XM Vs FBS 2023

Overview

FBS was founded in 2009 and since then has become one of the leading Belize based brokers with more than 190 countries of presence, 16 000 000 traders, and 410 000 partners. XM was founded in 2009 as a Cyprus-based forex and CFD broker, and it is regulated by CySec, and the British Financial Conduct Authority (FCA). This broker was formerly known as XE Markets and had several thousand traders around the world. The range of products offered by these forex brokers varies, and you’ll need to know more before choosing a broker that provides a wider range of tradable offerings, including currency pairs, indexes, commodities, shares, and cryptocurrencies, among others. Our comparative review of XM and FBS will help you choose the Forex broker best suited to you.

XM

Features

- XM group was established in 2009. With a presence in 195 countries, XM group is one of the most popular online brokers registered by Trading Point Holdings Ltd.

- XM is a broker based in Cyprus and provides excellent services for trading foreign exchange. It offers a wide choice of instruments, which include CFDs on commodities, indices, currency trading, energies, precious metals, and stocks on Metatrader 4 and Metatrader 5. 99.35% of XM’s trades are executed within one second. It also provides attractive bonuses and promotions for its traders.

- XM is regulated by the Cyprus Securities and Exchange Commission (CySec). XM global limited was founded in 2017, and it is regulated by the international financial service commission (IFSC).

- XM is an award-winning broker backed by excellent research. It provides educational tools for all types of traders, starting from beginner, advanced, and intermediate users who have different expertise in trading, and it offers features that are up to date. XM publishes research, market overview, XM TV, trade ideas, technical summaries, and forecasts on its website for traders.

- At XM, all clients receive the same quality services, the same execution, and the same level of support regardless of net capital worth, account type, or size of the investment. All our

- This broker provides over 1000 instruments that cover forex, indices, commodities, stocks, energies, 55+ currency pairs, and precious metals. XM offers trading platforms that are globally recognized, like Metatrader 4 and Metatrader 5 for Mac, PC, iOS, web, and Android systems.

- XM offers Dow Jones (US30) as cash and futures CFDs. There is a 0.1% commission on the UK, French and German markets and a 0.04% commission on US markets.

- CFDs on over 100 US, UK, and Germany shares are available to trade on the XM platform.

Awards

- Best Customer Service Experience – Global- Awarded by Global Business Awards 2020

- Best FX Service Provider for 2020 – Awarded by City of Wealth Management Awards 2020

- Best Customer Service Global 2019 – Awarded by Capital Finance International Magazine (CFI.co)

- Best Market Research and Education Global 2019 – Awarded by Capital Finance International Magazine (CFI.co)

- Best FX Service Provider – Awarded by City of London Wealth Management Awards 2019

- Best Forex Customer Service – Awarded by Shares Magazine

- Best Market Research & Education – Awarded by Capital Finance International Magazine (CFI.co)

- Best Trading Support for 2017 – Awarded by Capital Finance International Magazine (CFI.co)

- Best FX Service Provider for 2017 – Awarded by City of London Wealth Management Awards 2017

FBS

Features

- FBS Inc is one of the most popular online brokers with a presence in more than 190 countries. This broker has more than several million clients across five continents and is a prominent name in the trading industry.

- FBS Inc uses state-of-the-art technology on its website. FBS provides great trading conditions on both Metatrader 4 and Metatrader 5 trading platforms.

- Like many leading brokers who operate in the international markets, FBS is regulated in the European Union through the Cyprus Securities and Exchange Commission. This allows clients flexibility in leverage and other benefits, which include loyalty programs and trading bonuses.

- Clients are provided maximum leverage of up to 1:30, and if you are a professional trader, you qualify for 1:500. By having an international subsidiary, FBS provides leverage as high as 1:3000 to its retail and professional traders.

- To provide the best customer experience FBS organizes seminars and special events, providing its clients with training materials, cutting-edge trading technologies and latest strategies on the Forex market.

Awards

- Best FX IB Program

- Best FX Broker Indonesia

- Best Forex Broker Southeast Asia

- Best International Forex Broker

- Best Customer Service Broker Asia 2016

- Best Forex Brand, Asia 2015

- Best Safety of Client Funds Asia 2015

- Best broker in Asia-Pacific region 2015

- Best broker in the Middle East

- Best Forex Trading Account 2018

- Best Copy Trading Application Global – 2018

- Best Forex Broker Asia-2018

- Best Investor Education – 2017

- Best FX IB Program – China 2017

- The Most Progressive Forex Broker Europe 2019

- Best Forex Broker Vietnam 2019.

