Exness Review 2023

Overview

Exness is an online forex broker founded in 2008 that offers robust platforms like the MetaTrader 4, MetaTrader 5, MT4 web terminals and mobile forex trading, oil, gold, silver, Bitcoin, and 34 cryptocurrencies for both personal investment and trading. There are also 97 forex currency pairs available to the traders to choose from. They can also enjoy access to free VPS hosting, along with the updated financial market analysis and Dow Jones news and features like a trader’s currency converter and calculator. Through this Exness review 2023, you will get detailed information about the features and other different aspects of this broker.

Exness Broker Review – Overview of Platform

Exness Broker Review – Overview of PlatformExness was established by a group of industry experts from the information technology and finance sectors and its head office is in Siafi Street, PORTOBELLO, Office 401, 3042, Limassol, Cyprus. Regulated in the EU, Exness provides multiple types of accounts and are Standard Cent, Standard, Pro, Raw Spread, & Zero and also offers Islamic account (Swap-free). Although there are 97 forex currency pairs (EUR/USD being the most popular one) along with 8 metal contracts to its clients settled all across the world.

The Exness Group offers 2 entities, both of which are regulated in the EU, namely, Exness UK Ltd, which is regulated by the FCA or the Financial Conduct Authority in the UK (registration number 730729). Exness (UK) Ltd. is registered in England and Wales under Companies House Register number: 08861481. Exness (Cy) Ltd is regulated by the CySEC or the Cyprus Securities and Exchange Commission (CySEC) (registration number 178/12). The divided nature of the platform facilitates clients based all across the world to enjoy the investment solutions and financial trading services that are tailored to meet the requirements of the traders. However, the number of active traders at Exness is over 260K.

Nymstar Limited is the trading name of the Exness Group. Nymstar Limited is solely regulated by Seychelles Financial Services Authority. The Seychelles office of Seychelles Financial Services Authority regulated Nymstar Limited is at F20, 1st floor, Eden Plaza, Eden Island.

Features

Exness provides some of the top-notch trading features to its clients that contribute to the growing popularity of this broker across all corners of the world where apex regulatory bodies regulate it. Some of the robust trading features that take this market maker to a different level while giving traders a good user experience are discussed hereunder.

~ Easy Registration: It allows even the beginners to place the trade as effectively as a pro irrespective of their transaction history or trading history. The easy-to-use features will enable them to grab the working procedures of the platform very easily. Traders very soon become familiar with the broker’s legacy platforms like MetaTrader4 and 5 used as a desktop platform, web/mobile platforms.

The sign-up process is also pretty much easy. There is no need to download the platform separately, which is an added advantage for users. All they need to do is register their accounts on Exness known as one of the forex brokers and upload all the documents in support of the details that they have provided while filling in the registration form.

After the entire details of the new customers are verified along with their financial details, the trading platform would be directly launched from the web. If clients face any technical issue during the process, they can get in touch with the customer service team via live chat, phone or email. Clients can also get in touch through the Contact us section on the website.

However, if the clients want to download the platforms that will be at their own discretion as downloading Exness is not mandatory. There are various accessible download links for both the MT4 and MT5 platforms.

~ Deposits and Withdrawals: Exness offers easy deposits and withdrawals of funds. Clients usually do not face any withdrawal problems. Deposits can be made almost instantly after the traders choose the mode of deposits that they prefer, an Exness account that they want to make the deposits to. Withdrawals, too, are processed immediately after the traders’ details are verified. These help the traders immensely to move their funds to various accounts and e-wallets. Traders also have the liberty to enjoy internal transfers between accounts with equal ease and speed, thereby granting the Exness customers full control over their funds any time. If users face any issues, they can get in touch with the customer service team via live chat, phone or email.

Easy Deposit and Withdrawal Options

Easy Deposit and Withdrawal Options~ Flexible Leverage: According to our review, Exness traders have easy access to margin trading in this broker, which means that they can leverage their capital any time to gain more market movements and exposure. You can access the margin requirements through its website (www.exness.com).

