DEGIRO Review 2023

- DEGIRO is a Europe based retail stock broker that operates across the world. Unlike other brokers, DEGIRO provides remarkably low cost services being a discount broker. The authorities that regulate DEGIRO’s financial services include the Netherlands Authority for the Financial Markets (AFM) and the Dutch Central Bank (DNB). The financial firm is registered in Amsterdam at the Chamber of Commerce and Industry.

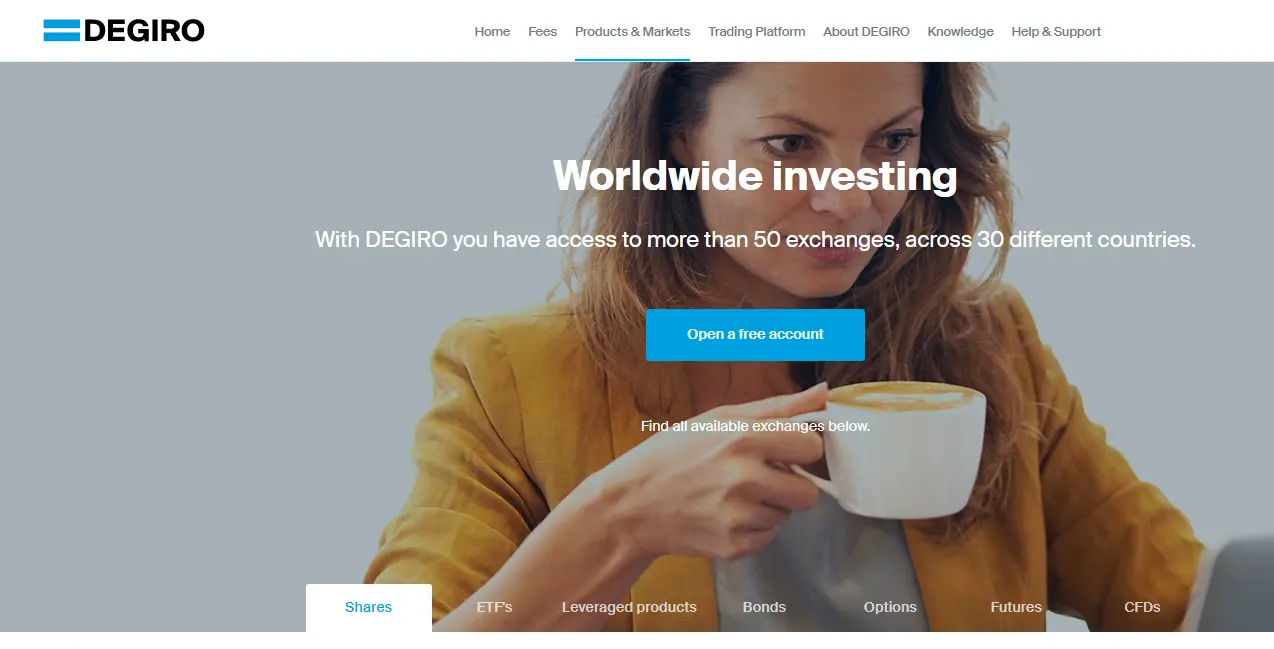

- As per our DEGIRO review, DEGIRO aims to offer custom-made and affordable financial services to worldwide investors. The core idea behind this is to perfectly merge technology with financial knowledge. DEGIRO puts emphasis on the widespread global level access which covers Australia, Japan, Hong Kong, and many other countries apart from Europe and the US. DEGIRO UK has developed quickly to become one of the top online trading brokers in Europe. However, DEGIRO may not be available in many countries.

What is DEGIRO?

- DEGIRO is one of the leading online brokers from the Netherlands, that offers trading at low prices with good discounts to its traders. It was founded in the year 2008 but again restarted as a stock brokerage firm in the year 2013, exclusively for retail investors. This broker offers access to over 60 security exchanges to its traders and provides a good trading experience.

- Traders can indulge in buying and selling of stocks, mutual funds, bonds, ETFs, warrants, and options by using the platform or they can use the mobile trading application offered by this broker.

