AvaTrade Review 2026

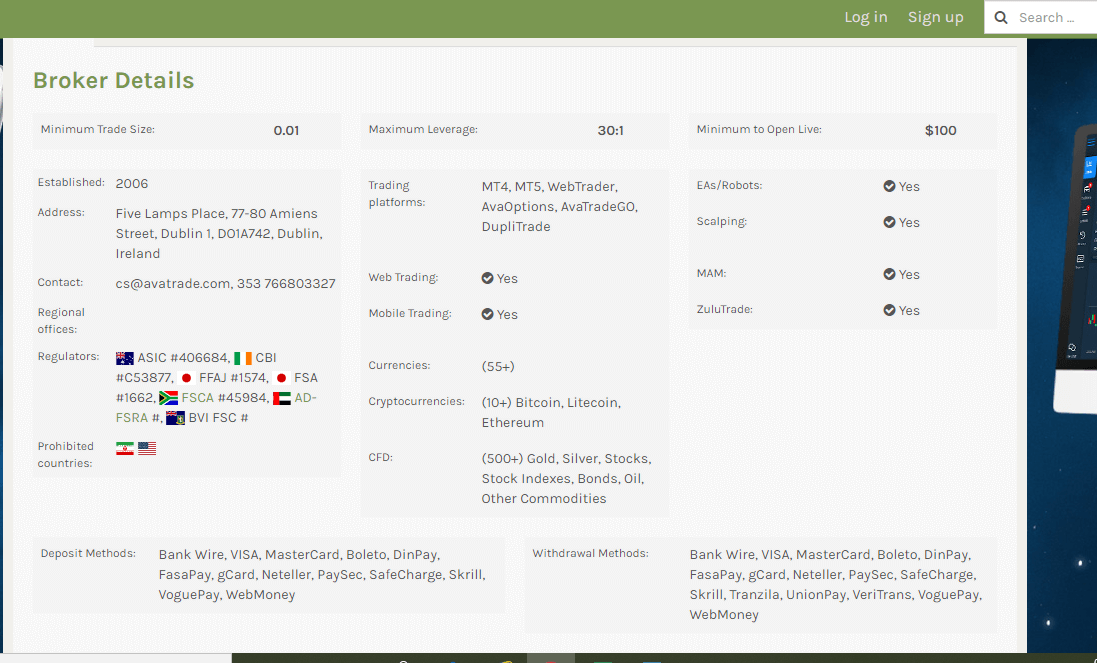

AvaTrade (a part of AVA group) is one of the leading and automated online brokers in the world today. Founded in 2006, AvaTrade has its headquarters in Ireland. AvaTrade is regulated by the Central Bank of Ireland and other top-notch financial authorities.

Currently, AvaTrade allows users from many countries and European Union member states to open an account and start trading. Some of these are Australia, Japan, South Africa, United Kingdom, Greenland, Grenada, Saudi Arabia, French Polynesia, Barbados, Belarus, Hong Kong, Burkina Faso, Gibraltar, Greece, Central African Republic, Benin, Bermuda, Bhutan, Sri Lanka, Cape Verde, Cayman Islands, El Salvador, British Virgin Islands, Western Sahara, Yemen, Zambia, Nicaragua, Niger, Latvia, Lebanon, Lesotho, Equatorial Guinea, North Korea, Mauritius, Mayotte, Mexico, Micronesia, Solomon Islands, Guinea Bissau, Northern Mariana Islands, Marshall Islands.

It provides multiple platforms for trading Forex, CFD, FX options, and cryptocurrencies to over 200,000 clients settled worldwide, who place nearly 2 million trades every month. People in the United States are not able to use AvaTrade.

The Ava Trade online trading platform was designed to empower individuals to place trades with confidence by identifying and avoiding situations that could lead to financial loss. CFDs are complex instruments. Traders should begin trading CFDs only when they understand how CFDs work and consider whether they can take the high risk of losing their money.

Many retail investor accounts lose money while trading CFDs and other financial instruments, primarily due to the use of leverage. The trading platform is designed to enable clients from all levels and backgrounds to unleash their true trading potential confidently. This comprehensive AvaTrade review will help you know all the details about this web trading platform.

What is AvaTrade?

