Tickmill Review 2023

Introduction About Tickmill:

Tickmill is one of the most trusted trading platforms and forex brokers in the market. It offers trading services such as Forex, Indices, Commodities, Bonds, CFDs on the MetaTrader4 trading platform in more than 80 markets. Before you invest and start to make money on any platform, trust is a key factor. Therefore, you should definitely have a look at this screenshot before we move further with this Tickmill review.

Tickmill Review – Overview of Platform

Tickmill Review – Overview of PlatformThe trading platform is a good broker that suits both the computer as well as mobile platforms that cover major platforms such as Windows, Mac, Web, Android, and iOS System. The trading platform (a part of Tickmill Group) was established in 2015 with its head office in Seychelles. It was established as a result of the movement of the retail clients of Armada Markets (an FSA regulated body) to Tickmill in Seychelles. As this broker expanded, it reached the United Kingdom and acquired more regulatory licenses. It is now a regulated broker that offers more than 80 CFD instruments for trade which include:

- Forex

- Indices

- Commodities

- Bonds

Features

Some of the trading features of Tickmill are described below:

- Tickmill offers tighter spreads, which start from 0.0 pips; these affordable and competitive trading conditions that are offered by this broker imply that variable spreads in VIP and Pro accounts start as low as 0.0 pips for some of the major currency pairs.

- This broker offers commission-free stock, indices, and bond, CFDs etc. There are no commissions for CFDs trading for major stock indices, futures, and bonds. Further, commissions for VIP and Pro accounts are highly affordable, assuming that spreads for these accounts can start with as minimum as 0.0 pips.

- According to the Tickmill review, the trades placed through the Tickmill trading platform are very fast and the platforms NDD model (non-dealing desk model) are placed on an average in less than 0.15 seconds. Further, FIX API access implies speedy execution of orders for traders.

- During periods of huge volatility and high risk in the market, the clients of Tickmill can benefit from no re-quotes when they are placing orders over the platform’s asset offerings. Traders should invest in the market only when they can take a high risk of losing money rapidly due to leverage in the markets. They should also take note of every risk warning put forward to them.

- Tickmill allows the usage of several strategies, which include scalping, hedging, arbitrage, and algorithmic strategies. It invites all traders who use any such trading style and technique to trade on their platform as per their trade requirements.

- Securities Dealer by Seychelles’ FSA regulates Tickmill UK Ltd, which means that the client’s funds are given utmost protection and are stored in a separate bank account. Tickmill has tied up with tier-1 banks for this facility. This assures you that your funds are safe and there is no high risk of losing your money.

- The Tickmill UK Ltd website provides in-depth information about margin requirements and also has a margin calculator. This helps traders grab all appropriate trading opportunities.

Advantages and Disadvantages of Tickmill

Let us discuss a few advantages and disadvantages of this broker –

Advantages

- Tickmill is regulated by UK regulation and offers high standards for customer safety.

- It is described as one of the cheapest Forex brokers around the world.

- There are no re-quotes; it offers high liquidity.

- Offers good customer service. Users can get in touch with the support team via live chat, phone support or email.

- When you compare brokers offering the same services, you will find that this broker offers very low trading fees.

- This is one of the preferred trading platforms for Forex trading.

- Offers 84 trading instruments, including 62 currency pairs.

- Stop Loss and Take Profit orders can be set on all account types with no limits.

- Low entry requirements.

- No inactivity fee. No deposit fees.

- Users can check price action in real-time.

Disadvantages

- Regarding stock trading, Tickmill does not offer this facility.

Who Can Trade With Tickmill?

- Tickmill is considered one of the best and most popular online trading platforms. It was founded by experienced professionals and fulfills the demands of beginners and professional traders.

- This platform offers a higher level of accessibility to beginners who do not have experience in trading, Tickmill clients, therefore, find the trading conditions very conducive. It also offers intuitive trading platforms and education material for the new traders to learn the fundamentals of trading.

