Webull Review 2023

Quick Overview

- Who is Webull

- Features

- Why should You Open an Account with Webull

- Advantages

- Platform and Tools

- Commissions and Fees

- Fees for Transferring Funds

- Short Selling Fees

- Webull vs Robinhood

- Who can use Webull?

- Benefits of Webull

- Security

- Desktop Application

- Tradable Asset Classes

- Account Types

- Requirements for Account Opening

- Account opening process

- Free Demo Trading and Stock Promotion

- Order Types

- Types of orders

- Tiered Margin Interest Rates

- Research Offerings

- In-depth Analysis Tools

- Bonus

- Customer Support

- Drawbacks

- Wrap Up

- FAQs

Established in 2017, Webull is a mobile application broker that highlights the commission-free stock and Exchange-Traded Fund (ETF) trading. We found from Webull review that it is regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). It is also a member of the Securities Investor Protection Corporation (SIPC).

Who is Webull?

- Webull was founded in the year 2017 and was launched in 2018. This brokerage is based in New York City. It can also be described as a mobile stock trading app which offers various platforms on desktop, mobile, and web for Google Chrome browser. Further, it offers free trades in thousands of ETFs and stocks, and currently, it is offering options trading for its customers.

- It offers more experienced traders especially technical traders with an array of tools that can be used for technical analysis.

- Webull mobile app can be downloaded at Google play store for Android devices and for iOS devices it can be downloaded from the Apple app store. This platform is also available through the Google Chrome browser.

- Opening an account with this broker does not require any money, but a minimum of $2000 needs to be added for margin accounts, to access shorting and leverage. Further, they should have 25000 dollars for unlimited intraday trading.

- Webull is a privately owned company and it is funded by venture capital. Presently, it has more than 10 million customers on its platform.

Features offered by Webull

Let us discuss of the features offered by Webull’s platform –

- As per our Webull review, Webull offers several trading courses, a trading simulator, a demo mode with current data, and advanced charting abilities for U.S.-listed stocks. Moreover, these features can benefit beginners who need to get familiar with the market and build up a trading plan with ease of use.

- Webull primarily focuses on intermediate and experienced independent investors and traders. Webull’s commission-free structure is mainly designed for active and short-term traders, who can save a substantial sum on commissions when compared with other forex brokers USA.

- Webull provides technical indicators, ratings from research companies, economic calendars, short-selling, and margin-trading for its active clients.

- As per our review, users can set up a new account via Webull.com or the app store. Most of the new applications are approved in 1 hour. It might take a long time if the application needs further verification.

- Webull supports only stocks and ETFs in significant markets. The trader cannot trade mutual funds, options, or access pink sheet/OTC stocks. If the trader is looking for stocks and ETFs, then Webull can be a great decision.

- Funds can be added with an ACH bank transfer.

- All rights reserved by the platform for its tools and features. While we may receive compensation for the process of our Webull reviews, we follow strict standards while reviewing brokers.

Why should You Open an Account with Webull?

- It is the best choice for an experienced and self-directed investor who prefers technical analysis. Webull is the most sought-after broker for traders who engage in short sales, day trading, and margin trading.

- This platform is designed mainly for trading ETFs, and stocks and very recently it has launched its options trading. Moreover, it does not offer other investments like bonds, real-estate investments, mutual funds, and other investment types. It is important to have alternative other Investments along with a trading account with this broker.

- We do not suggest Webull for inexperienced or less suitable investors, or anyone who wants to invest their life saving as Investments with this broker.

Advantages

Few advantages offered by Webull are discussed below –

- This broker offers traders commission-free trading over various options, stocks and ETFs.

- As per Webull reviews, it does not charge fees to open and maintain an account.

- Moreover, leverage of 4:1 on margin trades on the same day and leverage of 2:1 on trades held overnight.

- It offers an intuitive trading platform with fundamental and technical tools analysis.

- This broker offers high-quality platforms for Mac, Windows, iOS, Android, and the web. Also, it supports the PC version.

- It offers paper trading, extensive research tools, customizable charting features, advanced order types, accessibility for multi-platform and free current quotes on certain stocks.

