Libertex Review 2023

Overview

In the recent era, where online brokers are very popular, Libertex is yet another very popular name when it comes to CFD trading and Investment in real shares.

Libertex is an online broker, founded in 2012, offering tradable CFDs with underlying assets being commodities, Forex, ETFs, cryptocurrencies, and others. Libertex also offers commission-free investments in real stocks (where only market spreads apply).

Libertex is a trading platform used by Indication Investments Ltd., a Cyprus Investment Firm, which is regulated and supervised by the Cyprus Securities and Exchange Commission (CySEC) with CIF Licence number 164/12 and provides investment services to the European Economic Area and Switzerland; the platform is used by numerous clients.

Libertex Website Interface

79.1% of Retail Investor Accounts Lose Money When Trading CFDs

Amazing Features of Libertex

There are some amazing features that this online broker offers to its clients. Some are discussed hereunder.

Multiple Trading Platforms: The Libertex trading platform is compatible both on the desktop and mobile. To be more specific, the trading platform is compatible with Windows and Mac and also as a mobile application on both iOS and Android-enabled phones. Apart from these, Libertex also provides an in-house trading platform through the widely popular MetaTrader 4 and MetaTrader 5.

Libertex MetaTrader 4 Platform

On the day of online trading, Libertex offers a total of over 250 underlying assets for trading. Very few other online brokers can offer such a wide range of underlying assets to their clients.

Fees: The fee structure of Libertex is slightly different than what its competitor’s CFD broker currently offers. The broker charges commissions such as inactivity fees, withdrawal fees, commission per trade, and overnight fees.

Commission per trade starts from 0.0003% and depends on the asset class you choose for trading. Deposits are commission-free but you may be charged a commission for withdrawal depending on the payment method you choose; if you withdraw through Skrill or PayPal, it’s commission-free.

If the Client’s Account is inactive for 180 calendar days (i.e. there is no trading, no open positions, no withdrawals or deposits), the Company reserves the right to charge an account maintenance fee of 10 EUR (10 GBP, 10 CHF, 50 PLN respectively) per month. (Applies to clients with a total account balance less than 5000 euros (4500 GBP, 5300 CHF, 22500 PLN respectively). Lastly, the Rollover fee is charged from the trader’s accounts at the end of each trading day, sharp at 9 pm GMT as an interest. For the CFD instrument, the rollover fee is triple when the trade is rolled from Friday to Monday.

Why Libertex?

Multilingual: Libertex offers its traders to choose between 8 languages available on its official website, which includes English, German, French, Italian, Spanish, Portuguese, Polish, and Dutch. Moreover, the in-house trading platform on Libertex is also available in 10 languages, including English, German, Spanish, Italian, French, Dutch, Polish, Russian, Portuguese, and Turkish.

Education: We bumped into this amazing feature of Libertex while doing this Libertex review. This online trading system, unlike most other online brokers, makes an unputdownable effort to impart useful education for the traders apart from the usual news and articles section. Moreover, there are separate news sections on the company’s website that are dedicated exclusively to different class assets such as cryptocurrencies, forex, etc., or education, market reviews, news, etc., among many others.

Libertex Academy

79.1% of Retail Investor Accounts Lose Money When Trading CFDs

Regulation: The Broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) bearing the CIF License number 164/12.

Robust Customer Service: While doing this Libertex review, we came across a robust team of customer support that provides valuable insights to all customer support queries over multiple channels of communications like phone, email, and live chat. When there is no scope for any physical interactions with online brokers, it is the customer support team that the users look up to for solving their queries. The customer service representatives of Libertex are always at the service of their users. They promptly respond to the comments sections on the social media platforms that contribute to the emerging popularity of this online broker.

Libertex Awards

Pros and Cons of Libertex

| Pros | Cons |

| It offers a user-friendly platform. | Only over 250 underlying assets are available on it. |

| Allows MetaTrader 4 and MetaTrader 5, which is almost non-existent in most of the trading platforms like Libertex. | There are fees and commissions charged on Libertex, like the commission for trade, withdrawal fee, and inactivity fee. |

| The minimum amount that needs to be deposited is just 100 EUR. | Low leverage ratio of up to 1:30 for Retail customers. |

| Regulated by CySEC. | ECN/STP model not available for clients. |

| Tight Spreads model available. |

Deposits and Withdrawal at Libertex

It is at the discretion of the traders to select the mode of payment in which they want to make their deposits to their accounts at Libertex. Among the various modes of payments allowed by the online broker, debit cards, credit card, wire transfers, Neteller, Skrill, MasterCard, PayPal, bank transfers, SEPA, are some of the common modes that the users feel convenient to use.

