Solana Staking ETP Jumps $110M, Bitwise CEO Horsley Updates

Key Highlights:

- Bitwise Solana Staking ETP crosses $110M, reported by Bitwise CEO Hunter Horsley.

- The blockchain’s growing ecosystem and ETF momentum is driving strong institutional demand for Solana staking.

- Increased Solana staking demand indicates increasing investor appetite for yield opportunities.

Bitwise’s European Solana Staking ETP has surged in popularity as it has managed to draw more than $50 million in inflows within a week and has quickly reached over $110 million in assets under management (AUM), indicating an increased investor confidence in blockchain’s future growth. This surge was highlighted by Bitwise CEO Hunter Horsley on social media platform X (formerly known as Twitter).

Surge in Staking ETP Demand

Bitwise CEO Hunter Horsley revealed on September 27, 2025, that the firm’s European Solana Staking ETP has attracted $60 million fresh capital in just five sessions and tweeted “Solana on people’s minds.” Today, October 3, he updated the tweet and stated that the AUM has surpassed the $110 million which indicates a significant momentum and investor confidence toward Solana exposure in Europe.

This product lets investors earn staking rewards and also allows them to have a full exposure to Solana’s native token, SOL. The product has been listed in Frankfurt on Deutsche Börse Xetra exchange. The ETP uses blockchain’s fast speed, which handles up to 65,000 transactions per second, making it appealing for staking in crypto.

Institutional Appetite and Market Context

The strong inflows into this staking product indicates clear interest in the Solana blockchain. In the U.S., Bitwise has also filed a Form 8-A with the SEC for a spot Solana ETF, which is an important regulatory step that could lead to the launch of the first U.S. Solana ETF with staking features.

Nate Geraci, President of NovaDius Wealth Management, had recently said that the SEC could approve several Solana spot and ETF filings within weeks. The same notion was also presented by Eric Balchunas, a senior ETF analyst at Bloomberg on X. Firms like Bitwise, Franklin Templeton, and Fidelity are in the mix, and the staking feature could increase yields for investors while driving stronger demand.

Competitive Edge in Staking ETFs

Hunter Horsley has also pointed out that the Solana’s faster withdrawal times provides the blockchain a greater edge than Ethereum for staking ETFs, as with Solana, investors get their assets back more quickly. Ethereum’s long queues make liquidity harder to manage, even though it makes use of tools like stETH.

Bitwise CEO Matt Hougan, on the other hand adds that SOL’s smaller market cap means new capital has a great impact, suggesting that inflows of $30 billion could move SOL’s price as much as Bitcoin.

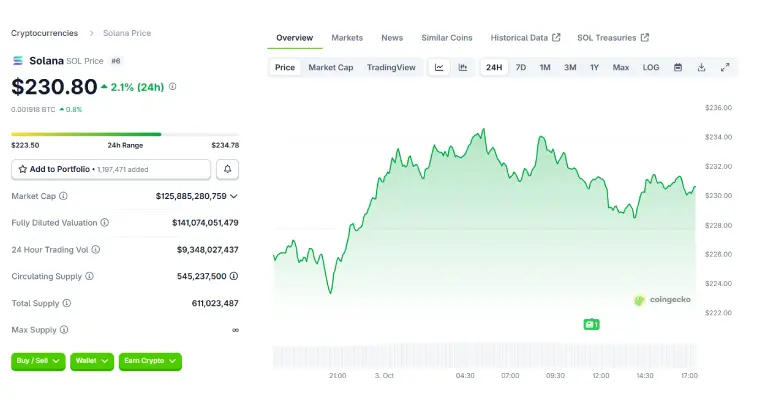

As we all know that there is great interest in the SOL blockchain. The price of SOL token is also experiencing an uptick. At press time, the price of the token stands at $230.80 with an uptick of 2.1% in the last 24 hours as per CoinGecko.

SOL Blockchain’s speed, ecosystem growth and ETF Demand Drive Surge

This surge is driven by technological advantages the blockchain provides, rapid ecosystem expansion, and strong market interest. The blockchain’s ultra fast transaction speeds of up to 65,000 per second and very low transaction fees make it ideal for decentralized apps, DeFi platforms and NFTs, especially after recent upgrades enhancing scalability and reliability. The platform’s growing adoption includes popular projects like Raydium and institutional validation through pilots by companies such as Visa.

Institutional investors have been pushing for Solana ETFs with staking features, expecting that SEC’s approval could bring in major inflows. With strong analysts forecasts, and positive sentiment, the blockchain is being seen as a leading contender for fast growth in the crypto market.

Also Read: Hedera Token Price Soars as Hashport Launches Mainnet HBAR Faucet