Ethereum Momentum Builds with Hayes’ $9.5M Move

Key Highlights:

- Arthur Hayes has accumulated a huge amount of ETH in the last 24 hours.

- His wallet’s largest bets include ETHFI, LDO, and PENDLE.

- His moves signal institutional interest and rapid shift in DeFi cycles.

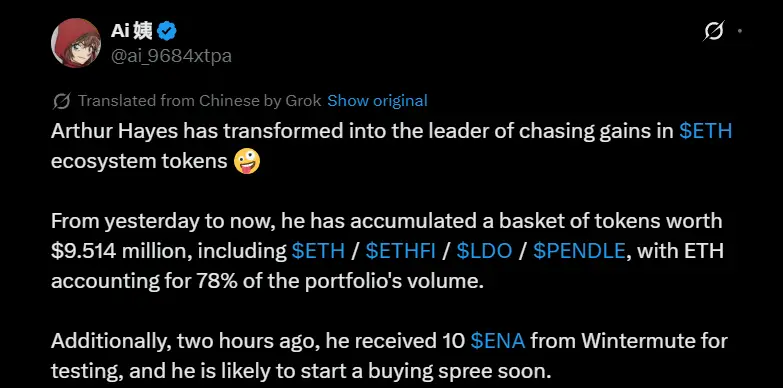

Arthur Hayes, the co-founder of BitMEX, has captured the attention of the crypto community. This time around, the influencer has aggressively accumulated tokens centered around Ethereum (ETH). In the last 24 hours, Hayes has managed to accumulate a portfolio that is now valued at $9.514 million. Hayes with this portfolio is heavily focusing on ETH and a selected group of altcoins such as ETHFI, LDO, and PENDLE.

According to a X (formerly known as Twitter) user, Ai Aunt, the influencer and co-founder has invested 78% of its portfolio in Ethereum itself. As per Arkham Intelligence, Hayes’ wallet has been extremely active and the tokens that hold a majority of his portfolio have been listed below:

ETH: This token is the anchor of the entire portfolio, comprising the lion’s share of allocations. If you consider today’s price of $4304.49 per ETH, it is clear that his bet rides on Ethereum’s continued momentum.

ETHFI: This is a decentralized restaking protocol that mirrors DeFi’s growing popularity.

LDO (Lido DAO): Allows liquid staking for ETH, another booming DeFi niche.

PENDLE: This token lets users tokenize and trade future yield, adding another advanced yield strategy to his investment mix.

Adding to all of this, the influencer and co-founder has also received a small exploratory transfer of 10 ENA tokens from market maker Wintermute. This move is being interpreted as a test before launching another round of targeted altcoin buys.

A Signal for Altcoin Season?

The timing of Hayes’ aggressive buying couldn’t be more compelling for crypto watchers. As of August 2025, the Altcoin Season Index sits in the high 30s, well below the 75 threshold that historically indicates a shift into dominance of the altcoins. Usually, these cycles follow Bitcoin’s initial surge, with capital rotating into altcoins, especially those with strong real-world use cases and DeFi infrastructure. The current trend indicates that the rotation may be in its early stages.

As this activity by Arthur Hayes has been made public, the crypto sentiment is surging, Google search trends are spiking, and social feeds are a frenzy of “altcoin season.” While the Altcoin Season Index remains in the high 30s, strong weekly performances from heavyweights like ETH, XRP and ADA are keeping the possibility alive in traders’ mind.

ETH Price Surge and Market Environment

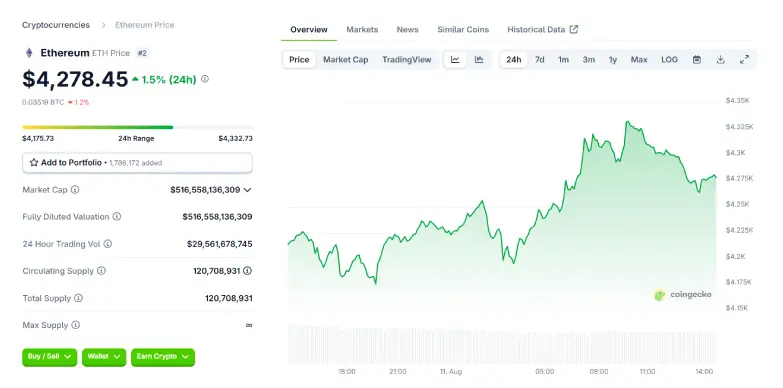

At press time, the price of the Ethereum token stands at $4,278.45 with a surge of 1.5% in the last 24 hours and an impressive surge of 20.4% in the last week as per CoinGecko. This surge indicates the increased confidence and inflow of both retail and institutional capital.

Hayes’ Track Record and Whale Psychology

This is not the first time that Arthur Hayes has moved markets with his decisions. In July 2025, Hayes spent $12.5 million on Ethereum and related projects, showing his strong belief that Ethereum is undervalued and will play a key role in the next stage of DeFi growth.

Also, last week, Hayes sold 2,373 ETH for $8.32 million when it was trading somewhere around $3,500. In a short span, he repurchased ETH worth 10.5 as the price had reached $4,150. This entry point was roughly 18% higher than his sell price. This move added to already strong bullish momentum, as institutional and whale accumulation topped over $4.17 billion in ETH since mid-July. These patterns reaffirm his reputation as a market mover and amplifying force during altcoin cycles.

Hayes wallet address (which is tracked closely every min by the blockchain sleuths and on-chain tools) serves as a barometer for gauging the sentiment of the institutions. Every move that Hayes’ makes, speculators keep an eye for the ripple effect his action may have on the market and the liquidity it brings across DeFi tokens.

Also Read: SBI Holdings Denies Crypto ETF Filings, Plans Still Pending