Comparison of Pros and Cons

Let’s take a look at the pros and cons of these brokers:

| XM | FBS | |

| Pros | ||

| Regulated by top-tier authorities like CySec, ASIC, IFSC | Regulated by top-tier regulatory bodies like IFSC and CySEC | |

| The minimum deposit is very low and provides demo account for its traders | Minimum deposits are low and provide a demo account for its members | |

| Offers attractive Bonus and Promotions | Offers a variety of promotions | |

| Provides Negative balance protection | Provides negative protection, and traders can use stop orders for minimizing the trading risks | |

| Provides excellent trading platforms | FBS provides great live support | |

| Cons | ||

| Does not accept traders from the US, Canada, and Israel | Provides limited trade instruments | |

Comparison – General Features

| Features | XM Group | FBS |

| Established in | 2009 | 2009 |

| Headquartered in | Cyprus | Belize |

| Minimum Deposit | $5 | $1 |

| Fees | ||

| Inactivity fee | Y | Y |

| Commission | N | N |

| Deposit fee | N | N |

| Withdrawal fee | N | N |

| Minimum Trade | 0.01 Lot | 0.1 Lot |

| Maximum Trade | 50 Lots | None |

| Account types | ||

| VIP account | N | Y |

| Micro account | Y | Y |

| Standard account | Y | Y |

| Zero spread account | Y | Y |

| Demo account | Y | Y |

| Islamic account | Y | Y |

| Funding Methods | ||

| Bank transfer | Y | Y |

| American Express | N | N |

| Credit card | Y | Y |

| Neteller | Y | Y |

| Skrill | N | N |

| PayPal | N | N |

| Bitcoin | N | N |

| Trading Instruments | ||

| Forex | Y | Y |

| Indices | Y | Y |

| Majors | Y | Y |

| Dow Jones | Y | N |

| Penny stocks | N | N |

| IPO | Y | N |

| FTSE | Y | N |

| Energy | Y | N |

| Metals | Y | Y |

| ETFs | Y | Y |

| Agricultural | N | N |

| Bitcoin | N | N |

| Other features | ||

| Social Trading | N | N |

| Forex Variable spreads | Y | N |

| Price alerts | Y | N |

| Scalping | Y | Y |

| Fixed spreads | N | Y |

| Hedging | Y | Y |

| Limit orders | N | Y |

| Stop-loss orders | Y | N |

| One-click trading | Y | Y |

| Trailing Stops | Y | N |

| Expert Advisors | Y | Y |

| Virtual private server | Y | Y |

| Market maker | Y | Y |

| Direct market access | N | N |

| Trading Signals | Y | Y |

| ECN broker | N | N |

| STP broker | N | Y |

Comparison – Regulation and Safety

XM

- XM is regulated by the Australian Securities and Investment Commission and also by the International Financial Services Commission of Belize.

- This broker is regulated by CySec, which provides a guarantee to clients’ funds. Clients’ funds are covered through compensation schemes. All their deposits with regulated brokers in Cyprus are covered with 20,000 Euros per client, and they are guaranteed by the Investor Compensation Fund.

Risk Warning – Your capital is at risk. Between 74-89% of retail investor accounts lose money when trading CFDs.

FBS

- FBS is regulated in Cyprus by the Cyprus Securities and Exchange Commission(CySEC) and the International Financial Services Commission (IFSC) in Belize. These licenses help this broker to service clients throughout the European Union and around the world. FBS does not service a few countries like the US, Japan, UK, Canada, Malaysia, Israel, Myanmar, Brazil, and the Islamic Republic of Iran.

- FBS provides European traders negative balance protection since it has obtained a CySEC license in 2017.

XM Brokers Vs FBS – Commissions and Spreads

XM

Not all of XM’s trading accounts are available for fixed spreads. XM provides variable spreads; it offers commission-free accounts that are 1.7 pips on currency pairs like EUR/USD. Zero account spreads are averaged to 1.1 pips on currency pairs like EUR/USD. Trading costs on zero spread account amount to 0.8 pips, which includes commission. You can open a zero trading account with a minimum deposit of $100. As a market maker, XM Group may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements, and no commission on trades.

