Cons |

|

Good Search function |

No two-step login |

|

User friendly |

Mutual Funds

On the Firstrade website, there is a screener on the profile page for mutual funds. The trader can use the mutual fund screening tool to display all the products available. The investors can purchase and sell mutual funds for free. Suffice to say, there is a short term redemption expense of 19.95 dollars that applies to any mutual fund shares held under 90 days.

Firstrade Navigator

As per our review, Firstrade Navigator is a very much structured and powerful framework with a great deal of significant data that can be instantly accessible, enabling the users to get down to details. Further, it is entirely customizable and has a collection of widgets that can be embedded in the dashboard. Stock charts and studies are additionally included. Moreover, Firstrade offers lots of videos to diversify the education center.

Firstrade’s platform offers the following –

- Manage and trade from one screen

- Advanced technical charting

- Customizable widgets

- Adjustable layouts

- Position simulator

- Helpful graphs

- Guides and podcasts available for education purposes

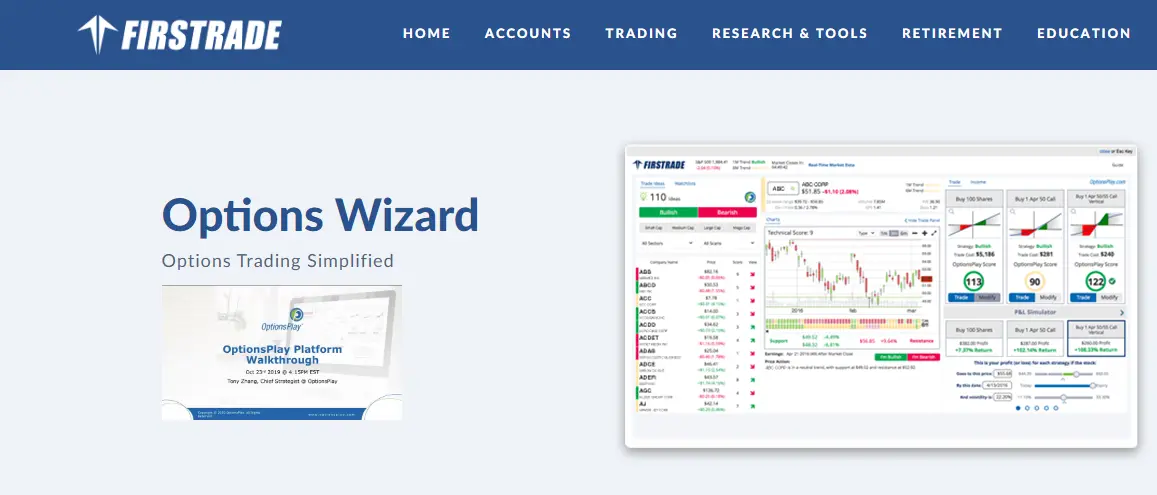

Options Wizard

Options Wizard provides comprehensive analytics for options traders. The Options Wizard includes the following –

- One of the distinct areas where Firstrade stands out is the trading of options, Firstrade web site also offers various instruments and information resources to help in building options strategies and then implement them in options trading. One of the essential offerings on the platform is the Options Wizard.

- This instrument gives the trader instant feedback on value and the probability of success of any of the options strategies, options orders, and options trades made by the trader. It utilizes sophisticated analytics that changes market data into significant information regarding options trading.

- The Options Wizard gives a professional evaluation in options and analytics. This incorporates trend indicators, strategy checklists, support and resistance levels, technical and fundamental rankings, over 65 technical indicators, profit and loss simulations, and over 40 complex options procedures.