- The countries supported by DEGIRO are Italy, Netherlands, France, South Africa, Switzerland, Austria, Germany, Spain, Czech Republic, Poland, Portugal, Greece, Hungary, Sweden, Denmark, United Kingdom, Norway, Finland, and Ireland. Traders who are living in these countries are able to use the services of DEGIRO to trade.

- This broker is regulated by the Dutch AFM (The Netherlands Authority for the Financial Markets), Financial Conduct Authority (FCA) in the UK, and DNB (Den Norske Bank); these regulatory bodies approved DEGIRO to be one of the safe and trustworthy online brokers that are available in the market currently. Besides, this broker has about 400,000 plus traders and also the investment protection feature, which is available for the traders for 20,000 Euros.

- DEGIRO offers affordable prices and lowest fees that are available for the traders when compared to other best UK forex brokers. The traders cannot trade derivatives such as CFDs (Contract for Difference) by using the same account where some of the other assets are traded.

Background

Initially, the firm was established as a wholesale broker in 2008. As per our DEGIRO reviews, DEGIRO came up with its online brokerage services in 2013. It was based in the Netherlands and as part of the expansion, it has covered 18 European countries. DEGIRO differs from its peers to quite an extent because it has embraced change and has developed their offerings from time to time. Traders can trade a wide range of financial instruments from any asset class.

Is Investing in DEGIRO Safe?

- When selecting a broker, many people are doubtful if their money would be safe with that broker. To assure themselves, traders should look for two basic points. First, the background of the broker. Second, what risk measures are in place by the broker, in case, it goes insolvent.

- DEGIRO was established in 2008, and since then has had a good track record with an overall rating of 90% success. We found many good DEGIRO reviews, especially in Trustpilot, thanks to the satisfied traders who shared their experience with this broker.

- As already mentioned, this broker is completely regulated with the Dutch Central Bank and also by the Netherlands Financial Market Authorities. Moreover, it is registered with the financial authorities in the countries it operates, such as the FCA in the United Kingdom.

- In case, there is a situation when the company goes bankrupt, the stocks and ETFs on this brokerage are exchange traded, which means if DEGIRO goes bankrupt, the instruments from any asset class will be safe because the trader is the owner of their stocks and ETFs that they purchase through DEGIRO.

- This broker is secure and has two-step authentication available on the platform, which we highly recommend to keep the account safe, in case your password is hacked. It also has a wide range of IT security measures in place.

Waiting List

Keeping in mind its clients degiro.co.uk website introduced a temporary waiting list for new user registrations on March 25, 2020; Degiro has added a waiting list because it is receiving more new registrations during the ongoing high market volatility. Considering the situation, the investment account creation process is taking more time even though it is uncertain, and exactly when this will be carried out. Also, the trader should be aware that investing in trading is always risky and should always take care of each and every risk warning.

Know the Reason for DEGIRO’s Growing Popularity!

The four major aspects of its growth are:

- Global Access:

DEGIRO connects European investors with the global and home market. The global access gives an opportunity to the clients to fetch profits from the diversification of assets. COVID 19 has affected all markets but still DEGIRO has been able to continue with its services globally.

- In-house Development:

DEGIRO has its game on point when it comes to its trading tools. The brokerage company has been innovative with its tools while developing it. All the tools under DEGIRO are built in-house and tailored according to the needs of a varied range of clients.

- Reduced Costs:

As per our DEGIRO review, DEGIRO offers its financial services at a remarkably low cost. It also does not apply any custody fee. This aspect lures most of the traders, as commission fees play a notable part while getting on a brokerage platform. This has also helped the firm to become one of the largest retail stock brokers in Europe.