Webull Zero Commissions

Platform and Tools

- As per our Webull reviews, Webull, one of the leading trading platforms is available in the mobile web-based and webull desktop application with features that are helpful for intermediate and experienced traders. The tools provided by the platform give information and knowledge to assist the traders in making profitable trades.

- Concerning fundamental analysis, the platform lets the traders access experts’ recommendations, revenue and earnings per share, key insights, insider trades, stock information like dividends, earnings, and news feeds so that the trader can keep track of news that could influence the buy and sell of stocks.

- From the technical point of view, the application gives a real-time bar, line charts, and candlestick that have periods going from 1 minute to 1 hour and a set of data that backtracks to the past 5 years. Additional technical resources incorporate popular indicators like MACD, Bollinger Bands, oscillators and several more.

Webull Trading 0 Commissions

Commissions and Fees

- Unlike its competitors, it does not charge a commission on U.S. stock trades or for account opening based on Webull reviews. Nonetheless, SEC and FINRA charges apply. Let us see SEC and FINRA charges –

-

- SEC fees consist of 13 dollars as a charge for a sum of 1,000,000 dollars on only stock sales, with a 0.01dollars minimum.

- FINRA fees consist of trading activity fees (TAF) of 0.000119 dollars per share only on stock sales, with a minimum of 0.01 dollars and a maximum of 5.95 dollars.

- According to Webull review, this trading platform provides Webull free stock promotion in which the trader needs to refer another person to Webull. In turn, the trader will get one share of stock worth up to 1,000 dollars.

Fees for Transferring Funds

- According to Webull review, if the trader has a U.S. bank account, they can either set up an ACH (Automated clearing house) or utilize a US local wire transfer.

- ACH is free service, but the trader can transfer up to 50,000 dollars from the bank account to a Webull in a day.

- Further, U.S. Local Wire transfers have fees related to them, however, the trader can transfer a much bigger sum into the Webull account.

- Charges for depositing through U.S. domestic wire transfer is 8 dollars per transfer.

- Charges for withdrawal through U.S. domestic wire transfer is 25 dollars per transfer.

- If the trader has a non-U.S. bank account, the only possible way to transfer funds is through international wire transfer.

- Charges for depositing through International Wire transfer is 12.5 dollars per transfer.

- Charges for withdrawal through International wire transfer is 45 dollars per transfer.

- All rights reserved by the trading platform for its tools and features. While we may receive compensation for our review process, we follow strict standards while reviewing brokers.

Short Selling Fees

As per our Webull review, considering a short position, the trader needs to acquire portions of an organization before the trader sells them. Moreover, the expense related to a short sale is the fee for obtaining the stock of the organization. This expense is variable and changes are for daily accessible stocks. Similarly, the interest on margin trading is determined daily and charges monthly.

Webull vs Robinhood

Webull and Robinhood have the same fees for trading stocks and equities which is $0. By using options, the base fee is $0 for Webull and Robinhood. Also, options contracts for Webull and robin hood are the same as $0, which is good. Webull is designed for advanced and intermediate traders, who are looking for fundamental or technical data; where these details cannot be found on other trading platforms. When we compared between Robinhood and Webull, we found Webull is the best online broker.

Who can use Webull?

Even though from Webull reviews, we believe it is preferred by all types of investors because of its expert trading tools, the platform it is more convenient for:

- Since it offers advanced tools and zero commission trades, it is preferred by short-term investors and intraday traders.

- Webull offers a powerful mobile trading platform based on Webull reviews, that allows the trader to trade from anywhere from their mobile phone.

- It offers $0 trades, advanced tools and there is no requirement of minimum deposit, makes Webull an excellent choice for new investors.

Benefits of Webull

Webull is one of the leading and most popular brokers which helps the user to trade seamlessly and it helps to manage their portfolios either on the desktop platform or through the mobile app. Some of the benefits are given below –

- It offers zero commissions for the trades carried out on its platform.

- It provides an excellent mobile app that allows traders to analyze, research, manage their portfolios, execute trades, and several more.

- This broker offers great tools such as a trading simulator, stock screener, charts and indicators, trading instruments, and market data insights for their trades.