FBS inc

This broker offers the following types of spreads –

- Fixed starting from 3 pip

- At FBS, the average spread for one of the most popular currency pairs, the EUR/USD, is 1 pip.

- Floating starting from 0.2 pip

- Trading without spread – the fixed spread of zero pip

- The value and the spread are determined by the account type used by the user

Comparison of XM and FBS – Trading instruments

- XM has a wide range of CFD instruments that are available to trade on their platform. It offers 6 asset classes that can be traded in more than 1000 instruments. Some of the trading costs like spreads, overnight swap rates, and commissions vary depending upon the instrument being traded and the account type.

- FBS provides users around 75 trading instruments that include forex, energies, indices, stocks, and metals. Some of the trading costs like spreads, overnight swap rates, and commissions vary based on the instrument and the account type of the user.

Risk Warning – Your capital is at risk. Between 74-89% of retail investor accounts lose money when trading CFDs.

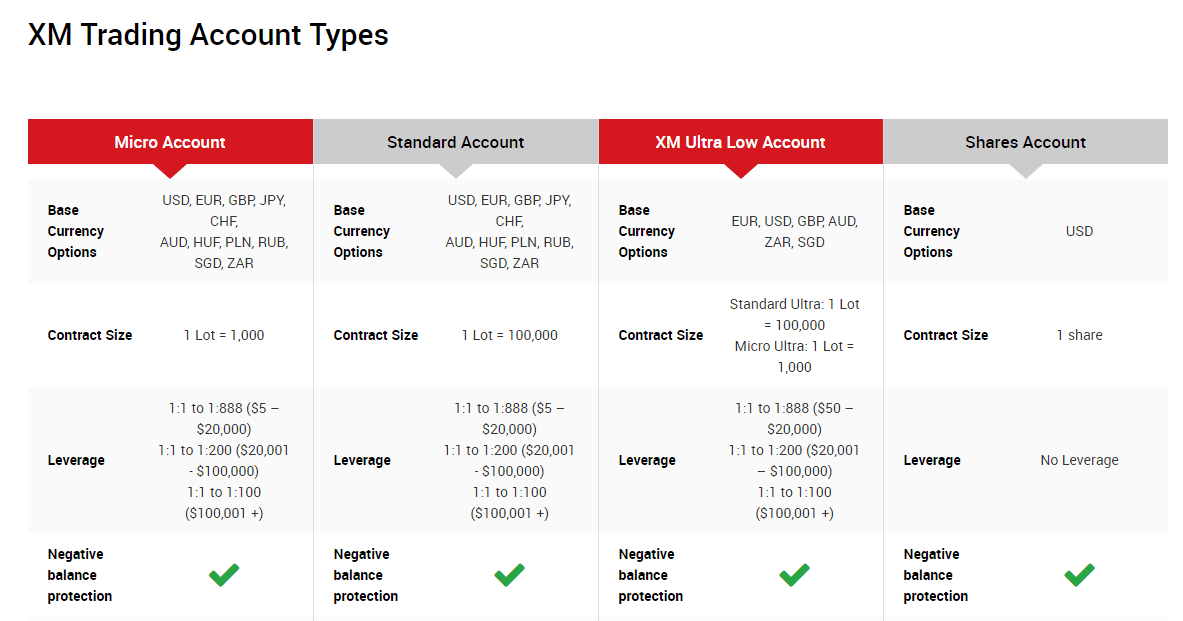

Comparison of XM and FBS – Account Types

- XM provides the investors with 4 types of accounts, Micro, Zero, Standard, and Ultra-low, with low spreads. The Micro account and Standard account minimum deposit are $5. The zero accounts minimum deposit is $100 with the lowest spreads. A commission of $3.5 is charged for every $100,000 traded. Ultra-low account minimum deposit is $50 and allows the user to trade with Micro or Standard lots, and it also offers a lower spread.

