Know why crypto sports betting is gaining more popularity. The reason behind popularity, feature, tips and tricks all at one place.

Latest News

-

Cryptocurrency Exchange

Bitkub’s 2025 IPO fuels bold ASEAN expansion drive

Bitkub Capital Group, the most reputable company in the cryptocurrency exchange sector in Thailand, has planned an IPO (Initial Public…

Read More » -

Press Release

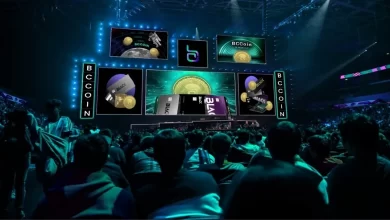

BlackCard and BeCoin Experience Remarkable 4000% Value Surge Within 30 Days

The relentless hard work has finally paid off, leading to a highly successful debut in the market. BlackCard Credit Card…

Read More » -

Cryptocurrency News

Biden’s bold 44.6% tax proposal May boost crypto appeal

In a revolutionary move to address the income gap, President Joe Biden proposed a plan to raise the rate of…

Read More » -

Cryptocurrency News

Tether to block wallets utilizing USDT

Tether, a stablecoin supplier, will block all wallets utilizing USDT to avoid unnecessary sanctions pertaining to oil exports in Venezuela. …

Read More » -

Cryptocurrency News

Bitget Research’s report on crypto acceptance in the Middle East

Bitget Research shares a detailed report on the acceptance of crypto in the Middle East, the prime factors related to…

Read More » -

Blockchain News

Transforming transactions: The impact of blockchain on cryptocurrency purchases

Blockchain technology has changed our transactions, especially when buying and selling digital money. It is decentralized, making it a transparent,…

Read More » -

Cryptocurrency News

Victory Securities launches Hong Kong Bitcoin Ethereum Spot ETF

Victory Securities, a well-known Hong Kong-based financial company, has launched its most recent innovation, the Hong Kong Bitcoin Ethereum spot…

Read More » -

Cryptocurrency Exchange

Kraken takes over TradeStation’s cryptocurrency wing

As per a statement released by CoinDesk, Kraken has taken over the cryptocurrency wing of online brokerage firm TradeStation. However,…

Read More » -

Bitcoin News

Bitcoin’s anticipated halving: A tale of Promise and Pragmatism

The imminent arrival of Bitcoin’s halving event, a fundamental aspect of its monetary policy, has garnered considerable attention and anticipation…

Read More » -

Cryptocurrency News

Cryptocurrency investment strategies for UFC enthusiasts

Like other types of investing, cryptocurrency investing requires strategy and a connection to the investor’s financial objectives. Since this type…

Read More » -

Ethereum News

Ethereum’s ‘The Machines Arena’ hits Epic Store & Android

The highly anticipated Ethereum-based hero shooter game Machines Arena (TMA), currently in the closed beta phase, will be moved to…

Read More » -

Cryptocurrency News

Up your game: How crypto can elevate your sports fandom

The intersection of cryptocurrency and the sports industry is becoming more prominent daily, with the introduction of new ways of…

Read More »