Tastyworks Review 2023

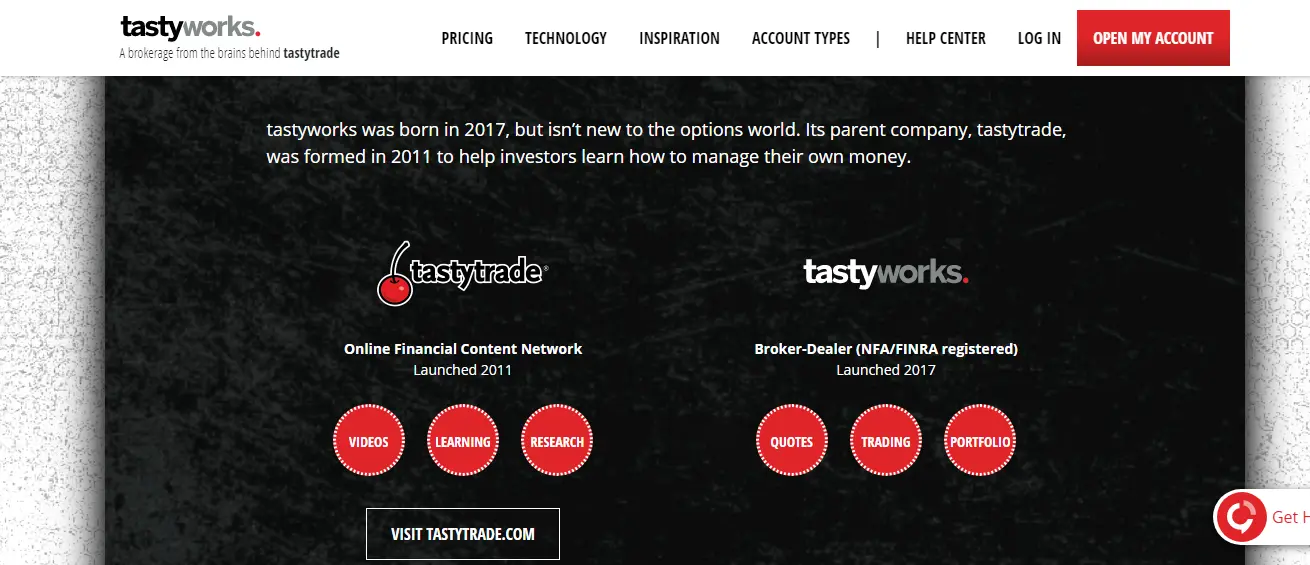

Established in 2017, Tastyworks is a newcomer in the world of brokerage firms. It is a segment of Tastytrade, an online financial system that was started in 2011. Besides, the platform is designed, keeping in mind the active traders who are interested in trading derivatives. Having extremely quick and stable data feeds, it supports options trades, futures, and stocks. In any case, this platform is not for everybody, as some may find the website’s investment alternatives lacking in a few areas.

What is Tastyworks?

- Tastyworks is one of the leading online discount brokerages, which offers trades exclusively on stocks, futures, and options markets. It offers a unique fee structure on all the trades, which makes its pricing much lower when compared to big discount brokerages. It is designed for experienced traders offering an array of features.

