Forward Industries Secures $1.65B for Solana, Altcoins Up?

Key Highlights

- Forward Industries secures $1.65 billion in cash and stablecoins to advance its Solana treasury strategy.

- The funding indicates a growing interest in the Solana blockchain.

- Solana price and altcoin markets have reacted positively.

Forward Industries had announced on September 8, 2025 that it had raised $1.65 billion in a private investment in public equity (PIPE) deal with cash and stablecoin commitments. According to a recent press release, the deal has been closed today, September 11, 2025 and it has been confirmed that the funds will support its new strategy of making Solana (SOL) a core in its treasury by buying more SOL and investing in Solana-based assets. Along with Forward Industries, the deal was also backed by Galaxy Digital, Jump Crypto and Multicoin Capital.

Major boost for Solana positioning

According to the press release, the private placement had been set up to give Forward Industries multi-year reserves that are specifically meant to grow its presence within the Solana ecosystem. This means that this fund will be used to provide liquidity, support validator operations, build cross-chain projects, and explore on-chain treasury management tools and all of it directed at creating long-term stability within the ecosystem.

As per the deal, Forward Industries will be holding both fiat cash and stablecoins. Holding fiat cash gives the company stability because cash does not change in value and holding stablecoins allows the company to move money quickly on-chain for blockchain investments or trades. By keeping both, Forward Industries can protect themselves against sudden price swings and can also have ready to use immediate funds available as well.

The focus on Solana shows a wider trend where companies and asset managers are treating major alternative blockchains as reliable treasury assets, not just speculative investments. Many of the analysts also consider this size of a raise as an ‘institutional validation’ of growing confidence within the blockchain industry.

Impact on Altcoin Markets

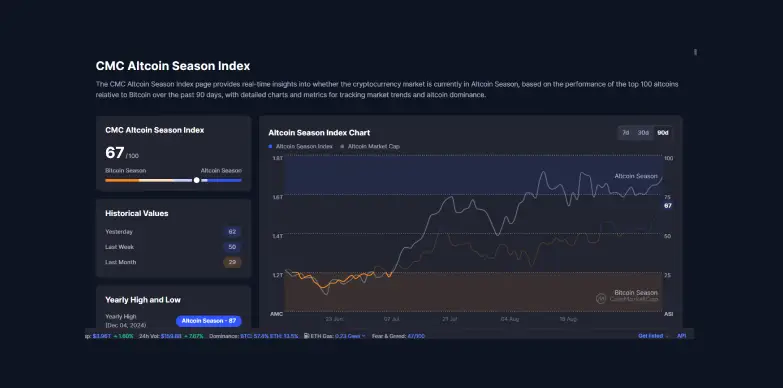

Crypto market is one of those markets that reacts very quickly to market conditions. As soon as this announcement was made, Solana (SOL) recorded an uptick in daily trading volumes and a short-term price rally. Traders on X (formerly known as Twitter) described it as a “mega bullish” catalyst for altcoins. The Altcoin Season Index has also shifted from 29 to 67 in September, which indicates that the money is flowing more into non-Bitcoin cryptocurrencies at a faster rate.

At press time, the price of $SOL token stands at $224.96 with an uptick of 2.31% in the last 24 hours as per CoinMarketCap.

The timing of this raise is also something that stands out because Bitcoin has been dominating the market through its ETF inflows, and many altcoins were struggling to gain some attention. By putting a large sum of money into Solana could inspire other projects to do the same and may bring in a great amount of liquidity to the altcoin market. For example, if Solana proves itself to be a reliable treasury asset, other fast and scalable blockchains might also start getting similar backings.

Raising the Bar for Blockchain Treasuries

Forward Industries has mentioned that part of the funds will be directed towards testing Solana-based payment systems and asset management tools, including tokenized treasuries, DAO participation, and staking-linked sustainability projects. The company is acting as an investor and a contributor to the ecosystem as it is investing beyond just holding the tokens. This approach could speed up Solana’s adoption and push other corporates to rethink how treasuries use blockchain.

What Comes Next?

The $1.65 billion raise has created strong optimism, but there are still open questions about how it will be executed, what the governance structure is going to be like, and how will regulators respond to such a large treasury move. Even though, the scale indicates that the corporate treasuries in crypto are now entering a new stage.

As the deal is now complete, the focus will shift to how Forward Industries rolls out Solana-based plans in the coming months and if others will adopt the same option.

Also Read: Cardano’s Charles Hoskinson Explains Why ADA Lost to Solana