Arthur Hayes Ramps Up ETH Accumulation Amid Altcoin Market Boom

Key Highlights:

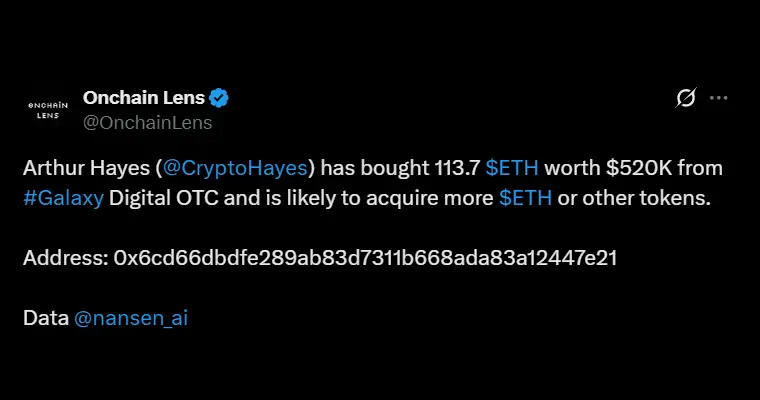

- Arthur Hayes buys 113.7 ETH worth $520,000 through Galaxy Digital OTC Desk.

- The purchase is in line with broader altcoin market rally hitting record-high weekly closes.

- Hayes accumulation pattern typically involves smooth moves, large OTC purchases that are timed with strong momentum.

Arthur Hayes, co-founder and former CEO of BitMEX, has recently bought 113.7 ETH. This purchase is worth $520,000, and has been carried out through an over-the-counter (OTC) trade with Galaxy Digital, a crypto-focused financial services company. From the looks of it, analysts believe that Hayes might keep adding to his holdings as this purchase has come during a positive period for crypto market and Ethereum as well. The price of the token has also been steadily rising over the past week, which is supported by large inflows into spot ETH ETFs. These ETFs inflows are seen as a sign that institutions are gaining confidence in Ethereum.

ETH Buoyed by ETF Inflows and Altcoin Rally

Ethereum ETFs have seen a big surge in inflows recently. From September 29 to October 3, 2025, Ethereum ETFs received about $1.3 billion, which reversed the outflows from previous weeks. This reversal also indicates an increased institutional interest in Ethereum as an investment.

These inflows helped push the price of the ETH token above the $4,000 mark. Leading ETFs that contributed to this trend include BlackRock’s ETHA and Fidelity’s FETH, with some single-day inflows exceeding $547 million. In total, Ethereum ETFs now manage about $30 billion, which is somewhere about 5.5% of Ethereum’s total circulating supply.

At the time of publication, the price of the token stands at $4,562.81 with an uptick of 0.3% in the last 24 hours as per CoinGecko.

Institutional buying has been a major factor behind Ethereum’s recent price rise. At the same time, the broader altcoin market hit its highest weekly close ever, increased by gains in Layer-1 networks and DeFi tokens. This overall market rally aligns with Arthur Hayes recent ETH purchase.

Fear & Greed Index Signal Strong Sentiment

Overall market sentiment is turning strongly positive. The Fear & Greed Index has also moved into the “Greed” zone. As of October 6, 2025, the Fear and Greed Index has hit 71, which indicates greed. This move from fear to greed indicates that the traders feel confident about the near-term price gains. However, high greed levels can sometimes warn of correction, in the early stages of a rally they often signal fresh money flowing in and keeping momentum strong.

Some experts believe that Arthur Hayes’ Ethereum purchase was influenced by several factors such as, rising ETF demand, better macroeconomic conditions, and strong on-chain signals. For example, ETH balances on exchanges have been dropping over the past two months, suggesting that large investors are buying and moving their coins into self-custody. Hayes’ move aligns closely with this trend of accumulation.

Galaxy Digital’s OTC Role and Strategic Positioning

Arthur Hayes used Galaxy Digital’s OTC desk for his Ethereum purchase, showing why wealthy investors and crypto veterans prefer this route. OTC (over-the-counter) trades usually make it easier to buy large amounts quietly without causing any price swings on public exchanges. They also let investors build their positions strategically without signalling their moves to the market right away.

Analysts that are tracking his wallets note patterns that suggest that he could expand into other altcoins, especially those gaining from recent jump in market value and the excitement around ETFs.

Arthur Hayes follows a strategic accumulation pattern that is built on macroeconomic timing, deep conviction in Ethereum and careful risk management. With a portfolio worth more than $16 million, heavily weighted towards Ethereum, Hayes times his buys around volatility, liquidity flows and policy shifts, while using OTC trades to quietly build large positions without moving markets. He concentrates on liquid assets like ETH, Layer-2 tokens and DeFi protocols, hedges risks with derivatives, and invests selectively in sectors with strong narratives such as scaling and real-world asset tokenization.

Also Read: Cardano Eyes $1 as ADA Returns To Hashdex Nasdaq Crypto ETF