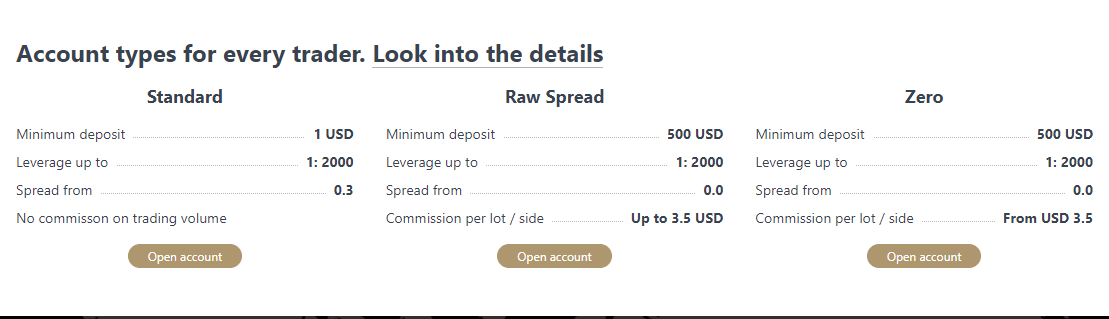

However, due to the restrictions imposed by EXMA, the maximum leverage that the European clients are allowed to is 1:30 but then they can also choose from various smaller increments like 1:2 or 1:10, depending on which margin requirements and instruments they are trading. Clients from other parts of the world can enjoy unlimited maximum leverage allowed on it. It also has a high trading volume. However, the maximum leverage of Exness is 1:2000.

~ Negative Balance Protection: Sometimes the traders at Exness Forex Brokers using leverage end up having a negative balance in their trading account. In such a case, the broker allows them to reset the balance in his account back to zero. There is also no obligation to deposit more funds as working capital in order to cover up the negative balance.

~ Low Spreads: This website (www.exness.com) offers tight spreads which begin from 0 pips and goes around 0.1 to 1.3 for Mini and Classic account holders. Though the ECN account holders pay the lowest spreads, they have an obligation to pay a commission proportionate to their trading volumes.

~ Updated News on Trade Research: Exness clients have the liberty to access updated news on financial market trends and researches on Trading Central. All the updated market news is supplied via Dow Jones news feed, which has its own news channels that are streamed directly to the client portals of Exness. Besides updated news on market researches, website Exness (www.exness.com) also provides analytical reports on various financial instruments through its trading channels and intuitive research tools.

~ Exness Regulations: According to this review, Exness (www.exness.com) is outwardly legit and there is no room to doubt it as a scam. Besides other criteria, protection of the investors’ interest and funds are two of the primary concerns of the Exness group.

By conforming to the world’s strictest rules set by regulatory bodies like the UK Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC) of Cyprus, Exness protects its clients’ interests. Exness (UK) Ltd. is registered in England and Wales under Companies House registration number: 08861481. Exness UK Ltd is also regulated in other smaller jurisdictions of the world, but then the CySEC, FCA approval contributes immensely in permitting Exness to serve its clients across the entire EU.

The regulated forex companies under the Exness banner also assure to provide support to the traders in the event of the broker becoming insolvent. Therefore, for the UK members of Exness UK Ltd, a GBP up to 85,000 would be sanctioned if Exness becomes insolvent, which is the rarest of the rare cases that could happen with Exness as it keeps its clients’ funds safe in segregated bank accounts through tier 1 banking institutions. In case of insolvency events, forex education company/forex broker Exness and its traders remain most secured from any loss or damage.

