Ethereum Nears Record High as Crypto Market Soars Past $4 Trillion

Key Highlights:

- Ethereum nears $4,700, just a few dollars away from its current all-time high.

- The global crypto market crosses the $4 trillion mark.

- ETH outperforms Bitcoin in August.

Ethereum is now trading close to $4,700, approaching its November 2021 all-time high (ATH) of $4,878. The spike has attracted the interest of numerous traders and investors, and it portends new bullish momentum for Ethereum and the cryptocurrency market as a whole.

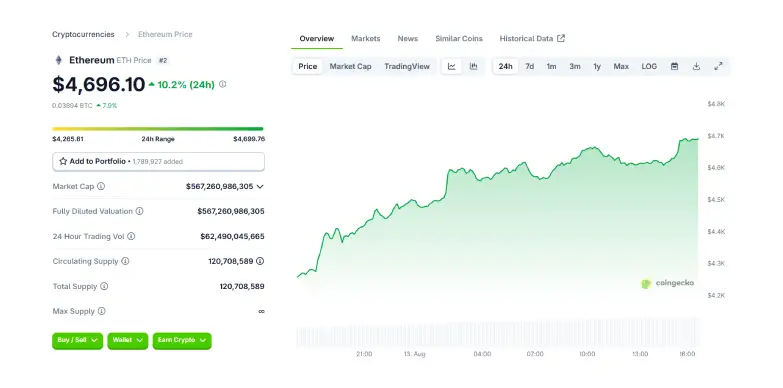

At press time, the price of the token stands at $,4,696.10 with an uptick of 10.2% in the last 24 hours as per CoinGecko.

Increased Institutional Interest

Ethereum’s strong run is being driven by a number of factors, with growing institutional interest at the forefront. . Bitmine Immersion Technologies and SharpLink Gaming have also pushed their ETH holdings by millions of tokens. This has led to tightening of the token supply and has also lifted the demand of these tokens. BlackRock recently bought over $12 billion worth of ETH, and Bitmine is reportedly looking to raise $20 billion for more purchases. These significant actions are pushing the market confidence and contributing to the token’s rising price.

The increase in inflows into Ethereum based exchange traded funds (ETFs) is another factor that is causing the rise in the price of the token. Recently, spot Ethereum ETFs recorded their largest net inflows in a single day, which surpassed $1 billion. This increase is directly linked with the institutional demand for ETH. The capital infusion and the expectation that more ETFs will be approved by the U.S. Securities and Exchange Commission (SEC) have fueled investor excitement.

Technical Indicators Flash Bullish Crossovers

If you look at the current situation, Ethereum has shown a strong positive momentum. MACD indicator suggests that there is going to be a bullish momentum and the price of the token will be on the rise. In the options market, traders are placing aggressive bullish bets. Recently, more than $5 million went into call options expecting Ethereum to break above $5,000 by the end of September, with some targeting strikes as high as $7,500 by year-end. This reflects strong trader conviction that Ethereum will not only top its previous high but will aim for fresh record levels.

Ethereum Outpaces Bitcoin in August 2025

Ethereum’s price growth this August has outpaced gains of Bitcoin. While Bitcoin has risen modestly which is about 3-4%, Ethereum has managed to surge around 25-28% over the same timeline. This strong outperformance is closing the valuation gap between the two leading cryptocurrencies. Analysts believe that Ethereum’s momentum to growing confidence lies in its blockchain’s capabilities, particularly with upcoming network upgrades aimed at boosting scalability and overall utility.

Ethereum’s surge is also being supported by the larger cryptocurrency market. The market capitalization of all cryptocurrencies today has surpassed $4 trillion and has exhibited an uptick of about 4%. Even though altcoins such as Ethereum have shown a positive gains, Bitcoin remains stable at $120,000.

Future Prospects

However, experts have warned of a possible volatility around resistance levels. The $4,700 mark has often acted as a barrier. This is the spot where profit-taking and short term selling pressure emerges. If Ethereum pushes for another breakout without sufficient strength, future market data suggests that there can be a risk of liquidation. Some analysts warn that a pull can be expected if the $4,350-$4,700 range is not cleared. A retest of support around $4,000 or choppy price action may result from this.

The overall sentiment as of now is positive. Many of the experts believe that Ethereum may hit $5,000 mark by the end of August 2025. If the trends, ongoing adoption of the decentralized apps are in the favor of the token, its price can also target $6,000 and $7,200 or higher. Strong institutional buying, healthy ETF inflows, and supportive technical all provide a firm base for further gains.