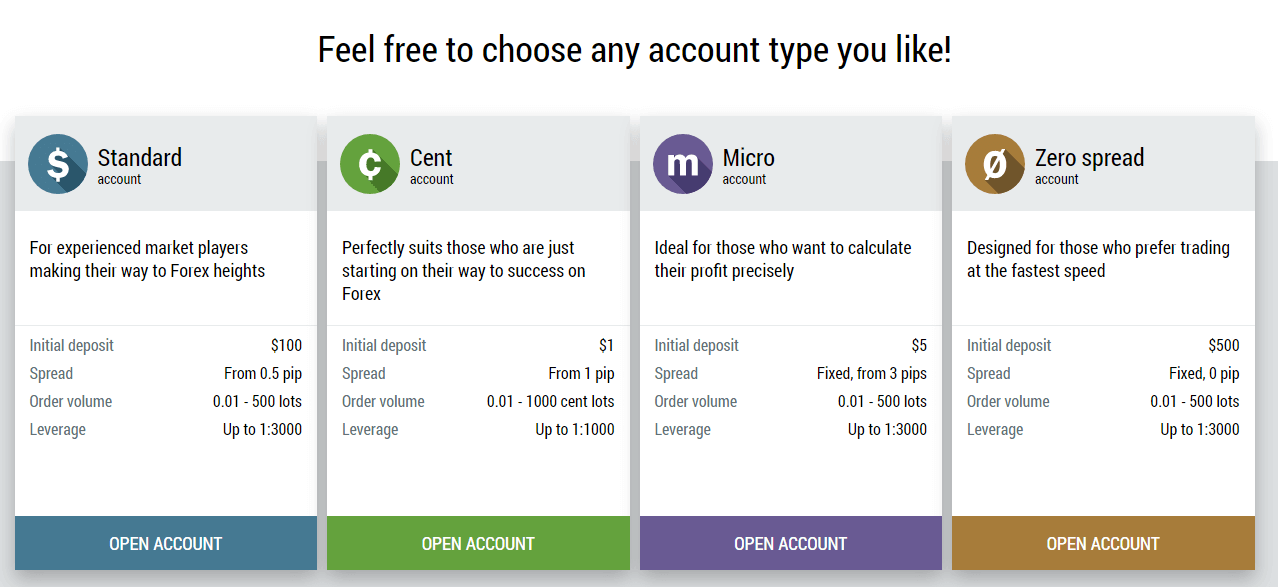

- FBS provides five account types: Standard account, Cent account, Micro account, ECN account, VIP account, and zero spread accounts for International investors.

- The standard account is for experienced users, and the Cent account for beginners in the forex trading markets.

- Both FBS and XM offer an Islamic account service.

XM Brokers Vs FBS – Mobile Trading Platforms

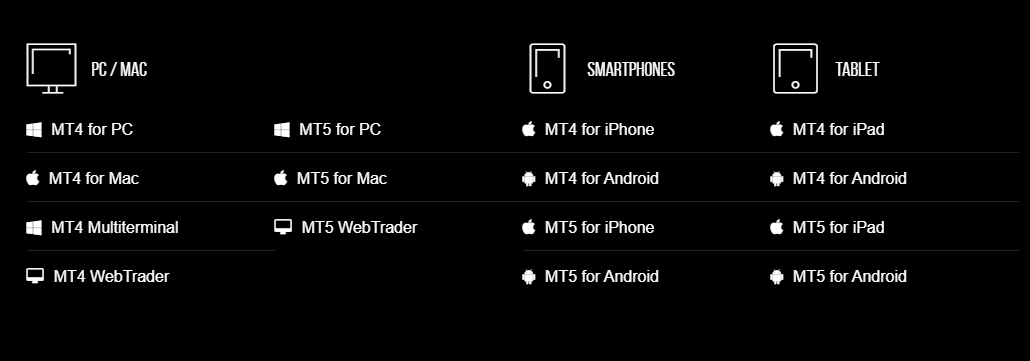

- XM users can download trading platforms MT4 and MT5 from the Google play store and Apple app store.

- FBS also provides its users access to mobile trading through Metatrader 4, Metatrader 5; FBS trader mobile trading apps are available for both IOS and Android devices. Links to the app can also be found on the broker’s website client portal area.

XM Brokers Vs FBS – Leverage

Brokers provide leverage to customers so they can trade larger amounts than they have on deposit. Many people who start trading tend to go with brokers with the biggest leverage possible. They ultimately lose money when trading because of over-leveraging their accounts blowing them in a short space of time.

Leverage can be good in forex, though, so it just needs to be used wisely.

- XM provides flexible leverage of 1:1 to 1:500. By using leverage, the user can trade positions larger than the amount in the trading account. The leverage is always expressed in ratios like 1:50,1:100, and 1:500.

- FBS offers of up to 1:3000, and the user can execute orders by using this amount exceeding initial deposits that can make more money as profit with smaller Investments.