- Types of trades offered by Tastyworks –

- Stocks

- Futures

- Options on stock

- Options on futures

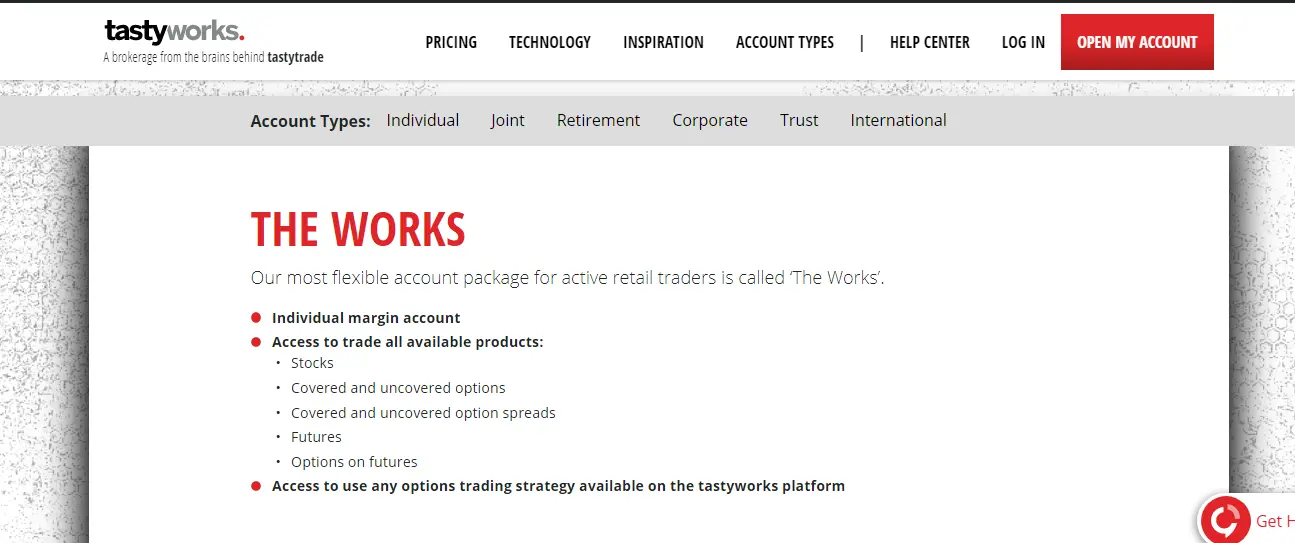

- This broker offers several account types, and the premier account is known as “The Works”; which is called an individual margin account, where the traders can access stocks and options. The traders can execute the trades for options, as well as option spreads. By using this account, the trader can access stock and futures trades.

- Few other accounts offered by this broker are the individual cash account, corporate investment accounts, traditional and Roth IRAs, and exclusive accounts for international customers.

Working of Tastyworks

Tastyworks can be described as a low-cost online broker that uses powerful technology, and it is primarily designed for options traders. Few traders might find this platform lacking in investment types, yet they can trade stock, options, and futures.

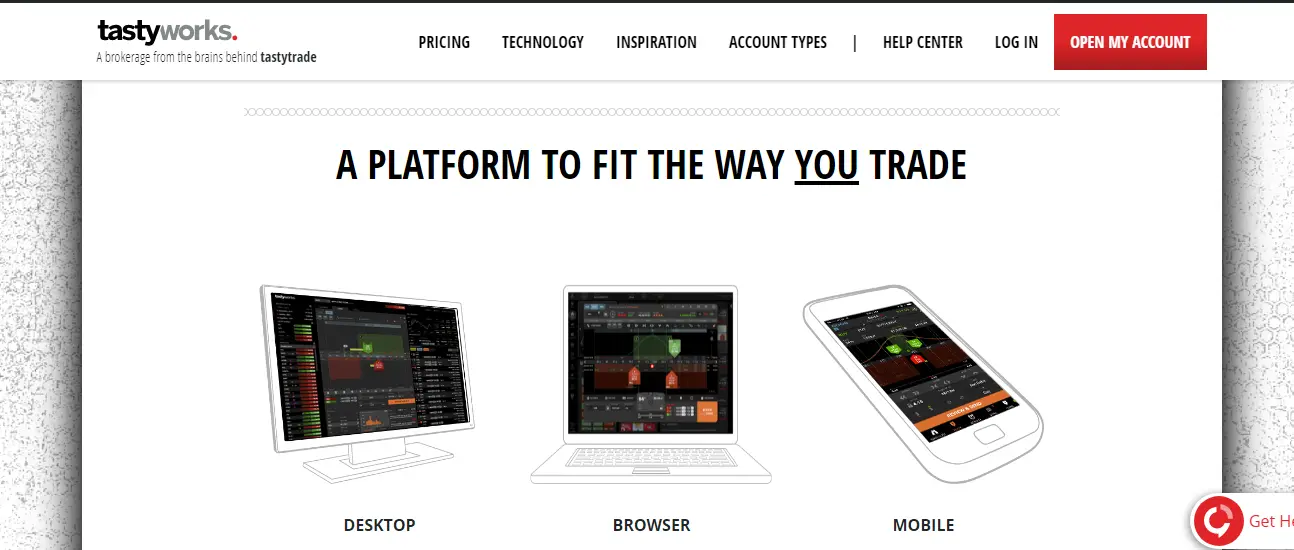

It offers an online account and can be accessed through a web browser, mobile app, and a downloadable desktop application. These interfaces provide similar access to trading, pricing, and account information details.

