Bitwise Files For Spot Chainlink ETF, Is $100 Mark Next?

Key Highlights:

- Bitwise Asset Management filed the first Spot Chainlink ETF with the U.S. SEC.

- The custody of the token will be with Coinbase.

- Chainlink has partnered with SBI Group (Japan) to increase RWA tokenization.

On August 26, 2025, Bitwise Asset Management filed S-1 with the U.S. Securities and Exchange Commission for a Spot Chainlink ETF. With this filing, Chainlink is also entering the spot ETF race. The cryptocurrency sector is witnessing a major shift for Chainlink (LINK), as institutional players are showing a great interest in both decentralized finance and traditional markets. Moreover, the project has also announced its partnership with Japanese financial giant, SBI Group that aims to advance cross-chain real-world assets (RWA) tokenization.

The Chainlink ETF will track the LINK token using the regulated CME CF Chainlink-Dollar Reference Rate, which will average trading data from various major exchanges. The custody of the tokens will be with Coinbase.

This filing has come at a time when regulatory approvals for crypto ETFs have expanded globally. The first spot Bitcoin ETFs saw record inflows earlier in 2024 and quickly Ethereum ETFs followed the same suit. This investment vehicle has opened doors for investors across other major infrastructure tokens.

If the Chainlink ETF is approved by the SEC, it could give both retail investors and institutional investors a simple, compliant exposure to LINK without actually holding the crypto.

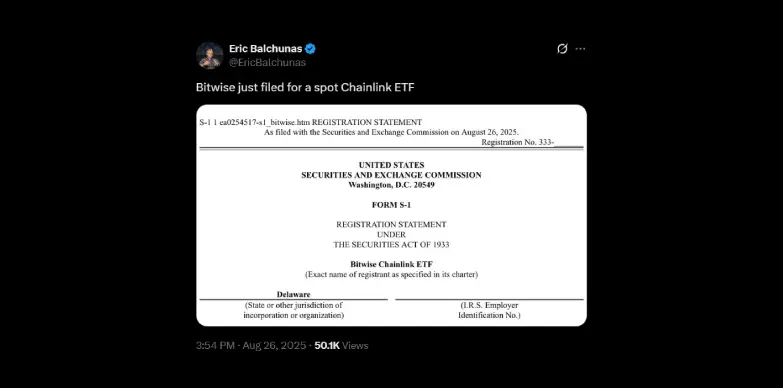

Bloomberg Analysts Speaks Up

According to the official documents, shared by Bloomberg ETF analyst, Eric Balchunas on X (formerly known as Twitter), Bitwise has submitted an S-1 registration form to launch an exchange-traded fund directly backed by Chainlink’s token LINK. The Bloomberg analyst also emphasized the significance of this move in his post. He stated “Pretty sure it’s the first one for chainlink, at least for a true blue spot Chainlink ETF as Tuttle did for a 2x chainlink under 40 act.”

Eric Balchunas mentioned Tuttle because it had filed for a leveraged Chainlink ETF (2x version) under a different set of rules (the 40 Act), which is not a straightforward spot ETF. This current move by Bitwise indicates that Chainlink is now getting serious consideration from mainstream institutional product providers.

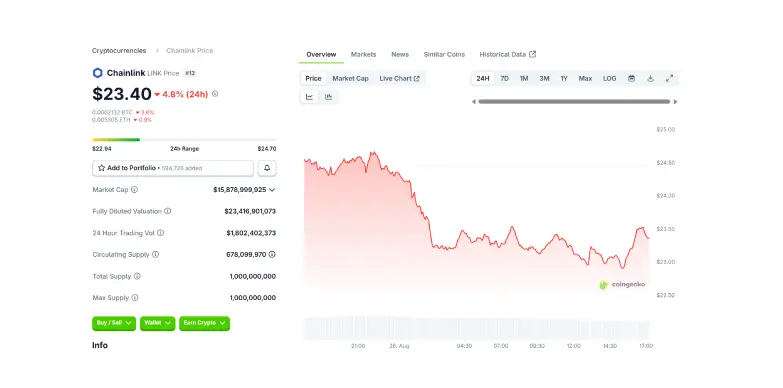

Chainlink Price Movement

As of now, the price of LINK stands at $23.40 with a dip of 4.8% in the last 24 hours as per CoinGecko. However, as this news broke, in the past hour, the price of the token has been up by 0.8%.

Chainlink Partners with SBI Group

Moreover, in parallel to the U.S. market development, Chainlink announced yesterday, August 25, 2025, that it has partnered with SBI Group to leverage the project’s Cross-Chain Interoperability Protocol (CCIP), Proof of Reserve, and Smart NAV (Net Asset Value) data services to tokenize and manage real world assets. These assets include real estate, bonds and stablecoins.

Also, along with these benefits, this partnership will support payment-versus-payment solutions for foreign exchange and cross-border settlement without having to rely on an intermediary “bridge currency.” Previously, Chainlink, SBI Digital Markets and UBS Asset Management worked under Singapore’s ‘Project Guardian’ to test blockchain for fund management and transfers. This new update indicates that there is a shift from small pilot trials to real, large-scale collaborations.

$LINK to Hit $100?

According to crypto analyst Ali, Chainlink might experience one more dip before it hits the $100 mark. This might indicate that the current dip is a short-term correction before the token experiences a rally towards $100 price level. This is in line with the current market development, where the first spot ETF for $LINK has been filed by Bitwise and a strategic partnership with the SBI Group.

Even though this price mark seems to be highly anticipated but whether this will happen or not, only time will tell.

While the SEC approval is still uncertain, and the implementation of RWA tokenization is still in its early stages, the alignment and technological momentum presents a promising future for Chainlink’s future.

Also Read: Ondo Finance (ONDO) Set for 10x Surge by 2026: Here’s Why