Risk Warning – Your capital is at risk. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Comparison of XM Brokers Vs FBS – Trading Platforms

XM

- XM provides both trading platforms MT4 and MT5. MetaTrader 4 offers technical indicators, expert advisors(EAs), advanced charting packages, and extensive backtesting options.

- According to various XM reviews, XM also provides a free virtual private server (VPS) for both existing and new users of XM. With a minimum deposit of $5,000 and they need to trade a minimum of 5 round turn lots a month. It allows VPN hosting 24 hours, 5 days a week.

FBS

- FBS inc is an STP broker and offers its users Metatrader 4, Metatrader 5, and the mobile trading platform. Metatrader 4 is one of the most popular trading platforms because of its technical indicators, extensive backtesting environment, advanced charting tools, expert advisors. These features allow users to automate their trading. Metatrader 4 is available on desktop and mobile.

- FBS Trader is the proprietary trading platform app available on Android and IOS devices for all types of accounts.

Risk Warning – Your capital is at risk. Between 74-89% of retail investor accounts lose money when trading CFDs.

XM Brokers Vs FBS – Bonus and Promotions

XM

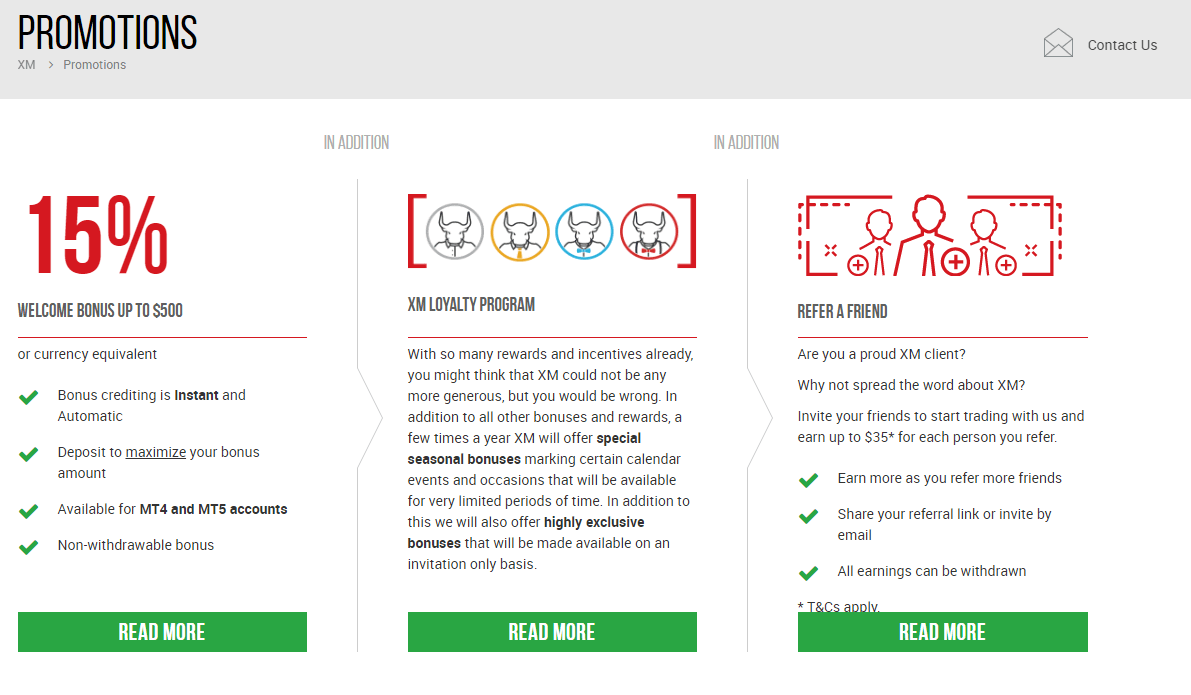

Welcome Bonus

- XM provides a deposit bonus of 15% as a welcome bonus account of up to $500 or currency equivalent

- The bonus is credited automatically and instantly

- Users can deposit more to maximize their bonus amount

- Available in Metatrader 4 and Metatrader 5 accounts

- This is a non-withdrawable bonus.

XM Loyalty Program

XM loyalty program offers rewards and incentives to users. It also offers a special seasonal bonus a few times a year available for a limited period. It also provides a highly exclusive bonus available only on an invitation basis.

