Forward Industries Files $4B SEC ATM Offering for Solana Growth

Key Highlights:

- Forward Industries will be using a $4 billion ATM program to raise funds for its Solana holdings.

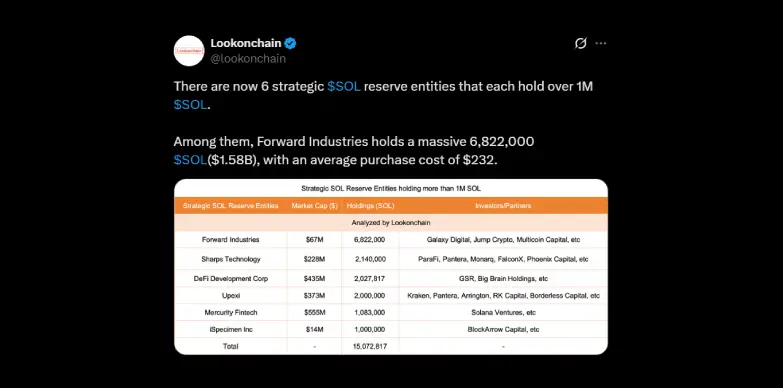

- Forward Industries has already acquired 6.8 million SOL which are almost worth $1.58 billion.

- The company plans to stake SOL, participate in DeFi and use institutional strategies to generate yield and grow shareholder value.

Forward Industries (NASDAQ: FORD), a leading company that is focused on Solana, has announced that it has started a $4 billion stock sale program to raise more money for their Solana Treasury. This move comes right after their recent $1.65 billion private funding that was led by Galaxy Digital, Jump Crypto, and Multicoin Capital. These moves strengthen Forward Industries’ position as a major player in the Solana (SOL) ecosystem.

$4 Billion ATM Offering for Flexible Capital

On September 16, 2025, Forward Industries filed a registration statement with the U.S. Securities and Exchange Commission (SEC) to launch an ATM program that will allow the company to sell up to $4 billion in common stock at current market prices.

With this initiatives, the company will have a flexible and efficient way to raise funds to support its Solana treasury strategy, general needs of the business, and its growth plans.

According to Kyle Samani, Chairman of Forward Industries, the ATM program will improve the company’s ability to carefully deploy capital to expand its Solana holdings, strengthen its balance sheet, and pursue growth initiative in line with its long-term vision.

“Having recently completed the largest Solana-focused digital asset treasury raise to date and initial purchases of more than 6.8 million SOL, the ATM Program enhances our ability to continue scaling that position, strengthen our balance sheet, and pursue growth initiatives in alignment with our long-term vision.” -Kyle Samani

The stock sales will be handled by Cantor Fitzgerald & Co., which will be making reasonable efforts to sell the shares following normal market practices, without any set minimum amount required.

$1.65 Billion PIPE Led by Galaxy Digital and Strategic Partners

A few days ago, Forward Industries closed a $1.65 billion private investment in public equity (PIPE) deal, with lead investors Galaxy Digital, Jump Crypto and Multicoin Capital backing most of the funding. This funding was one of the largest PIPE deals in crypto history and it has allowed the company to acquire more than 6.8 million SOL tokens to launch its active treasury program.

The PIPE funds are mainly focused on building the world’s largest corporate Solana treasury. The company plans to manage this treasury through staking, lending, and DeFi activities and to plans to generate on-chain revenue with these activities.

CEO Michael Pruitt said that the company is aiming to earn higher returns by using trading tools, prime brokerage and advice from partners. Galaxy Digital is not just helping with the funding but it is also supporting the company with infrastructure and trading support, so Forward can actively grow profits instead of just holding SOL tokens.

Strategic Vision and Market Impact

Forward Industries aims to be “not only the top Solana-based digital asset treasury but be the top digital asset treasury in the world,” according to Kyle Samani. In an interview with TBPN, Kyle also highlighted that the company plans to grow into a $50B+ publicly traded permanent capital vehicle within the next 5-10 years by expanding its SOL holdings and deploying them across several blockchain strategies.

The $1.65 billion PIPE brought in major market attention, with Forward Industries’ stock rising over 15% in pre-market trading after the announcement. This early success sets the stage for the $4 billion ATM program, which will give the company an extra capital to continue expanding its treasury and supporting corporate growth.

Risks and Considerations

While the $4 billion ATM program indicates a huge confidence in Solana and Forward Industries’ plan, experts warn that the success of this initiatives also depends on Solana’s price and adoption, and on Forward’s ability to use its capital to earn real revenue, not just rely on token gains.

Investors will be closely monitoring every development and will be tracking the company’s deployed funds and what returns it generates, given the large scale of these financing moves.

Also Read: Crypto Funds See Record $3.3B Inflows as Bitcoin, Ethereum, and Solana Lead the Surge