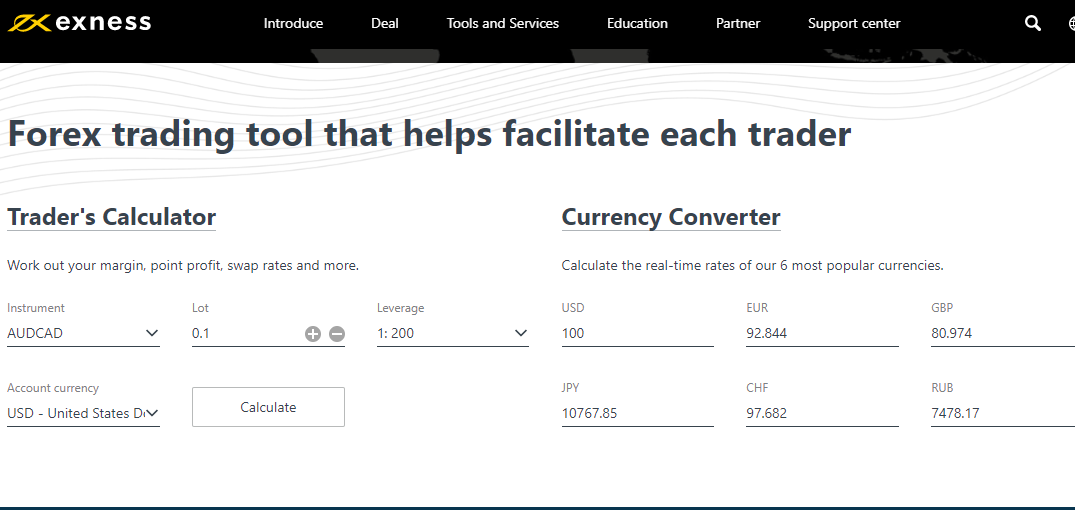

~ Trading Platforms: It offers multiple trading platforms like MetaTrader 4, MetaTrader 5 (both by MetaQuotes Software Corp.), WebTerminal, and Mobile trading, for oil, gold, silver, Bitcoin, and other cryptocurrencies for both personal investment and trading. There are also 97 FX pairs (EUR/USD being the most popular one among site users) available to the traders to choose from. Traders can convert currencies very easily with the platform’s convenient currency converter.

Forex Trading Tools

Forex Trading Tools~ Fees and Commissions: It exhibits a very flexible structure as far as the trading costs, commission, or keeping the minimum account balance is concerned. As such, there are no rollover fees or inactivity fees charged by Exness, which is an excellent advantage for Exness clients. Unlike other contemporary online brokers, Exness does not charge a hefty commission and unnecessary trading costs like inactivity fees.

As per the Exness user reviews across the internet including TrustPilot and Forex Peace Army, traders at Exness also have the liberty to choose from any accounts, be it Mini/Standard Account, Cent account, Classic, or ECN. All these account options require different account balances, and the traders can open a trading account which he thinks he would be able to manage in terms of maintaining the minimum account balance and enjoying the trading spreads.

For example, for a Classic account, it requires a minimum balance of $2,000, but no commissions and the tight spreads start from 0.1, as mentioned in the client agreement. For a Mini/standard account, it requires a minimum deposit of $10, but then it is accompanied by larger spreads beginning from 0.3 but fewer instruments available to trade. In case the traders seek the ECN interbank network for better liquidity and faster execution, they would need to pay the lowest spreads and also encounter hefty commissions starting from $50 for every $1 million trade volume. The Mini account type is apt for users as it requires a $10 minimum deposit, minimum lot size depends on the instruement, and no deposit and withdrawal commissions.

Swap rates particularly those on leveraged overnight positions are applied as mentioned in the Client Agreement. Fees and commissions may vary depending on the trade size or instrument the client is trading.

~ Security and Reliability: This website (www.exness.com) provides traders utmost peace of mind amid a stable trading environment and rewarding user experience. It is the perfect platform for those who are not so used to sudden interruptions or downtime, which are pretty much inherent to online FX trading. The fact that Exness UK Ltd is regulated by apex regulatory bodies like the CySEC, FCA adds confidence and reliability on this web browser, Exness fulfills its custodial duties to perfection. Through its excellent customer support, Exness customers can get help whenever required via live chat, phone call, or email through the contact us section. The stringent account security adds reliability to the platform and helps them. As these market makers operate online, the only way of interaction is through the customer care executives via the contact us section. So, it is essential to have a robust support team, which immensely adds to the credibility of the platform, and the clients also feel very safe and at peace while trading via this platform.

Risk warning: Please note CFDs are complex instruments and come with high risk. Many retail investor accounts lose money when trading CFDs.

As per our review 2023, Exness also has Exness Academy. Exness Academy has video tutorials, webinars, news from markets, information materials, and other educational material for traders to enhance their trading skills and trading ideas. Exness also allows traders to place stop-loss limits.

Risk disclaimer: The forex market is subject to volatility. Please consider your financial condition and invest as per your risk appetite.