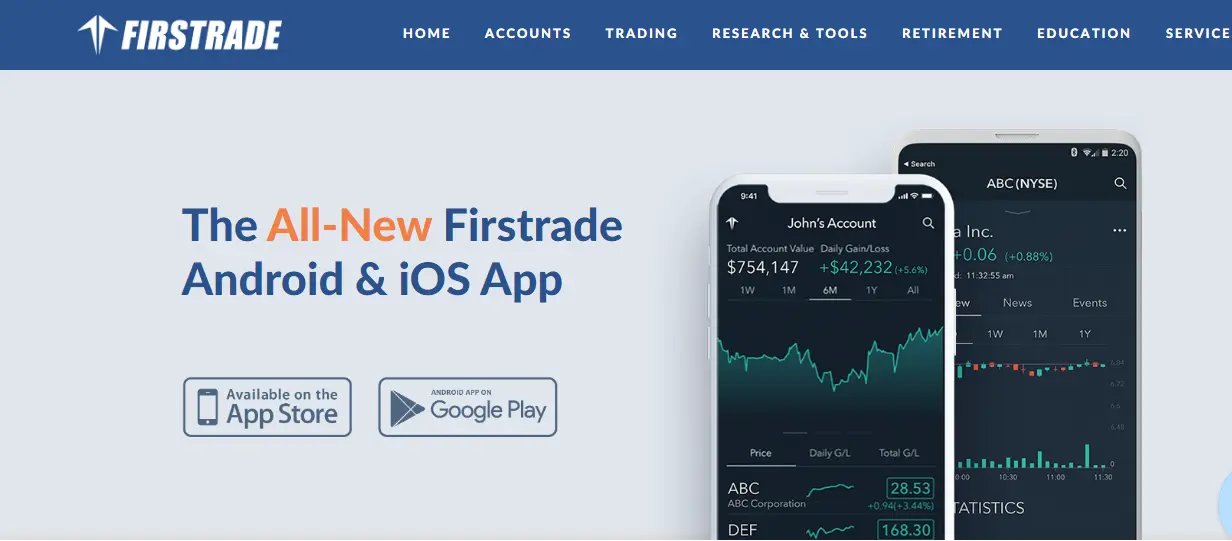

Mobile App

- Firstrade’s mobile app was launched last July, which presently includes a consolidated portfolio dashboard, intuitive swipe actions, and updated research with advanced charting abilities.

- Firstrade offers a mobile trading application that is easy to use for trading and offers Face ID recognition for login. Further, stock watch lists sync with the changes the trader makes on the platform and can check ongoing streaming quotes on the mobile trading application too.

- The mobile trading application immediately synchronizes with a desktop platform, and clients can trade, transfer funds between accounts, see market orders history and can create a watchlist to keep up with trading opportunities, and learn good account management skills. Firstrade’s mobile app is available for users on both iOS and Android.

- The traders can monitor the portfolio’s performance effectively with the Firstrade mobile trading application, which offers an expert option when compared to the desktop trading platform. The traders will be seeing advanced charts, equity ratings and fundamental data, complete dashboard and advanced research and easy to use and user friendly trading interface.

- The traders can see options and charts within the application, along with 19 other stock charts. Sometimes, the stock charts are hard to read and not too many alerts can be set-up.

- The mobile trading application’s order entry features, good order flow and watchlist are coordinated with the online Navigator platform, which created a good user experience. Additionally, streaming market news and analysis from Briefing.com, Morningstar, and Benzinga are not accessible inside the mobile app and there are no screening tools and other research tools are also not available.

| Pros | Cons |

|

Variety of order types |

No price alerts |

|

User friendly interface |

Mutual funds and bonds are not added |

|

Good Search function |

No two-step login |

|

News streaming and analysis from Briefing.com, Morningstar, and Benzinga are not accessible in mobile app |

|

|

No money transfer through credit cards/debit cards |

Account Minimum

To sign-up and use the Firstrade account, there is no account minimum requirement. Besides, to use the Firstrade Premier and navigator platform, clients should have an account minimum balance of 10,000 dollars. Clients can see the balances and positions in the account through the dashboard, which incorporates customization of news, tracking, and charts. One of the best features of Firstrade is that it offers commission-free trading.

Funding, Payments, and Withdrawals

- As per our review, deposit with an ACD fund transfer, wire transfer or cheque deposit can be made by traders. There are no withdrawal charges for ACH transfers, however, if the trader uses wire transfer to withdrawal, they will be charged 30 dollars for domestic and 50 dollars for international withdrawal.

- All options, stock, and ETF trades have zero commission charges. Traders can also lower the securities cost by lending their shares for daily income through Firstrader’s program.

- Firstrade offers trade-off for lower trading costs. Traders need a premier account if they need to take advantage of lower costs.

- Firstrade charges high margin rates for traders’ margin accounts as compared to other brokers. Also, there are fees for various account transactions, like higher charges for ACAT transfers and wire transfers.

- It does not allow money transfer through credit cards or debit cards.

Account Fees – Annual, Transfer, Inactivity

- Zero annual fee

- 75 dollars full account transfer fee

- 55 dollars partial account transfer fee

- Zero inactivity fee

Commission and Fees – Comparison With Other brokers

| Commissions & Fees | Firstrade | TD Ameritrade | E*Trade |

| Minimum Deposit | Zero | Zero | 500 dollars |

| Online Option Orders | Zero | 0.65 dollars per trade | 0.65 dollars per trade |

| Online Mutual Fund Trades | Zero | 49.99 dollars | 49.99 dollars |

| Options Trades | 0.50 dollars per trade | 0.65 dollars per trade | 0.65 dollars per trade |

| Online Stock Orders | 0 stock | 0 stock | 0 stock |

| Broker-assisted Stock | 19.95 dollars | 25 dollars | 25 dollars |

Upcoming IPOs

One of the best features offered by this broker is Upcoming IPOs, where it mentions the name of the company, symbol and the date when the IPO is expected.