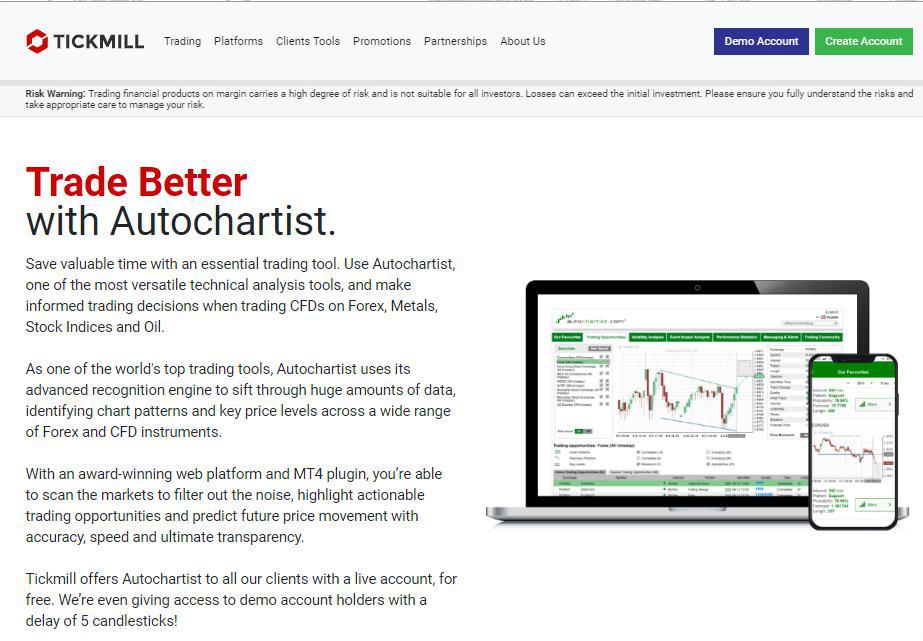

- Additionally, this broker offers several tools like Autochartist, one-click trading fundamental technical analysis, which help the new traders to increase their confidence and their trading abilities.

- TickMill is a good broker. Experienced traders will find the platform very useful for trying several trading strategies which include hedging, arbitrage, trading options, and scalping without any restrictions.

- Even though several traders prefer advanced trading technology, they will not appreciate MetaTrader 4 to suit their preferences and they might find this platform a bit restricting.

Is Tickmill Regulated?

This question is an important one. You need to consider whether you understand the technicalities of the trading platform or not. That is why we decided to deal with this question right at the beginning of our Tickmill review 2023. Attributed as a “market maker” in many user reviews, Tickmill is authorized by the Financial Conduct Authority. CFDs are complex instruments and come with high risk; when trading CFDs, traders should be ready to take the high risk of losing money rapidly due to leverage. Before trading, it’s better to understand how CFDs work and whether you can afford to take the risk to let your accounts lose money by taking the high risk involved. Many retail investor accounts lose money when trading CFDs. By creating a link to a third-party website, Tickmill does not endorse or recommend any services or product range offered on that website.

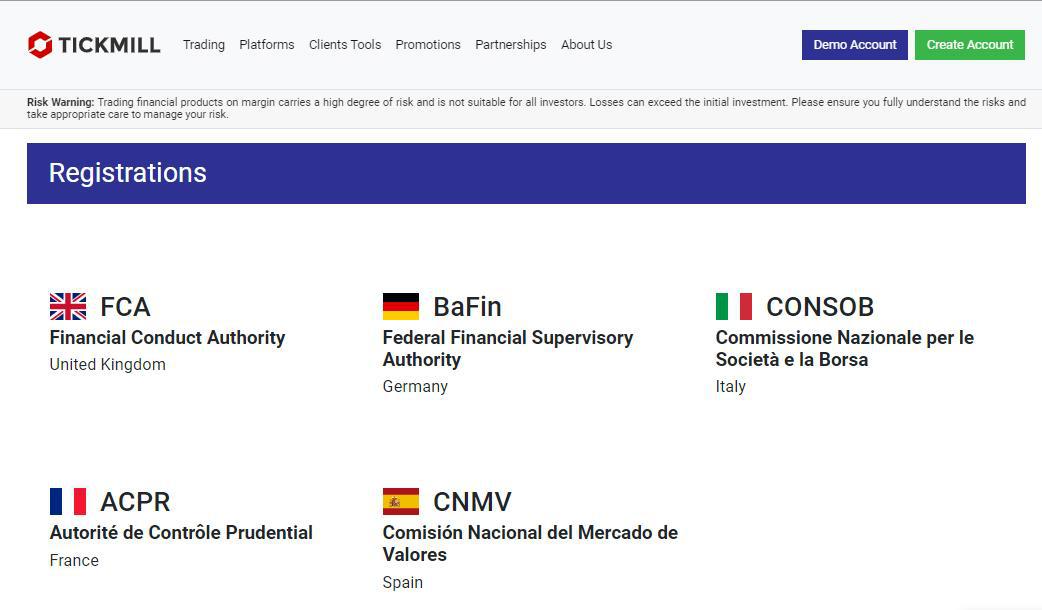

The below screenshot from the official website of broker Tickmill shows the organizations that regulate it:

Tickmill Reviews – Regulations

Tickmill Reviews – RegulationsAs per a news release, in the trust score department out of 99, Tickmill scores 81, which makes it stand out among other market makers. Industry experts consider this trading platform as an “average-risk” and not a high-risk broker. Different tier regulators authorize it. For instance, it is authorized by one tier-1 regulator (which reflects high trust), one tier-2 regulator, which is an indicator or average trust, and one tier-3 regulator, which shows low trust.

Traders from many countries like South Africa, Puerto Rico, North Korea, Solomon Islands, Guinea Bissau, Northern Mariana Islands, Marshall Islands, United States, Central African Republic, Benin, Bermuda, Bhutan, British Virgin Islands, Greenland, Grenada, Gibraltar, Greece, Cayman Islands, French Polynesia, Burkina Faso, Cape Verde, Middle East, Netherlands Antilles, Western Sahara, Yemen, Zambia, Sri Lanka, El Salvador, Nicaragua, Niger, Latvia, Lebanon, Lesotho, Barbados, Belarus, Equatorial Guinea, Mauritius, Mayotte, Mexico, Micronesia, consider Tickmill a good option to trade with.

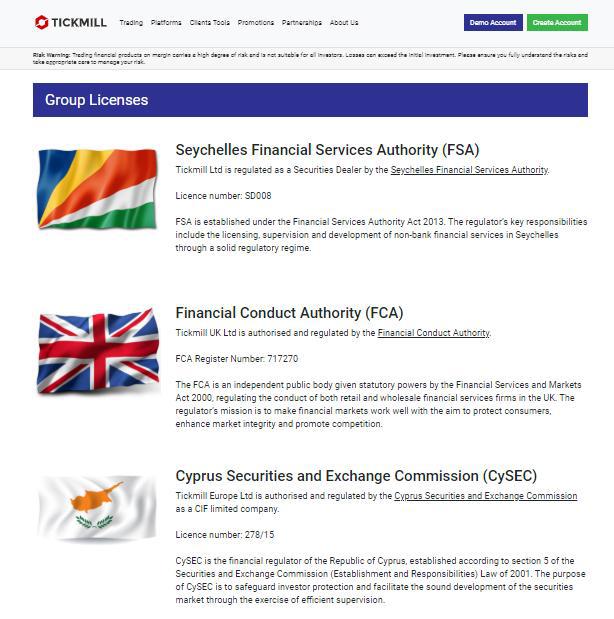

This Forex and CFD broker platform has also scored licenses from:

- The UK Financial Conduct Authority (FCA)

- The Cyprus Securities and Exchange Commission (CySEC)

- The Seychelles Financial Services Authority (FSA)

The below screenshot from the official website of Tickmill shows the licenses it has gained:

Tickmill Group Licenses

Tickmill Group LicensesTypes of Accounts Offered by Tickmill

This section of our Tickmill reviews will look at the various kinds of trading account Tickmill offers. This variety gives the users a chance to trade as per their high risk capacity, budget, amount of time they can spend in trading, and trading goals. You should first consider whether you understand the risk involved to let your accounts lose money. CFDs are complex instruments and come with a high risk. Many retail investor accounts lose money when trading CFDs or other instruments. The market has a high risk of losing money rapidly due to leverage. Tickmill offers three categories that a user can choose from on this website. They are as follows:

- Pro Account

- Classic Account

- VIP Account

Here is a screenshot from the official website to show you why you should open a trading account to start trading at Tickmill:

Tickmill Account Features

Tickmill Account FeaturesIn addition to the above categories, Tickmill offers two more types-

- Demo Trading Account

- Islamic swap-free account

Faster Order Execution

- Tickmill has several data centers and data across the world. By trading with MetaTrader4, the user can choose the best server to trade. Also, you learn more about the forex MT4 from our expert’s guide. If the trader finds it very slow, traders can rent a VPS server.

- If the trader would like to use large positions such as 30 lots and above, they can easily trade on this platform. The trader will be directed to immediate execution by offering the best prices.

- This broker is an NDD (non-dealing desk broker), which is similar to an ECN broker. Some of the differences between ECN and NDD brokers are that they act as an intermediary between the clients and the market. A responsibility to pay extra funds can be excluded.

