IG Review 2023

Overview

IG is a forex broker, founded in the year 1974, and has been ranked as the best forex broker. Since its inception, IG has been serving as one of the global leaders of online trading, and as such, it has been a pioneer for CFDs (contract for difference) and spread bets.

IG is listed on the London Stock Exchange FTSE 250 (LON: IGG), and regulated by tier 1 regulatory bodies. This contributes to the credibility of the trading platform in a big way.

IG offers Web Trader and MetaTrader4 or MT4 trading currency platforms with over 100 forex currency pairs, shares, over 17,000 products spread over multiple asset classes. Apart from commodities, IG also offers indices, equity indices, bonds, CFDs, stock CFDs, CFDs on crude oil, S&P 500 CFD, IG index, gold, silver, Bitcoin and other cryptocurrencies for both the purposes of personal investment and brokerage options.

The broker allows its clients to indulge in share dealing and invest in funds, shares, and investment trusts in global currency markets and earn significant profit therefrom. As per the recent reports, IG provides services to over 130,000 active clients settled all across the world. Also, it processes around 350,000 transactions each day, across all its regulated entities settled in the UK and other international locations.

IG is regulated by multiple jurisdictions from all around the world, and this fact makes the platform outwardly legit with no room left to tag it as a scam. Multiple regulators from all around the world like the NFA in the US, the FCA or the Financial Conduct Authority in the UK, the FSCA or the Financial Services Compensation Scheme in South Africa, ASIC or the Australian Securities and Investment Commission in Australia, and Dubai Financial Services Authority (DFSA) in the United Arab Emirates, Federal Financial Supervisory Authority (BaFin) in Germany, Monetary Authority of Singapore (MAS) regulate IG. We have prepared this IG review to let the users know about its positive and negative traits so that it becomes easier for them to decide whether or not this is the right system that matches their trading criteria.

IG Review – Overview of Platform

IG Review – Overview of PlatformFeatures

~Country of Regulation: IG provides its services to traders in EU, Switzerland, Hong Kong, UK, US, Japan, France, Singapore, South Africa, Sweden, Germany, Luxembourg, Australia, Qatar, UAE, New Zealand, and more. The system is governed by different regulatory bodies of the respective jurisdictions. Its size and trading volume are enviable.

~ Fees Structure: There are no transfer fees charged from UK traders using their debit card. However, for non-European debit cards, credit cards, or PayPal, 1.5% transfer fees are charged on IG. An inactivity fee is charged on an account that has seen no trading activity for a certain period of time. This is one disadvantage of the otherwise sound broker that needs to be improved. There are no deposit fees.

If clients hold around £15,000 in their IG Smart Portfolio accounts, they are exempted from all fees. If clients invest in IG’s Smart Portfolios, they need to pay a fee for “Total Cost of Ownership.” This fee consists of the spread costs, the admin fee, and cost of the underlying ETF. If users want to opt for stocks listed on NASDAQ or the New York Stock Exchange, they need to pay 2 cents per share, with the minimum being $15.

Custody Fees: On its ISA accounts and share dealing accounts, IG levies a custody fee of £24 per quarter. The custody fee depends on the user’s trading activity. If a custody fee is due, it will be deducted from the user’s share dealing account. If the account does not have sufficient funds, the custody fee will be debited from their ISA account.

As far as withdrawal fees IG are concerned, there are no withdrawal fees as such, but if the traders are too keen to receive the payment on the same day, using a CHAPS bank transfer, they are charged a fee of 15 of EUR USD. The minimum withdrawal amount is $100, and the withdrawal request is processed very fast. The funds get credited into the client’s bank account within 24 hours of the submission of the withdrawal request form.

IG charges overnight financing costs. Regarding commission fees, clients get commissions ranging from £3.00 – £8.00 per trade for all asset classes.