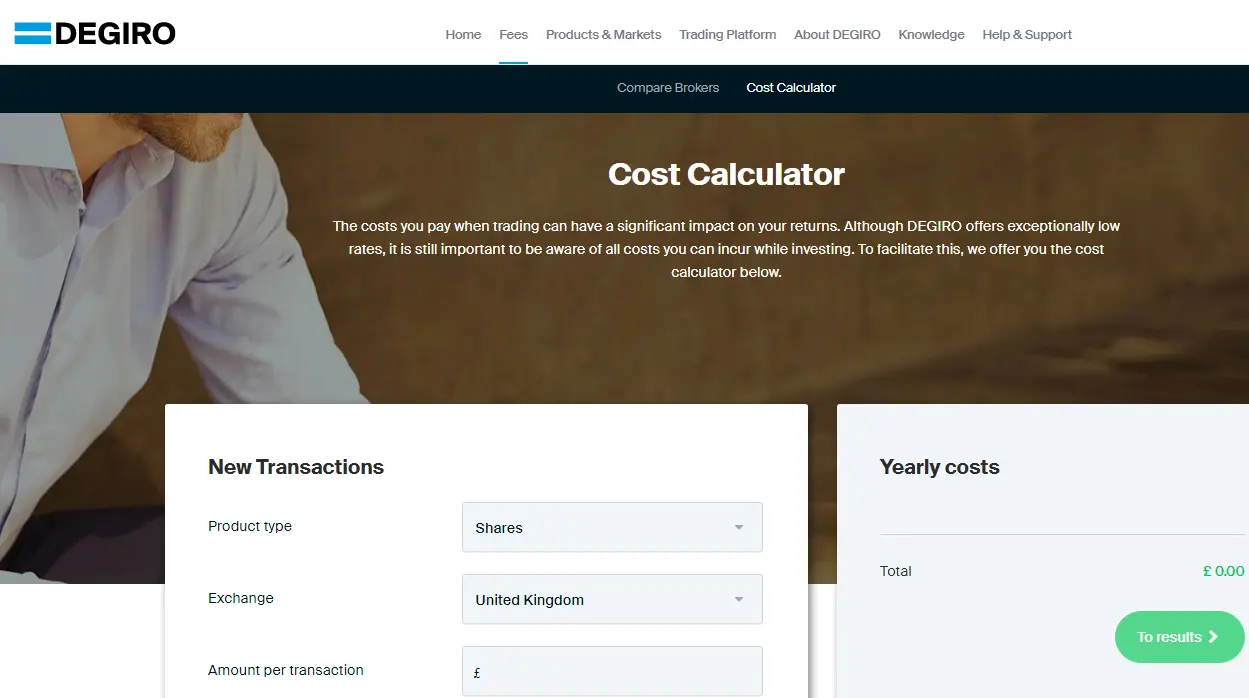

Moreover, DEGIRO manages to provide its retail clients with the same low rates, low transaction costs, and opportunities that used to be available to professional clients only. Also, the brokerage offers a drop-down of cost calculator, which lets you know the costs that you need to pay when trading. It is an appropriate broker for traders of long term investments. It is a no-frills stockbroker.

- Regulated Brokerage Service:

As mentioned above, DEGIRO is monitored by AFM and DNB. The firm holds a license pursuant to article 2:96 of the Act on Financial Supervision in the Netherlands being an investment firm.

The timeline of the platform has been:

- 2013: Launch of DEGIRO

- 2014: Expansion to 9 countries

- 2015: DEGIRO enters North Europe & Italy

- 2016: Largest broker in the Netherlands

- 2017: More than 200,000 clients

- 2018: More than 350,000 clients and 40+ awards

Accounts:

- As per our DEGIRO review, It offers different types of accounts including Custody, Basic, Active, and Day Traders. In a custody type account, one gets to trade Shares, Bonds, Options, Investment Funds, and Trackers (ETFs) but can’t get into Leveraged Products and Warrants. While holders of custody accounts can get free real-time prices on Euronext exchanges, they can’t go short.

- Basic account holders, on the other hand, can trade in Shares, Bonds, Investment Funds, and Trackers (ETFs) along with Leveraged Products and Warrants. Basic account also enables free real prices on Euronext exchanges with Free dividend and coupon processing.

- Active Trader and Day Trader accounts offer all types of trading facility, however, their limits vary when it comes to buying on margin as per the margin requirements.

- Moreover, DEGIRO has a rapid and simple process for opening an account. The process will be fully digital and it requires no minimum deposit as account balance.

List of Various Account Types Offered by DEGIRO

DEGIRO is a leading and popular no-frills online broker and offers the below-given accounts –

- Custody account – This account type can be described as an entry-level, which permits the traders to trade investment funds, shares, bonds, and ETFs. Furthermore, these types of accounts are open for traders and investors and come with complete real prices for free on the latest Euronext exchanges.