Besides, the browser and the desktop versions are nearly similar. The trading dashboard is very comfortable for an experienced trader who has already used the live trading feature. This software offers an integration to watch live Tastytrade, where the trader can watch the trades without leaving the TastyWorks platform.

The trader can quickly access options and get quotes to execute the trades on the platform, create portfolios, watchlist, and follow the traders of TastyWorks in real-time, as they place the trades.

Users can access several accounts through the trading platform, which makes trading very easy for experienced traders. The trader can access the charts and the tables that offer several data for the trader to make a decision to trade.

The web-based version of Tastyworks runs through any browser; the desktop version is available for Windows, Linux, and Mac. The mobile app can be accessed on iPhone 6 and any Android phones.

TastyWorks offers a dedicated customer service that can be accessed by live chat, email, and phone, offering several email addresses for the trader’s specific needs.

Some of the Pros and Cons are discussed below –

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

Features

-

Tastyworks offers stock options, ETFs, futures, and options on futures. Further, it offers cash, corporate, margin, international, trust, retirement, and joint accounts.

-

One of the advantageous features is, there is no minimum deposit for cash accounts. Nevertheless, to use margin in the margin account, the trader would require a minimum of 2000 dollars in the account. In this way, it is sensible to deposit a minimum of 2000 dollars to acquire margin benefits.

-

As per our Tastyworks review, it offers easy, completely customizable, and simple-to-use charts. For these charts, this broker provides 100 different indicators to select from, and these have custom settings too.

-

Furthermore, they have 20 diverse drawing tools to select from. Moreover, these technical analysis features are completely customizable to fit each person.

-

Currently, Tastyworks has 11 distinctive preset watchlists to select from. Suffice to say, Tastyworks has several extraordinary features, particularly for options traders to trade. They have many normal and simple chain options that can be customized to the trader’s needs.

-

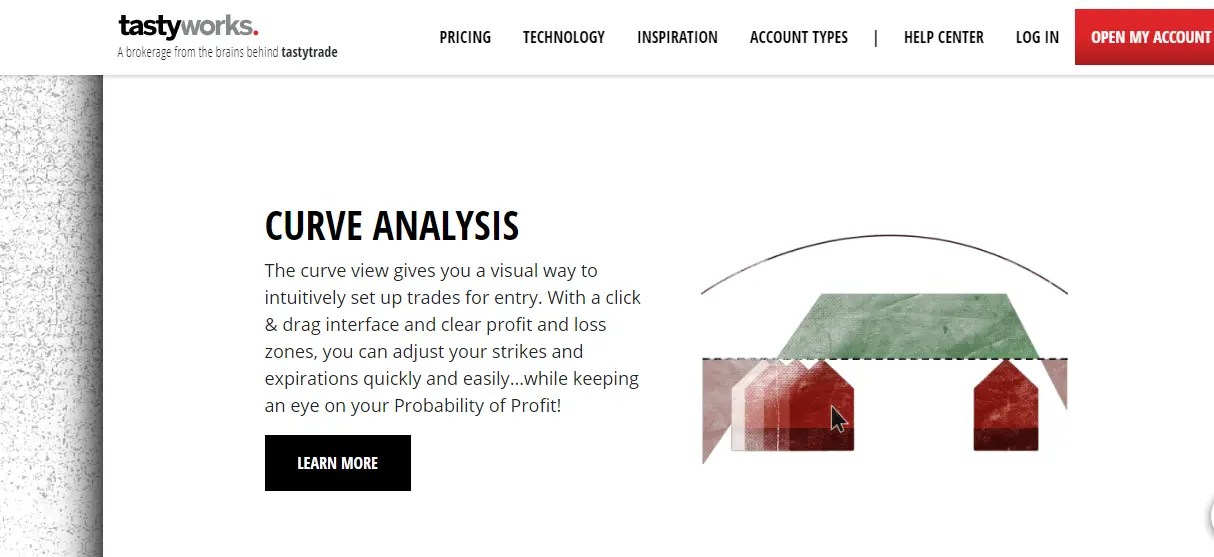

Along with the option chain, Tastyworks offers a cool, all the more engaging other options. Tastyworks have this interactive payoff curve, where the options traders can select/alter/change different stock or options positions. Directly this shows how the changes can influence the payoff.

-

Tastyworks platform is the best for Active traders, IRA investors, options traders, low minimum traders, and penny stock trades.

-

As per our TastyWorks review, the Tastyworks team added an analysis feature to their trade tab. The Analysis feature allows the trader to analyze current and potential situations in several different ways.