~ Mode of Payment: The traders can enjoy multiple payment methods and can make their deposits at their own discretion. There are options for wire transfers, Mastercard, Visa (debit, credit), PayPal, e-wallets, etc. Any mode of payment will serve the purpose.

~ Base Currencies Available: There are a total of 6 base currencies available with IG. It charges the most competitive currency conversion charges to convert CFDs and forex trades back to the traders’ account base currency.

~ Investment Products Offered: IG also offers share dealing, and trading in other products like stocks, ETFs, options trading, forex, CFDs, cryptocurrencies, and equities for UK-based clients. IG also offers services like the Robo-advisory service, price alerts, watch lists, or the IPOs for UK clients. With IG, traders can participate in IPO in 2 ways: IPO Grey Market and after the IPO. Vanilla options are also available.

If you are a UK client then you can also check other top UK trading brokers here. Many retail accounts lose money while trading CFDs with this provider. One should understand how CFDs actually work and whether you can afford to take the high risk of losing your money.

IG Products

IG Products~ Guaranteed Stop Orders: There is a stop-loss order feature allowed for the IG traders who want to close their positions after reaching a specific price pay. Also, a balance protection facility is available for customers depending on the trade size..0.0.0

IG Trading Features

IG Trading FeaturesWide range of Benefits of Using IG for Trading

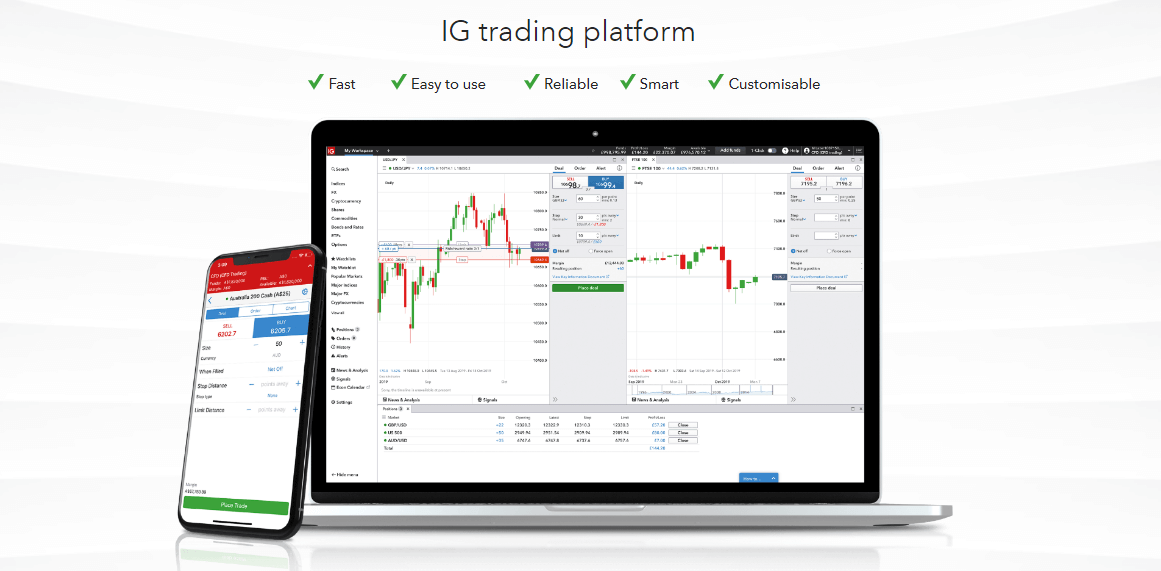

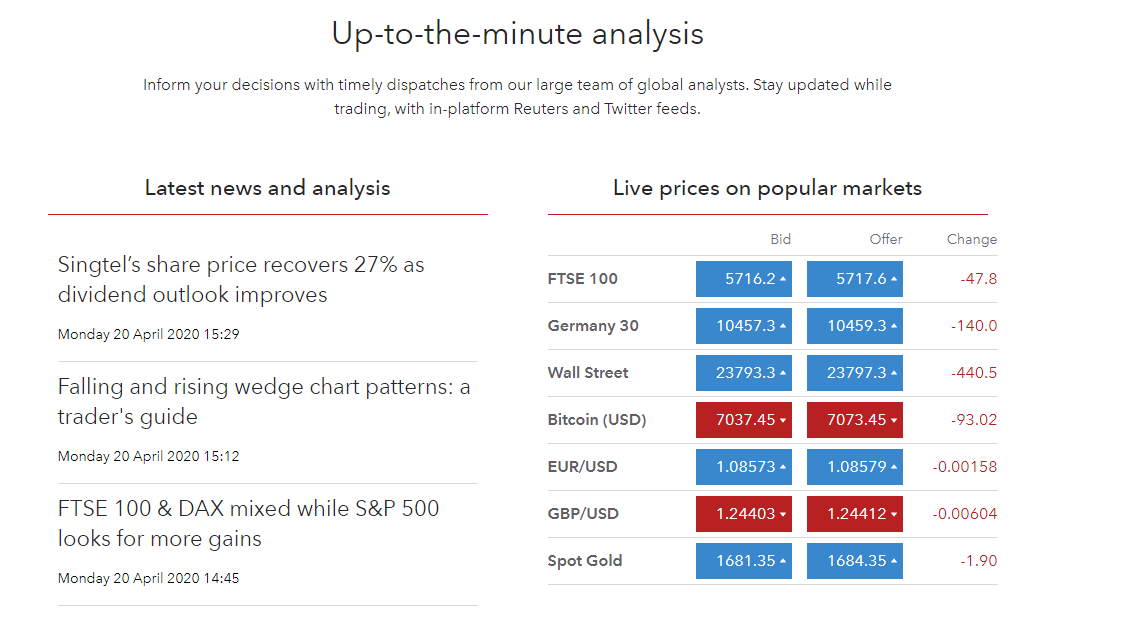

~ Compatible With Both Desktop and Mobile App: With the robust API interface and the industry-standard MetaTrader 4, IG offers the best user experience. You can also discover more about the forex trading API from our latest guide. Though MetaTrader 5 is not available on the platform, still the