- Basic account – It includes all the features that are available with the custody one. A basic account also offers the traders to trade on the leveraged warrants and products. Basic account traders cannot short stocks or can buy on margin.

- Active account – This combines all the functionalities and features of both types of accounts – basic and custody – with an additional option of being able to buy up to 50% of the available margin and the ability to go short.

- Trader account – In addition to all the above-mentioned features gathered from other accounts, this account permits the users to buy up to 100 percent of the available margin; and these account holders can also get access to coupon processing and free dividend.

- Day trading account – It allows the traders to trade derivatives and they can buy up to 100% of the available margins, with additional margins that are available during open trading hours.

- The above account types offered by this broker cover almost all types of traders and some of them come with their exclusive benefits. Some of them can be tailored to suit the trader’s trading requirements.

Placing Orders

There are several types of orders available according to the DEGIRO review 2023; It does not have every tradable instrument. Once you complete the order placing process, you will receive a mail on your registered email address regarding order confirmation. This broker does not provide the same via text message. It lacks a price alert function too.

The order types include:

- Limit

- Market

- Stop loss

- Stop limit

- Trailing stop

- Day

- Good-till-cancelled (GTC)

Deposits

DEGIRO offers its traders several methods to deposit funds on the platform. Some of them are given below –

- Trustly

- Bank transfer

- Electronic wallet

This broker has several strict rules for bank transfer deposits; which means this broker will accept Bank transfers in the bank accounts linked to the trader’s name, that also from accepted countries only.

Few deposits take several processing hours, whereas an electronic bank transfer is instant. Typically, Trustly deposits take 30 minutes to be processed. Moreover, this broker does not charge any deposit fees or commission for depositing their funds.

Account Opening Process

DEGIRO functions in 18 European countries starting from Australia to the United Kingdom. Opening an account with this broker is very easy, and it does not require more than 15 minutes. To start trading, you need to add funds to the newly opened account, which might take more time, if the account is not a local account. The opening process is seamless, quick, and fully digital. Besides, the account will be ready for trading in one day.

For the initial registration process, the trader needs to submit the following –

- A copy of ID card or the passport

- The bank account number where the fund will be added to the account

After the completion of the initial registration process, the trader needs to do three additional tasks before the account gets activated –

- The trader needs to complete an appropriateness test

- They should agree for real price conditions

- Transferring the money to their trading account

DEGIRO Mobile App

- DEGIRO offers a dedicated mobile app that is basic and simple. We get to know from DEGIRO reviews that the traders find the mobile app very straightforward. Having an intuitive interface, they can trade in a matter of seconds, which is very important for the day traders for those who want to strike the exact moment for-profit and meet their interest purposes.

- Further, order management in the mobile app functions in the same way as the desktop site. Besides, the traders can turn-on the push notifications and email notifications. Currently, DEGIRO does not offer price alerts.

- The mobile app has been designed for the traders to trade on the go, by allowing the traders to make trade decisions, wherever they are around the world. In simple words, this app is user-friendly where the traders can easily navigate and trade. Additionally, this mobile app offers,

- The trader can quickly open, modify, and close positions.

- Updates on real-time trades

- Single click rates

- Chatting tools

- The trader can choose from hundreds of instruments that are offered.

Products and Markets:

As per our DEGIRO review, with DEGIRO, you can possess quite a diversified portfolio as it has a wide range of trading options including stocks, options, and futures trading, ETF selection, and crypto. However, this broker doesn’t allow trading CFDs and forex trading.

DEGIRO offers the option to choose from among 9 base currencies which include GBP, PLN, CHF, NOK, DKK, EUR, SEK, CZK, and HUF. In case, traders have any difficulty in accessing the products, they can get in touch with customer care through phone or email support.

Stocks

DEGIRO enables you to experience the biggest international markets as well as the smaller stock exchanges of Europe. A user can get access to 32 stock exchanges on the platform. Penny stocks are also there as a trading option. DEGIRO’s range of stocks for stock trading is between that of Interactive Brokers stocks and Saxo Bank.