-

Tastyworks also offers options on futures, which are a less expensive way to trade large indices.

-

In an update, Tastyworks added another interface, which is called Active and is designed for active traders. It allows the trader to order and manage mainly stock, options trades, and futures positions with intense ease and speed. This aspect makes Tastyworks more desired for stock traders, yet the interface is significantly more helpful for futures traders.

-

Particularly for less advanced traders, there are preset procedures. Directly from the options chain or the curve, the trader can choose from 20 plus diverse option trading methodologies, similar to vertical spreads, iron condors, straddles, strangles, calendar, and several more.

-

There are several good Tastyworks reviews given on the internet, saying that the traders had used this trading platform to trade and generated more profits.

Is TastyWorks a safe platform?

Below given are a few pointers about the safety of Tastyworks platform –

-

Tastyworks was established in the year 2008 and has operated for more than a decade for both new and experienced traders. It is headquartered in the United States.

-

Tastyworks trading platform is regulated, which implies that this platform is supervised by the regulatory body such as The Financial Industry Regulatory Authority (FINRA).

-

Before choosing a broker like TastyWorks, the trader must find out the regulatory status of the broker. Besides, any broker who conducts the trades without the regulatory body’s supervision is a high-risk factor.

-

A broker does not manipulate market prices if they are governed by the regulatory body and supervised by them. If the broker violates any of the rules, their regulatory status will be canceled.

-

Any funds added to the Tastyworks account by the users are held in an exclusive bank account, and for this purpose and also for added security, this platform uses tier 1 banks. Tier 1 bank means, banks that have great financial strength and health.

-

We highly recommend the traders to create two accounts, when they start working with Tastyworks. One should be a demo mode, and the other one is the real mode, where the trader can add their real money. The purpose of a demo mode is to experiment with the trading platform and learn about its various features and functionalities.

What can be traded at Tastyworks?

Tastyworks platform can be used for trading futures and options and stocks. If you are an experienced trader looking for other investment types, this platform does not offer any. Besides, this platform does not offer different investment types. Tastyworks is not the right place for mutual funds and bond traders. Even though it has a limited number of investment types, there are several traders actively trading on this platform.

Tastyworks Platform Comparison with other brokers –

| Features | Tastyworks | eToro | Forex.com |

| Account fees | No | No | No |

| Inactivity fees | No | Yes | Yes |

| Bank Transfer | Yes | Yes | Yes |

| Credit/debit cards | No | Yes | Yes |

| Electronic Wallets | No | Yes | Yes |

| Time to open an account | 1 day | 1 day | 1 – 3 days |

| Stock | Yes | Yes | No |

| ETF | Yes | Yes | No |

| Forex | No | Yes | Yes |

| Fund | No | No | No |

| Bond | No | No | No |

| Crypto | No | Yes | Yes |

| Demo account | No | Yes | Yes |

Some of the benefits of TastyWorks platform are –

-

There are different options to select from brokerage accounts. Besides, the Tastyworks login in the account will offer the trader with everything they need. This kind of account is extremely simple to use and has heaps of features that come with customer service support.

-

Traders can trade with more than 217 instruments. Besides, options on futures are a less expensive way to trade large indices.

-

As per our review, Tastyworks has no closing charges on stocks, options, and futures, which could save the trader a huge sum of cash. While some other online trading brokers may charge the traders huge fees for these types of trades, here, the trader does not need to pay anything at all.

-

As per our TastyWorks review, there is a wide scope of customer service options for all traders, which means the trader can contact customer service staff by email, phone, or live chat if they need any assistance.

-

Opening a new trading account with Tastyworks is simple and can take as little as 15 minutes.

-

Tastyworks platforms can be accessed from a desktop or mobile device.

-

Besides, Tastyworks acknowledges clients from different nations. Customer service can find the list of qualified countries in their platform. Practically all EU nations, generally South and Central American nations, Indonesia, India, New Zealand, and Turkey, are qualified.

Safety

This broker is regulated by a top-level U.S regulator FINRA, which provides a high investor protection level. On the other side, it has not been listed in the Stock exchange, and it does not offer negative balance protection.

Account Opening with Tastyworks

TastyWork’s account opening process is fast, fully digital, and user-friendly. An account can be opened without a minimum deposit.

| Pros | Cons |

|

|

|

|

|

Tastyworks Account types

Tastyworks offers two account types for customers – cash and margin accounts. By using a margin account, individuals can use leverage, which implies that the trader can borrow cash from the broker to trade.