Unlimited Demo Account

We get to know from Tickmill reviews that Tickmill offers a free demo mode, which is very useful for beginners and experienced traders. The demo mode is for an unlimited period and does not have an expiration date. The traders can execute the trades by using virtual assets and they can simulate real-time trades just like in a live account. Experienced users can test their new strategies or test new markets, similar to what they do in a live account. For accessing the demo mode, the broker does not ask for any deposit amount or verification.

Does Tickmill Offer Negative Balance Protection?

The negative account balance is feared by several traders. Traders might sometimes have a negative balance, or they might have built up debt because of the extreme market volatility. Trading conditions, therefore, need to be balanced accordingly. Tickmill platform does not ask for additional funding and the user is protected against a negative balance in case of extreme trading conditions.

Variety of Trading Tools at Tickmill:

The users at this broker are also offered a good variety of trading, analysis, and research tools. These tools include informative regular seminars, educational tutorials through various video platforms, webinars, in-depth articles about the various fundamental and technical tips, and market insights. Tickmill does not endorse any third-party products and services on its web application. Along with the above facilities and trade support, the users are offered:

- Autochartist

- Forex Calculators

- VPS services

Here is a screenshot from the official website to show the details of Tickmill’s Autochartist:

Tickmill Autochartlist

Tickmill AutochartlistInvestments at Tickmill:

This broker offers 84 different kinds of tradable symbols to its clients and traders. This variety includes CFDs on 16 indices, two metals, four bonds, and 62 forex pairs. Other investment products include:

- Forex Spot Trading

- 62 Currency pairs

- 22 CFDs

- Social or Copy trading

Please note that this broker does not offer crypto currency trading as actual or as CFDs. Further, CFDs are complex instruments and come with a high risk. When trading CFDs, traders should be ready to take the high risk of losing money rapidly due to leverage, and therefore, extreme precaution should be undertaken. Many retail investor accounts lose money when trading CFDs. You need to consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Fees, Commission, and the Minimum Deposit at Tickmill

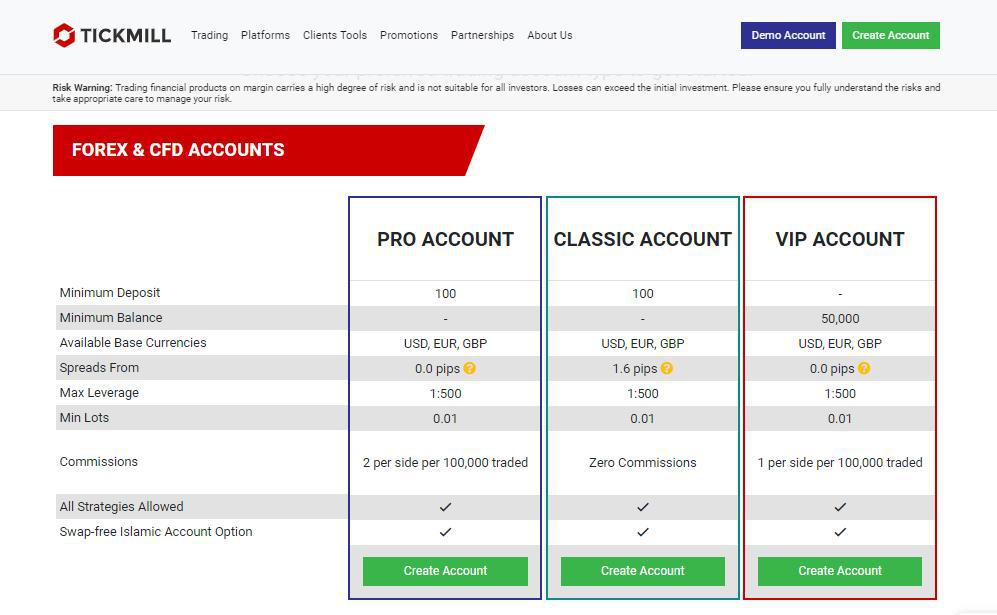

As per Tickmill review, the broker fees and commissions vary based on the type. Tickmill offers three types of accounts, such as Classic, Pro, and VIP.

Here is a screenshot from the official web site of this broker to show the details of the various types and their details at a glance:

Tickmill Account Types

Tickmill Account TypesHere, we will look at the fees and commission as per each type:

Tickmill Classic Account:

- This account is commission-free.

