Know why crypto sports betting is gaining more popularity. The reason behind popularity, feature, tips and tricks all at one place.

Latest News

-

Press Release

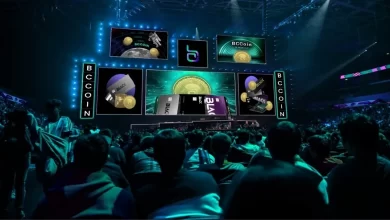

BlackCard and BeCoin Experience Remarkable 4000% Value Surge Within 30 Days

The relentless hard work has finally paid off, leading to a highly successful debut in the market. BlackCard Credit Card…

Read More » -

Cryptocurrency News

Biden’s bold 44.6% tax proposal May boost crypto appeal

In a revolutionary move to address the income gap, President Joe Biden proposed a plan to raise the rate of…

Read More » -

Cryptocurrency News

Tether to block wallets utilizing USDT

Tether, a stablecoin supplier, will block all wallets utilizing USDT to avoid unnecessary sanctions pertaining to oil exports in Venezuela. …

Read More » -

Cryptocurrency News

Bitget Research’s report on crypto acceptance in the Middle East

Bitget Research shares a detailed report on the acceptance of crypto in the Middle East, the prime factors related to…

Read More » -

Blockchain News

Transforming transactions: The impact of blockchain on cryptocurrency purchases

Blockchain technology has changed our transactions, especially when buying and selling digital money. It is decentralized, making it a transparent,…

Read More » -

Cryptocurrency News

Victory Securities launches Hong Kong Bitcoin Ethereum Spot ETF

Victory Securities, a well-known Hong Kong-based financial company, has launched its most recent innovation, the Hong Kong Bitcoin Ethereum spot…

Read More » -

Cryptocurrency Exchange

Kraken takes over TradeStation’s cryptocurrency wing

As per a statement released by CoinDesk, Kraken has taken over the cryptocurrency wing of online brokerage firm TradeStation. However,…

Read More » -

Bitcoin News

Bitcoin’s anticipated halving: A tale of Promise and Pragmatism

The imminent arrival of Bitcoin’s halving event, a fundamental aspect of its monetary policy, has garnered considerable attention and anticipation…

Read More » -

Cryptocurrency News

Cryptocurrency investment strategies for UFC enthusiasts

Like other types of investing, cryptocurrency investing requires strategy and a connection to the investor’s financial objectives. Since this type…

Read More » -

Ethereum News

Ethereum’s ‘The Machines Arena’ hits Epic Store & Android

The highly anticipated Ethereum-based hero shooter game Machines Arena (TMA), currently in the closed beta phase, will be moved to…

Read More » -

Cryptocurrency News

Up your game: How crypto can elevate your sports fandom

The intersection of cryptocurrency and the sports industry is becoming more prominent daily, with the introduction of new ways of…

Read More » -

Blockchain News

FuzzLand forms a calculated collaboration with Chainlink Labs

FuzzLand collaborates with Chainlink Labs to back the Chainlink BUILD program, which helps prospective Web3 startups grow and set up…

Read More »