Ethena Whale Dumps $26M ENA Amid Hyperliquid USDH Bid

Key Highlights:

- A major whale has deposited 39 million ENA tokens on Binance, signalling possible dumping activity.

- The whale’s average deposit price ranged from $0.64 to $0.82 per ENA token.

- Ethena has also emerged as the 6th contender in the competitive race for Hyperliquid’s USDH stablecoin issuance.

Ethena is making it to the headlines as large token deposits to Binance have raised concerns about possible selling pressure, while the project is also aiming to issue Hyperliquid’s USDH stablecoin. The project has entered as the sixth competitor in this space and it is trying to stand out with new promises that could change how users earn rewards and how platforms run their economies.

Whale Activity and Dumping Signals

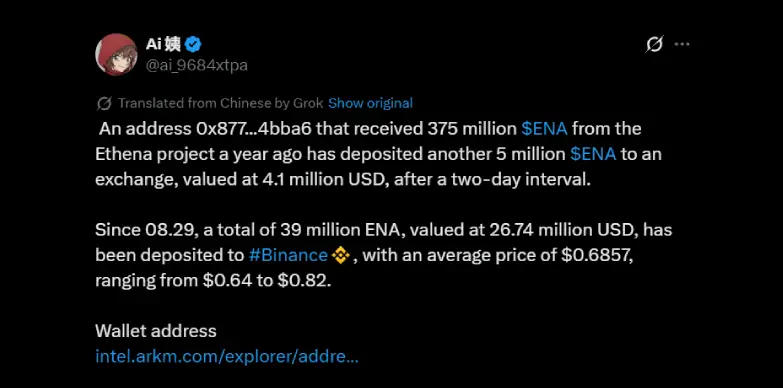

According to an X user, ai_9684xtpa, on-chain data shows that an Ethena-linked wallet, 0x877…4bba6, has sent another 5 million ENA to Binance in just the last two days. Since August 29, this wallet has managed to move a total of 39 million ENA, which is about $26.7 million in value. What stands out is that these transfers happened as the token’s price was climbing, from $0.64 up to $0.82, with an average deposit price of around $0.69.

This steady pattern of sending tokens to an exchange suggests one of Ethena’s biggest holders is adding sell pressure. In crypto, this behaviour is very common and is often seen as “dumping,” which means that the holder is selling off a large amount of tokens and is cutting back their position. Such moves have a short-term impact on the price of the tokens.

Market analysts and technical traders generally warn that such moves can cause distribution risk and as the large volumes when transferred to exchanges can increase volatility and tend to create short-lived resistance levels.

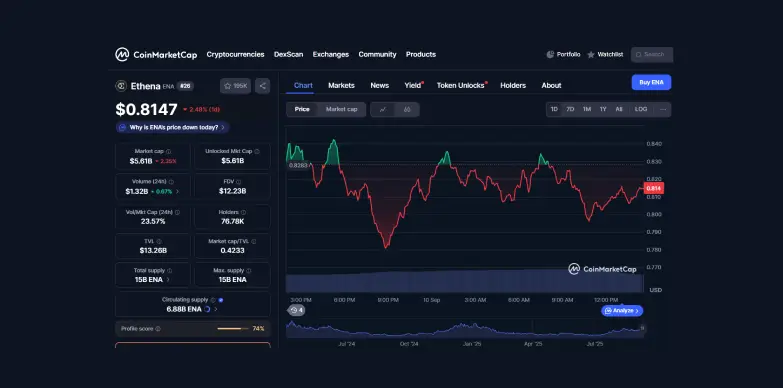

At press time, the price of the token stands at $0.8147 with a dip of 2.48% in the last 24 hours as per CoinMarketCap.

Ethena is only currently in the red for today. For the past week, it has shown clear signs of gains. Ethena over the last two months has surged more than 140% and pushed the RSI into the overbought territory. After this sharp run, it is normal for traders to get greedy and make profits, especially as the token neared the $1 barrier.

Moreover, since late August, large holders have shifted almost 80 million ENA, which is about 1.16% of the circulating supply, onto exchanges such as Binance. These moves usually point to potential selling, adding liquidity on the sell side. Simultaneously, Ethena’s $260 million buyback program is working in the opposite direction which is creating a tug-of-war between the supply and the demand. This back and forth is making ENA’s price swings more sharper.

Ethena’s USDH Stablecoin Bid

Ethena’s wallet news is now being overshadowed by its aggressive campaign to secure Hyperliquid’s USDH stablecoin mandate. The project has become the sixth official contender, along with Paxos, Frax, Agora, Native Markets, and Sky, all vying for control of a USDH supply that could unlock %5 billion in liquidity and significant DeFi revenues for the winner.

This proposal by Ethena offers 95% of reserve revenue to users, covers the cost of migration and commits at least $75 million in incentives. Ethena also plans to back USDH with USDtb via Anchorage, it also adds safeguards like a validator network and tokenized asset partnerships. Validators will vote on September 14.

Market Reaction and Outlook

This project has managed to gain dual headlines, whale selling concerns and stablecoin bid, which has created a unique moment for Ethena. While some worry about dumping risk, the others view Ethena’s push to issue the USDH stablecoin as a sign of a strong interest from big players in the DeFi space. The next few weeks will show if the big investors keep pushing the price down, or if Ethena’s stablecoin project helps it shine.

Also Read: OpenLedger Token Plunges 15% After 200% Jump on Debut