- The only thing the trader needs to pay for is the bid or the ask spread.

- The spreads in this account start from 1.6 pips.

- Users need to deposit 100 U.S. Dollars as the min deposit for this account.

- The base currencies available for the clients to trade in are USD, EUR, GBP, and PLN.

- The min. Lots in this account is 0.01.

- The max leverage for the retail clients for the Classic account is 1:30.

- The max leverage for pro clients at Classic account is 1:500.

Tickmill Pro Account:

- Tickmill Pro account charges commission. The commission is charged on the per-trade basis. This commission is charged on the lower spreads.

- The minimum deposit: Users need to deposit 100 U.S. Dollars.

- The minimum deposit for this type is 100 U.S. Dollars.

- The Round Turn (RT) commission at the Tickmill Pro is 4 U.S. Dollars standard.

- The spreads in this account start from 0.0 pips.

- This type is suitable for many, given the spreads are less expensive.

- The base currencies available for the clients to trade in are USD, EUR, GBP, and PLN.

- The max leverage for pro clients at Tickmill Pro account is 1:500.

- The min. Lots in Tickmill Pro is 0.01.

- It offers 84 trading instruments, which include 62 currency pairs.

- The max leverage for the retail clients for this type is 1:30.

Tickmill VIP Account:

- VIP Accounts, like Tickmill Pro, is also a commission-based type. The commission is charged on the per-trade basis and applies to the lower spreads.

- The minimum balance for VIP Accounts: The minimum balance required is 50,000 U.S. Dollars to let the clients access the low commission of 1 U.S Dollars per 100 k units, or 2 U.S Dollars per round turn (RT).

- The spreads in VIP Accounts start from 0.0 pips.

- The base currencies available for the clients to trade in are USD, EUR, GBP, and PLN.

- The min. Lots at VIP Account is 0.01.

- The max leverage for pro clients at Tickmill VIP is 1:500.

- The active traders at VIP accounts are eligible for discounts. These discounts depend on the trading volume.

- The maximum leverage for the retail clients is 1:30.

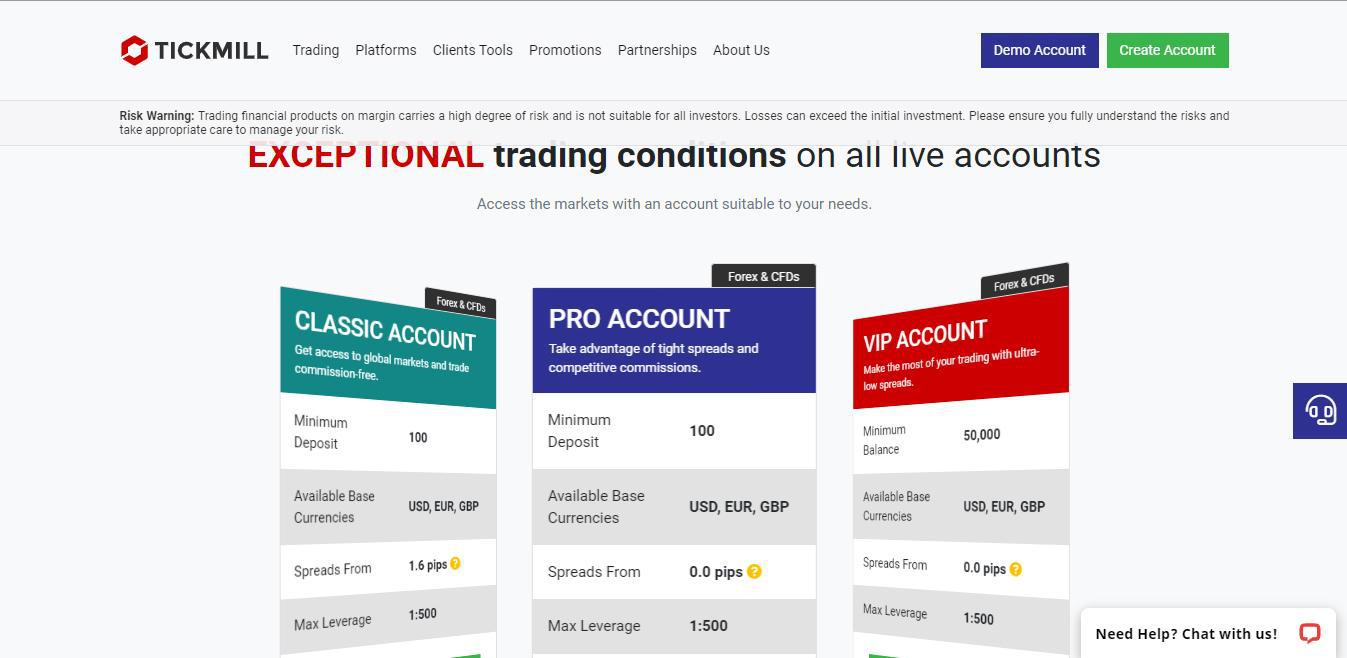

Here is a screenshot from the official website of Tickmill to show the types and their details:

