Vanguard Review 2023

Vanguard is one of the world’s biggest investment organizations, offering a huge choice of high-quality low-cost ETFs, mutual funds, consultation, and related services concerning investments. Here, institutional and individual investors, financial experts, traders, can profit from the stability, size, and experience that are offered by Vanguard. By the end of April 2019, Vanguard managed more than 5.6 trillion dollars in worldwide assets. Additionally, Vanguard has 189 funds in the United States and 225 funds in worldwide markets.

What is Vanguard?

- Vanguard is one of the leading, largest and trusted investment establishments around the world. This company provides a wide range of investment services and products which includes many of their low-cost industry-leading ETFs and mutual funds.

- By using the Vanguard account, the traders can invest in traditional bonds, stocks, money market accounts, certificates of deposits, and several more. Also, it offers personal financial advising services and retirement account options such as Roth IRAs and traditional IRAs.

- Vanguard is authorized and regulated by the SEC (Securities and Exchange Commission) and the FINRA (Financial Industry Regulatory Authority) As per our Vanguard reviews, we can say that Vanguard is considered as reliable and safe because it is regulated by top-level regulators and has a long track record. It is highly recommended for long term investments; investors who are looking for competitive mutual fund and ETF offers.

Background

- Vanguard ownership has a unique structure. Moreover, the company is owned by its assets and is established as a not-for-profit entity.

- As per our Vanguard review, Vanguard specializes in low-cost investing. The organization has gained a good reputation for the low-cost expense ratio that investors pay for exchange-traded funds and index funds.

- For investors looking for long term investment, Vanguard has a wide range of selection and services for its clients.

Disclaimer: Even though we receive compensation for this article, the article is well researched, we offer the transparent Vanguard review 2023 about this article without being biased.

Features

Vanguard offers several features for its traders, some of them are discussed below –

- Vanguard is one of the leading online brokers established in 1975. The organization is regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC).

- Vanguard will be the right choice for customers who are looking to invest their money into the organization’s funds including Exchange-traded funds (ETFs) without commission.

- Additionally, Vanguard website enables the trader to trade stocks, different securities, although it is not a perfect fit for active traders. It is most appropriate for long term investors who are not making more trades every month.

- Besides, Vanguard is useful for retirement investors with large account balances while it is less appropriate for beginners or active traders.

- Even though Vanguard provides a huge choice of low-cost ETFs and mutual funds, their online website for individual trading needs further improvement.

- Recently their website added features include no commission for online transactions on around 1,800 ETFs, lower investment minimums for almost 40 of its lowest-cost index funds, and an extended lineup of low-cost, proprietary, and socially responsible exchange-traded funds. All rights reserved by the platform for its features and functionalities.

- Vanguard is best suited for –

- Retirement or long-term investors

- Low-cost investments

- ETFs and Index fund investors

- Investors holding large account balances

Who can choose Vanguard Brokerage Account?

- Vanguard offers more than 1800 in-house exchange-traded funds(ETFs) and also mutual fund options. It also offers no charges for online trading, this feature of Vanguard appeals to traders who are looking to buy and hold Investments. We recommend Vanguard brokerage accounts for these types of investors.

- Investors who are having high account balances can choose Vanguard tiered approach because it offers its traders lots of benefits and customers having high account balances usually receive lower account fees and more personalized help from their representatives.

- Long-term investors can choose Vanguard because their customer-owned model offers them a significantly lower expense ratio when compared to the industry average, which implies that whatever amount of money earned by the trader stays in their account, earning them more for their long term Investments.

- Traders who make less than 25 trades per year can benefit from Vanguard. Besides, trading fees are just $7 for stock trades, but it increases significantly for traders who execute more than 25 trades for a year.

Vanguard Account Opening

Is your money safe with Vanguard?

People might often think that what will happen if Vanguard goes bankrupt. The answer to this question is the traders will be compensated by the Financial Services Compensation Scheme(FSCS) where this will cover up to 85,000 pounds of Investments for the platform, per person. The traders can claim this compensation free online and they will not be required to use a claims management company to claim this. Besides, the traders will not be compensated for Investments that fall in value or the company in which they hold the shares goes bankrupt or from a bad performance as a result of bad advice given by a regulated independent financial advisor.