Refer a friend

XM has a “Refer a friend program” where you can invite your friends to start trading on the platform. You can earn up to $35 for each reference.

Free VPS Services

XM provides free 24×7 VPS services. This eliminates downtime when you are trading on the platform. It also helps speed up trades ideal for EAs.

FBS

Bonus and Promotions

- Get a car from FBS

- FBS trader parties

- 100% deposit bonus

- Trade 100 bonus

- Cashback

FBS Loyalty Program

FBS provides “FBS Loyalty Program” whereby joining this program the traders have a chance to get silver, gold, platinum, or green status prices which includes Rolex watches, a brand new car, or a trip to FBS headquarters. The users get the prices in exchange for the points earned by attracting new clients or by trading.

Free VPS

FBS inc provides free VPS, if the trader deposits $450 and trades 3 lots in the first month, they get a free VPS (virtual private server), and they can use it for free if they continue to trade three lots each month.

Comparison of Deposit and Withdrawal Methods

- XM accepts several local payment methods, including credit card, debit card, Neteller, Skrill, Bank transfer, and several more. The website accepts deposit and withdrawal transfer fees that are made through Moneybookers, Neteller, Skrill, and all major credit cards like Visa, Visa Electron, MasterCard, Maestro, and China UnionPay. All withdrawals and deposits more than $200 are processed by a bank transfer, which is included in the zero fees policy

- FBS inc website provides a wide choice of deposit methods such as bank transfer, Neteller, Skrill, Visa, SticPay, Bitwallet, Perfect money, and several more. All deposit methods are free of charge with the exception of instant deposits with SticPay, which charges commission. Withdrawal charges are based on commission, Neteller withdrawal has a commission of 2%, Skrill withdrawal has a commission of 1% plus $0.32 commission. Withdrawals through e-wallets are processed in 48 hours.

Risk Warning – Your capital is at risk. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Comparison of Education

- XM provides live education, platform tutorials, and videos. Webinars are offered seven days a week in 18 languages by several webinar instructors. The live education room is divided into basic and advanced rooms. They cover the trading session analysis, trading fundamentals, and a Q&A section. Users can access these rooms for free.

- FBS inc offers a wide choice of educational resources, including guide books, webinars, tips for traders, seminars, glossary sections, and video lessons. Online training courses guide new, intermediate, and advanced traders. Video lessons cover a wide range of topics for traders with different levels of expertise. It also hosts webinars that help users register for an online program.

Comparison of Customer care

- XM provides customer support 24×5, and they can be contacted from Monday through Friday via email, phone, and live chat. They also offer customer support in English, simplified Chinese, Greek, Traditional Chinese, German, Russian, French, Spanish, Italian, Polish, Arabic, Portuguese, and Romanian.

- FBS inc. Customer support can be contacted 24X7 through online live chat, call back service, Facebook, telegram, and messenger in English, French, Spanish, Portuguese, Malaysian, and Arabic. Support covers issues regarding verification and registration, recovering and changing personal data, trading conditions, financial operations, trading platform, etc.

Wrap Up

When it comes to forex brokers, you want to make sure that the broker you’re looking at is transparent and trustworthy. A Market maker has information that is not available to anyone else in the general public, so aligning yourself with them will ensure the validity of the information you receive. Both XM and FBS are market makers and provide several features like different types of trading accounts, Demo accounts, and excellent customer care. If you are an experienced trader, you can sign up with XM that offers low variable spreads, and choose to trade with Metatrader 4 or Metatrader 5.

FAQ’s

1. Which broker has lower trading costs and fees?

Both brokers provide low-cost trading opportunities equally. FBS charges withdrawal and deposit fees, while XM Group charges inactivity fees but has lower non-trading fees.

2. Which broker is more reliable, XM Group or FBS inc?

XM is the more reliable broker since it is regulated by the Financial Conduct Authority, ASIC, IFSC, and CySec, and provides negative balance protection; FBS is regulated by IFSC, CySEC and also provides negative balance protection.

3. What trading platform does each broker host?

FBS Inc. and XM Group host both MetaTrader 4 and MetaTrader 5. Features include one click trading, mobile trading, pending orders, and trailing stop-loss.

Investment Advice – Your capital is at risk. Trade with caution. These products might not be suitable for everyone, so make sure you understand the risks involved.

Risk Warning – Your capital is at risk. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.