AvaTrade is one of the most popular and leading international Forex brokers, and it is a part of the AVA group of companies. Founded in 2006, AvaTrade is one of the oldest online brokerages currently available. AvaTrade offers several beneficial features, including trading platforms, a mobile trading app, MetaTrader 4 integration, and various deposit and withdrawal methods for its traders.

Ava Trade Ltd has offices located worldwide, in Australia, Ireland, Japan, and the British Virgin Islands. AvaTrade is one of the most respected and prominent online brokerage firms globally. It accepts traders from several regions and trading accounts from various types of currencies.

Recently, Ava Trade Ltd announced its major partnership with English Premier League champions of 2018–19, Manchester City, and underlined the brand’s visibility and growth. The promotional campaign of this promising partnership included some free online trading courses.

List of the Features Offered by AvaTrade Broker

According to our Avatrade reviews, the AvaTrade trading platform offers some exciting features that many other trading platforms do not support. It keeps all rights reserved for its distinctive features and services.

Manual Trading Platforms: The AvaTrade trading platform offers two manual trading platforms that enable traders to place trades and engage in trading activity more frequently. This increases their chances of winning while simultaneously reducing their risk of capital loss.

Many retail investor accounts lose money while trading CFDs or other financial instruments, primarily due to the use of leverage. Traders should start trading CFDs only when they understand how CFDs work and consider whether they can afford to let their retail investor accounts lose money.

The two-manual platforms are compatible with mobile browsers and are named MetaTrader 4 and AvaTrade. There are also auto-trading options available on the AvaTrade trading platform, with the most widely used auto-trading feature being ZuluTrade.

AvaTrade Contact

AvaTrade, a forex broker, is considered a market maker and is backed by a robust customer service team that resolves all traders’ queries. The Ava Trade customer service team can be reached via live chat, phone support, or email, and traders can communicate with the team in any of their preferred languages, which is a notable advantage of this trading platform.

Clients can also contact the customer support team through social media platforms, such as Facebook. The customer service representatives regularly check the comments and respond to them instantly through live chat.

Moreover, traders who make an initial deposit of $1000 or more to get started with the AvaTrade platform are assigned a dedicated account manager to guide them through placing their first trades. They will also keep the traders informed about how these platforms work and provide them with regular updates on market conditions and risks. Many retail investor accounts lose money while trading in the market, so traders find it very helpful to have an expert guiding them.

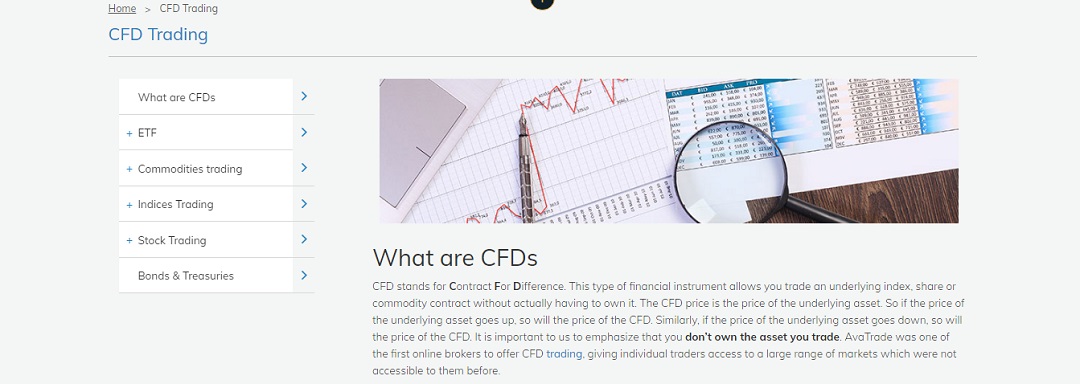

CFD Trading

In addition to offering cryptocurrency trading, AvaTrade also provides Forex options, CFDs, FX, and vanilla options trading. AvaTrade was one of the first few online brokers to introduce Forex, CFD, FX, and vanilla options trading.

Risk Disclaimer

Trading Forex Options and CFDs entails High risk and could result in situations where you lose money. CFDs are complex instruments. Many retail investor accounts lose money while trading in such complex instruments. So, traders should invest in CFDs only when they understand how CFDs work and consider whether they can afford to lose money.

