Best Forex Brokers in India 2023

Overview

Trading foreign exchange in India involves quite a few limitations and legal issues. In India, the Reserve Bank oversees foreign exchange transactions while the Securities and Exchange Board of India (SEBI) is the principal regulator of the stock market. The role of SEBI is to regulate the capital markets in India. Forex brokers based in India are licensed under FEMA. Currency pairs that don’t have the Indian rupee as the quote currency are restricted from being traded in India unless a specific transaction is authorized by the Indian government.

Forex brokers in India are only allowed to offer Indian rupee based currency pairs for USD, EUR, GBP, and JPY because If the majority of Indians traded the dollar (which is the most traded currency) outside of India, the Reserve Bank of India would come to a point to be compelled to buy the USD with INR at cheaper rates. That would weaken the already weak Indian rupee.

Due to an increase in financial scams involving foreign exchange brokers in India, the government was forced to severely restrict the way citizens can operate in the forex market.

It would seem that while the Reserve Bank of India (RBI) has many restrictions around trading, there are ways for residents to trade. If you want to open an account with a foreign-based broker, you should at all costs avoid wire transfers from banks or any other financial institutions based in India or a credit or debit card issued by an Indian entity to fund a forex trading account. Instead, deposit through an electronic wallet like PayPal or Neteller.

Not all forex brokers are created equal, so make sure your needs as a trader are adequately met by the forex broker you select before committing any funds.

The Best Forex Brokers in India

If you’re from India and looking for a reliable online forex broker, the list below names some of the best online FX brokers outside of India but regulated by reputable financial authorities.

Saxo Bank

We selected Saxo Bank as the Best site for forex trading in India on our list based on in-depth analysis and testing the live accounts of 30 online forex brokers. Saxo Bank Group, a Danish investment bank founded in 1992, provides online trading and investment services. Backed by superior research, the Saxo bank trading platform is the most user-friendly and well-designed one out there. The extensive product portfolio covers all asset types and many international markets. Saxo Capital Markets offers an excellent option for advanced forex traders and sophisticated professionals with well-funded accounts.

PROS

- Extensive range of offerings

- Industry’s best research

- Superior user interface

- Offers protection for client accounts

CONS

- Lack of emphasis on customer service

- Confusing financial instruments fee structures

- No MT4 broker

FOREX.com

Forex.com, founded in 2001 as part of GAIN Capital Holdings, is an established global online forex broker that caters to individuals seeking to trade the retail F.X. and CFD markets. FOREX.com ranks as the No. 1 U.S. forex broker by client assets as per FOREX.com review. One can trade on 80+ currency pairs, equities, indices, commodities, and cryptocurrencies.

Forex.com offers its customers access to the company’s proprietary Advanced Trading Platform for Desktop, Web Trading platform if you prefer to trade via a web browser, and mobile trading through apps. The platform has 70+ technical indicators, a host of time intervals, multiple chart types, and 50+ drawing tools.

The leverage available at Forex.com ranges from 0.5% to 20%, depending upon currency pairs.

PROS

- Low $50 initial deposit

- VPS hosting for active traders

CONS

- Equities are not available on the MetaTrader 4 platform

- Account funding through credit & debit cards and wire transfer

Interactive Brokers

Interactive Brokers (IBKR) ranks very near to the top in our 2023 review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Interactive Brokers India Pvt. Ltd. is a member of NSE, BSE, SEBI. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Interactive Brokers has made a great effort to make its technology more appealing to the mass market, and its wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. You can know more about its features, trading platforms from our review page.

PROS

- Extremely smart order router

- Wide range of offerings around the world and across asset classes

- Mutual Fund Replicator finds less expensive ETFs

Cons

- Streaming data runs on a single device at a time

- IBKR Lite customers cannot use the smart order router

- Small or inactive accounts generate substantial fees

FxPro

FxPro is best for forex and CFD traders who want a wealth of choices in trading markets. Their range of forex pairs and the ability to trade equity indices, cryptocurrencies, commodities, and futures set them above competitors in the space. FxPro competes among the top MetaTrader brokers, offering the full suite of MT4 and MT5 platforms with multiple accounts and execution methods. The primary drawback to an otherwise balanced offering is pricing that is higher than the industry average.