Countries They Serve

Firstrade is open to international investors. Apart from U.S customers, it offers its brokerage services to customers from Japan, China, South Korea, Taiwan, Hong Kong, Macau, New Zealand, Singapore, and Mexico.

Chinese Language Options

Firstrade’s platform supports native Chinese, which can be accessible in simplified and traditional Chinese.

Referral Program

Firstrade offers its clients a free stock for themselves and for a friend they refer to the platform. Further, the company says, one out of each 100 gets an opportunity to get a free stock in Apple, Facebook or Microsoft.

Streaming Watchlist

One of the first lines of options Firstrade offers is the streaming watchlist. Traders will be able to respond to market conditions instantly with Firstrade’s real-time streaming quotes, which is compatible over all browsers.

Dividend Reinvestment Plans (DRIPs)

Firstrade allows its clients to sign-up for the DRIP program. Once it is done, they are automatically registered in the DRIP of any stock that offers the plan. Moreover, qualified stocks must be valued at around 4 dollars per share and incorporate domestic securities. Traders can sign-up for the DRIP program whenever they want to and also can cancel the participation at any time.

Advanced Screener

This tool allows the trader to streamline their investment decisions using predefined screening criteria. The traders can look out for high return stocks, small-cap stocks and stocks of any other criteria at rock bottom pricing.

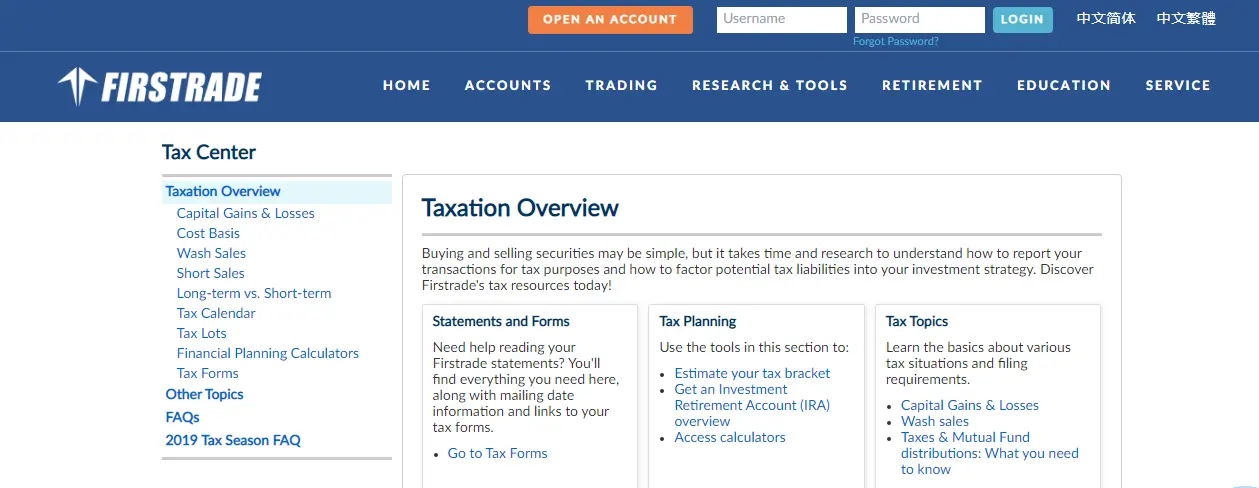

Tax Center

This broker offers a dedicated tax page. It gives significant information and dates for investment purposes. The page lets the user print tax documents. Also, it offers access to normal tax documents for its clients. It additionally offers tax topic discussions, which include wash sales, long term capital gains, short sales, and several other informative topics. Moreover, Firstrade provides a financial calculator that will help the users in their investments.

Analysis, Charting, and Research Tools

- Firstrade has numerous trading tools for screening, research, and testing. The best one is the mutual fund and stock screening tool. However, it can be used only on the web browser edition. If the trading requirements are too complicated, then entering the trades is simple through the easy to use screening tool.

- The trader can look for different ideas for options and analyze trades or spreads by comparing them with real-time information.

- Charting is accessible on the easy to use browser and mobile application version. Furthermore, browser screens have fundamental charting abilities that cannot be customized. If the user signs up for navigator through Firstrade Premiere, charting can be customized utilizing MultiCharts under TradingView.

- Even though there are few portfolio analysis tools and accounting features offered by Firstrade, it does not have advanced features as compared to other online brokers. Moreover, investors can screen their positions and watchlists while downloading account statements and history in real-time.

Education

We found from Firstrade reviews that several videos and links can be found inside Firstrade’s knowledge base. This offers trading strategies and a good understanding of accessible markets. Firstrade has articles and videos covering trading strategies and a broad range of business sectors. For beginners, the material will give an introduction to most of the points though very little can be found there.