AvaTrade CFD Trading

AvaTrade CFD TradingBenefits of AvaTrade

According to our Avatrade review, AvaTrade clients benefit from easy deposit and withdrawal methods, tight spreads, multilingual customer service available worldwide, immediate position execution, over 1000 trading tools and instruments, and access to live liquidity features through various other platforms. Here we discuss some of the fantastic benefits that Ava Trade Ltd provides to its users.

Multiple Trading Platforms

AvaTrade offers various trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (which is expected to be uploaded soon, according to recent reports; however, confirmation is still pending), DupliTrade, AvaOptions, WebTrader, and the AvaTradeGO mobile app.

Additionally, these traders benefit from real-time online updates, which enable them to gain a competitive advantage over other online brokers and mitigate the risks associated with online trading.

AvaTrade charges no trading fees, but users may incur some hidden non-trading fees. Regarding the currency conversion fee, no fee is charged if users fund their AvaTrade account with the same currency as their bank account. A good way to save costs is to open a multi-currency bank account.

Islamic Account

Muslim traders enjoy the privilege of an Islamic account. These accounts adhere to Islamic Sharia law, allowing Muslim traders to engage in trading forex, CFDs, cryptocurrencies, and futures.

Global Sponsorships

AvaTrade is the proud global partner and subsidiary of the English Premier League champions of 2018–19, Manchester City. This enhances the online broker’s worldwide reputation.

Comprehensive Education

The Demo mode feature on the AvaTrade platform helps first-time users learn various online trading strategies. It also allows traders to test these trade strategies in a high-risk, free environment so that no accounts lose money while trading with real money.

In the demo account, traders have unlimited access to online video tutorials, articles, eBooks, economic indicators, and research tools. These resources help them immensely to sharpen their trading strategies and abilities. AvaTrade also hosts regular webinars featuring experts and professionals to assist traders with market analysis and other key aspects of online trading. It also features an educational website, Sharp Trader, offering exclusive content for AvaTrade users.

Worldwide Regulations

AvaTrade operates in multiple countries and complies with the regulatory requirements of each country in which it is licensed. The platform tips the scale of the top Forex brokers of the world. AvaTrade EU Ltd is primarily regulated by the Central Bank of Ireland and licensed throughout the E.U. In Australia, Ava Capital Markets Australia Pty Ltd is regulated by ASIC.

In Japan, Ava Trade Japan K.K. is regulated by the FSC, or the Financial Services Commission, and the FFAJ, or the Financial Futures Association of Japan. In the British Virgin Islands, it is also regulated by the BVI Financial Services Commission, as noted in the AvaTrade review. In Canada, it is regulated by the IIROC, or the Investment Industry Regulatory Organization of Canada.

It is also regulated by the prominent regulatory organization of South Africa, the South African Financial Sector Conduct Authority (FSCA). AvaTrade Middle East Ltd is regulated by the Abu Dhabi Global Markets (ADGM), Financial Regulatory Services Authority (FRSA).

Pros and Cons of using AvaTrade

| Pros | Cons |

|

Trading CFDs, forex, and cryptocurrencies is possible |

Only MetaTrader 4 available, no MetaTrader 5 |

|

AvaTrade EU Ltd is regulated by the Central Bank of Ireland; therefore, it is a legitimate entity |

Not much research functionality is available |

|

AvaTrade offers some of the unique social trading features |

There are some hidden non-trading fees, such as inactivity fees for accounts that remain inactive beyond a specific period, and an administration fee, which is gradually revealed after users register with the AvaTrade platform |

|

AvaTrade offers an excellent education center to keep its users informed about recent developments in the cryptocurrency and forex world. The education section features research tools and content to help users learn trading tactics, ensuring that no accounts lose money while trading |

Users cannot set notifications and price alerts |

|

Residents of the United States are not permitted to use AvaTrade |

Demo Account

One of the most advantageous features offered by AvaTrade is the demo account. We highly recommend this demo mode for new traders to practice and become familiar with the platform. It is the best way to train one’s skills with a good trading strategy and to determine the investment products and ideal trading instruments that can be practiced without using real money.

The Demo account offered by AvaTrade shows real-time market prices and conditions. Additionally, the demo account is only valid for 21 days. However, the validity of the account can be extended by contacting AvaTrade’s customer service or account supervisor.

What is the Minimum Deposit for AvaTrade?

The minimum deposit requirement is $100 if the deposit is made via debit or credit card. However, we found from the AvaTrade review that the minimum deposit for bank transfers is $500.

