Cardano Eyes $1 as ADA Returns To Hashdex Nasdaq Crypto ETF

In stunning crypto news, Cardano has made a triumphant return to the Hashdex Crypto Index US ETF, marking a significant milestone in its journey toward broader institutional acceptance. After a temporary removal due to regulatory challenges, ADA’s reinstatement signals growing confidence in the project’s potential and paves the way for increased participation from institutional investors.

This development not only underscores Cardano’s resilience but also highlights its growing recognition as a legitimate player in the global crypto market. As institutional funds tracking the index gain exposure to Cardano, the stage is set for potentially increased interest and investment in ADA, further solidifying its position in the crypto market.

Also, this move signals the Cardano token’s potential bull run, a projection that is further bolstered by the crypto’s current positive performance. Now, all eyes are on the cryptocurrency’s bullish future, with the possible targets at $1 and beyond.

Cardano Re-Enters Hashdex Nasdaq

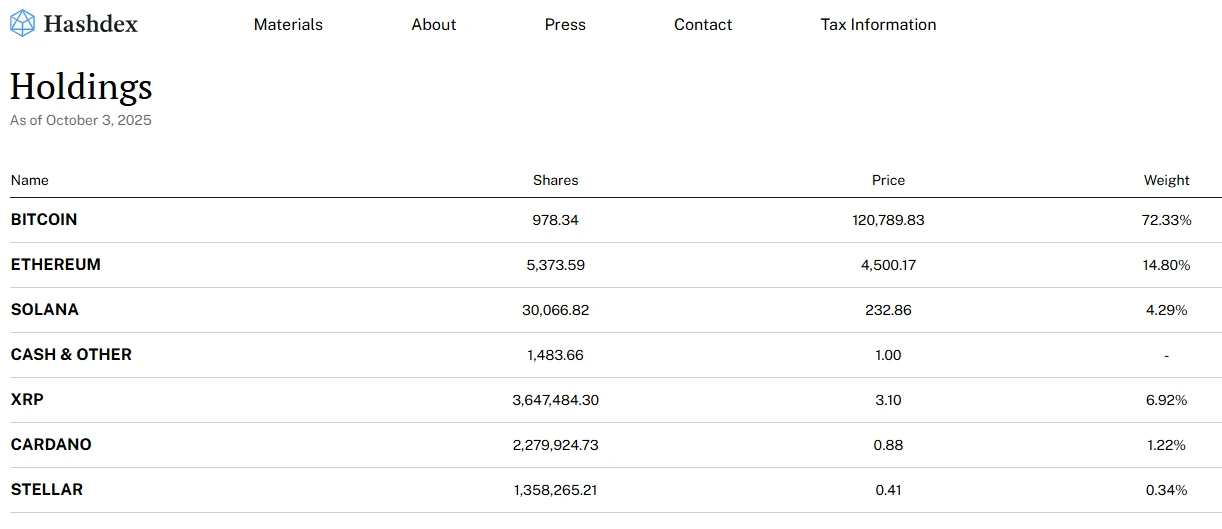

In the latest development within the Cardano ecosystem, ADA has rejoined the Hashdex Nasdaq Crypto Index US ETF. This marks a notable development that underscores growing institutional confidence in the token. With a 1.23% allocation, ADA trails behind Bitcoin and Ethereum, but outpaces tokens like LINK, XLM, and UNI. This ensures that institutional investors tracking the index have Cardano exposure. The development was revealed by Bloomberg reporter James Seyffart in an X post.

The asset manager has officially notified the SEC of Cardano’s inclusion in the Trust’s holdings, effective immediately, via a Form 8-K filing on October 1. With ADA’s addition to the Nasdaq Crypto Settlement Price Index, it will become an eligible asset under Nasdaq’s generic listing standards pending SEC approval. It is noteworthy that the move comes on the heels ofCharles Hoskinson addressing the blockchain’s fall.

Cardano’s eligibility under the generic listing standards paves the way for the potential approval of Grayscale’s ADA ETF. This is likely to be among the funds decided on by the SEC this month. Notably, ADA’s existing futures market on Coinbase already meets the requirements for approval under these standards, further supporting its prospects.

Bloomberg analyst Eric Balchunas believes the chances of approval for crypto ETFs meeting the generic listing standards are now 100%. This further bolsters the anticipation surrounding the potential approval and the subsequent launch of ADA ETFs.

Further, the US government shutdown has added complexity to the potential approval timeline, with Bloomberg analyst James Seyffart previously cautioning that a shutdown could disrupt the approval process.

ADA Price Eyes Key Levels

Currently, Cardano is experiencing a bullish trend, successfully recovering from the recent trends. At press time, the cryptocurrency is valued at $0.8878, up 3.5% in a day, $13.56 in a week, and 6.5% in a month. The trading volume is also up by a marginal 1.5%, highlighting the traders’ optimistic approach to ADA. With a market cap of $31.8 billion, the altcoin is ranked 10th on CoinMarketCap.

The crypto’s support levels are $0.83, aligning with the 20-EMA and 2.618 Fibonacci level, followed by $0.78 at the 3.618 Fibonacci level. A stronger support zone is expected around $0.75, coinciding with the 4.236 Fibonacci level, which could act as a potential floor.

The path to further gains is clear, with $0.88 acting as the initial resistance level that ADA needs to surpass. A successful break above this level could pave the way for a move toward $0.91, aligned with the 0.786 Fibonacci retracement, and potentially up to $0.95, the previous swing high. The converging EMAs suggest a potential bullish shift if ADA holds above $0.83.

According to CoinCodex’s prediction, ADA is poised to hit $1.2 in November 2025. Analysts like CryptoKing also reiterate this bullish perspective, but with an even more aggressive forecast. According to his prediction, ADA is likely to hit $2 in the near term.