WazirX Legal Update: Court Filing Complete, Waiting for Next Order

Key Highlights:

- WazirX has filed legal submission in the Singapore Court as a part of its restructuring process.

- Over 95% of creditors have approved the amended restructuring scheme, which proposed 85% of frozen user funds.

- The Singapore Court will now review the submissions and direct next steps.

WazirX, one of India’s most popular cryptocurrency exchanges, has submitted its legal documents to a Singapore Court on Friday, September 26, 2025 as instructed by the judges. This is the most recent development by the platform as an effort to have the restructuring plan approved by the court. The plan has been set up in away that it helps users get their money back following a cyberattack that cost millions of dollars.

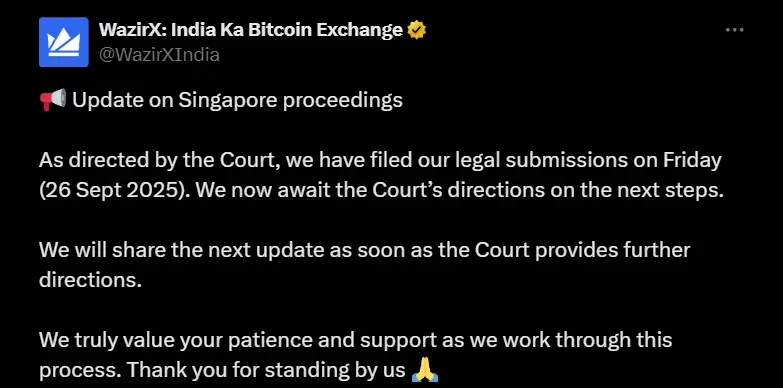

This announcement was made today on X (formerly known as Twitter), September 29, 2025. WazirX stated “As directed by the Court, we have submitted our legal filings on Friday (26 Sept 2025). We now await the Court’s guidance on the next steps. We will share further updates once the Court issues directions.”

Along with the official announcement, the platform also added a thank you-message to its users, which appreciates their patience while the legal proceedings continue.

Background: The Cyberattack and Aftermath

In July 2024, WazirX suffered a cybersecurity breach which resulted in the theft of approximately $230 million worth of digital assets. This incident led to immediate halt of all the withdrawals on the platform. Even though the halt was imposed for security reasons, it created financial uncertainty for millions of investors and traders in India who made up the majority of the platform’s user base.

In response to the hack, WazirX’s parent company, Zettai Pte Ltd, applied for a court-led restructuring in Singapore to handle creditor claims and outline a plan for asset recovery and user repayments. Singapore was selected as a neutral venue because of the exchange’s global operations and diverse user presence.

The Restructuring Scheme Explained

WazirX’s restructuring plan uses a “scheme of arrangement,” which, if approved by the Singapore Court, would allow 85% of the user claim balances to be repaid from existing liquid assets soon after approval. The remaining claims will be covered over time through “recovery tokens” that are designed as digital instruments linked to possible asset recoveries for future revenues.

The proposal had been made public to the creditors to vote and it received 95% backing in a recent round. The plan has seen various revisions and hearings since the Singapore High Court first rejected it in early 2025 due to missing details and other concerns. The court later allowed for a revote on the revised plan and will have Zanmai India manage recovery tokens while repaying ~85% of claims upfront and the rest through future-linked tokens, extending the freeze on creditor claims into mid-September 2025.

Court’s Role and Next Steps

With its latest filing submitted on September 26, WazirX now awaits the Singapore Court’s review to decide on approving the revised restructuring scheme. If this is sanctioned, the company will start the first round of user fund distribution within 10 business days. WazirX has also pledged further that it will relaunch its exchange services once the scheme takes effect and receives court clearance.

These two steps would be the major steps towards restoring user trust and platform activity. The Court’s decision will now determine if more hearings are required or if the plan can move straight to execution. The case remains complex given the scale of user losses, global operations, and regulatory oversight in both Singapore and India.

WazirX’s Road to Recovery

Over 4.3 million users had been affected by this hack and now await the Court’s decision, which could unlock partial recovery of frozen assets. The restructuring plan is being seen as the fastest and the fairest routes even though there have been delays. For India’s crypto sector, the case could be an example for managing exchange failures under Singapore laws. WazirX has promised transparency, asking users to stay involved as it follows court and regulatory orders. With creditor support in place, the Court’s decision will be the next key step in its recovery.

Also Read: YouTube Star MrBeast Pours $1M into ASTER Amid Controversy