How Long Do AvaTrade Withdrawals Take?

The AvaTrade withdrawal method is smooth and hassle-free. There is no withdrawal fee. Typically, it takes 24 hours to process a withdrawal request. For this, users need to fill out a withdrawal request form, after which the details will be verified against the broker’s database.

Our AvaTrade review found that the request would then be initiated within one business day, and the entire requested amount would be reflected in the user’s account within a few business days. For e-wallets, the amount is reflected within 24 hours. For debit cards or credit cards, it takes a maximum of 5 business days for the payments to be received into the users’ accounts. For a bank transfer, it takes around 10 business days to receive the payments.

Is AvaTrade Safe?

AvaTrade is one of the leading brokers, with a market capitalization of $17 billion, a figure typically not seen in Forex trading. This fact significantly contributes to the credibility of Ava Trade Ltd. As a registered entity in Ireland, AvaTrade complies with the stringent EU regulations, which further enhances the safety and reliability of the platform.

Second-factor authentication is not required for desktop, mobile, or web trading platforms. Account holders can choose to use MetaTrader’s One Time Password (OTP). AvaTrade assures its users of the highest security and data encryption standards, utilizing some of the top IT experts who keep users informed about recent developments in the IT world.

Moreover, some of the leading customer review websites & AvaTrade user reviews rated AvaTrade with a trust score of 93 out of 99 for customer support. Founded in 2006, AvaTrade has a long-standing track record of being regulated by prominent financial authorities worldwide.

The platform is authorized by three tier-1 regulators, which implies high trust, three tier-2 regulators, which means average trust, and two tier-3 regulators, which indicates low trust.

Options Trading Platform

Avatrade offers a web-based trading platform, AvaOptions. The web version of AvaOptions provides seamless integration with any desktop trading platform, allowing users to trade options and securities simultaneously. According to the AvaTrade review, the options platform’s interface allows traders to manage and execute options trades within a single account.

They can trade options in more than 40 currency pairs, including precious metals, and offer risk management features. Additionally, the desktop platform offers options trading strategies, a limit situation with advanced stop-loss and limit orders, a customizable interface for both call and put trading orders, and overnight support for one year.

Mobile App

AvaTrade offers a user-friendly and convenient mobile trading app for Android and iOS phones. The traders need to download the mobile app from the Google Play Store or the Apple App Store and log in to their account. Users of Ava Trade can then view their account details and execute a wide range of trades.

Furthermore, the mobile trading app also supports multiple account types simultaneously, including MetaTrader 4 forex broker accounts. By using the app, traders can access features at their fingertips, such as faster trades, charting, and watchlists.

If the trader does not like the proprietary AvaTradeGO platform, it also supports the MT4 mobile trading app. When compared to the desktop platform of Ava Trade, the app’s features are limited; traders can use either a desktop or a laptop, but they can also use the app on the go.

Trading Instruments

Apart from considering certain features related to the safety of client funds, regulatory oversight, and the fee structure of AvaTrade or other brokers, the trader should also consider important features when choosing a new CFD or Forex trading platform, as well as the assets they offer to traders.

Several traders may be looking to trade a single asset class, such as forex, CFDs on individual shares, and stocks. However, advanced and experienced traders may be seeking diversified asset classes, which implies a wide range of offerings across commodities, foreign exchange options, industry stocks, and other investments.

Below is the list of AvaTrade instruments that it offers for trading:

- AvaTrade offers over 55 forex currency pairs, including exotic pairs, for diverse trading opportunities

- In commodities, it provides 19 commodities with several features

- It gives 20 equity indices from developed markets, including China and the Global Cannabis Index

- The platform features more than 500 individual stocks from the UK, USA, Germany, France, and Italy, from top-performing companies.

- AvaTrade offers 46 options contracts on currency pairs, including precious metals such as gold, with a focus on high-demand instruments.

- AvaTrade offers five major ETFs (Exchange-Traded Funds) and provides two major government bonds, offering low-risk investment options.

- AvaTrade includes 14 major cryptocurrency pairs, featuring the top five cryptos by market capitalization.

- The platform supports five base currencies for account flexibility.

Order Types

According to the AvaTrade review, the AvaTrade platform offers three different order types for its traders. A trader can choose the order types as per their preferences and financial condition.

