MYX Clocks 156% Gains in 24h; Genuine Rally or Pump-and-Dump?

Key Highlights:

- MYX Finance experienced an over 150% surge today, September 8, 2025.

- Surge is said to be driven by V2 upgrade, exchange listings and massive liquidations.

- Analysts warn of possible market pump-and-dump schemes.

MYX Finance has made it to the headlines as the token chart showed a parabolic movement today, September 8, 2025. The token has experienced more than 150% of surge and has managed to gain attention from the crypto community members. Even though this spike is exciting, it has also raised questions and concerns within the industry.

At press time, the price of the token stands at $4.17 with a surge of 159.35% in the last 24 hours as per CoinMarketCap.

What Triggered MYX Finance’s Surge?

This leap that the project has experienced can be largely attributed to the much-anticipated V2 protocol upgrade, where the project is going to introduce zero-slippage trading, easy cross-chain support, and a streamlined experience for its users. All of these features can solidify the platform’s image as a leading decentralized derivatives exchange.

Moreover, this token MYX Finance has also been listed on Binance Alpha, which has given the token a great amount of visibility and liquidity. This listing has also opened doors for new investors to come in and invest in the token and project.

On the other hand, the trading volume also exploded by more than 700% which surpassed $350 million in spot traders and $4.23 billion in perpetual contracts.

Project Overview: What is MYX Finance?

MYX Finance is a decentralized platform that is used for perpetual trading. The platform is said to be using a unique Matching Pool Mechanism (MPM) that offers its users zero slippage trades. The users can trade USDC-margined perpetuals with up to 50x leverage, which is powered by Pyth Oracle’s real-time pricing. The funds stay in self-custody, while the platform delivers fast execution and balanced risk-reward for the traders. Security is reinforced through PeckShield audits, multi-signature controls and community governance.

The key features of the platform have been listed below:

- It provides decentralized derivatives trading with high liquidity.

- It uses MPM so that there is an efficient, and frictionless position matching.

- It provides up to 50x leverage on supported assets.

- It provides governance features and staking rewards as well.

- Traders who provide liquidity (or makers) get rebates, and the platform is also known for offering big rewards to attract and grow its current community.

The roadmap of the project indicates that it is currently supporting cross-chain trading, expanding asset coverage, mobile deployment and other few advancements that are based on community voting.

Is This Market Manipulation or a Real Rally?

The bullish momentum is clearly there but the surge has definitely brought in controversy along with it. There have been various reasons due to which the crypto community members believe that this could be a case of market manipulation.

- Analysts highlighted that this rally has come up right after the 39M token unlock, which indicates that the insiders may be selling into the retail demand.

- The perpetual trading volume exceeded spot activity, which sparked concerns of artificial liquidity and potential whale-driven wash trading.

- There have been similar trading patterns on Bitget, PancakeSwap, and Binance which suggest that there is a well-coordinated whale activity, because open interest was climbing and massive liquidations took place, short sellers were completely wiped out.

- Market watchers are warning the community that the setup looks like a pump-and-dump, with insiders pushing prices up only to sell off to retail traders, increasing volatility risks.

Could This Be a Pump and Dump?

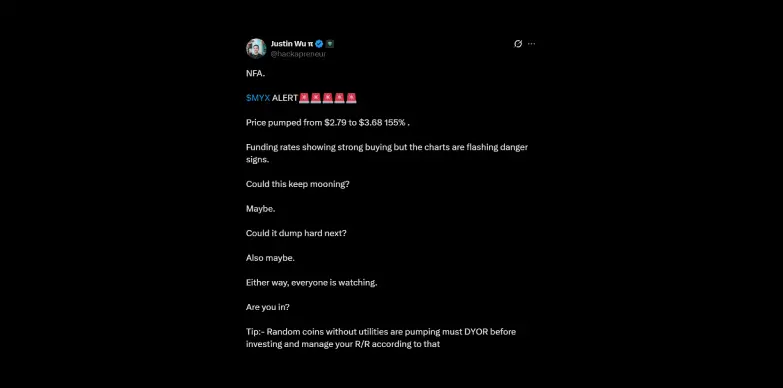

Justin Wu, a well-known Web3 growth strategist and community builder, also warned his fellow users on X (formerly known as Twitter), that despite MYX’s 155% rally, technical signs and speculative risks indicate that traders should remain cautious.

The evidence is mixed. There are no direct proofs that prove that there indeed has been market manipulation but since there has been an overlap of token unlock, high leverage and sudden volume spikes, it is being speculated by the crypto community members that there is a possibility of whale-driven moves at retail’s expense. Similar patterns in DeFi have often preceded sharp corrections. Traders, however, are warned to stay cautious amid volatility and potential artificial price supports.

Also Read: Injective Rebounds as Pineapple Financial Launches $100M INJ Treasury