Both the deposit and the withdrawal methods are very easy and user friendly. The withdrawal can be made both via the web platform and also via the mobile application. In case if the traders are using the web trading system, they need to click on the “withdraw” tab to initiate the withdrawal request. On the other hand, if they are using the mobile app, they need to first select “Wallet” and then click on the “Withdraw Funds” tab to initiate the withdrawal processing request.

The details of the payment options, along with the transaction charges, if any, are discussed in detail below:-

Deposits made by Visa or Mastercards are processed instantly. The minimum deposit, in this case, is €100. For withdrawal funds using Visa, a withdrawal fee of €1 per transaction is charged from the traders, and the processing requires a maximum of 5 days. Deposits made via bank wire transfers take 3-5 days for processing There is a 0.5% fee charged as the withdrawal fee on the amount withdrawn (0.5% min 2 EUR, max 10 EUR).

In case the traders use Skrill for making the payments, withdrawal takes 24 hours to initiate processing. Here the minimum deposit that can be made is €100. However, Libertex does not charge any commission for Skrill transactions.

Deposits made via Neteller are free and instant, but the withdrawal fee of 1% is charged on the amount withdrawn, and the processing times it takes can be a maximum of 24 hours. Here, the minimum deposit is €100, which can be made via any of the payment solutions for deposits like Sofort, iDeal, rapid transfers, P24, etc. There are no processing fees attached to any of these payment solutions.

How Many Underlying Assets Are Available on Libertex?

More than 250 underlying assets are available on Libertex that are categorized into stocks, forex, indices, commodities like gold, energy, and agriculture), cryptocurrencies, and ETFs. This number is comparatively lower than other CFD brokers like Libertex, which is a severe disadvantage for it.

Libertex Assets

A full list of the assets available as CFDs on Libertex is given hereunder.

- Stocks and shares that include Medical cannabis, consumer goods and services, automobile industries, healthcare services, energy, finance, industrials, luxury items, materials, technologies, telecommunications, and potential trading underlying assets.

- Forex that includes all the Major, minor, exotics, and crosses.

- Agricultural crops include Corn, Soyabean, wheat, sugar, coffee, and cocoa.

- 15 global indices from different parts across the world, including Europe, North America, South America, Asia, and the Middle East.

- 40 cryptocurrency pairs, including Bitcoin, Bitcoin Cash, Litecoin, Ethereum, and Ripple.

- Metals including silver, gold, platinum, palladium and copper.

- Oil and gas, including Brent crude oil, natural gas, light sweet crude oil, WTI crude oil, and heating oil.

- 10 ETFs in total.

How Does Libertex Work?

To get started with Libertex is pretty easy, and as such, it does not require the users to download it. It can simply be operated through web browsers. The following steps will help the traders understand how to start trading with it:-

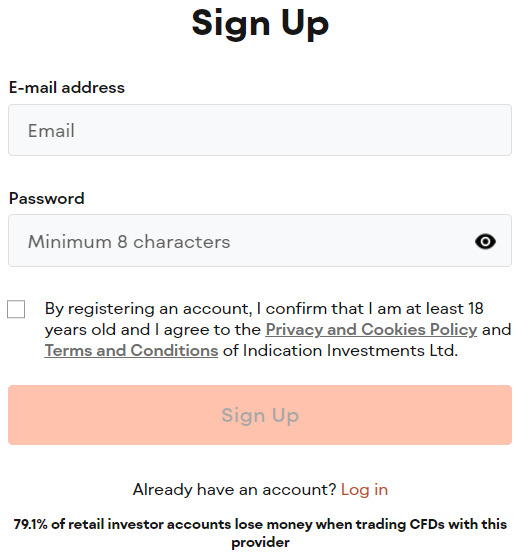

Account Opening: Generally, creating an account on such platforms is pretty easy, and it does not take more than 5 to 6 minutes’ time. All that the users need to do is visit the official homepage of Libertex; there is a “login” tab on the upper right-hand corner of the page that needs to be clicked on. This will direct the users toward another section of the in-house best trading system that reads “sign up”. On clicking the “sign up” tab, a registration form will open that needs to be filled up by the user with some of his basic details like his full name, address, email id, phone number, etc.