Advantages

As per our Vanguard review, Vanguard provides several advantageous features for its users. Some of them are described below –

- Large account balances qualify for discounted and free trades. Moreover, approximately 1,800 commission-free ETFs are accessible.

- Vanguard provides good educational materials for long-term planning.

- Vanguard trading fees are normal. The fee structure is straightforward, however, the fees are dependent on the trader’s account balance.

- Vanguard provides various services depending on the trader’s investment account balance. The higher the account balance, the higher will be the discount.

- Treasury bonds are free of charge. Moreover, new issues, apart from municipal bonds, are likewise free.

- If a trader trades non-treasury securities on the secondary market, there will be a trading fee of 2 dollars per 1,000 dollars face value with a 250 dollars maximum if the trader invests an amount below 500k dollars. If the trader invests in more than 500k dollars, the commission is 1 dollar per 1,000 dollars, with 250 dollars max.

- Moreover, Vanguard has funds that specialize in short-term savings, retirement, college savings, and for all investing situations possible. These assets are famous to the point that a finance magazine as of late selected 24 mutual funds of Vanguard for its Money 70 list of best Mutual funds.

- Vanguard provides free mutual fund and ETF trading for some of its products including its own ETFs. Besides, it does not charge account opening and inactivity fees for its customers. Everything is digital and the mobile trading platform has a great design and is more user-friendly.

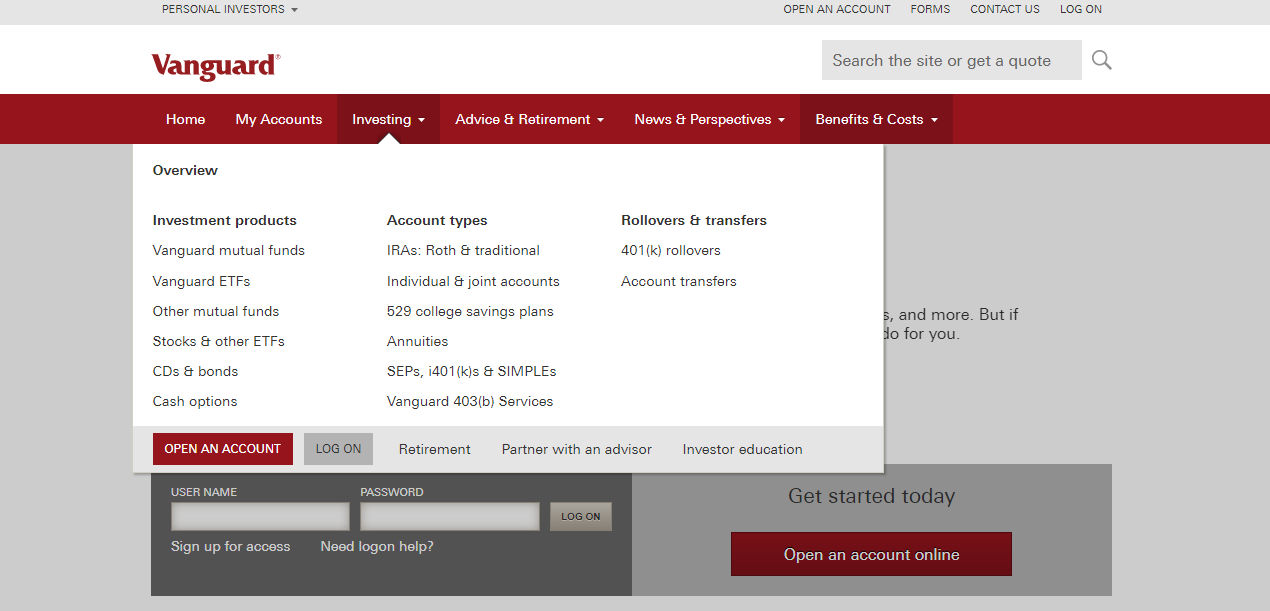

Account types

Vanguard website offers different types of account for its customers –

- Individual Brokerage Account

- Business Accounts

- Education Savings Account

- Trust Account

- Joint Brokerage Account

- Individual retirement accounts

- Vanguard Personal Advisor Services

Types of Investment Accounts

Mutual Fund

- This account is used for investing in Vanguard mutual funds apart from retirement accounts. Moreover, there are no tax advantages, but the trader can withdraw cash whenever needed and there are no restrictions on the investment amount.