- Webull does not ask for a minimum deposit, moreover, the account opening process is free. The trader need not add a minimum deposit to trade ETFs, options, or stocks.

- It offers two free stocks for a limited time frame, where one free stock offered is worth up to $250, when the trader signs up. Webull offers another free stock worth $1000 with an initial deposit of $100 or more within 30 days when the trader opens an account.

Security

- Webull’s parent organization, Webull Financial LLC, is a member of the Securities Investor Protection Corp (SIPC). Further, Webull protects the securities of its customers up to 500,000 dollars.

- Webull is reviewed, approved and regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC).

- The organization’s clearing company, Apex Clearing Corp, has likewise obtained an additional insurance policy. Over and above, the policy covers insurance for securities and cash up to 150 million dollars. As per Webull reviews, 37.5 million dollars and 900,000 dollars are the maximum limits for a customer’s securities and cash respectively.

- Moreover, both the SIPC protection and the additional insurance policy held by Apex Clearing Corp, does not cover Webull’s customers from a loss of the market value of their securities.

Desktop Application

- Webull introduced a desktop trading application for Windows, Mac, and Chrome OS in 2019.

- Webull’s desktop platform integrates advanced features onto a customer-friendly interface.

- Besides, this platform features screeners, advanced charting and integrated trading. It offers support to traders in order to analyze and trade the stocks, options and ETFs in a simple to use platform.

- Webull’s platform runs easily and several features are intuitive. Also, the trader can use this platform for paper trading.

Tradable Asset Classes

- As per our Webull review, Currently it offers to trade in several U.S. stocks, options, and ETFs with the ease of use in the United States. Besides, the broker does not support trading in OTC stocks, mutual funds, bonds, cryptocurrencies, so that a few may find it limiting.

- Besides, it enables the trader to trade the stocks accessible during extended trading hours, which includes pre-market and after-hours. Specific timing for extended trading is-

- Pre-market trading hours are from 4:00 a.m. to 9:30 a.m. EST

- After-hours trading hours are from 4:00 p.m. to 8:00 p.m. EST

- This broker allows its traders to trade with a balance of 25,000 dollars or more in value; one can access unlimited day trades. Moreover, day trading in a cash account can be funded only with settled funds.

Account Types

- Webull is well focused on active stock and ETF traders. They offer individual brokerage accounts, which are completely taxable, Margin accounts and IRA accounts.

- We get to know from Webull review 2023, this broker does not offer retirement accounts, custodial accounts, joint accounts, business accounts, or trust accounts.

Requirements for Account Opening

To get started, if a trader is planning to open an account in Webull, they have to meet few requirements along with their basic details like name, email, and contact number.

- The trader must be above 18 years of age

- Should have a valid social security number

- A legitimate U.S. residential address

- They should have a U.S. citizenship, Valid U.S visa or permanent residency

Account opening process

Let us discuss how to account opening process with this broker –

- The first step would be to create an account by providing the details like name, email address, phone number. Opening an account with this broker is very easy and simple. Furthermore, if you want to open an account with this broker, the trader should be a US resident having US citizenship, and they should have a valid US visa or a permanent resident status. Also, users need to enter a social security number for tax purposes.

- Their approval process does not take more than one day. Further, funding the account can be done through electronic funds transfer, which is fast and free.

- Also, setting up a new account by using the mobile app is very fast and easy. The trader can download Webull.com on their smartphones app store. The account applications are approved in 1 hour, besides if further verification is required, the application takes longer time.

Free Demo Trading and Stock Promotion

To get started, Webull permits its clients to choose demo or simulation trading to start with and get accustomed to the charts, tools, and real-time quotes for U.S. markets. Additionally, stop-limit orders are also acknowledged. All limit orders are Good-for-Today kind; no GTC orders are accessible.

Order Types

As per our Webull review, it supports stock and ETF trading, it has a noteworthy list of trade types. Basic orders supported by Webull includes market, limit, stop order (which is also called stop-loss). Conditional and advanced orders are also accessible. These incorporate stop-loss/take-profit bracket orders, OTOCO, OCO, and OTO.