Retirement accounts are accessible to US residents. The trader can select between a traditional, self-employed (SEP), a Roth IRA, or a beneficiary inherited IRA.

Traders can also open a joint account where they can share ownership with another person. Besides, Tastyworks also offers International accounts for its abroad customers.

Moreover, Tastyworks offers trust and corporate accounts for legally established US organizations.

All the rights reserved by Tastyworks for features and several functionalities of the platform.

Type of Traders Tastyworks supports

The type of traders Tastyworks supports is options and futures. Tastyworks could be one of the best interactive brokers, for active traders who need great technology and who place tasty trades occasionally with a larger number of shares or contracts. As per our review, the desktop platform is designed for futures and options trades, as well as account stock traders with options strategies. Even though ETFs are allowed to sell, there are no commission-free funds; and this puts Tastyworks behind its competitors.

| Pros | Cons |

|

|

|

|

|

|

|

Minimum Deposit: Tastyworks’ required minimum deposit is zero for cash accounts to open trades. Besides, for margin accounts, the trader needs to deposit a minimum of 2000 dollars according to industry regulations to trade. Further, there are no ongoing expenses, so the trader can open an account and leave it at zero dollars.

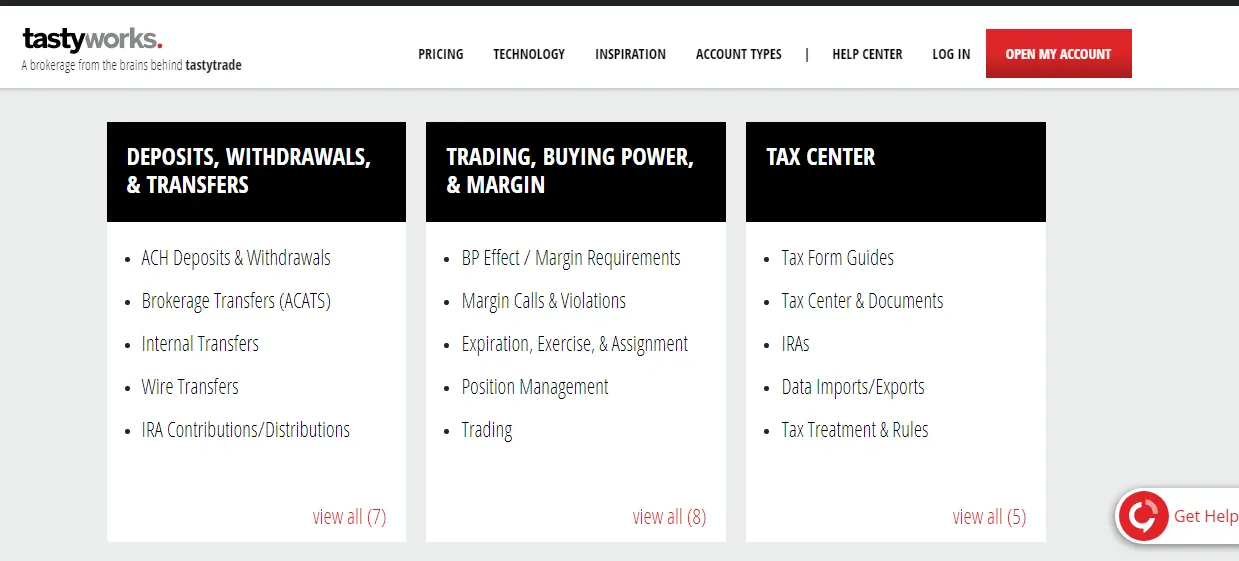

Deposit Fees: Another important feature of Tastyworks is that deposits are free of charge. Nonetheless, non-US residents can only use bank transfer, which is known as wire transfer in US banking.

Withdrawal Fees: Withdrawals at Tastyworks costs around 45 dollars for non-US customers and 25 dollars for US customers. Withdrawal of money should be possible the same way as deposits, wire transfers for non-US residents, and ACH and cheque for US residents. The UI for withdrawal wire transfer is user-friendly and simple to use.