News and Research

Firstrade provides its clients with a well-adjusted research experience, which is dependent on Morningstar as its essential supplier, an offering that outperforms the deep discount brokers. Firstrade provides just a single third-party research report for stocks and ETFs. As compared to its competitors, this is an important feature, as its competitors do not provide such a research report.

| Research Feature | Interactive Brokers | Firstrade |

| Stocks | Yes | Yes |

| ETFs | Yes | Yes |

| Mutual Funds | Yes | Yes |

| Pink Sheets / OTCBB | Yes | Yes |

| Fixed Income | Yes | Yes |

| Screener Stocks | Yes | Yes |

| Screener ETFs | Yes | Yes |

| Screener Mutual Funds | No | Yes |

| Screener Options | Yes | No |

| Screener Bonds | Yes | Yes |

| Portfolio Builder | Yes | No |

| Portfolio Allocation | Yes | Yes |

Customer Service

- Firstrade offers several customer service options, which include live chat with a registered customer service representative from Monday through Friday, 8 A.M to 6 P.M ET, or the trader can use Firstrade Chatbot, named Sammi.

- Even though Firstrade does not offer live support 24×7, there are two advantageous features based on Firstrade review that makes its customer service unique from other brokers like Ally Invest or e Trade. Firstly, they offer complete support in traditional and simplified Chinese.

- Secondly, the trader can reach out to them through phone support. Firstrade’s customer service, especially the phone support service, is responsive and fully knowledgeable when the trader calls during market hours.

- Sammi is the new AI Chatbot accessible to Firstrade customers. It can respond to some fundamental questions but the trader will be connected to various areas of the site for more answers.

- Also, client support is accessible in simplified and traditional Chinese, with customer service executives who talk both Cantonese and Mandarin. For others, the users should depend on the FAQ area of the site or they can send an email to Firstrade’s customer service team through their registered email address.

Drawbacks

- Active investors might be frustrated as Firstrade offers no forex trading, crypto, futures options. However, retirement investors have more options to build and manage their portfolio with this broker.

- Firstrade customer service needs to be improved. Moreover, other brokers like e Trade have several branches, for example, eTrade online trading broker offers 30 branches while Firstrade has none.

- Firstrade’s online chat is less than satisfactory. Firstrade gives only automated answers through online chat, which needs to be improved.

- Firstrade trading platform does not have full-features as its competitor platforms. While Firstrade enables the trader to trade straight from the account dashboard, its trading platform does not provide more proficient features like its competitor broker e Trade offer for their customers.

- Firstrade advanced tools and options are only accessible in the Navigator platform, which requires a premier account. This requires a 10,000 dollars account minimum. Moreover, there are essential devices accessible for the free account, traders will not be able to customize or see complex charting tools with the basic account.

- Moreover, Firstrade customer support can be accessed during business hours only compared to other online brokers. There are no branches for this broker except headquarters in New York.

- Firstrade does not have Robo-advisory options. If a trader needs help, they need to consult a third-party advisory. This option does not assist much with risk management/risk tolerance.

- No money transfer through credit cards/debit cards is allowed.

Wrap Up

From Firstrade reviews, we conclude that Firstrade is a trend-setter in commission-free trading with zero amounts as commissions on trading stocks, ETFs, options. Additionally, Firstrade does not charge any contract fee on options trades. Moreover, local Chinese speakers will be attracted to Firstrade’s platform, which is accessible in both simplified and traditional Chinese. If traders are interested in US markets, then it is best to make use of this trading platform. Else, the traders might have an inadequate product portfolio which covers only the US market.

FAQ’s

1. Is Firstrade a good broker?

Ans: When compared to other brokers offering $0 commission fees, Firstrade is the best choice for options traders and active stock traders based on Firstrade review 2023 who are looking for a more streamlined approach for order flow, which features advanced options spread trading that offers very low cost, while at the same time has multiple order types. It is because of its multiple investment choices, Firstrade is preferred by both new and experienced traders.

2. How does Firstrade make money?

Ans: By offering $0 commissions on all options, ETF trades, the online platform, and mobile app offer the traders 100% commission-free trading. Investors looking to make money, can do it in other ways, rather than charging a commission from its traders.

3. What are the benefits of Roth IRA?

Ans: Just like the contributions that are made to the traditional and simple IRA, the contributions made to Roth IRA are not detected. One of the major benefits of the Roth IRA is that the earnings derived from the investments are tax-free. Firstrade also gives an opportunity to grow your retirement savings with a no-fee IRA.

4. Is Firstrade safe?

Ans: It is an established online broker and it is in compliance with regulatory requirements of FINRA, and it is also an SIPC member which implies that the traders are insured against losses which might occur at Firstrade, if it goes bankrupt. This shows that it is a safe and reliable broker.