PROS

- Real-time news

- Above-average product offering

- Transparent pricing

CONS

- Relatively high fees

- No anonymous demo account

- Weak educational platform

eToro

eToro’s social trading platform has provided forex products and more to its retail clients for over 11 years. eToro platform creates a trading community for users. eToro’s most popular forex trading features include CopyTrader, CopyPortfolios, and the Social News Feed. CopyTrader and CopyPortfolio give you the ability to locate a successful forex trader and copy their strategy. You can copy 100 traders, and the feature is easy to set up and access. eToro advocates social trading, where forex traders get to share their strategies and tips. The minimum first-time deposit varies from $50 to $10,000 based on your region and country regulations. eToro offers leverage of up to 1:400 with a facility of negative balance protection so that you trade comfortably.

PROS

- 2000+ financial instruments

- $100,000 virtual practice account

- Copy-trading and social trading facility

CONS

- Flat $5 withdrawal fees

- Minimum withdrawal amount of $50

- Leverage of 1:400

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether losing your money is a risk you can take.

Olymp Trade Forex Broker

Olymp Trade is an award-winning broker managed by Saledo Global LLC and offers leverage up to 500 times. At Olymp Trade, you can trade Commodities, Stocks, Indices, ETFs, Currencies, and Crypto assets using the Olymp Trade platform.

PROS

- Access to a demo practice account

- Trading guides and insights

- Profitable Fixed Time Trading

CONS

- Leverage of 1:500

- Differing commissions on trades

OctaFX

OctaFX was founded in 2011 and offers Forex ECN trading, as well as CFD trading on Indices, Metals, and Cryptocurrencies, across the MetaTrader and cTrader suite of trading platforms for Windows Desktop, Web (Windows and Mac), and Mobile (Android and iOS), as well as their own OctaFX Trading App. New Fx traders can explore video tutorials and get started with copy trading. You can open an account online with a minimum deposit of $20. Deposits can be made using Neteller, Skrill, Bitcoin, and Paytm. You can trade higher limits with a maximum leverage of 1:500 and negative balance protection.

PROS

- Wide range of trading accounts (Micro, ECN, Pro, Sharia) for beginners and advanced traders

- cTrader ECN platform for automatic (similar to algorithmic) trading

- Access copy trading, bonus promotions, and a wide range of research tools

- Zero commission on deposit & withdrawal

- Customer Support available in Hindi

CONS

- Limited commodity markets, no individual Stock CFDs

Libertex

Libertex is the trading arm of Indication Investments Ltd, a part of the Forex Club Group. Libertex serves Indian forex traders and is the perfect choice for those who want to trade across a variety of different industries. Leverage rates on Libertex can change dependent on the trades considered by the user. The maximum leverage rate is 1:30.