Market Order: This market order is executed at the present market price.

Limit Order: This order type sets a maximum buy limit price at which the trader is willing to buy the asset, or a minimum sell price at which the trader is willing to sell the asset. This order will be executed at a limited price, whether it is a buy limit order or a sell limit order.

Stop Order: The primary advantage of the AvaTrade stop order is that it minimizes the risk of losing money. If the market price falls below the stock price, this order will become a market order once the price is reached.

AvaProtect is a type of order that acts as a sort of insurance policy against circumstances that might trigger the risk of losing money. This results from trading operations conducted during a specific period. This type of order incurs additional trading fees, and any losses resulting from the trades will be reimbursed to the user, provided they occur during the specific period covered by the order.

What is AvaTrade Leverage?

In financing terms, “Leverage” refers to the ratio between the positional value and the investment required. Users can open a leveraged trading account with AvaTrade, a forex broker. Our AvaTrade review found the following advantages that this trading platform has over others.

- Leveraged trading allows traders to utilize their initial capital more effectively.

- It increases the profit potential, but then every profit comes with an associated high risk owing to the volatility of the crypto market.

- It increases the market exposure of traders, which is crucial for earning a significant amount of profits and capitalizing on appropriate trading signals and market investments.

- AvaTrade leverage can mitigate every high risk that might result in users losing money. Capital losses resulting from other trading positions can also be avoided. Many retail investor accounts lose money while trading in such complex instruments. CFDs are complex instruments.

However, the leverage available on the AvaTrade platform varies depending on the nature of the asset and the trader’s country of domicile. However, for European traders with a professional account at the AvaTrade forex broker, higher leverage may be available, depending on the account type.

How Does the AvaTrade Trading Platform Work?

- Registration: To get started with the AvaTrade platform, users must first register by opening an AvaTrade account. For account opening, users must first visit the official AvaTrade website and complete the available application form, providing their details, including full name, address, phone number, and a valid email address. Next, users would need to verify these details by uploading certain valid documents to support the information they entered on the application form.

- Click on the ‘Upload Documents’ Section and Add Either of the Following Documents:

- A colored photocopy of a valid ID issued by the government, like a driver’s license or passport. The ID must display your name, photo, and date of birth, and these details must match the ones you provided on the application form.

- Similarly, for address verification, users must upload a utility bill that is no older than 6 months.

AvaTrade Sign Up

AvaTrade Sign Up- AvaTrade offers a standard account and a demo account. The minimum deposit required to open a standard account is $100 or $500, depending on whether funds are transferred via credit/debit card or wire transfer, respectively. Corporate accounts are also available on the AvaTrade platform. However, Corporate accounts require additional documentation, such as the Corporate Board Resolution, Memorandum, Articles of Association, Certificate of Incorporation, and Shareholders Register, which users must upload to the platform.

- Funding: According to the AvaTrade review 2025, after users register for the account opening process on the AvaTrade platform, it is time to fund their account to begin real trading. However, please note that the base currency pairs (such as EUR, USD, GBP, or AUD) of your account cannot be changed once it has been set up. However, you can always add an account with another such currency pair in the future if that becomes necessary.

- Account: Traders can easily open either a live account or a demo account. After registration for account opening, the trader will receive their account details and information regarding how to start trading through email.

- GBP can be used as one of the base currencies exclusively by the residents of the U.K., while Australians can have AUD as their base currency. However, U.S. residents cannot use this AvaTrade platform as it does not have a regulated broker to partner with.

- Start Trading: After users have funded their Avatrade account, they can participate in live trading. AvaTrade also allows its users to try their hand at trading initially with the demo mode, which is virtually funded but features all the necessary trading tools found in real trading.

- This way, clients can gain insight into real online trading before they try it with real money. This mitigates the high risk of losing money due to a lack of understanding about how a web trading platform works, as facilitated by brokers like AvaTrade. Once the traders are ready to trade with confidence, they can switch to real trading at their discretion. Traders should, however, be cautious that the market is volatile and that accounts can lose substantial amounts of money due to the use of leverage.

- AvaTrade is also one of the most reliable copy trading platforms. Users can also opt for copy trading. Copy-trading can be very useful to beginners as they can learn from other traders’ technical analysis, investment objectives, skills, and risk appetite. Copy-trading can also be beneficial for experienced traders, as they can learn new strategies and trading tools, thereby enhancing their success.