clients can upgrade to the advanced charting platform that is free of cost, as long as they trade actively in a month. According to IG review, the desktop platform of IG trade has some of the basic features like risk management tools, account balance protection, multiple account types, and guaranteed stop losses. ProRealTime and the Reuters news feed are also something that the trading platform users can expect from the broker. Charts can also be split into multiple time frames using the desktop features allowed on it.

IG also allows mobile apps for Android and iOS and can also be downloaded on tablets. The IG mobile app comes with 28+ technical indicators, as given in reviews in many app stores. The basic features compatible with the mobile app include price alerts, customized watchlists, and technical IG index and charting tools. There is also a useful tab named “menu” on the IG mobile trading app that features third-party trade signals. The mobile trading app provided by IG are protected by the face and touch ID. In the mobile app, clients can use similar order time limits, limit orders, stop losses, and other order types as in the web trading platform.

~ Amazing Customer Service: The IG customer service is one of the prompt redressal systems that the system mightily boasts of. The UK residents can contact the customer service team with a toll-free number that is available 6 days a week from morning 8 o’clock till night at 10 o’clock. Both the present and the prospective clients can connect to the customer support team at any time of the day through email, live chat or phone.

~ User Friendly: This is perhaps one of the most important criteria to become the traders’ favorite platform. This is where the trading platform IG wins over the traders’ confidence. With an easy-to-handle interface and rewarding user experience, it helps beginners to try their hands in online brokerage efficiently.