Types of Orders

- Limit Order

- Market Order

- Stop-Limit Order

- Stop Order (Stop-Loss Order)

Tiered Margin Interest Rates

- This broker offers 4x day-trade purchasing power and 2x overnight purchasing power with the margin account. The trader should have a minimum of 2,000 dollars to qualify.

- Further, Interest on margin trading is determined daily and to be paid monthly. Moreover, the margin rate is variable and is calculated by the size of the margin credit.

Research Offerings

- As per our Webull review, Webull’s research page gives the trader the greatest advantage with the ease of its use, with filtering abilities and generally with educational value. Further, research is found on 4 unique pages on the mobile application, with

- Market news

- Individual stock page

- Screener’s page

- The screener’s page gives the trader an option to track certain stocks; it helps to figure out what set of technical parameters to watch and set alerts.

- Besides, Webull includes an economic calendar with forthcoming IPO dates, earnings, and news about stocks that are being watched. Moreover, the trader can set up their watchlists and get alerts through email or SMS on the application.

- Apart from U.S. based stocks, Webull can track ETFs, Canadian stocks, cryptocurrencies, commodities, futures and options and indices.

- Stocks can be tracked in real-time through the application which includes 5 classifications over several nations/regions with more than 25,000 stocks.

- Additionally, Webull provides trade ideas and trading courses like day trading courses for newbies. Moreover, one of the best elements of this platform is the trading simulator, which is fundamentally a demo account that the trader can use on the platform and simulate trading strategies.

- Research tools cover a wide range of assets, which include stocks from various countries and regions, cryptocurrencies, ETFs, Futures and options indices, commodities, as well as foreign exchange.

- One of the best ways to learn about Webull is its Reddit network. It has a help section where traders can enlighten themselves with various topics.

In-depth Analysis Tools

Webull offers powerful and intuitive advanced charts, several technical indicators, and different advanced real-time market information options, such as Nasdaq Basic, Nasdaq TotalView, and NBBO to assist clients to analyze trends, organizations, and capture profitable trading opportunities.

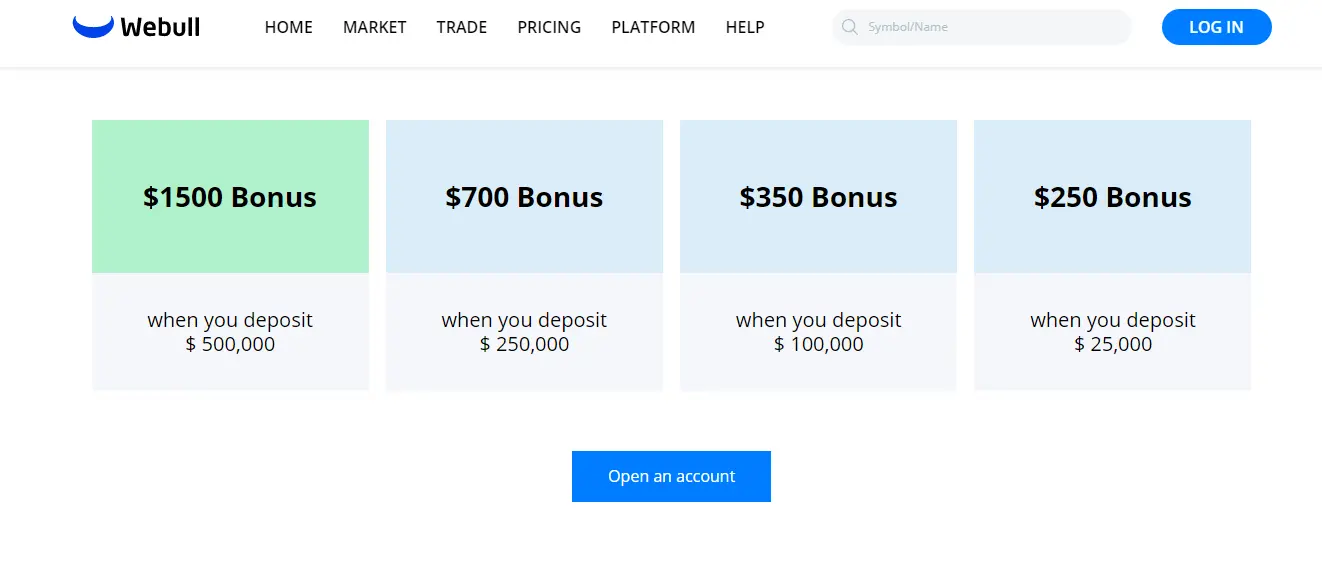

Bonus

Webull provides its customers with a bonus sum when they deposit an amount. The bonus amount of details offered by Webull are given below –