Tickmill Trading Accounts

Tickmill Trading AccountsPlease note:

- The minimum initial deposit at Tickmill is 25 U.S. Dollars.

- Swap-free Islamic accounts are available for Classic, Tickmill Pro accounts, and VIP accounts.

- Tickmill does not charge any inactivity fees or withdrawal fees.

How to Open an Account at Tickmill?

Account opening with this broker is quite a straightforward method. In this section of our Tickmill review, we will show you the simple steps that you need to take to open an account on this website.

On the official website, click on the “Create Account” button. This will land you to a new page where Tickmill asks you about the basic personal information for setting up your account on the trading platform. You need to fill in information such as:

- Country of residence

- Preferred communication language

- Client type

- Full legal name

- Email address

- Phone number

Once you fill out the registration form, you are then asked to undergo the compliance checks by answering a few simple compliance questions like:

- Tax information

- Financial background

- Trading knowledge and expertise levels

- Trading experience

- CFD investment knowledge

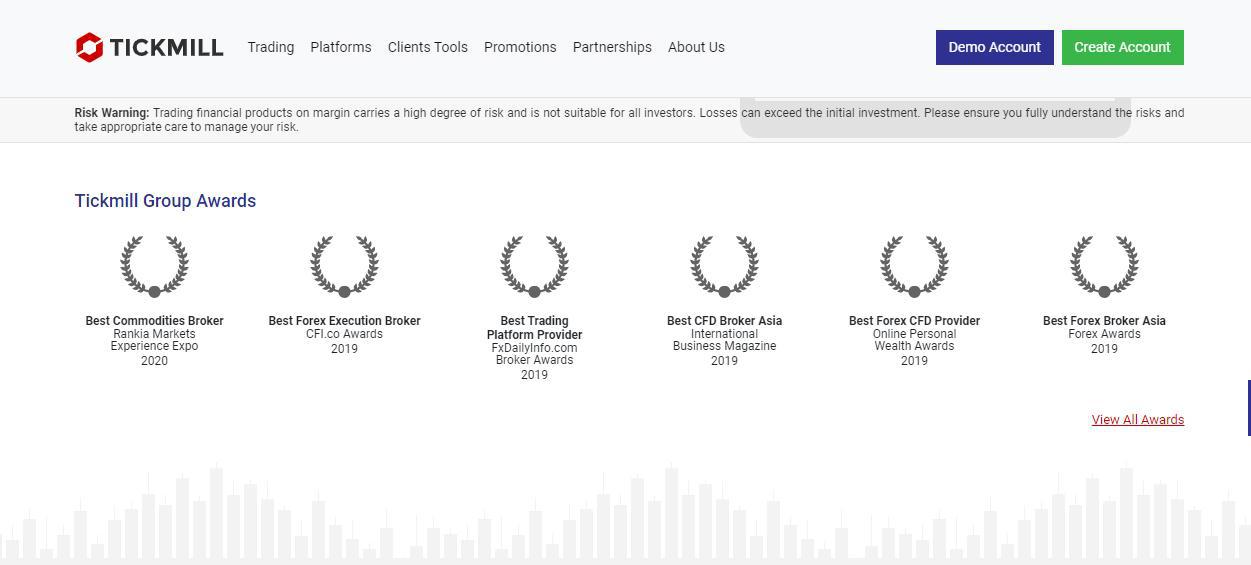

Tickmill Awards

Tickmill AwardsThe registration process usually gets completed in max. 3 minutes.

- After the successful completion of the above information, Tickmill requests the client to confirm the email address. At this stage, the user can easily access the trading accounts, deposits, withdrawals, etc.

- To start trading, the user needs to upload a colour copy of the identification documents and the proof of address documents.

- The documents can be submitted in .jpg, .pdf, .png, and .JPEG format.

- The document/s need to show a high-resolution user image.