- Vanguard offers over 120 mutual funds. These incorporate bonds, money market, REIT and stock mutual funds. Also, the trader can choose between actively and passively managed funds.

- Furthermore, Vanguard offers what it calls as Admiral Shares. They are mutual funds with lower expense ratios. In any case, to benefit from Admiral Shares, the trader should explicitly meet certain criteria.

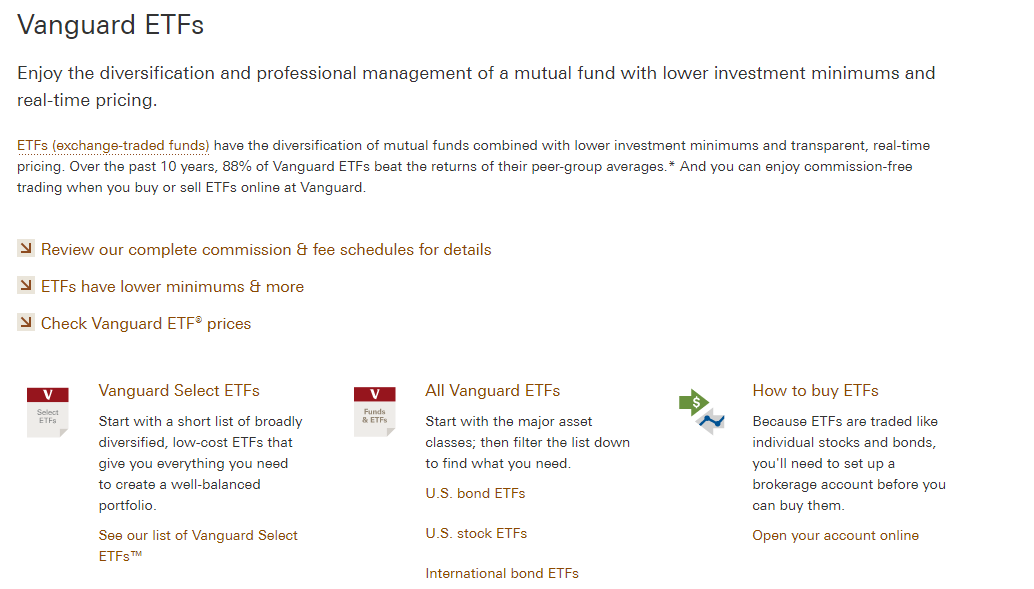

ETFs

- When the customer has a brokerage service account, they can invest in ETFs offered by Vanguard. These funds are much similar to mutual funds, yet are traded daily on an exchange, similar to stocks.

- Besides, Vanguard ETFs have no transaction costs and the normal fund expense ratio is just 17 percent; the industry average is 53 percent.

- Apart from mutual funds, Vanguard has become a significant player in the ETF markets, presently offering 1,800 distinct ETFs with no fees on commission. Further, the average expense ratio across all ETFs and mutual funds is 1.05%

- The requirement for an account minimum to start trading with Vanguard is $0 and the fees are $0 per stock and ETF trades, $0 plus $1 per contract to trade for options.

IRAs

According to Vanguard reviews, this website offers tax-sheltered accounts for retirement. The most popular IRA accounts are the cost-effective and simple Target Retirement Funds. To invest with Vanguard mutual funds, the trader needs to choose the number of years they have until retirement and Vanguard decides the suitable fund for their age. All rights reserved by the platform for its features and functionalities.

- Options Account

If the customer already has the Brokerage services account, they can also open an options account. Moreover, Vanguard charges 30 dollars in addition to 1.50 dollars per options contract. If the customer has Flagship Services (accounts over 1,000,000 dollars) at that point, the cost of the option is only 8 dollars in addition to 1.50 dollars per contract. Vanguard is generally suitable for the options trader who may require help with options trades.

- Brokerage Services Account

A customer can open a Vanguard Brokerage Services account and buy individual stocks, bonds, mutual funds, and CDs from various organizations. Further, a Brokerage Services account costs 20 dollars every year and offers the trader access to any mutual fund or stock.

- 529 College Savings Accounts

If a customer is looking for their children’s future school expenses, Vanguard offers a 529 Plan. 529 investment plans, allows the customer to save for college expenses based on tax advantage.

