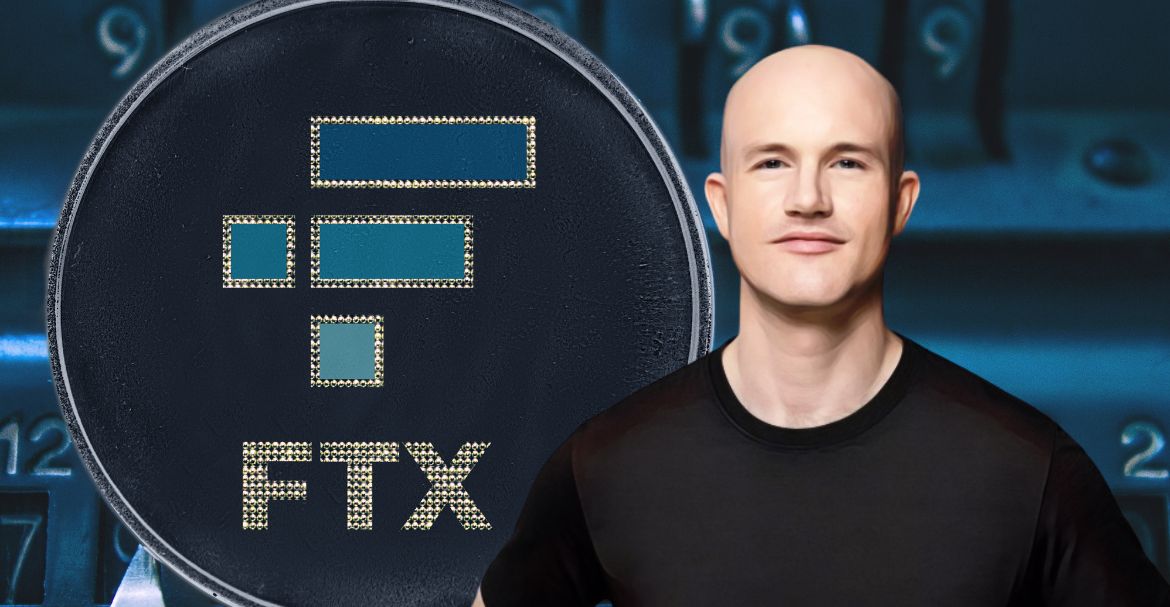

Coinbase contradicts faulty accounting claims of FTX

The FTX crisis goes deeper as Brian Armstrong, the Chief Executive Officer of Coinbase, rejects claims made by Sam Bankman-Fried that the funds were mismatched due to double-counting by the accounting system.

Brian Armstrong took to Twitter to state that even the most gullible person should not believe these claims. He further stated that there was no way for such a large amount – $8 billion – to slip away in front of anyone, including the Founder & former Chief Executive Officer of FTX. Brian refused to acknowledge the claim saying that such transfers come to the notice no matter how messy the accounting is.

The CEO of Coinbase believes that the mismatch is created by transferring the money to a hedge fund. Reports have also claimed that the transfer was made from FTX to Alameda Research, chalking out nearly $8 billion worth of money from the network.

Sam Bankman-Fried has denied these allegations saying that he did not knowingly commingle funds. The explanation goes further with Sam clarifying that the money is transferred to the hedge fund because banks were more willing to deal with a hedge fund than with a crypto exchange. Users’ accounts have been credited, and the assets were double-counted.

The FTX crisis has sent the entire crypto exchange industry to the pit of dubiousness. Customers are hesitant to deposit their funds under the impression that another liquidity crisis can get their money stuck into the system. The same was the case with FTX, with users unable to withdraw their funds despite submitting several withdrawal requests.

John Jay Ray III has overtaken the position of CEO for FTX now. He has described the situation as unprecedented.

While Sam has put the accounting system under the bus, documents submitted to the court have revealed no accounting department at FTX. Coinbase is only one of the players in the industry to suffer the most. At the time of drafting this article, its share prices have slipped from $57.46 to $47.67, registering a fall of 17%. The picture is equally bearish for other players.

Coinbase has attempted to take control of the situation by getting an advertisement published in a newspaper. The advertisement is titled Trust Us and featured in Wall Street Journal. It further adds that millions of users placed their trust and money in a platform that did not deserve it. The full-page advertisement went on all out to revive the image of Coinbase.

It remains to be seen if other crypto exchanges will follow the trend. For now, FTX sees its claims discredited by Coinbase, with the court seeking something more to grant a safety net to the deep-troubled crypto platform.

FTX was at the top of the game, and its fall has urged everyone to inquire before investing or keeping enough funds for backup thoroughly.