StableStock Completes Incubation, Secures Seed Funding, Enters Beta

Key Highlights:

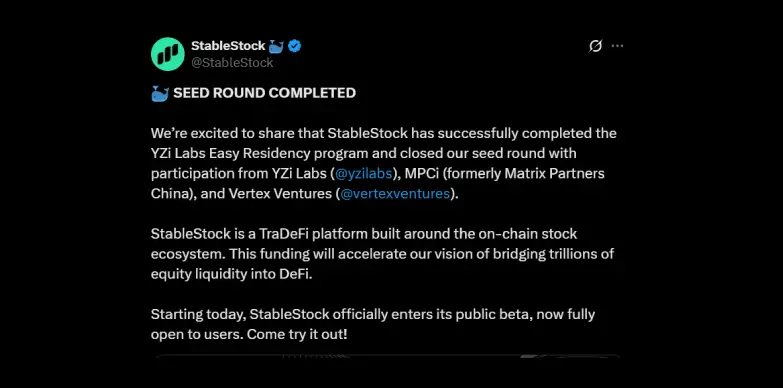

- StableStock has completed YZi Labs’ Easy Residency program and has managed to secure seed funding for various investors.

- The company is aiming to bring in trillions of dollars in stock liquidity into DeFi by bridging traditional stock markets with decentralized finance.

- The platform has launched a public beta phase which will allow real-world testing and will allow the developers to collect feedback from the users.

StableStock, a leading TraDeFi platform which is centered around the on-chain stock ecosystem, announced today, August 20, 2025, that it has successfully completed the Easy Residency incubation program by YZi Labs. The company has also secured seed round funding from a well-known group of investors, which includes YZi Labs, Matrix Partners and Vertex Ventures.

This infusion of capital from this group of investors indicates that there is a strong confidence in StableStock’s potential. This funding will be used by Stablestock for enhancing the performance of the company, increase the speed of development, increase capabilities of the platform and expand its user base.

Unlocking Trillions in Stock Liquidity through TradeFi Innovation

The investment from these major investors will speed up the platform’s goal of moving trillions of dollars in stock liquidity into the DeFi space. With this move, StableStock will bridge traditional stock markets with DeFi protocols. The platform wants to make sure that this process is seamless, transparent and it is able to create a liquid marketplace. StableStock will be using blockchain to deliver quicker trades and lower costs. Its fresh “TraDeFi” model blends the scale of stock markets with the perks of DeFi, opening the doors for investors everywhere.

Public Beta Launch Opens Platforms to Users

Along with these announcements, StableStock also announced that it has entered its public beta phase. This means that the company has opened the platform for user participation and feedback. This move by the platform will open doors for investors, traders, and developers to experience and contribute to the evolution of a stock trading ecosystem that leverages decentralized finance innovations.

Industry Veteran Investors Signal Strategic Validation

With Matrix Partners, Vertex Ventures, and YZi Labs backing its seed round, StableStock is entering the market with a solid credibility. These investors contribute not only capital but also deep expertise in tech and finance, giving the platform the edge to scale properly. The support from these investors, as mentioned above, also indicates the platform’s potential to redefine the bridge between traditional stock market and DeFi.

With this move, the platform will bring 24/7 on-chain access, instant settlements and lower fees by cutting out middlemen. The investors will gain more control and transparency, while developers can build new tools and products on top-paving the way for fresh innovation at the crossing of stocks and DeFi.

Challenges and Opportunities Ahead

Even though the platform has made great progress in its field but it is going to face challenges moving forward. The challenges would include regulatory compliance and user adoption barriers. However, the platform’s recent achievements, which includes successful completion of the incubation period, strong funding from the investors and the platform’s public beta launch, all of this indicates its momentum and readiness to navigate through these challenges and obstacles. If the participation in the beta phase is more, with all the feedback, the platform will be able to roll out a fine tuned version for the final launch.

What is Ahead for StableStock

After the public beta, the platform plans to add trading features such as limit orders and portfolio dashboards. It also plans to integrate with other DeFi protocols for loans and liquidity mining while making sure that their focus is on the regulatory compliance part and scaling for more users, paving the way for a smooth full launch.

Also Read: Miami Hosts DigiAssets US 2025: Institutional Digital Assets