- The full legal name should be clearly visible on the document.

- If the user intends to upload the National Insurance Number, then please ensure that both the sides of the document are uploaded.

- Another point to keep in mind is to ensure that any document submitted as identity proof must have 3 months of validity.

- In case of proof of address:

- The bills should not be more than 3 months old.

- The documents can be submitted in .jpg, .pdf, .png, and .JPEG format.

- Driving license, passport, national ID, a utility bill, or bank statement are accepted as proof of address. Please note mobile bills are not accepted under this category.

- The bill must be in the applicant’s name.

- The image should be of high resolution and unobstructed.

The account opening process at Tickmill only involves:

- Registration

- Creating an account

- Making a deposit as per the account type

- Launching into trade

Users who have opened accounts with this broker get protection for their funds through the Investor Compensation Fund (ICF) and Financial Services Compensation Scheme (FSCS).

Mobile Trading at Tickmill:

Tickmill acts only as a Meta Trader broker. Unlike other major forex brokers, Tickmill offers mobile trading services for iOS, Android versions of the MetaTrader 4 app. This mobile trading app can be easily downloaded from the Apple iTunes store, and for Android users, they can download it from the Play Store. On this mobile trading app, the users can:

- Trade forex

- Trade CFDs

- The users get basic fields alerts and watch list

- They get 30 charting/indicators lists

- The users also get access to charting draw trend lines

- It also offers its users the charting multiple time frames

- The users get real-time quotes

- The clients of the Tickmill mobile app can directly trade from the chart. They are also allowed to access multiple asset classes while using many types of trading indicators.

What is the Customer Service of Tickmill Like?

- In our research, we also investigated the customer service of this broker. This section of our Tickmill review will look at the quality of the customer satisfaction factor when one uses it.

- Our research brought forward that the average connection time a phone takes to connect a user to Tickmill is less than 1 minute.

- Market research tells that the average net promoter score of it is 6.1 out of 10. When it comes to professional levels of providing a customer support team, the brokers trading platform scores 7.4. Overall the trading platform holds the #16 spot out of 22 brokers in comparison.

- The desktop platform is very similar to the web trading platform. It offers a conducive trading environment and users do not have to incur any transaction cost.

How to Withdraw a Tickmill Bonus?

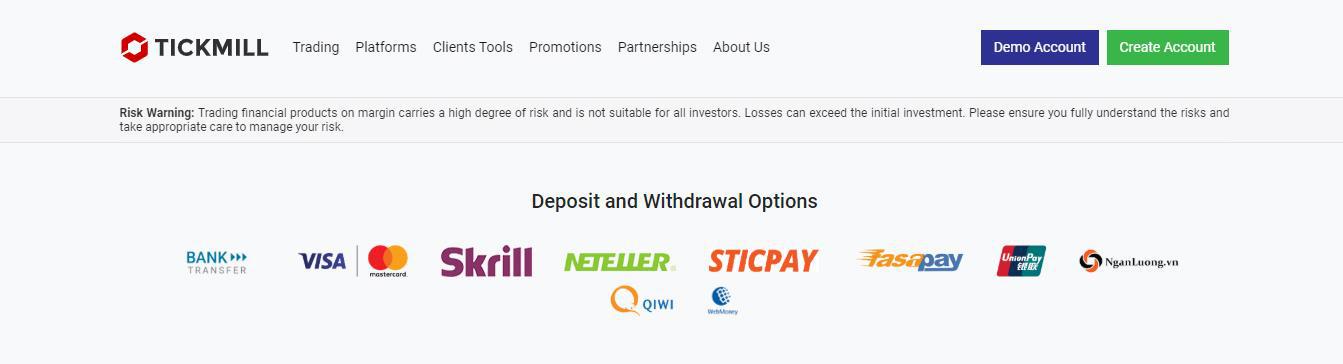

In this section of our Tickmill review, we will look at the variety of funding methods through which one can deposit funds from their bank accounts or other accounts and also ways to withdraw money from this broker. While trying to make money, users can opt for a free-of-cost deposit and withdrawal method, which the trading platform offers. The below screenshot shows the different types of withdrawal and deposit methods that can be made through bank transfers, credit/debit cards, or others.