IG Trading Platform

IG Trading Platform~ Impressive Market Research Tools: It operates a news portal named as DailyFX.com. IG research tools, insightful articles, comprehensive news topics, an educational portal with in-house topics including IG market conditions and fundamental analysis by finance industry experts, feature on this website. There is also an in-house production of real-time news covering major currency pairs. Multiple live webinars are organized by IG to help traders build their trading skills by following the trading signals. There is a section dedicated exclusively for trading strategies that highlight the short-term trade signals, pivot points, analyst picks, myriads of technical data points and technical indicators to help the traders understand the online trading strategies efficiently. Many retail investor accounts lose money while trading CFDs with this provider. One should understand how CFDs actually work and whether you can afford to take the high risk of losing your money.

~ Imparts Quality Education: The DailyFX Forex University under the IG academy provides course-based materials covering forex trading, share dealing, and other technical topics. Moreover, the IG academy also has its own educational portals and other education resources that cover essential topics like CFD brokers, CFDs trading, and spread betting. They also share ways through which users can view a deal ticket without a chart. The course materials are segregated into 3 levels, namely, beginner, intermediate, and advanced, to make the syllabus easier to understand for the traders. Clients can also avail of the course materials via the IG Academy mobile trading app.

Pros and Cons

| Pros | Cons |

|

IG offers a guaranteed stop-loss feature to its users. |

There are some unnecessary subscription and exchange fees that the users from the IG community find bothersome. |

|

It operates in multiple financial markets, thereby enhancing fair chances of earning profits in the various markets. |

There are fees charged for dormant accounts beyond a certain period of time, which is also something that needs to be discarded. |

|

Comes with a downloadable DMA platform—L2 Dealer, which gives traders of forex direct access to share trading and forex markets and their current interest rates. |

There are no provisions for retail clients to trade Forex on Interbank. |

|

It offers trading industry-standard MT4. |

There are no provisions of copy trading or social trading, so it becomes difficult for beginners to trade via IG platform. |

|

IG operates with some of the high-end trading platforms that add to the credibility of the platform. |

|

|

Has an IG community- an active social media network of 80,000+ client base. |

Disclaimer:- The risks of loss in CFD trading can be substantial and the value of your investments may fluctuate. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Many retail accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading spread bets also come with a risk profile IG does not support or endorse any third party web trading platform.

How Does IG Work?

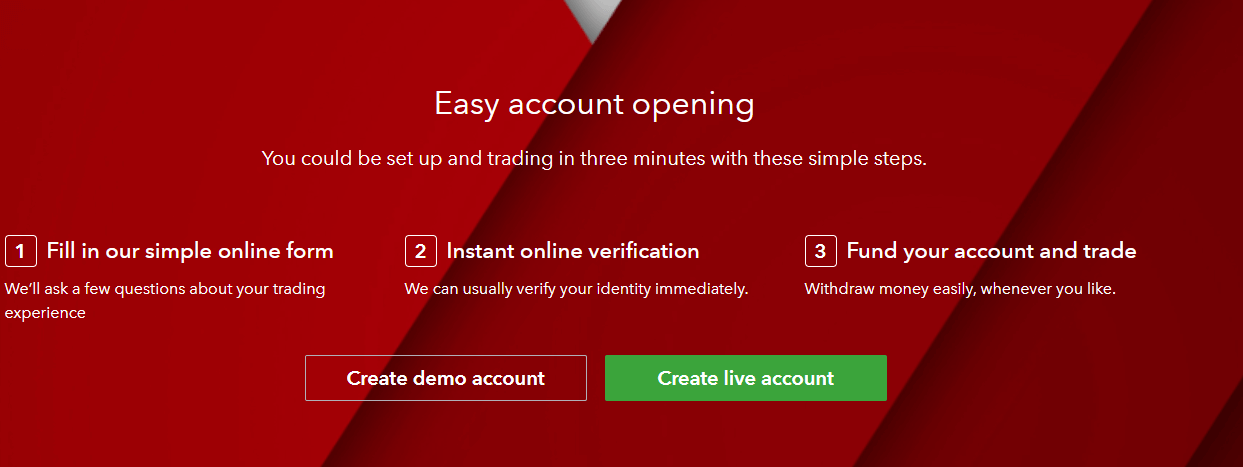

To avail of the various amazing features that IG offers, the traders need to register themselves on the IG platform. Registration is free. If an account has no trading activity for a certain period of time, the broker charges some inactivity fees, as per IG reviews available online. Here are the steps of registration on IG discussed.