Exness Features

Exness Features| Pros | Cons |

|

Registration process is absolutely free and also the traders are allowed to start over trading even with a minimum account balance that reduces the burden of financial commitments to a large extent. |

Less financial products offered as compared to other online brokers of the like. |

|

4 types of accounts are available on Exness which increase the chances of earning profits exponentially. If one trading account fails to earn a substantial amount of profits or if the trader is not satisfied with the amount of profit, he can swiftly switch on to the other accounts and place trades at his own discretion. |

Leverage ratio for European clients is low at only 1:30 |

|

Excellent customer care service available through the Contact us section. The contact us section allows you to contact the customer support executives instantly via live chat, phone calls, emails, or even over social media platforms. |

|

How Does Exness Work?

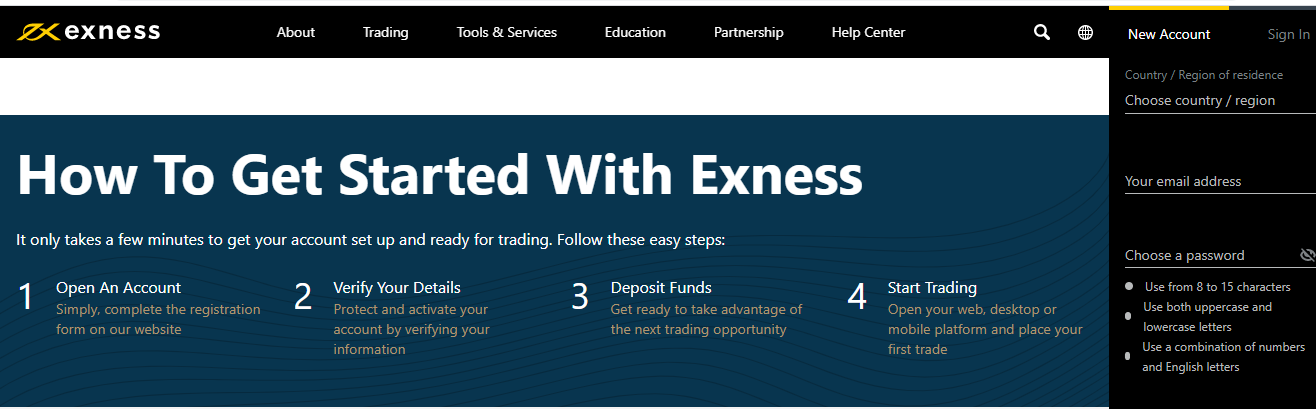

As far as the working process is concerned, Exness offers some of the easiest steps directed towards account creation on the platform. To trade with Exness online trading platform, traders need to follow the simple steps.