Other Accounts

- Traditional and Roth IRAs

Vanguard gives the investors the choice of opening either a

- Traditional (Pre-tax contributions)

- Roth IRA (post-tax contributions)

By using the Roth IRA, the trader can find it as an effective investment method when combined with low-cost mutual funds.

- Annuities

Vanguard presents both fixed-salary and variable annuities. Further, Vanguard has probably the least rates in the business for annuities. This is presumably because the organization does not have full-time sales reps selling the product, which in turn passed on as a discount to the trader.

- Individual and joint accounts

Vanguard enables the customer to save money in taxable accounts by investing either in bonds, stocks, mutual funds or CDs.

What are the benefits of Vanguard?

Vanguard is one of the leading and most popular online brokers which offers several unique benefits for its traders. Some of them are discussed below –

- One of the most advantageous features of using Vanguard brokerage according to Vanguard reviews is that there is no need to add a minimum deposit to open a new account to start trading. Several brokers will ask for a deposit upfront, which means a few thousand dollars to get started, but Vanguard does not ask any. One of the most important points is that to start trading, the trader needs to invest money. The main requirement is the trader should have enough money to purchase a single share of ETFs.

- Vanguard can be described as an investor-owned company. When an investor invests their money in either an ETF or a mutual fund, they own a part of the company and it also offers a low expense ratio of 0.14 % which means lower overheads, to offer more earnings to the investor.

- Vanguard offers a wide range of investment options such as, if the trader is looking to invest for retirement, or investing to grow the wealth, or saving for education, this broker has options for its investors and it also offers advisors to help to build their portfolio.

- Vanguard is one of the best brokers for those who wanted to buy and hold stocks for a long time. One should also know that if you are an intraday trader or an impatient investor, then Vanguard is not the right choice. By offering low-cost mutual funds and free ETFs, the traders are attracted to use these choices as Investments.

- One should also note that the more amount of money the trader holds in an account, the cheaper the trading becomes. Moreover, traders can invest in individual stocks or if they want to invest for their retirements such as low-cost funds, index funds or ETFs, Vanguard is the best choice.

Is Vanguard trustworthy?

- Vanguard is usually a preferred brokerage firm for investors who are building up their retirement portfolios. It also provides traders or investors to select from several investment options to tackle potential risks like index funds. These index funds are set up to track the performance of a market index such as S&P 500. These funds do not require any active managers and it keeps the fees low which is more advantageous.

- Traders who are investing in retirement have many options such as index funds and retirement investors funds, which are lower risk and low-cost Investments, that will offer benefits for the long period, which is very good for the investors.

- Vanguard provides a wide range of investment account options such as bonds, stocks, exchange-traded funds, and mutual funds. Vanguard has developed its brand of ETFs and mutual funds.

- Even though every investment carries risk, the traders are assured that their money is safe when they are invested in Vanguard funds. Also, one should note that Vanguard is a member of the securities investor protection corporation, a regulatory body that protects the individual investor assets worth up to $500,000. Vanguard provides extra coverage for eligible investors/customers through Lloyd’s of London.

- Additionally, this broker uses several security measures to make sure that only the customer can access their accounts, moreover, it offers a two-step login as a security measure for its traders.

