Will XRP Defy September’s Bearish Odds and Surge To $5?

September’s track record for cryptocurrencies is nothing short of brutal, with many assets recording negative returns. As the market gears up for another potential tumultuous month, all eyes are on XRP, wondering if it will succumb to the usual September blues or defy the historical patterns.

Despite the bearish sentiment, XRP’s recent price action has sparked optimism among traders and investors, with some believing that the token has a high possibility of bucking the trend and posting gains despite the historically challenging month.

In addition, the increasing odds of ETF approvals have also contributed to these positive expectations. This article will examine whether the crypto is poised to exhibit a bullish rebound this month.

XRP Rebounds

Currently, XRP is experiencing a rollercoaster ride, with its price highly fluctuating. While the token recently experienced a notable uptrend, it was soon met with an opposing force, eventually trending downwards.

Most recently, the Ripple token has managed to rebound, marking a marginal surge of 1.5% in a day. However, over the past week and month, it has seen 4.22% and 5.33% declines, respectively, currently at $2.87. The trading volume is also low at $5.96 billion, down by16%.

Despite this negative trend, analysts remain bullish about the token’s uptrend in September. In an X post, analyst JackTheRippler posited that XRP is poised to hit a new all-time high of $5 towards the end of September, marking a 77.44% surge. He bases his prediction on the increasing odds of the SEC’s XRP ETF approval.

Meanwhile, another prominent analyst STEPH IS CRYPTO, shared a more optimistic forecast of the XRP coin. According to him, the Ripple token is likely to hit an ambitious $12 by the onset of 2026. Currently, the crypto is hovering around its critical resistance of $3. If it manages to break past this level, the next stop is at $12, says STEPH IS CRYPTO.

ETF Odds Surge

Significantly, the prevailing bullish thoughts on the XRP price’s potential rally are mainly driven by the increasing odds of ETF approval. According to Polymarket, the ETF odds have surged to 87%, marking a 16% hike.

Especially following the SEC-CFTC Joint Staff Statement that highlighted the regulatory efforts to promote spot trading of certain crypto products, the anticipation of the Ripple ETF soared. The SEC’s Division of Trading and Market Oversight and the CFTC’s Division of Clearing and Risk are joining hands to facilitate spot trading of cryptocurrencies. Experts like Armando Pantoja wrote on X, “OMG! The SEC is about to approve all of the XRP Spot ETFs.”

Redtember is Here

Interestingly, September has historically been a challenging month for cryptocurrencies. Many cryptocurrencies have experienced significant declines in previous Septembers. Driven by this overarching negative trend, September is often as “Redtember.”

As the month has already arrived, the crypto market is experiencing major fluctuations and high volatility. Despite ETF expectations and potential predictions, investors are anxious about a possible downturn in the XRP price.

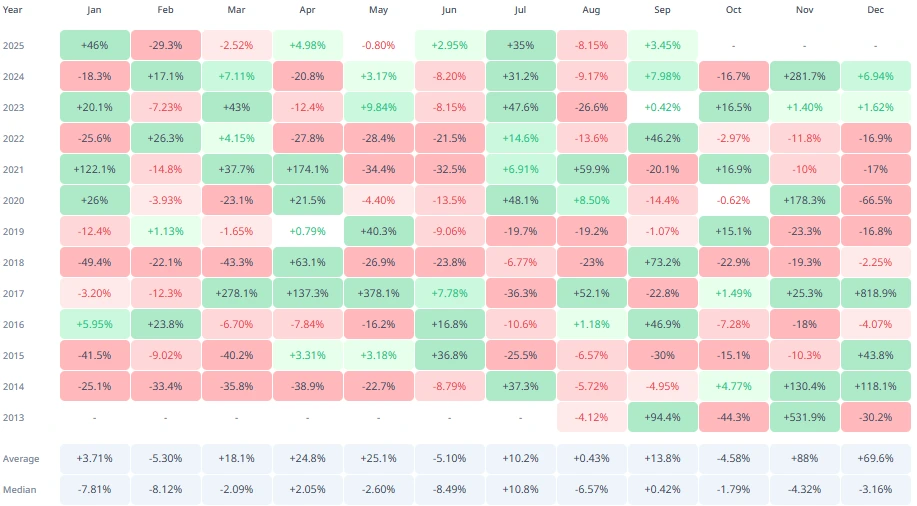

However, XRP presents a different picture, with the token recording an overall positive return over the previous years. The average monthly return for XRP in September across the years 2013-2024 is +13.8%.

Despite this positive average, the token has seen varying returns in September. On one hand, some years have seen remarkable gains, such as the significant positive returns of 94.4% in 2013, 46% in 2016, 73.2% in 2018, and 46% in 2022. On the other hand, years like 2015, 2017, 2021, and 2021 saw significant declines in returns. This mixed pattern has continued in recent years, with a +3.37% gain in 2025, a +7.87% increase in 2024, and a near-flat +0.42% return in 2023.

This highlights the unpredictability of this September’s performance in the XRP market. Nonetheless, bullish predictions and ETF odds inject a wave of optimism within the space.