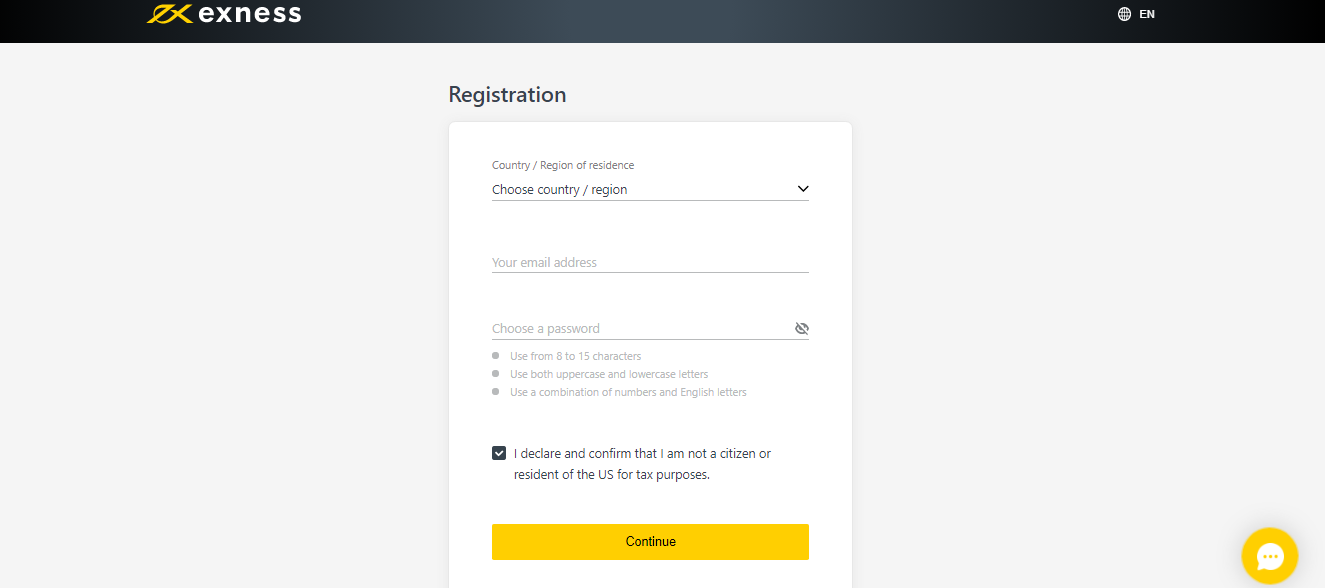

~ Registration: The registration process to open an account with Exness is quite simple and gets done in 5 to 6 minutes. Registration for account opening requires traders to visit the official website of Exness, and fill up the registration form, that they will get on the upper right-hand corner of the page. They need to fill in their credentials as to their full name, address, email id, phone number. With these credentials, this website will create an account in the name of the trader and the account number will be shared with the trader. The trader also needs to provide a robust password for his account number. This password he will need to feed in every time he logs in to his account number on the Exness platform.

How Does Exness Work?

How Does Exness Work?Next, in order to make this account active, the trader needs to produce and upload documents in support of the details that he had provided at the time of registration of the account on the Exness platform. Valid documents that are accepted on the Exness platform are a driving license, bank statement, or any other government stamped documents. For address verification code, any of the utility bills will do, but make sure that the utility bills are not more than 6 months old. Bank statements are also accepted.

All these documents should contain the same details as fed into the registration form by the trader otherwise, the account will stand inactive. Once all the paperwork is done, an auto-generated email will be sent on behalf of Exness to the trader’s email inbox to confirm that his account is active. The trader, however, does not need to reply to this mail received at his email address as this is an autogenerated one.

Exness Account Types

Exness Account Types~ Funding Methods: After the user’s account with Exness has been created, it is time to fund the account with some working capital in order to start trading on the Exness platform. Out of the 4 trading accounts that Exness offers, namely Mini, Cent account, Classic, ECN, and Pro account. Mini accounts can be funded with any amount at the discretion of the traders. The Pro account is apt for experienced traders. Alternatively, there is also a provision to sign up for a demo account that is absolutely free. Through a demo trading account, the traders can test the online trading ecosystem and the trading strategies that work.

The payment system of Exness is very convenient. There are various payment methods available on the Exness trading platform, so the trader will never face any issues as to the payment options. Exness offers EPS, cryptocurrency, bank cards, local payment systems, and internal transfers.

Though at the time of registration only some basic details were required to fill in the registration form, to make the deposits and withdrawals the traders need to feed in some more details like the card details if he is using cards or e-wallet details if he is using e-wallets to make the deposit money.

~ Start Trading: After the traders have funded their Exness trading account, they can start over with placing online trades on the Exness platform. Though there is a high risk associated with trading with an online broker, trading with Exness will build in that confidence in you that you have never experienced with any other FX brokers alike. The fact that CySEC and FCA regulated online broker Exness UK Ltd contributes to the credibility of the broker and does not leave any room for doubts as to its legality, which in turn ensures the safety and reliability of the traders’ funds.

Risk Warning: Please note CFDs are complex instruments and come with high risk. Many retail investor accounts lose money when trading CFDs.

Steps to Start Trading

Steps to Start TradingIs Exness a Good Forex Broker?

Yes, Exness is undoubtedly a good FX broker with amazing forex ratings (forex ratings.com). It is in no way a scam broker. In fact, it is the brand name of the global brokerage firm, the Exness Group that has many brand offices and they are Cyprus, United Kingdom, South Africa, Seychelles, Curaçao, British Virgin Islands. Offices located in Cyprus and the United Kingdom do not provide services to retail clients.

The broker has also won numerous awards and they are ● Best Customer Support Award at Financial Markets Expo Cairo 2021 ● Premium Loyalty Program Award at Financial Markets Expo Cairo 2021 ● Most Innovative Broker at Dubai Expo 2021 ● Most People-Centric Broker at Traders Summit 2022 ● Global Broker of the Year at Traders Summit 2022 and excelled as a retail broker by offering stable and reliable brokerage services to its clients especially retail traders, who can trade at peace amid the comfortable trading environment offered by it.

