Ethereum ETF Inflow Tops $1B, FG Nexus Eyes Large Stake

Key Highlights:

- Ethereum ETFs managed to bring in $1 billion in a single day.

- FG Nexus plans to hold 10% of the total ETH supply.

- Institutional confidence grows as ETH adoption accelerates, signalling a shift from Bitcoin.

U.S. Ethereum ETFs have shattered records on August 11, 2025, as it managed to pull in $1 billion in net inflows. This is the largest single-day haul till date. The milestone was achieved after a week of unprecedented institutional and corporate appetite for ETH.

This influx was driven by heavy hitters, BlackRock’s ETHA leading with $640 million, Fidelity’s FETH close behind at $277 million, and strong showings from VanEck, Invesco, and Grayscale. Nearly every U.S. Ether ETF closed the day in green, with only QETH flat, indicating a decisive shift in how these institutions see ETH, not just as a speculative play, but as a bona fide core portfolio asset.

Expert Speak

Bloomberg ETF analyst Eric Balchunas summed up the mood on social media with his usual wit: “A billy-a-day keeps the Sister Hazel metaphors away.” He called the flows “a legit haul, and a team, everyone contributing – a good sign,” pointing to the broad-based demand spanning heavyweights like BlackRock, Fidelity, and other major issuers.

Eric Balchunas and other analysts point to three converging forces fuelling crypto’s “ETF era”: regulatory clarity, product innovation, and mainstream acceptance. Balchunas highlights Ether ETFs’ team-driven success as a proof of a sector coming of age, no longer dependent on a single issuer, but supported by a deep, competitive field with both backbone and staying power.

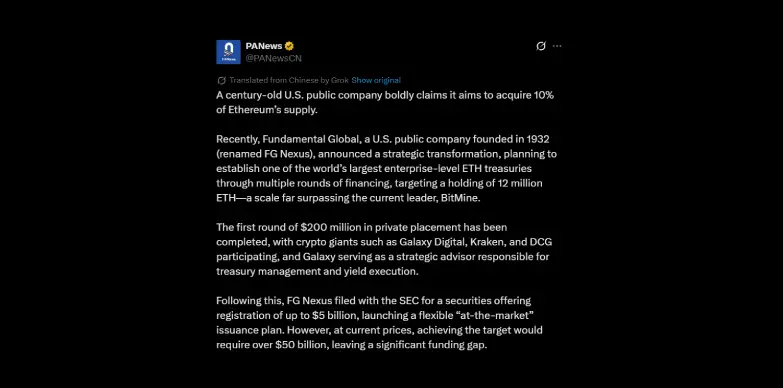

FG Nexus Plans to Acquire 10% of Total ETH Supply

Adding fuel to the institutional surge, Nasdaq listed FG Nexus stunned the market with its plans to acquire up to 10% of Ethereum’s total circulating supply. Kicking off in late July, the firm has funnelled $200 million from a private placement for steady ETH accumulation.

As of now, the company holds more than 47,000 ETH each worth more than $4,200 during the ETF rally. This move is just not about buying and holding. All of this ETH will be staked and restaked to earn yields. The move shows a strong, long-term bet on ETH as a “corporate-grade-asset.” with CEO Kyle Cerminara and digital asset head Maja Vujinovic aiming to become one of the largest ETH holders in the world, rivalling major crypto treasuries.

The Shift From Bitcoin ETF to Ethereum ETF

FG Nexus’ treasury play is part of a bigger shift in the institutional world, one that used to be all about Bitcoin. With the 2025 U.S. CLARITY Act locking in Ether’s status as a commodity, big players like companies, pensions, and asset managers are now putting ETH and BTC on the same level.

According to analysts like Balchunas, smartest investors are chasing ETH not just for price action, but for its real-world utility-staking rewards, powering DeFi and driving tokenization projects across the financial world.

Signs of a slow but steady “Bitcoin-to-Ethereum shift” are becoming hard to miss as:

- Ether ETFs are closing the gap with Bitcoin products, and in some cases, beating them in daily inflows.

- Corporate treasuries and mining companies that once held only BTC are now stacking ETH for diversification and bigger longer-term gains.

- Wealthy investors and institutions, no longer spooked by unclear rules, are piling into ETH through both ETFs and direct holdings.

The jump in ETF inflows and corporate treasury buying indicates a growing conviction in Ethereum, seeing ETH not just as a trade, but as a core piece of both traditional finance and web3 infrastructure. FG Nexus’s plan to hold 10% of all ETH can possibly also inspire other big players to follow this suit and could set the stage for future supply squeezes and potential price rallies, just like Bitcoin’s past waves of institutional adoption.