ETFs

DEGIRO gives you access to over 5,000 ETFs. ETFs selections are also between that of Interactive Brokers and Saxo Bank.

Funds

The selection of funds at DEGIRO is average as compared to Interactive Brokers. This is because DEGIRO provides a bit of a narrow selection of funds.

Bonds

The Bond game at DEGIRO is not up to the mark as it shows a ‘so so’ picture here. It compares poorly to IB or Saxo Bank in this respect.

Options

DEGIRO gives you 13 options markets, and this is where it looks a bit competitive as compared to Saxo Bank broker.

Cryptos

DEGIRO allows you to trade on the Swedish stock exchange in Bitcoin and Ethereum through ETN instruments.

Fees

- DEGIRO fees have a luring enough low fee structure for traders as it charges lower fees than the majority of its peers, to the extent that a few ETFs can be traded for free of cost once in a month. The associated cost savings help DEGIRO to provide lower trading fees.

- However, Asian and smaller European stock exchanges have to face higher trading fees. Higher trading fees take place each time you trade. It can be in the form of commissions, spreads, financing rates, and conversion fees. If the account currency or base currency of a trader differs from the asset currency, DEGIRO charges currency conversion fees.

- A few more fees include withdrawal fees or inactivity fees. DEGIRO while trading, the stock, ETF, and warrant fees are the same and there is no custody fee from this broker.

- When a trader trades in stocks (other than the London Stock Exchange), an annual fee of €2.5 is charged.

- DEGIRO deposits client funds in Money Market Funds. The funds are deposited either in Fund share Fund Management (GBP, EUR, CHF, etc) or Morgan Stanley Investment Management (USD, EUR) Money Market Funds.. Money Market Funds like Morgan Stanley Liquidity Funds or Fund share Cash Funds incur no custody fees.

Check Out Its Unique Features

- Charting

Traders who do not possess any technical prowess can excel here. DEGIRO gives you a pretty basic, yet enough charting tool. It is user-friendly and shows more than 20 technical indicators. One can save these charts too.

- Newsfeed

Users can find the newsfeed on both the platforms, the web and the mobile app. It is a basic news panel with short but useful market news that is compatible on any internet device. It also has many social media features. Feeds regarding how COVID 19 has affected the markets and how markets are recovering are quite helpful for the traders to get an insight about the current market scenario. Traders or other interested entities can follow DEGIRO via social media on Twitter, Facebook, and LinkedIn

- Fast Trading

It has to be quick when it comes to trading. This platform is speedy enough and it responds immediately. You will find a QuickOrder button at the top of every page where you can enter your order quickly and easily.

- Real-time Streaming Prices

Here, major European markets and US exchanges will be available for trading with real streaming prices.

- Bid / Ask Spread in the Order Book

DEGIRO also lets you see your orders up to 5 levels on a platform called Euronext. The tool helps to view the depth of the order book.

- Favorites List

Here, you can sort your favorite products by creating a list. The platform provides a tool named WebTrader, where one can easily view the favorite products and thereby, attract traffic sources.

- Concerning DEGIRO Login, the trader can select either a one-step or two-step login. Further, if the trader chooses a two-step option, it is available through Google Authenticator.

- 80% of retail investor accounts lose money when trading complex instruments like CFDs with this provider.

Customer Service

As per our DEGIRO review, DEGIRO provides customer support in many languages with reliable phone support. However, customer service is not accessible 24/7 and it also doesn’t provide any chat support. Meanwhile, their phone support is up to the mark and gives relevant responses when needed. The customer support team is also available through email support and responds to the query email within 2 days. The customer service team responds quickly but are available from 7 am to 9 pm on weekdays only.

Learning

Here, DEGIRO can make major improvements. The trading platform teaches the tools in Dutch and English only. Also, the set of tools is quite limited here.

Investor’s Academy

As per our DEGIRO review, Investor’s academy aims to offer knowledge regarding investment and investment strategy related to it. It gives an insight regarding how investing works, which products you can invest in, and what strategies you can use. This section of education holds a total of 10 lessons.