The platform caters to the needs of the most demanding traders, charges no hidden commissions, and comes with intuitive research tools. Apart from providing comfortable trading conditions to its clients, Exness offers amazing customer care in 14 languages along with the updated financial news. Moreover, these forex brokers also actively take part in social media platforms and interact with various organizations that partner with big celebs like Cristiano Ronaldo.

What are the Deposits and Withdrawals Methods for Exness?

Exness charges third-party deposit/withdrawal fees. It offers the following deposits and withdrawals methods.

~ Deposit Methods: The payment system of Exness is very convenient. Offline bank transfer, Bitcoin, Bank Card, Online Bank Transfer, Online Bank – 1, UPI, UPI QR, Skrill, Neteller, Perfect Money, SticPay, Tether (USDT ERC20), & Webmoney as deposit options.

For any transactions made with any of the third parties listed on the Exness page, the client and the third party are liable for any loss or damage to the client funds.

~ Withdrawal Methods: The withdrawal system is very convenient and easy for traders. And the withdrawal methods are the same as discussed in the payment methods for deposits above.

Wrap Up

The presence of the Exness Group in various countries contributes to the wide popularity of the broker. The fact that all its offices are regulated by necessary local authorities, like for example, the Exness UK Ltd is authorized and regulated by the Financial Conduct Authority (FCA), while Exness CY Ltd is also authorized and regulated by CySEC holds great value for an online broker like Exness and adds to its credibility. This allows it to provide financial products or services to its registered countries where the broker is regulated. Exness is not regulated with FSCA in South Africa.

It is always recommended that whenever a trader selects an online broker for a long-term partnership, he should not only consider the company’s trading conditions or forex ratings but also make sure that the broker’s operations comply with the relevant legal requirements and internationally recognized financial standards. Trading with Exness web platform gives the trades assurance on these matters, and the traders can fulfill their investment objectives keeping in mind their high-risk tolerance.

The trading process at Exness is delivered by the intuitive MT4 WebTerminal platform with a focus to facilitate CFD trades and Future trading options on a wide range of financial markets.

Risk Warning: Please note CFDs are complex instruments and come with high risk. Many retail investor accounts lose money when trading CFDs.

FAQs

How long does it take to withdraw money from the Exness account?

If the trader opts for a transfer directly into his bank transfer, then a minimum of 3 to 5 days will be required for the amount to reflect in his bank account. The delay in crediting the bank account with the withdrawal money is due to the formalities that are required by banks and other financial institutions. Therefore, if the trader is opting for e wallet transfers, then it may take 1 business day for the amount to be reflected in his account, after the details are verified.

How many Forex pairs are available on the Exness platform?

Exness offers over 97 pairs (EUR/USD being the most popular one) to its traders. This count excludes other instruments like cryptocurrencies and commodities. This count excludes other instruments like cryptocurrencies and commodities.

What is the minimum deposit amount required to start trading on the Exness Web platform?

There are 4 types of accounts available on the Exness website. The minimum working capital that would require to start trading in the live Forex market is $10. Alternatively, there is also a provision to sign up for a demo account that is absolutely free which allows the traders to test the online trading ecosystem and the trading strategies that work. It exposes the traders to the real trading scenarios absolutely free of cost where they do not even have to put their real money at high risk for a real trading experience.

Are commodities tradeable on the Mobile Trading App offered by the Exness platform?

No, only FX pairs are available for trading via the mobile trader app available on the Exness trading platform.

How is the customer support system of Exness?

As per Exness review 2023, Exness is backed by a robust customer service team that is available at the customers’ service at any time of the day around the week through the contact us section. The customer service executives can be connected easily via email, live chat, or phone call. Please note: Users can get in touch via email at [email protected] or [email protected]. The maximum responding time limit taken by the customer support team to revert to the clients is 48 hours. Besides the contact us section on the website, clients can also reach out to the customer support team via live chat service of WhatsApp and Viber.

What type of broker is Exness?

Exness was founded in 2008. This online broker offers platforms like MetaTrader 4, MetaTrader 5, and WebTrader to place online traders in the financial markets.

Does Exness have a bonus?

It does not offer any permanent bonus programs. Some kind of reward may be provided from time to time based on certain campaign conditions.