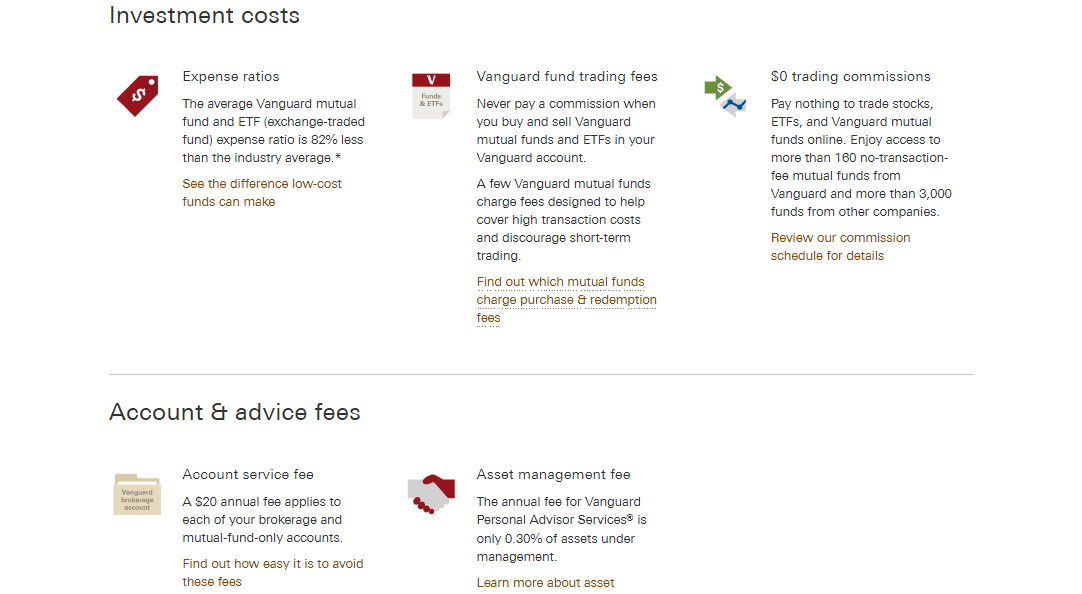

Commissions and Fees

As per our review, Vanguard website does not charge the traders the deposit fees. US customers can utilize ACH, checks, and wire transfers to deposit money in the account. Credit or debit cards and electronic wallets are not offered.

Deposit fees

Vanguard does not charge deposit fees. US customers can utilize ACH, checks, and wire transfers to deposit money in the account. Credit or debit cards and electronic wallets are not offered.

Withdrawal fees

Vanguard does not charge withdrawal fees. Yet, if the client uses ACH withdrawal, US domestic wire transfers cost 10 dollars. If the client has more than 1 million dollars in the account, there will be no fees for wire transfers.

Non-trading fees

Vanguard presents its clients low non-trading fees while it charges no inactivity fees. Additionally, there are no withdrawal fees if clients use ACH transfer.

Account fees

The broker charges no inactivity, closing or transfer fees. It applies 20 dollars yearly account service fees for all investment accounts and IRAs. The requirement for an account minimum to start trading with Vanguard is $0 and the fees are $0 per stock and ETF trades, $0 plus $1 per contract to trade for options.

Stock trading costs

Vanguard website provides stock trading costs which differ by assets invested in their Mutual funds and ETFs. Some of the costs are given below –

- Less than 50,000 dollars, vanguard charges 7 dollars per trade for the first 25 trades every year, 20 dollars subsequently.

- 50,000 to 499,999 dollars – charges are 7 dollars per trade

- 500,000 to 999,999 dollars – charges are 2 dollars per trade

- 1 million to 4,999,999 dollars – for first 25 trades every year are free, 2 dollars subsequently

- 5 million dollars and up – for the first 100 trades every year are free, 2 dollars subsequently.