~ Opening an Account: Opening an account on online forex trading brokers like IG or Interactive Brokers generally appears to be very simple. Like other online brokers, IG all requires its users to login to the official web platform and fill in an application form. For any account type, some personal details like full name, valid email address, and phone number for further communication, full address, etc. need to be shared. After the traders fill in these details, they need to upload copies of some authorized documents in support of the details that they have entered in the application form like government ID, utility bill, or bank statement. The documents would be verified, and a confirmation email would be sent to the email address provided to confirm that the registration process was successful, and now the trader can fund his account and commence trading via the IG Broker. If you face any issues you can contact the customer service team via phone support, email, or live chat support.

~ Fund Your Account: After creating the account on the IG broker, the traders are required to fund their accounts. The minimum amount needs to be deposited on the IG account, which is $250 per month via the user’s debit or credit card. However, for wire transfers, there is no minimum range for deposits per trade. Apart from funding via cards like debit or credit, there are also options for wire transfers, e payments, and other modes of payments like Mastercard, Visa, Skrill, etc.

For making the initial deposits, the traders first need to log in to their account by feeding in the login details provided and then selecting the “Live Account” and clicking on the “deposit funds” tab and finally selecting the “mode of payments,” to deposit funds into their trading accounts. There is no deposit fee.

~ Start Trading: After funding the account, the traders literally get the license to start trading. But for that, they need to set the criteria first and click on “live trading.” The broker will place a trade as soon as your criteria match with the trade; in fact, the trade will be automatically triggered when the criteria are met. Alternatively, it also allows its users to sign up for a demo account initially. The demo accounts allowed on IG have all the necessary trading tools as in the “live trading account,” and exposes the traders to the same trading environment as in real trading.

The only difference in the demo account is that the demo account is virtually funded, which means that the traders can trade without risking their real money. This helps the traders to understand how the brokerage firm works, what strategies will work best on the system etc. After the traders gain enough confidence regarding trading, they can quickly switch modes to “live trading” and earn significant profits with just a few clicks. In case you have any queries or issues setting up your account, you can get in touch with the customer support team. In case you have any queries or issues setting up your account, you can get in touch with the customer care team.

IG – Easy Account Opening Process

IG – Easy Account Opening ProcessIs IG a Good Broker?

Yes, we found from the IG reviews that IG Markets Ltd is undoubtedly a good broker. The fact that IG is listed on the London Stock Exchange FTSE 250 (LON: IGG), and regulated by tier 1 bodies, contributes to the credibility of the system.

IG Trade Analysis

IG Trade AnalysisHow Long Do IG Withdrawals Take?

IG allows easy withdrawals of funds. If the user wants to initiate a withdrawal, all he needs to do is to fill up a withdrawal request form. Then select the withdrawal method he prefers. He would have to give the details like to which account they would like to withdraw funds, or what would be the mode of receiving funds, what amount they want to withdraw, etc. After the application is received, it is then verified, and once everything falls into their places, the processing is initiated within 24 hours.

Testimonials Shared by Various Users of IG

“Easy to use platform. ProRealTime is a superb charting package with advanced drawing tools and intuitive IG research tools. It is a free platform until the minimum trading activity requirements are maintained. IG offers effective trading ideas. Very flexible and customizable, has good withdrawal methods.”

