Redstone Skyrockets 80% After Upbit Listing, Euler Joins Bithumb

Key Highlights

- Upbit listed Redstone (RED) and the price of the token has surged by nearly 80%.

- Bithumb has announced listing Euler (EUL) with KRW trading pair.

- Both of these listings have increased DeFi token access for South Korean traders.

South Korea’s cryptocurrency market saw a great surge this week as Upbit and Bithumb made significant listing announcements that are supposed to expand local investor exposure to emerging DeFi tokens.

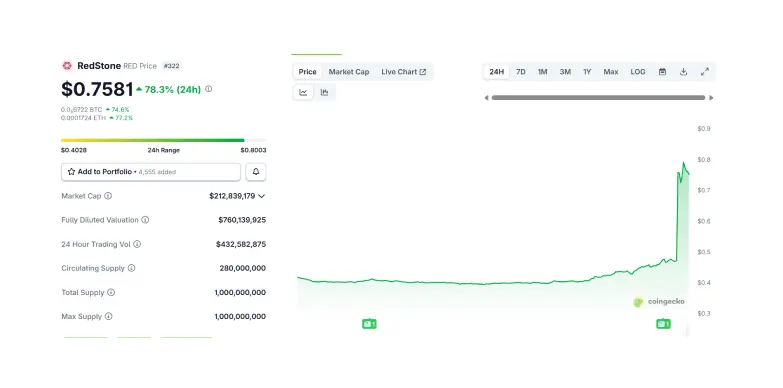

Upbit is the best cryptocurrency exchange in South Korea and it revealed today, September 5, 2025, that it will be listing Redstone (RED) against the Korean won (KRW). Right after the news broke, the token experienced a crazy market reaction. The token experienced a surge of almost 80% in the last 24 hours. At press time, the token has experienced a surge of 78.3% in the last 24 hours as per CoinGecko and the price of the token stands at $0.7581.

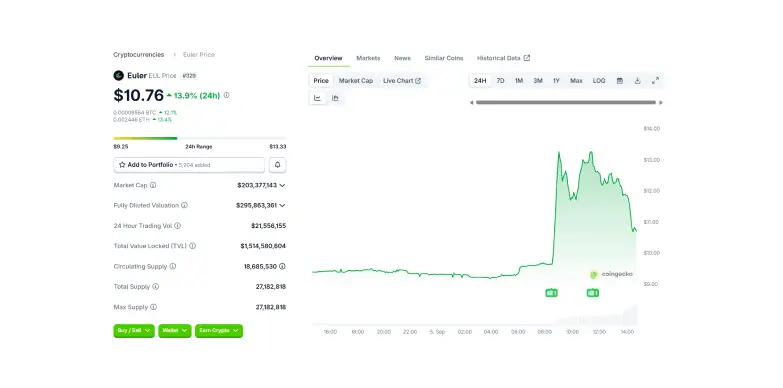

At the same time, Bithumb, which is South Korea’s second largest cryptocurrency exchange by trading volume, has also announced the addition of Euler Finance (EUL)/KRW trading pair. Euler is an Ethereum-based decentralized finance protocol that specializes in non-custodial lending and borrowing of digital assets. With direct fiat trading now available on Bithumb, EUL has become one of the DeFi tokens South Korean users can easily trade.

With this listing, the price of the token also saw an uptick of 13.9% in the last 24 hours and the price of the token stands at $10.76 as per CoinGecko.

This sudden increase in the price of the the token has put Redstone in the spotlight for local investors who are looking at blockchain infrastructure and DeFi services.

Redstone’s Role in DeFi Ecosystem

Redstone is one of the best known provider of oracle solutions and these solutions are tailored for decentralized finance. Oracle plays a critical role in blockchain ecosystems by serving as a bridge that is connecting on-chain smart contracts with off-chain data. Examples include price feeds for digital assets, commodities and other financial instruments.

Redstone is said to be different from older oracle providing services because it focuses on being flexible, low-cost and very easy to get used to or adapt. All of these properties make it simple for developers to add custom data to their dApps.

Redstone’s listing on Upbit boosts its reputation in Web3 and gives it more exposure in Asia’s one of the most busiest market.

The token’s nearly 80% price spike indicates that more than just listing-driven momentum, it signals investor recognition of the rising demand for scalable oracle services in the broader DeFi landscape.

Moreover, over the past few years, the so-called “Korea premium”, where asset prices trade higher domestically than on global markets, has highlighted the outsized impact of local trading behaviour. Redstone surge indicates the same concept, solidifying the notion that Korean exchanges can act as catalysts for liquidity and price recovery.

Euler’s Strategic Entry Into Korean Market

Euler Finance, the protocol behind EUL, is aiming to create sustainable on-chain lending markets. The protocol will be leveraging Ethereum’s infrastructure and will allow users to borrow and lend a wide range of assets in a non-custodial manner.

The project also focuses on using capital efficiency, managing risks, and staying decentralized, making it an alternative to lending platforms like Aave and Compound.

For the Korean investors, the Bithumb listing will make it easier to invest in a governance token that will help shape the project’s future. The KRW trading pair also removes the extra step of converting local currency into stablecoins or foreign assets, which will give both regular and big investor a simple access.

Read More: Pepe Coin Price Plummets: Is This the End?