Blog

- Here, the blog elaborates on the stock market and the most traded stocks in the UK along with the most traded sectors. After the first two trading weeks of each month, DEGIRO reports the top traded stocks via their trading platform for each country they are active in. It also shows winners and losers during this time period.

- A couple of more ways to learn share tradings are tutorial videos and general educational videos. These videos are generally about basic topics like asset classes and order terms.

- It also gives an insight regarding the trading platform, for example on how you can buy stocks via the DEGIRO web platform. However, they do not provide services like demo account, webinars, and educational articles.

Like other brokers, DEGIRO has its pros, cons. Here are some of its advantages.

- Secured

As per our review, when a user opens an account with this trading platform, he or she gets investor protection for up to €20,000. Not just this, DEGIRO holds a Two-step (safer) login process to ensure safety. Traders also have the option to to enable two-factor authentication under their profile page. Even though it is a secured platform, traders should take notice of any warning that comes up.

- Low Fees

DEGIRO offers services at significantly low rates. In most cases, it gives you the best on the market. DEGIRO charges currency conversion fees, if the base currency differs from the asset currency. It has an inactivity fee.

- Simple Platform

No special technical prowess is required to use this platform as an investor. The easy to use interface opens the door for a wide range of users for DEGIRO. Users have expressed their satisfaction over the easy to use and smooth browsing experience they have had.

- Fully Digital

As per our DEGIRO reviews, to open an account with DEGIRO is fully digital, it comes across as a quick, seamless, and easy to use platform.

- Fast

At DEGIRO, you will find quite a smooth process regarding account opening and order placing. This makes it a rapid and hassle free platform for trading. Also, no minimum deposit and user-friendly outlook are a major plus.

Some of the Limitations of DEGIRO

- Limited Research and Education

DEGIRO fails to impress when it comes to its research tools, learning and education section. Limited language options (only English and Dutch) and the lack of a demo account disappoints a bit. The trading platform also doesn’t offer any webinars or educational articles.

- Credit/Debit Card Not Available

For deposits and withdrawals, a user cannot get any debit card or credit cards here. This makes the platform less feasible. Deposits via PayPal, Currencies Direct, Revolut, Currency Cloud etc are not allowed. No third party payments are accepted.

- No Price Alerts, No Forex, No CFD

In a nutshell, DEGIRO’s portfolio and fee reports are well organized. They are transparent, and you can easily see what products you own and the related transaction fees you paid. However, you can’t get access to Forex and CFD markets, while also cannot use debit or credit cards. No third party payments are accepted.

- No Third Party Services for Payments Are Accepted

Wrap Up

DEGIRO is a good choice for traders who want a simple platform and who do not want to spend a lot of money on fees. When we look at DEGIRO reviews and compare them with other bigger European rivals, this broker’s current fee listings are highly competitive. The process to open an account with this broker is quick and fast, which means the account will be ready to use within a day. By offering an integrated and dedicated web platform and mobile trading app, this broker is good for traders who want to place several trades. To conclude, it is a great online broker if you want to trade with no minimum deposits or with an activity fee.

FAQ’s

1. Is DEGIRO any good?

Ans: DEGIRO is one of the leading trading platforms and offers low trading and non-trading fees for its traders. By offering several asset classes, it is considered one of the best online brokers that is available in the market currently. Also, it offers some of the ETFs to the trader to trade for free once a month, which is a good feature for buy-and-hold investors.

2. Is DEGIRO good for beginners?

Ans: As per our DEGIRO review, we can say that this trusted broker is one of the best brokers for beginners. It offers the lowest transaction fee in the market. It offers a seamless and fast account opening and mobile trading app which is the most advantageous feature.

3. What happens if DEGIRO goes bust?

Ans: DEGIRO is regulated by top-tier regulators and if it goes bankrupt, the assets will be safe as the traders are the owners of the assets which are brought through DEGIRO.

4. Which one is the best broker for investors in the UK- Interactive Investor or DEGIRO?

Ans: When we compare Interactive investors with DEGIRO, Interactive investors is highly recommended for beginners and traders who are focusing on the UK market, while DEGIRO is highly recommended for buy and hold investors and for the traders who are looking only to execute the trades. DEGIRO charges only a minimal currency conversion fee, if the base currency differs from the asset currency.