Bitcoin Price Alert: Could This Quiet Market Signal Trouble?

Quiet markets can be a blessing and a curse at the same time in the crypto world. On one side, the stable performance of cryptocurrencies like Bitcoin can attract new investors and foster sustained positive momentum. On the other side, the absence of volatility can mask underlying risks and create a false sense of optimism.

In this context, onchain analytics firm CryptoQuant warns that the current calm atmosphere surrounding the Bitcoin price could be dangerous. According to the analyst, a storm is brewing beneath the prevailing calm waters. Is this calm before the storm paving the way to a wave of volatility?

The Hidden Risk of Bitcoin’s Calm Surface: Decoding IFP Signal

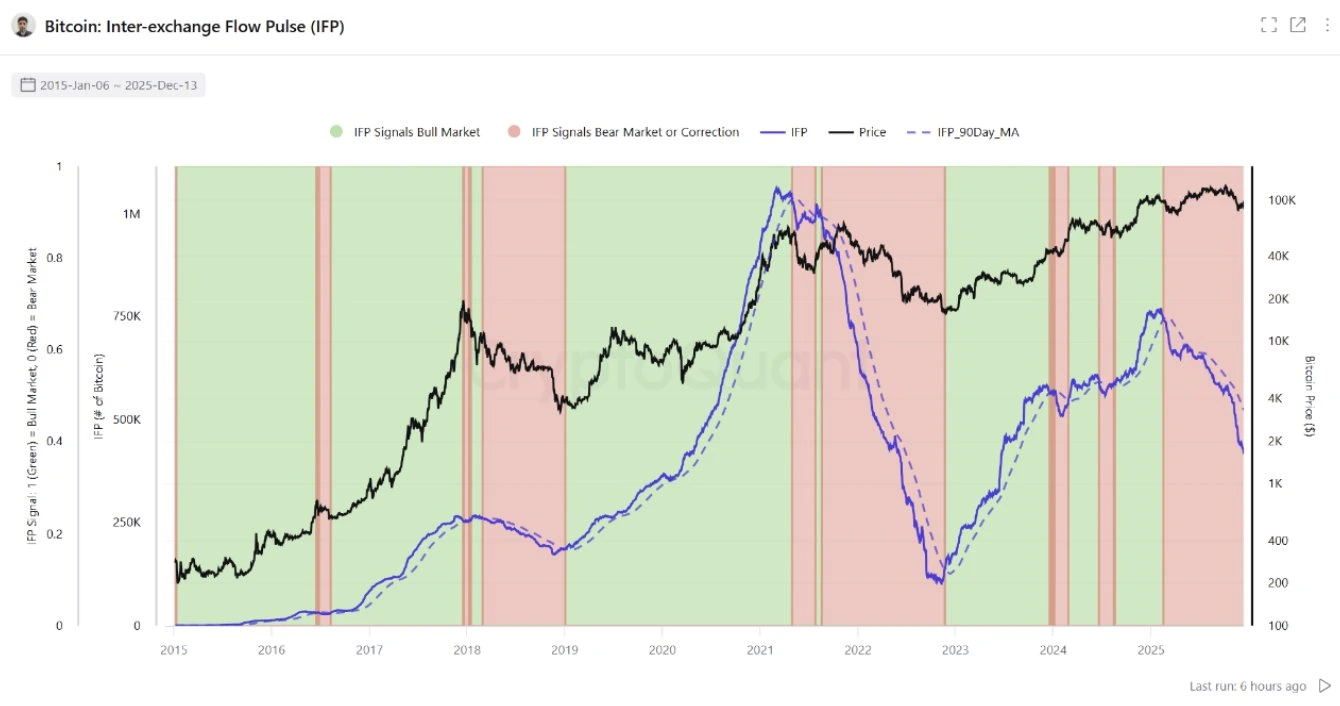

On December 15, 2025, the onchain analytics platform CryptoQuant shared an X post, detailing the hidden dangers of the Bitcoin price’s prevailing quietness. The analysis focused on the Inter-Exchange Flow Pulse (IFP), an indicator that measures the active movement of BTC from one exchange to another.

According to CryptoQuant’s analysis, the IFP has turned red, signalling a severe slowdown in the cryptocurrency’s movement across exchanges. Such a vanishing movement in market activity precedes significant market crashes or price corrections. The platform noted,

“Historically, periods when IFP turned red were not defined by orderly trends but by sharp corrections and sudden price swings.”

As per CryptoQuant, when IFP is high, it indicates robust market activity, with smooth arbitrage, ample liquidity, and stable prices. Conversely, a decline in IFP signals reduced market flow, making prices more vulnerable to even minor trades and potential volatility.

Significantly, this decline in liquidity is coinciding with record-low exchange balances, creating a double-edged sword. While reduced sell pressure can support prices, it also leads to thinner order books, making markets more prone to volatility. As prices start to move, slippage intensifies, and volatility accelerates. With leverage still high, the market’s instability is increasingly driven by the magnitude of the price movements rather than their directions.

History suggests that orderly trends are unlikely when IFP turns red. Instead, sharp corrections and price swings become more probable. Thus, as per Santiment’s projection, the Bitcoin price is more likely to have a significant market crash, continuing its negative trend.

Bitcoin Future: What to Expect for BTC in the Coming Days?

Currently, Bitcoin is trading in a calm range, without making much noise. As of press time, BTC is exchanging hands at $89,782, with a 0.22% dip in a day. Over the past few days, the pioneer cryptocurrency has been trading within a narrow range of $87k-$92k, sparking renewed optimism.

According to experts like Peter Brandt, this level is the last line of defense before the cryptocurrency’s potential downturn. On the other hand, analysts like Ted remain bullish, predicting that BTC could once again hit the critical $100k level if it manages to rally past the $92k-$94k zone. Ted bases his projection on the fact that the Bitcoin price has retested the $88k support, sparking bullish momentum.

Another market analyst, Clifton Fx, has also shared a bullish Bitcoin price prediction. According to him, BTC has confirmed a major trend line upside breakout in a 10-hour timeframe. This indicates that Bitcoin is poised for a bullish rally in the coming days. His projection offers an ambitious target of $125k, with a massive 42% hike.