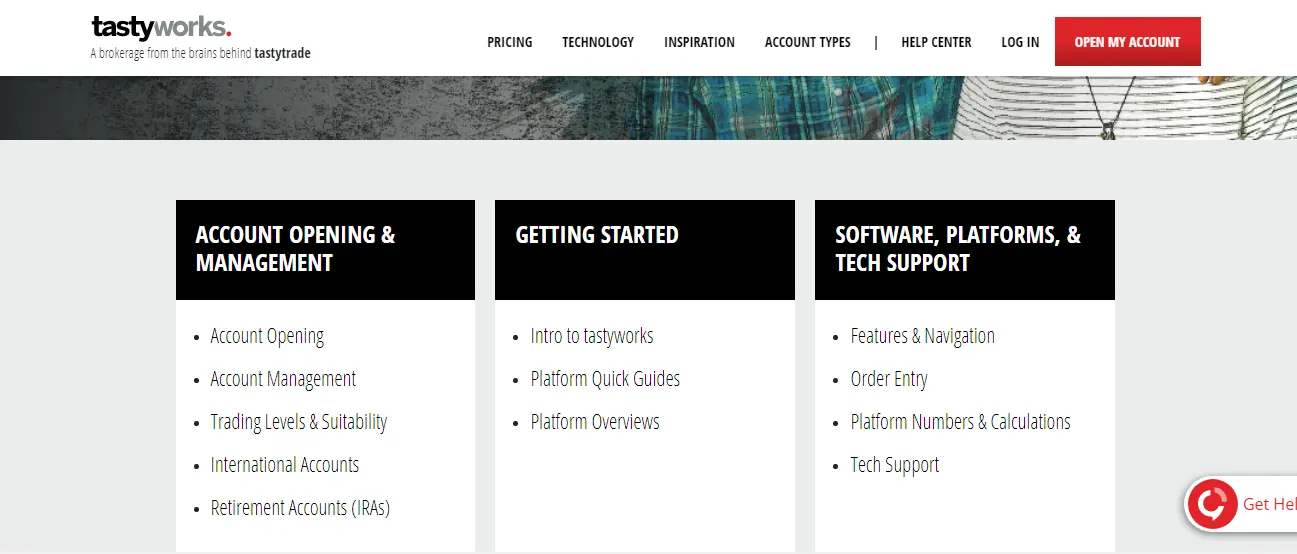

Tastyworks Review – Deposit, Withdrawal, & Transders

Some of the Pros and Cons of Deposit and withdrawal fees are discussed below –

Tastyworks Deposit and withdrawal fees need more improvement. Even though there is no deposit fee and is very user-friendly, traders can only use bank transfer, and fees for bank transfer withdrawal are very high.

| Pros | Cons |

|

|

|

|

|

|

|

|

Tastyworks Pricing and its closing trades

Stock Commissions: In Tastyworks, stock and ETF transactions cost 5 dollars on the opening side (which is for unlimited shares) and zero dollars for the closing side. Moreover, Exchange and regulatory fees are passed across the client. This broker does not offer mutual funds; pricing when compared to other brokers, is okay.

Options and Futures

-

Equity options are $1 per contract to open a trade side and zero dollars on the close side. There are 10 cents clearing charges per contract to open trades. Recently, Tastyworks established an options commission cap of 10 dollars per contract.

-

Even though Tastyworks does not offer mutual funds, it has future trading. The commission is $1.25 per contract, and the charge is applied on both sides. Moreover, there is a clearing fee of 30 cents per contract, and exchange charges can also be applied at times.

Trading fees: As per our Tastyworks reviews, when compared to other platforms, Tastyworks trading fees are low. Tastyworks charges $1 per contract to open trade for stock options and $2.50 per contract for options on futures for opening a position. Moreover, closing a position on options is free. For futures, it charges $1.25 per contract to open and close trades. Lastly, stock trading incurs no commission charges. Besides, when compared to other platforms, stocks, ETFs, and options are free to trade on the Tastyworks platform.

Non-trading fees: Tastyworks has normal exchange fees. It doesn’t charge you a general record expense, an inertia charge, a guardianship expense, or a store charge. On the flipside, Tastyworks’ withdrawal charge is very high: it is 25 dollars for US financial balances and 45 dollars for non-US ledgers. ACH withdrawal is free.

Shorting Stocks: Tastyworks needs an initial margin requirement of 50 percent or 5 dollars per share (whatever is greater) to short equity priced above 5 dollars. Besides, for equities below 5 dollars, the initial requirement is 100 percent or $2.50 per contract. Maintenance is 30 percent for stocks above 5 dollars and 100 percent for stocks below the level.

