Ethereum Price Plunge Proves Costly: Trader Losses $3.24M to FOMO

The wild price swings of Ethereum have once again made headlines, as a trader has fallen victim to the latest volatility. As the Ethereum price has retreated to a low of $3.1K after reaching a weekly high of $3.4K, traders and investors are feeling the market’s whims.

An unfortunate trader, who bet big on Ethereum’s continued rise, faced a loss of about $3.24 million when the ETH price plummeted. The trader’s decision to invest heavily in Ethereum was driven by FOMO- the fear of missing out on potential gains. However, his quick investment decision turned out to be immature, ultimately proving costly. As the cryptocurrency market continues to see significant ups and downs, this incident serves as a strong reminder of the importance of careful risk management and strategic decision-making.

Ethereum Price Crash Unveils Trader’s Unfortunate FOMO Tale

On-chain analytics platform Lookonchain took to X to share insights on the hidden dangers of FOMO trading. He cited the example of a recent trader who lost a massive $3.4 million in a FOMO ETH trade. Lookonchain warned, “Please don’t FOMO trade.”

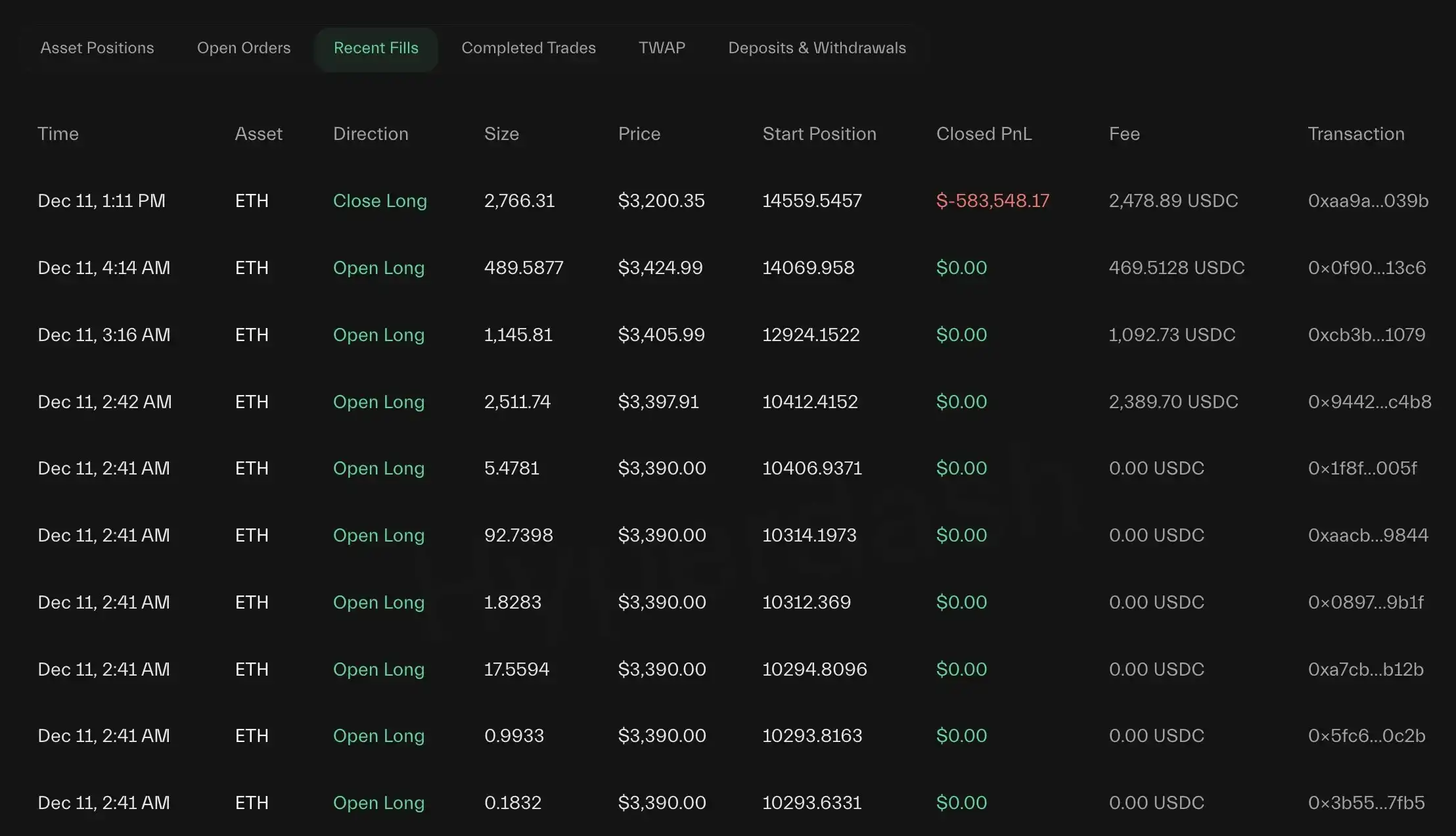

According to the onchain analyst’s findings, trader 0xa43d incurred a loss of $3.24 million in just 14 hours by aggressively buying Ethereum longs at the market peak, driven by FOMO. It is reported that the trader opened the long position at the peak and partially closed three hours later, resulting in a loss of $583,500. Making the matter worse, the trader is still holding onto 11,793 ETH worth $37.6 million, with $2.66 million in unrealized losses.

After slipping below $3,000 earlier this week, the token started showing positive signals later. On December 9, it surged above the red zone, reaching $3.36. This positive momentum continued till December 11, when the Ethereum price hit a weekly high of $3,436.

What’s FOMO Trading? ETH Price Correction Explains

Interestingly, the recent green signal in the Ethereum price created a false sense of optimism, leading the trader to believe that the upward trend would continue. As the chatter around Ethereum price remained bullish, he felt compelled to capitalize on the momentum without missing out on potential opportunities for gains. This fear of missing out prompted him to buy long positions in ETH.

However, the Ethereum price surge proved to be temporary, and the market soon began to dip, reaching its current value at $3,192, with a 3.8% decline in a day and a massive 10% plummet in a month. Thus, the trader’s decision was proven wrong and resulted in this massive unrealized loss.

Significantly, this cautionary tale highlights the dangers of FOMO trading and the importance of discipline and risk management in the crypto space. FOMO trading is a common practice in the industry where traders feel pressured to buy assets for not to miss out on potential gains. This fear can lead traders to make sudden, immature decisions, ignoring their own risk management strategies and trading plans. When traders let emotions control their decisions, they can end up facing losses, wiping out their profits, and even entire investments within seconds.

While this trader’s FOMO trade and the subsequent losses he faced stand as a stark reminder, investors are encouraged to practice caution and do diligent research investment decisions. Considering the unpredictable nature of the crypto market, careful actions are mandatory for avoiding losses.