- 1500 dollars Bonus, when the trader deposit 500,000 dollars

- 700 dollars Bonus, when the trader deposits 250,000 dollars

- 350 dollars Bonus, when the trader deposits 100,000 dollars

- 250 dollars Bonus, when the trader deposit 25,000 dollars

Customer Support

From Webull reviews, we get to know that its customer support services are available through email and phone. On the website, no chat support is mentioned. Besides, Webull’s FAQ page gives the user all the relevant details about opening an account, funding, deposits, and withdrawals of stocks and cash. Besides, it also has an exclusive section, “Trading on Webull” where it gives information about fees, commissions, tradable assets, and order types. The FAQ’s found on the help section assist the user with answers for almost all the topics.

Drawbacks

Some of the Drawbacks of Webull are mentioned here –

- Webull supports trading in stocks and ETFs, and it does not support trading in mutual funds, options, bonds or OTC stocks.

- This broker does not provide retirement, joint or business accounts.

- They provide restricted account types like cash and margin accounts.

- This broker offers limited security trades like the U.S. listed ETFs and stocks only.

- While Webull has a strong charting feature, some may discover charting somewhat hard to use on a mobile application.

- Webull platform’s intuitive design and feature could be viewed as advanced for beginners.

- Currently, they do not support mutual funds, options, OTC Bulletin Board, Bonds, or Pink Sheets stocks. Moreover, stocks that are under 1 dollar or potentially have a market cap of 10 million dollars or less are also restricted.

- Webull customer service needs to be improved. Customer service does not offer live chat or phone support when the trader needs help in solving their problems.

Wrap Up

Finally, even though the platform just permits trading in stocks, the platform’s charting abilities are more than satisfactory for some brokers, who use technical analysis with several technical indicators. Besides, Webull’s commission-free structure gives day traders and short term traders a significant cost advantage as per the trusted Webull review. Another noteworthy advantage is Webull’s 4x leverage on margin day trades and 2xleverage on overnight positions. Apart from this, the platform’s news feed and expert evaluation also give the user more information about trading analysis and investment.

FAQs

1. Does it provide watch lists and alerts?

Yes, Webull offers its clients to create different watch lists. Also, it enables Smart Alerts to notify through SMS or email when stocks trigger on any of the stocks or options that are in the watch lists.

2. In what way Webull Financial Calendars are beneficial?

The Webull financial calendar is a helpful instrument that indicates forthcoming profit reports, IPOs, and finance-related events. While this market data can be found through different sites on the web, it is the comfort factor of having this market data on a single mobile application.

3. Does Webull any promotions for its clients?

By signing up for a new account, new clients can get a free share of the stock. Moreover, when the user deposits 100 dollars in the account, after a week, the free stock will show up in the user’s account based on Webull reviews.

4. What is Webull Options Trading?

Recently, Webull has launched options trading for its traders from 2020, where the users can trade options trading on its platform. One of the major advantageous features is, rather than charging $0.65 as commission for a contract as other brokerages do, this broker offers its trader’s options trading with zero commission and with zero contract fees.

Webull

Pros

- Webull offers several trading courses, trading simulator, demo account with current market data.

- Webull primarily focuses on intermediate and experienced independent investors and traders.

- Webull offers technical indicators, ratings from research companies, economic calendars, short-selling, and margin-trading for its active clients.

- Funds can be added to the account with an ACH bank transfer.

Cons

- it does not support trading in Options, mutual funds, bonds or OTC stocks.

- This broker does not provide retirement, joint or business accounts.

- They provide restricted account types like cash and margin accounts.

- Webull’s platform intuitive design and feature could be viewed as advanced for beginners.