Tickmill Deposit and Withdrawal Options

Tickmill Deposit and Withdrawal OptionsThe users can use a payment method as per their preference or convenience. Some of the available methods are:

- Debit Card

- Credit card

- Bank wires

- Neteller

- Skrill

- DotPay

- PaySafeCard

- Sofort

- Rapid

Please Note: The deposit options and withdrawal methods vary from country to country. Another thing to keep in mind is that the currency of the base currency of your account plays a vital role in every withdrawal. For instance, when a user makes a withdrawal request from the client area, the withdrawal will be processed in the base currency of your account. The deposit and withdrawal can be made directly from the client area. The process of deposit and withdrawal, ranges from an instant to 24 hours depending on the method of deposit or withdrawal and the country of operation. The time taken for a bank transfer may differ from a transfer through other methods. Although the deposits can be made in many currencies, it is advised that the user should be well aware of Tickmill’s minimum deposit and withdrawal amounts.

Upsides and Downsides of using Tickmill Forex Broker

Undoubtedly it is a very useful trading platform. But like anything else, it too has its own downsides that you must be made aware of before you choose this platform. Following is the list of pros and cons of using it:

| Pros | Cons |

| Tickmill UK Ltd is a regulated trading platform and holds licenses from CySEC, FCA, and FSA. | The downside is that it does not offer any stocks to its users. |

| The user of Tickmill UK Ltd can enjoy a commission-free account. | It does not offer Metatrader 5. As of now, only Tickmill MT4 is available. |

|

The users get access to competitive spreads and over-night swap rates. |

It does not offer cryptocurrency exchange as actual. |

| Along with other benefits, the users also get a good variety of trading, analysis, and research tools that can take their trading to the next level. | The broker does not offer cryptocurrency exchange as CFDs. |

The Final Verdict

Tickmill Europe Ltd is a licensed broker and is regulated by the UK FCA, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority of Seychelles. Trading CFDs, or instruments from any other asset class like indices, forex, commodities, bonds on the MT4 platform is possible through three main types Pro, Classic, and VIP Account. It has taken care of the preferences and requirements of beginners, and in order to support them, it offers demo trading and Islamic swap-free accounts. Moreover, there are commission-free trading accounts made available by it. Along with this, for its users’ comfort and ease, it is available on Windows, Mac, Web, Android, and iOS platforms.

Tickmill comes with a variety of research, analysis, and tools that include webinars, seminars, video tutorials and up-to-date fundamental and technical analysis articles, Tickmill VPS hosting, Autochartist, and a wide range of Forex Calculators. This forex trading platform is always on a lookout to support Tickmill clients with the best services.

Therefore, we will give a green signal to this broker. It is a sensible and trustworthy platform where one can invest money and trade. It limits the high risk of losing your money. Please do not consider this as investment advice or an investment recommendation. Along with this, we would like to suggest one universal advice that goes for each and every trading platform and the aspiring trader — please ensure that you do the background research of the credibility of any platform on your own before trusting any source.

CFDs are complex instruments and come with a high risk. Many retail investor accounts lose money when trading CFDs. It is, therefore, of utmost importance that you understand how CFDs work and whether you can afford to take the risk to let their accounts lose money. It is always advisable to risk capital as per your high risk capacity to lose money, budget, and trading experience. Please take note of this risk warning. Growing slow and steady is often the soundest advice you can adhere to while keeping the trading excitement under check and thereby, having a rewarding trading experience.

FAQ Section

1. What About Funds Protection at Tickmill?

Securities Dealer by the Financial Services Authority of Seychelles regulates Tickmill UK Ltd, which means that the client’s funds are given utmost protection and are stored in a separate bank account. TickMill has tied up with tier-1 banks for this facility.

2. Tickmill Offers Cash or Future CFDs?

Yes, the broker offers Cash CFDs. The trader can use the money without any subject to expiration.

3. What Are the Benefits of Choosing Tickmill?

Tickmill has a track record of providing many benefits to choose from:

- Low spreads starting from 0.0 pips

- Ultra-fast execution speed of average 0.15 seconds

- Instant processing of deposits through multiple payment methods like bank transfer, Skrill, Neteller, FasaPay, UnionPay, debit cards, and credit cards

- 24 hours of withdrawal processing

- High trading volume

- Offers CFDs on oil, bonds, stock indexes, precious metals, and other additional trading instruments

- Offers CFDs for S&P 500 US stock indexes and Nasdaq 100

- Users can check price action in real-time

4. Is Tickmill Regulated?

Well, as per information contained in Tickmill broker reviews, the Tickmill UK Ltd trading platform is authorized by the Financial Conduct Authority (FCA) with FCA register number 717270.