Libertex Sign Up Process

79.1% of Retail Investor Accounts Lose Money When Trading CFDs

Fund Your Accounts: After creating an account with the online broker, the users need to fund their accounts so that they can start trading. This funding up of his account is nothing but initiating trading with a working capital, which is required for all trades. The user needs to choose his preferred mode of payment and make the initial deposit. The various modes of payments allowed on Libertex are discussed above in this Libertex review.

Therefore, a deposit must be made before real trading begins, and the deposit must be made with the same name as used at the time of opening an account on Libertex. There are no deposit charges as such on Libertex. For the withdrawal purpose, a withdrawal request form must be filled up by the trader mentioning his account details from where he intends to withdraw, what mode he prefers for withdrawing money, and what amount he wants to withdraw. After the deposit has been made, the client needs to comply with all the verification processes, including “Know Your Customer” (KYC) procedures.

Start Trading: Now, the users are ready to initiate trading either using their real account or the demo trading account feature allowed on Libertex. The demo account feature has all the necessary trading tools as in the real account and also exposes the users to a real trading environment. The only difference is that the demo account is virtually funded, so naturally, the investors cannot earn or lose any real profits by trading through the demo trading account.

The profits earned will only be virtual and will not be reflected in the traders’ accounts for any reason whatsoever. It is only meant for practice purposes wherein the investors are exposed to real trading to understand the trading strategies and technical analysis that will work for them and also mitigate the high-risk factor associated with online trading.

The Libertex platform only allows these two accounts for trading, demo and real, unlike other online brokers, where multiple accounts can be created based on the experience of the traders and the amount of capital they intend to invest in it. This, in fact, creates confusion at the end of the day, and Libertex users are relieved from facing such confusion. Both the real account and the demo account are discussed in detail as to their account creations and funding.

Real Account: The steps for an opening account on the Libertex platform qualify for opening a real account. For filling up the registration form, some basic details are needed, but in order to make a deposit into the real account, some more information like the mode of payments, details of the payment mode, like your debit card or credit card details, etc. are also needed to be mentioned in the form to initiate the process. But, to deposit money, more information will be required by the broker. The min deposit required to open a real account is €100.

Libertex App: Access to Financial Markets in a Minute

Demo Account: This account is only for practice and experimental purposes. The demo account is credited with virtual money worth 50,000 EUR that the traders can use to place trades and experience real trading without risking their own money. The demo account creation process is the same as in the creation of real accounts, and the demo account feature is available on the web and also as a mobile application.

Traders can place trades immediately when the web browser is used, but if the traders prefer to use the mobile application mode, they need to first download and install the platform before placing a trade on it. But it is very easy to switch modes from a real account to a demo account and vice versa.

Wrap Up

While doing this Libertex Review, we came across various unknown facts that go in favor of this broker and tagged this platform as a legitimate one. There is no scope for doubts that can go against Libertex being a genuine broker that serves its clients with all the facilities that they expect from an online broker like this. Registration is easy; practicing trading at no risk is made easy by the demo account feature of the platform.

The deposit and withdrawal processes are hassle-free; what more can online traders ask for in an online broker? The commission charges sometimes pose threats to the emerging popularity of the platform, which it will soon take care of in the coming future.

FAQs

Is Libertex a Regulated Broker?

Yes, Libertex is regulated by the Cyprus Securities and Exchange Commission, which has the CIF License number 164/12.

What Is the Maximum Leverage Offered on Libertex?

The maximum leverage is up to 1:30 for retail clients.

How Many Underlying Assets Are There on the Libertex Platform?

The number of underlying assets on Libertex is over 250, which is sometimes considered a drawback of this online broker because other online brokers of the same category as Libertex offer many more financial products compared to Libertex.

Does Libertex Use MetaTrader?

Yes, Libertex uses MetaTrader, MT4, and MT5. You can also use Libertex in house trading platform and mobile app.

Is Libertex Available for US Citizens?

No, Libertex is not available for US residents. As such, it is not regulated in the US by any regulator like the Securities and Exchange Commission (SEC). It is based in Cyprus and is regulated by the CySEC.

Note: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.1% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.