“Straightforward easy-to-navigate platform, easy drawing tools, fast trade execution, no requotes, no charge for any forex guaranteed stop loss orders (GSLO) except if triggered + with no silly price distances from the strike, no inactive account charges, very efficient daily account reporting, PLUS a highly professional 24/7 support team. Legit and in no way a mere advertising planning program”

“Consistently reliable online broker with good margin requirements and interactive charts, including prorealtime charts. Unlike other online brokers, IG provides a lot of education material and trade ideas. There are also daily videos assessing the current financial markets. IG provides site visitors quality data that they can trust. I have tried other online forex brokers but never found one better than IG. You need a name you can trust when you have your money with them, so that you make money and not lose any while having a good trading experience. If you are looking to earn big money in North Korea, IG helps you grab the right opportunities. Recommended by most industry participants and traders, IG is one of those names I have trusted for many years”

“Saddened by the demise of Stuart Wheeler, founder of IG Group. IG is a premier league platform and has an impressive track record when compared to other trading systems. Indices have comparatively smaller contract sizes. IG works with its online broker representatives efficiently. I wanted to earn lots of money, IG gave the right platform. I have continuously recommended IG to family, friends, and work colleagues.”

“I’m very new to this—first month. But I enjoyed the IG Markets Ltd web platform. Easy to navigate with a high trust score given by traders, IG is highly recommended across all social media platforms. The best part is if clients hold around £15,000 in their IG Smart Portfolios, they are exempted from all trading fees. Also, IG awards commissions ranging from £3.00 – £8.00 per trade for any asset class. Has the most competitive currency conversion fees. Its stringent data validation process ensures low error rate. On its ISA accounts and share dealing accounts, IG levies custody fees of £24 per quarter.”

Risk Warning:- The risks of loss in CFD trading can be substantial and the value of your investments may fluctuate owing to the market volatility. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Many retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You should consider whether you understand how CFDs work and whether you can afford to take the risk to let your accounts lose money. Also, IG does not support or endorse any third party website.

Wrap Up

IG group began its journey in 1974 as an IG Index, initially to help the individual retail investors in speculating the market prices of gold. Soon, broker IG gained momentum to be the first-ever financial spread betting company of the world, and since then, the IG has been the market leader in forex trade, cryptocurrency trading and share trading.

The Group has a market capitalization of around £3.1 billion. We got to know from IG review 2023 that it has been operating in over 14 countries all across the world and serving more than 195,000 active clients from different corners of the world. It started with its first-ever online trading service in 1998 and eventually evolved with its first iPhone app services back in 2008.

IG has indeed come up a long way; in 2017, it launched its first-ever Smart Portfolios to manage its investment space for CFDs, Forex pairs, and cryptocurrency pairs that included Bitcoin, Ethereum and Bitcoin Cash. It obtained the US Forex Dealer Member license in the year 2018 that marked a major milestone in the economic success of the platform and also provides traders of forex direct market access (DMA) platform—L2 Dealer. Do not consider this review of IG as investment recommendation. Please do your own research and analysis before investing.

FAQs

1. Is IG safe for online trading?

Ans: Yes, IG is absolutely safe and reliable. The platform operates amidst a regulated environment for forex trading instruments as well as crypto trading and share trading. It also provides clients with the facility to set up a share dealing account wherein they can trade funds, shares, and investment trusts. In fact, the platform has been receiving regulatory oversight from many tier 1 global agencies, which makes the platform even more legit and safer. Moreover, each company within the IG Group complies with the regulations from the appropriate bodies in the area where it operates.

2. How can I deposit funds into my IG account?

Ans: Client funds can be deposited using any of the following modes of payments—credit or debit card, e-wallets, wire bank transfers, PayPal, MasterCard, Visa, etc. However, trading fees IG are charged if the payments are made via credit/debit cards, or PayPal. For bank transfers, there are no fees charged nor any trading fees.

3. Is registration free on the IG platform?

Ans: Yes, signing up on the platform is absolutely free based on IG review. But once the account is created, traders need to fund their accounts in order to start trading via IG.

4. What is the minimum deposit for IG?

Ans: The minimum deposit for IG is $0 in case of bank transfers and $250 per month in case of payments made by cards (debit or credit) or services like PayPal.