- Easy search functions and intuitive research tools are available.

Cryptocurrency Trading

- According to the AvaTrade review, traders can trade some of the top-rated cryptocurrencies 24/7 using the AvaTrade platform. Traders can start trading with cryptocurrencies for as little as $100 and obtain leverage of up to 20:1. The easy-to-use search functions can be particularly beneficial.

- Additionally, AvaTrade offers competitive swap rates and allows users to go short or sell a cryptocurrency, potentially leading to a profit when the price decreases. Moreover, profits are not possible in this situation if the trader trades in an exchange.

- Unlike when trading crypto in an exchange, there is no high risk of wallet hacking or theft. There is also no need to have a cryptocurrency wallet, as it will be confusing and time-consuming for new traders. Therefore, traders can trade with confidence with AvaTrade.

- The trader can use the search function to find available cryptocurrencies and trade Bitcoin, Bitcoin Gold, Bitcoin Cash, Ethereum, Litecoin, Ripple, EOS, and Dash.

- Currently, the limits are $600,000 for BTC pairs, $250,000 for XRP, and $400,000 for ETH. Additionally, there are limits of $200,000 for LTC and BCH, and $50,000 for EOS/USD and BTC/USD.

AvaTrade Regulation

- AvaTrade Ltd is regulated by the B.V.I. Financial Services Commission. Financial Services Commission. Financial Services Commission. Financial Service Commission.

- AvaTrade EU Ltd is regulated by the Central Bank of Ireland.

- Ava Capital Markets Australia Pty Ltd is regulated by the ASIC.

- Ava Capital Markets Pty is regulated by the South African Financial Sector Conduct Authority (FSCA) of South Africa.

- Ava Trade Japan K.K. is licensed and regulated in Japan by the Financial Services Agency.

- AvaTrade Middle East Ltd is regulated by the Abu Dhabi Global Markets (ADGM), Financial Regulatory Services Authority (FRSA).

Conclusion

The AvaTrade platform offers competitive spreads to its users, but these depend on the account type they have registered for. It allows traders to get started with online trading with a minimum deposit of $100.

By applying top-notch, cutting-edge technologies, offering multilingual customer service, and sharing comprehensive educational materials with its users, the AvaTrade platform is undoubtedly the ideal choice for those seeking to earn passive income through online trading with brokers like AvaTrade. The platform provides complete peace of mind, allowing traders to trade with confidence.

FAQs

Is AvaTrade Legit?

Avatrade is a legitimate trading platform that allows trading of forex, CFDs, and cryptocurrencies. Before investing in CFDs, ensure you understand how they work. The AvaTrade brand is well-regulated globally, including in Europe, South Africa, and Australia, where it is subject to various regulatory bodies.

Is Spread Betting Available via AvaTrade?

AvaTrade offers spread betting for residents of Ireland and the U.K., as per the AvaTrade review. U.K. residents can enjoy some tax benefits from this spread betting as compared to CFD trading.

How to Make a Deposit on AvaTrade?

AvaTrade offers various deposit options to fund your account, including debit card, credit card, bank wire transfers, and e-payment methods. Users need to click on the “Fund your account” tab and then select their preferred method for depositing funds into their account. For bank wire transfers, the minimum deposit is $500. There is no deposit fee.

Is AvaTrade Regulated?

Avatrade is a globally recognized and regulated company. The Central Bank of Ireland regulates AvaTrade E.U. Ltd., and Ava Capital Markets Pty is regulated by the prominent regulatory organization of South Africa, the South African Financial Sector Conduct Authority (FSCA). The ASIC regulates Ava Capital Markets Australia Pty Ltd.. AvaTrade Japan K.K. is regulated by the Financial Services Commission (FSC) and the Financial Futures Association in Japan (FFAJ). AvaTrade Middle East Ltd. is regulated by the Abu Dhabi Global Market (ADGM) and the Financial Services Regulatory Authority (FRSA).

Risk Disclaimer: Trading Forex Options and CFDs entails high risk and could result in situations where you lose money due to leverage. CFDs are complex instruments. Many retail accounts and retail clients lose money while trading in such complex instruments. Traders should start trading CFDs only when they understand how CFDs work and consider whether they can let their retail investor accounts lose money.