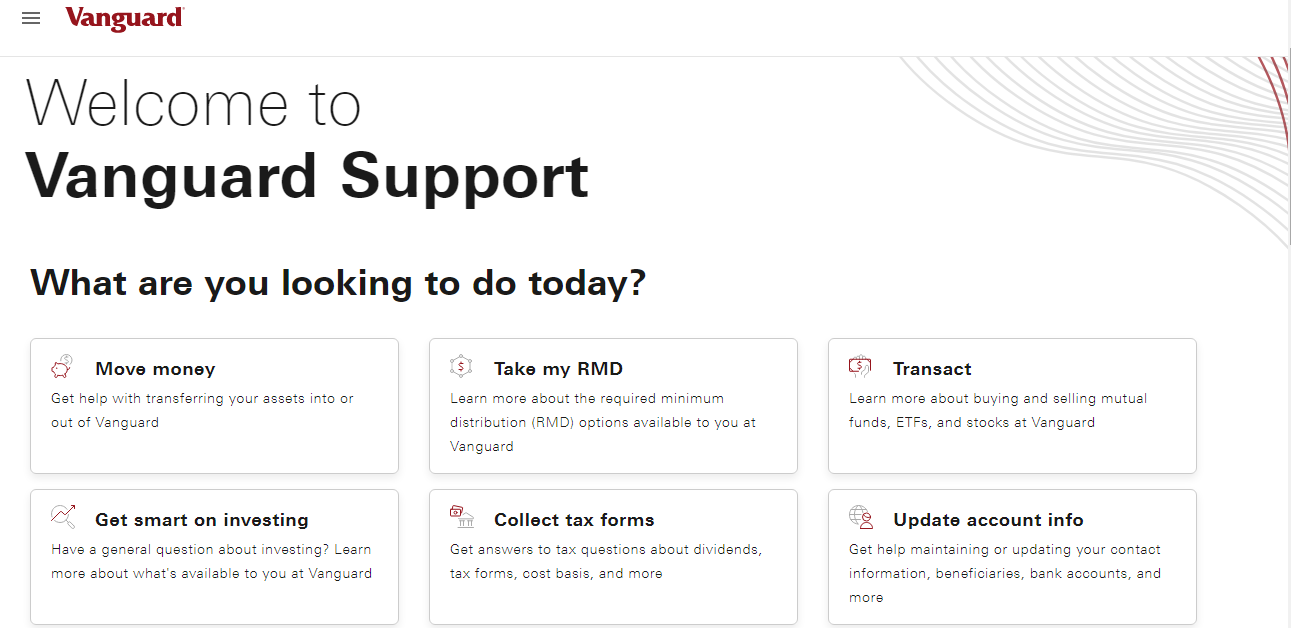

Mobile Trading Platform

- As per our Vanguard review, Vanguard provides its clients a user-friendly and well-structured mobile app trading platform. Needless to say, it does not have price alerts and the trader cannot trade stocks, bonds and options with it. Moreover, it does have a good search function.

- Similar to the web trading platform, Vanguard has an in-house created mobile trading platform known as Vanguard Investors. Besides, the application is accessible both on iOS and Android. The mobile trading platform is accessible only in English.

- Moreover, Vanguard offers mobile applications for iOS, Android and Kindle Fire devices. The design is simpler to use than the website. Vanguard offers the traders the “Vanguard” mobile application on the Google Play Store and Apple App Store.

Advance Features offered by Vanguard

Personal Advisor Services

Traders can use a managed account service if they need any help to manage their investments. The traders will get recommendations from an expert and Vanguard’s Robo-advisor technology. After adding the financial goals, this advisor recommends a portfolio that is rebalanced automatically. The minimum investment is 50,000 dollars and has a yearly 0.30 percent charge.

Newsfeed

The news feed provided by Vanguard is good. The trader can view it easily, but it does not have visual components, charts or pictures. It is offered by third-parties such as Associated Press or MT Newswires.

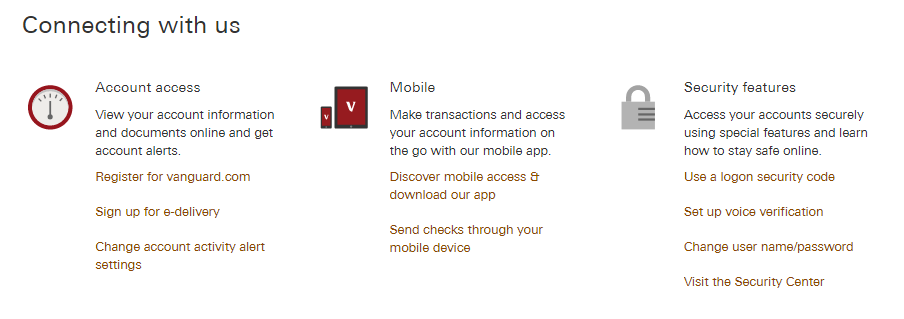

Vanguard Sign in

As per our review, Vanguard has a web trading platform. It offers a two-step login and there is a clear fee report. The trading platform is simple with search functions.

Education

- Vanguard offers reasonable quality educational videos and articles. Also, there are high-quality webinars that are interactive. On the other side, there are no demo account and the trading platform tutorial videos are absent. The traders can utilize Vanguard’s –

- Webinars

- General educational videos

- Quality educational articles

- The general educational videos and the archive webinars have great quality content, mostly focusing on beginners. The general topics include information related to bond, yield curve, etc.

- Education offered by Vanguard is genuinely basic, with the objective of long-term investing. They occasionally organize webinars for their clients that focus on long term investment options.

Research

- As per our review, Vanguard provides its traders with sharp research, intending to help address the necessities of retirement plan sponsors and institutional investors. It was created by experts who keep working in combination with industry experts and leading academics.