PROS

- Libertex provides a user-friendly in-house platform

- Low minimum deposit requirement of 10 EUR

- Multiple asset classes

- E-wallet withdrawals are processed within 24 hours

- More than 20 years of experience

CONS

- Has only one account type

- Specific commission fees are vague

- Lack of fundamental research

- It can be hard to find bid/ask spreads

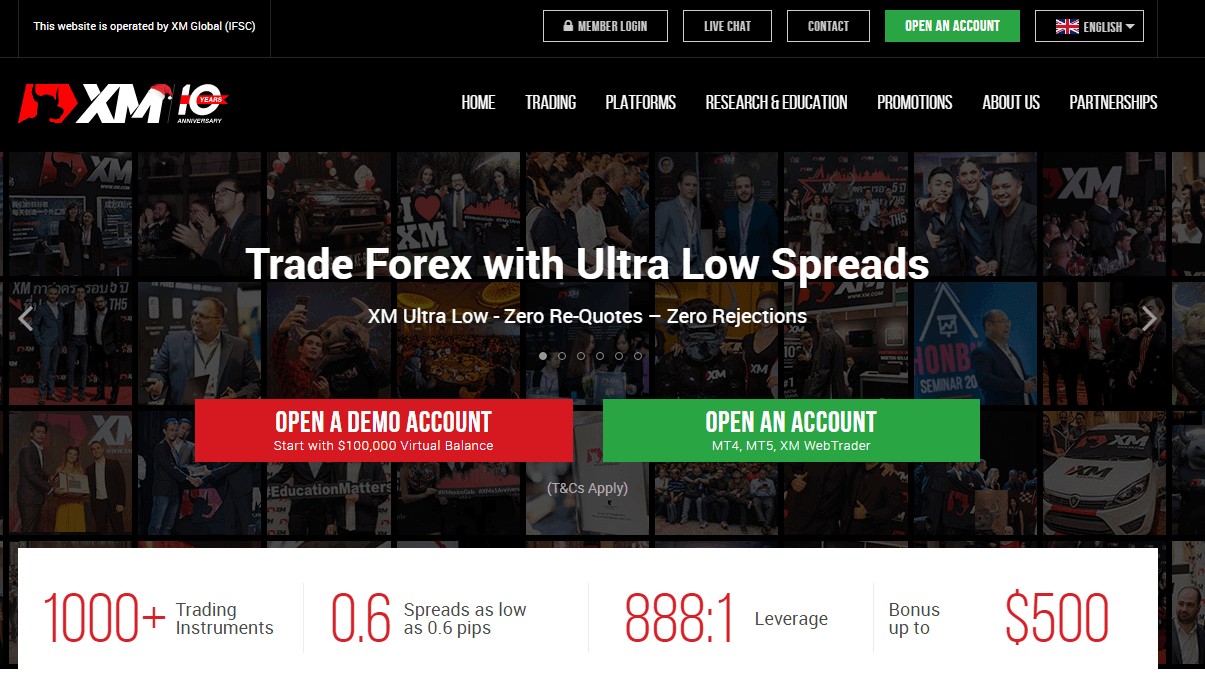

X.M. Group

X.M. Global Limited is a subsidiary company of Trading Point Holdings Ltd and is regulated by the International Financial Services Commission (Belize). X.M. has over 2.5 million traders from over 196 countries. You can trade over 55 global currency pairs and CFDs on indices, commodities, stocks, metals, and energies on its site. XM offers MT4 and MT5 trading platforms across 16 devices (Android, iOS, iPad, Mac, and P.C.) and even on the web through M.T. Web Trader. New traders can test their forex trading skills on a demo account that comes with $100,000 of virtual balance.

PROS

- Demo account with $100,000 of virtual balance

- Low minimum deposit Forex account

- Negative balance protection

CONS

- Max 200 open positions

- No proprietary platform

Wrap Up

There are several factors to be taken into consideration before setting up an account with a broker. Forex markets are complicated. Without the right research, novice investors who set up accounts lose money on the very first trade. Good forex brokers publish research reports and provide on-call guidance to help their clients understand the forex market, what factors affect the currency prices, and how to trade. You should trust and trade your money with those forex brokers who offer the best of what has been described in the article. Before you trade global forex, check your forex trading requirements, risk-taking capacity, and local regulations. Not all broker trading platforms are the same, and this is where it gets interesting. Every platform appears to have its advantages and disadvantages. You have to find something you are comfortable with. Another suggestion is that you do not place all of your funds into one broker, especially if you have a substantial amount. If you had, say, $100,000 to trade (which you don’t need!), you shouldn’t be depositing all of this with the one broker. Instead, spread it amongst two or more forex brokers, or keep funds in reserve and only deposit them with your broker if they are required – you will sleep better at night!

Once you have found the right broker to work with, focus on learning as much as you can. This will allow you to trade more confidently and increase your chances of success trading in the forex market.