Paper trading: Even though Tastyworks is perfect for experienced brokers, beginners will discover huge amounts of information as well. A trade journal is given to assist the trader to write down what worked out and what didn’t. For new traders, this instrument is particularly useful when the trader needs to look back and see the methods that led to successful trades.

Tastyworks – Trading Platform

- Tastyworks utilizes its trading platform for successful trades. It offers a user-friendly custom trading platform, accessible in terms of a downloadable program and as a browser-based WebTrader.

- Tastyworks is focused on options and futures and stock trades is its next focus. The Tastyworks web trading platform is good for advanced traders, however, it is difficult to explore as a beginner. When compared to other platforms, stocks, options and ETFs are free to trade on the Tastyworks platform.

- The Platform is well-designed, which can be used effectively with a touch of practice to trade. It is additionally equipped with a strong options trading panel, however, the platform is not customizable. Besides, it is available just in English. All the rights reserved by Tastyworks for features and several functionalities of the platform.

The web trading platform offered by Tastyworks is exceptionally good for experienced traders if they concentrate on options for their trades. Moreover, it takes time to learn its different functionalities and it has limited customizability.

| Pros | Cons |

|

|

|

|

|

|

Mobile trading platform

- The Tastyworks mobile trading platform is fundamentally the same as the web platform and offers its major functionalities. Moreover, the mobile trading platform is accessible in English for iOS and Android. The mobile trading platform is user-friendly and it has a perfect and modern design to start trades.

- Further, Tastyworks mobile application is intended to limit the amount of data entry the trader needs to do by making use of drag and drop.

- Almost every strategy the trader trades on the desktop or web trading platform is available on mobile. Even though the trader cannot open an account through the mobile application, the Tastyworks web platform is mobile responsive and has got account opening abilities.

Portfolio Analysis and Reports

Nearly at the top of the page, portfolio statistics can be seen along with liquidity, delta, theta, and purchasing power. For an in-depth analysis of the portfolio risk, the trader can create an account on the Quiet Foundation, which is a registered investment advisor that is run by Tastyworks and Tastytrade. Moreover, there are no charges to the client for the investment evaluation, and the trader can interface other investment funds for a glance at all their accounts.

Curve Mode

The curve mode described on the trading platform is a visual way of setting up the trades, which is completely unique. Moreover, this mode has a drag and drop functionality that permits the trader to visually place each leg of the options trade relative to its current stock price and its probability zone.

Education

- As per our Tastyworks review, tastywork trade framework is the place to learn how the active trader’s team thinks and works. The trader can watch live video throughout the day, and see additional videos too. Besides, their live events are held everywhere throughout the U.S., which are entertaining and lively, and are free to visit.

- The Tastyworks team declared their new digital publication called Luckbox in early March 2019. It is focused on proactive investors who want to make better investment decisions dependent on probabilities and risk-taking, and for this, the trader can sign-up for a free charter subscription.

Alerts and notifications

In Tastyworks, it is not difficult to set up order notifications and price alerts. Moreover, the trader can set up alerts for every asset for the price. Also, the client can set up push notifications, emails and text messages, if they are in the US.

Portfolio and fee reports

The portfolio report is well organized and structured. Its default setting is options trading centered on indicating delta and theta values. Moreover, the columns of the table can be effectively customized, and the fee report is clear. Both the fee and portfolio report can be exported to a CSV.

Social Trading

Tastyworks provides a social trading service. The options and futures traders can copy and follow the trades of the Tastyworks team. They are extremely active so that they can have more trading ideas.

News and Research

- Tastyworks research tools consist of great charting tools on the desktop, trading ideas, and high-quality news stream. Meanwhile, it is options centered and restricted fundamental data accessible.

- The majority of the research capabilities focus on analyzing option methodologies. The trader can keep the Tastytrade video feed open to perceive what is happening in real-time. The network’s members all publish their trades and the traders can pursue the ones that they like the most to follow.

| Pros | Cons |

|

|

|

|

|

Charting

Tastyworks has a complex and great charting tool on its desktop platform. Moreover, the traders can use more than 100 technical indicators, and the chart is interactive as well.

Newsfeed

Tastyworks offers news through its educational platform, Tastytrade. Here, one can have access to a wide scope of exceptionally useful options, futures trading content, and live news coverage for successful trades. The Tastytrade group runs live trading throughout the trading time every weekday.

