Ethereum ICO Whale Sells Entire Stake for $66.5M Profit

Amid the current crypto market crash, Ethereum is facing increased selling pressure, with huge ETH whales dumping their tokens. The recent development includes an anonymous Ethereum ICO whale, who liquidated their entire holding for an approximate profit of $66.5 million.

Significantly, this move is part of a larger trend of whales and institutional investors revaluating their positions in the market, potentially signalling a shift in investor sentiment. As the market continues to show notable fluctuations, the decision of this whale to cash out its entire position raises questions about the future of Ether and the potential impact on the industry.

Ethereum ICO Whale Puts an End to Long-Term Ethereum Hold

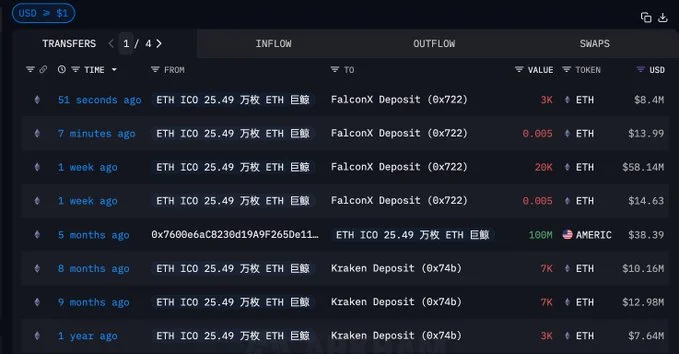

According to on-chain analyst ai_9684xtpa, a mysterious Ethereum whale who participated in the 2014 initial coin offering (ICO) has sold their entire holding of about 254,900 ETH. With this transaction, the Ethereum ICO whale netted a profit of over $66.53 million.

The wallet, starting with 0x2Eb08, has reportedly deposited 23,000 tokens to exchanges before gradually liquidating its position. Over the past week alone, the whale has dumped 3,000 ETH, worth $8.4 million. Following this move, the wallet now holds only 69. 83 ETH, marking the end of a long-term investment.

ETH Sell-Off Alert: Ethereum Faces Fresh Pressure Amid Whale Dump

Ether has faced significant pressure in recent weeks, mirroring the broader market downturn, with its price slipping to around $2,600 in November amid risk-off sentiment and heavy liquidations. Although it rose to $3,100, ETH slipped again to the $2,800 region on December 1, despite increased expectations of a Fed rate cut and a risk-on sentiment in stock markets.

It is noteworthy that the crypto has struggled with underperformance, particularly in exchange-traded funds, which have lagged behind Bitcoin equivalents due to deeper cost-basis losses. Additionally, liquidity issues have persisted, with reduced order book depth contributing to sharper price moves and decreased institutional activity, further intensified by at least one major market-maker scaling back operations since early November.

Adding fuel to the current downturn, more Ethereum whales are emerging, selling their long-held holdings. This has further intensified the prevailing pressure. These moves coincide with the recent debacle in the crypto market, where leading players like ETH saw severe losses.

As of press time, ETH is valued at $2,841, up by a marginal 0.47% in a day. But the token has seen severe declines of 2.96% and 27% over the past week and month, respectively. The traders’ sentiment is also waning as the 24-hour trading volume has now plunged to $24.49 billion, down by about 8%.

ETH Holdings Moved to Staking: A Renewed Confidence?

However, some whales’ moves have also reignited a positive sentiment. For instance, a long-dormant Ethereum investor has transferred 40,000 ETH, valued at around $120 million, into staking after lying inactive for over a decade.

Ethereum ICO wallet (0x2dCA) with 40,000 $ETH($120M) woke up after 10+ years of dormancy — and instead of selling, he staked the $ETH.https://t.co/AreBCXNG4Thttps://t.co/OWpE8REjVw pic.twitter.com/pPZVwkkB1A

— Lookonchain (@lookonchain) December 1, 2025

According to onchain analytics firm Lookonchain, the wallet, which participated in Ethereum’s 2015 ICO with a mere $12,000 investment, has moved his assets to a staking address recently. This move suggests renewed confidence in Ethereum’s long-term prospects. This positive sentiment is understood from the whale’s decision to send the tokens to a staking address instead of an exchange, which is often seen as a precursor to selling.