Trader James Wynn Goes Long on Bitcoin with 40x Leverage

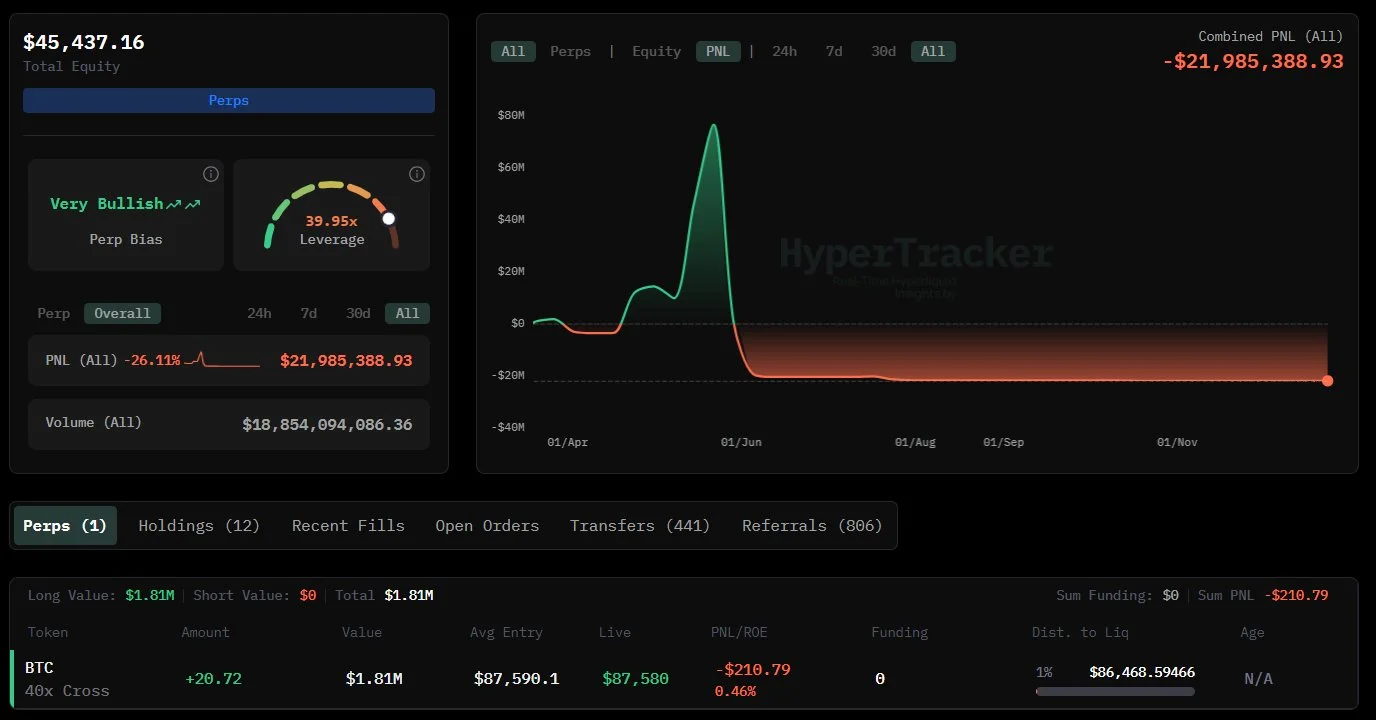

James Wynn, a high-profile crypto trader, always stands out for his unwavering confidence and unrelenting pursuit of profit. This seasoned trader, who is well-known for high-risk, high-reward strategies, has once again opened a 40x leveraged long position on Bitcoin.

With a recent track record that includes both impressive profits and notable losses, the latest Bitcoin move sparks attention. As the market continues to fluctuate, traders are keenly watching James Wynn’s moves to know if his Bitcoin bet pays off.

James Wynn Makes $1.82M Bet on Bitcoin

veteran trader James Wynn has unveiled a huge Bitcoin play, making a bold move. His latest move highlights his bullish stance on Bitcoin. According to an X post shared by Onchain Lens just minutes before, James Wynn has opened a long position on Bitcoin, worth $1.82 million, with 40x leverage.

Recently, James Wynn’s trading activity has garnered much attention, marking three separate transactions in the past 72 hours. These three moves were a mixture of success and failure, reflecting the unpredictable nature of crypto. His Bitcoin trades yielded a profit of $40,521, consisting of one long and one short position. However, his long position on PEPE didn’t pay off.

In the context of his previous trades, James Wynn’s latest Bitcoin bet indicates his confidence in the cryptocurrency’s potential surge. His use of 40x leverage amplified both potential gains and losses, making this a high-risk, high-reward strategy.

Will James Wynn’s Bitcoin Bet Pay Off?

Notably, James Wynn’s decision to go long on Bitcoin with 40x leverage could prove to be the perfect move if BTC price continues to surge. As of press time, BTC is valued at $87,690, down by 2.34% in a day. As the trader opened the position at $87,590, the position is currently at unrealized gains. If this positive momentum sustains and BTC continues to stay above this entry point, James Wynn could yield significant profits from his position.

Experts like Peter Brandt claim that the pioneer cryptocurrency is likely to continue its bearish trend until 2029. In his analysis, Brandt noted that BTC is currently on track that replicate its historical patterns. Reportedly, BTC had experienced five parabolic advances over the last 15 years, succeeded by at least 80% declines. This indicates that the crypto is likely to plummet further in this cycle, reaching a notable low of $25,000.

Given his recent profitable trades on BTC, it’s possible that James Wynn is executing a well-informed strategy. If the BTC price rises, Wynn’s leveraged bet could yield substantial returns, solidifying his position as a shrewd trader.

At the same time, Wynn’s bet is not without risks. The cryptocurrency market is notoriously volatile and unpredictable. With 40x leverage, even a small percentage move against his bet could result in substantial losses. Furthermore, Wynn’s previous $13.4 million loss on BTC trade and the recent $6,908 loss on PEPE long serve as a reminder that even experienced traders can go wrong on positions. As the market continues to fluctuate, it remains to be seen how Wynn’s bullish stance on the Bitcoin price will reward him.