Learning

At Tastyworks, the trader can learn in the following ways –

- Platform tutorial videos

- Webinars

- General educational videos

- Quality educational articles

Tastyworks educational resources are accessible through its education-specific platform, Tastytrade. Here, the trader can develop the options trading knowledge from the beginning. Moreover, their videos have great quality and are likewise enjoyable. It is a major advantage when the trader is using financial content.

Live Education Daily

One of the more creative and valuable parts of the Tastyworks platform is daily live education. When the trader logs in, they need to select the Tastytrade icon and a real-time streaming video feed opens up including live shows that are filled with helpful hints and training to improve the trading knowledge and skills.

Grid

- There is an incredible watchlist called ‘Grid.’ The trader can have an overview of a wide scope of assets in a single place. Every selected stock has an efficient mini infographic with some key information. Also, this is customized for options trading, as the most visible data points are inferred volatility positions.

- In contrast to traditional brokerage firms, Tastyworks has an alternate look and feel from beginning to end. The Tastyworks group needed the trading platform to be trader focused. The Tastyworks Grid is one example of how the platform is designed for traders for executing successful trades.

- The Grid features significant stocks and shows price changes presently. Regardless of whether the trader needs to see the most recent price changes, everyday changes, or even view more detailed information like unpredictability, it is visible at one glance.

Support

- Tastyworks telephone support is okay. The main drawback is that they are available to contact just on weekdays between 7 am to 5 pm.

- Tastyworks email support is accessible 24/5. Moreover, the broker additionally offers an email service. Tastyworks has a technology division for IT issues.

- Tastyworks supports a wide scope of languages including English, Czech, Spanish, Chinese, German, Italian, French, Polish, Romanian, Portuguese, Slovenian, Hebrew, Hindi, Arabic, and Russian.

| Pros | Cons |

|

|

|

|

|

Drawbacks

- The traders cannot invest in bonds or Mutual funds. For the more experienced traders, this might be an issue. Besides, even seasoned traders can profit by the low charges and commissions on the investment options accessible.

- Beginners could find the account options and multiple features a bit confusing to trade. With constant practice, they can trade easily and quickly.

- Tastyworks mobile application does not work with older devices.

- In Tastyworks mobile app, the trader cannot set price alerts and order notifications, which is a major disadvantage.

- Tastyworks search functions are okay. Like the web platform, the trader can search based on the ticker of the asset, yet the trader cannot set up filters for asset kind.

Wrap up

Tastyworks is a good broker for options trading, however, it is somewhat complex if the trader wants to trade only stocks. Trading charges are low, with free stock and average options trading fees. It is built for options and futures traders, and a bit intimidating for beginners. Moreover, its research and educational tools are great tools for learning. Tastyworks is not a good fit for a passive mutual fund investment but can be a great trading platform if a trader wants to grow his derivatives trading knowledge.

FAQ’s

1. What is the processing time for withdrawals from Tastyworks?

The withdrawal process offered by Tastyworks is fast and quick. The processing time for withdrawing money takes 2 to 5 days to be processed.

2. How to start trading with TastyWorks?

If you are planning to open a trading account with TastyWorks, the first step would be to sign up. After signing up and receiving the login details by the verified email address, the trader needs to submit their identification documents which are used for account validation, to make a deposit. The final step would be to download their preferred trading platform and start trading.

3. Is TastyWorks trading platform Legit?

Tastyworks was established in the year 2008, in the United States and it is one of the preferred trading brokers, and it is active for more than a decade. Tastyworks offers its traders social trading, Forex trading, and also share dealing trading. The funds deposited in the TastyWorks account are held in tier 1 bank accounts for safety and security. Tastyworks is regulated by the Financial Industry Regulatory Authority, and hence can be considered as a legit trading platform.

4. Is it possible to make money with TastyWorks?

There have been many good reviews and testimonials about Tastyworks which are offered by the traders, who have traded with this broker. The trader should be aware that trading with TastyWorks does not make them rich overnight. Further, the trader needs to educate themselves about the features, use the demo account to practice trading, and they should carefully plan the trading strategies to increase the chance of successful trades. The trader should never trade with the money they afford to lose.

5. Does TastyWorks trading platform offer guaranteed stop-loss?

Tastyworks is a leading online broker that does not offer its traders a guaranteed stop-loss. Moreover, with guaranteed stop-loss protection, the risk is minimized. The stop loss feature is a guarantee to close the trades at a specified price.