- This research offered by Vanguard provides insights on technical knowledge and client experience. It also provides knowledge on the difficulties the trader faces currently along with trading ideas, information on asset fundamentals and several more. Moreover, it is very user-friendly.

Stock Screener

Vanguard provides a stock screener, which is an exclusive ETF screener. The Mutual fund screener is simple and focuses on finding Vanguard funds. Moreover, options research is constrained to option chains, which are fundamentally less educational than chains on other broker chains. Charting is very fundamental and incorporates no technical studies or customization.

Alerts and notifications

The trader can set price alerts for ETFs, stocks, and mutual funds. Moreover, only email alerts are accessible and setting them will take a bit of time.

Portfolio Watch

The website of Vanguard offers a portfolio analysis tool for free to its customers. The trader can gain insights on various asset allocation, overall expenses of taxes, and also watch out for risks related to their portfolio. Vanguard’s summary section will provide traders automated recommendations to change their portfolio.

Customer Service

We get to know from Vanguard review that it has good customer service. It gives quick and relevant answers on every single accessible channel. On the other side, it does not have 24/7 service; live chat is also not provided by this broker. The customer service can be contacted only through Email and telephone. Besides, services are categorized and based upon the trader’s balance. The phone services are open from 8 am-10 pm Monday through Friday only.

Drawbacks

- Vanguard offers various low-cost ETFs and mutual funds, which can be purchased online. This broker does not offer in-depth education and trading tools, which would be a drawback for traders.

- Most Vanguard retirement funds and the Vanguard STAR Fund have a minimum investment of 1,000 dollars, and several other Vanguard funds should have a minimum of 3,000 dollars. Besides, the initial minimum purchase of 1,000 to 3,000 dollars will be high for some beginner investors.

- Account service fees can be avoided if the trader signs up for email delivery of fund prospectus and account statements; or else, the trader needs to pay 20 dollars yearly fees.

- Stock trade commissions are measured on the basis of the assets the trader had invested in index funds and ETFs. Investments with less than 50,000 dollars should pay 7 dollars per trade for the initial 25 trades and 20 dollars per trade subsequently. Moreover, accounts that are under 50,000 dollars in assets face high trading fees from Vanguard.

- Vanguard is the best broker when used for ETFs and Mutual funds. Apart from this, the services are simply basic. However, the vast majority of traders use Vanguard just for the low-cost indexed mutual funds and ETFs.

- Generally speaking, the usability of customer support has consistently been effective and direct. However, Vanguard offers client assistance Monday through Friday, not 24/7.

Wrap up

Vanguard is one of the largest US online brokers managed by top-level regulators. Despite the fact that Vanguard is a good choice for long-term fund investors based on Vanguard review, it cannot be considered as a good choice for stock traders except they have a large amount. Even though this broker offers lower fees on trading stocks, it has a few drawbacks too. The product portfolio covers just the US market and the research tools are exceptionally fundamental. Financing rates are likewise high when the customer trades on margin. One of the advantages relating to Vanguard is that there are low non-trading expenses and no inactivity fee is involved.

FAQ’s

1. Is Vanguard a good company to invest?

There are several good Vanguard reviews and testimonials offered on the internet that provides a good investment service and trustworthy brokerage establishment. Further, Vanguard charges very low fees and it offers a wide selection of investment offerings for its traders.

2. Is Vanguard or Fidelity better?

Vanguard and Fidelity differ in several aspects. Vanguard provides a wide choice of mutual funds and ETFs and it is a good choice for long-term investors. On the contrary, Fidelity has more than 190 financial planning offices and the trader can choose Fidelity if they want to have in-person experience with the investment firm.

3. Is Vanguard good for beginners?

As per our review, we can say that Vanguard is the best broker for beginners because they offer a wide range of no-load funds with low expense ratios, but experienced investors and professional money managers can also use Vanguard funds to build their portfolio.

4. Is Vanguard Roth IRA free?

Vanguard Roth IRA is not free; generally, with any broker, the trader pays for the investments in their account, either stock trading fees or ETF and mutual fund expense ratios. If the trader does not sign up for email statements with Vanguard, they might be charged with a $20 annual account maintenance fee by this broker.

Disclaimer- Even though we receive compensation for this article, the article is well researched, we offer the transparent review about this article without being biased.