Kanye West Launches $YZY Token on Solana-Hype or Pump-and-Dump?

Key Highlights:

- Kanye West has launched a token that is tied to his brand Yeezy.

- The market cap of the token raised $3.2 billion initially and then dropped low.

- There are many missing pieces to this project and hence it has raised some red flags for the investors.

Kanye West, artist and entrepreneur who is now known as Ye, has launched $YZY token on Solana blockchain today August 21, 2025. This token is tied to his brand Yeezy and as soon as the token was launched, the market cap of the token surged to $3.2 billion in just a few hours.

However, the market cap plummeted down to $1.3 billion soon after. This sudden downfall has raised questions if Ye is really looking to bring in the blockchain revolution or is it just another celebrity-driven speculation?

A Carefully Structured Launch, or Just Controlled Centralization?

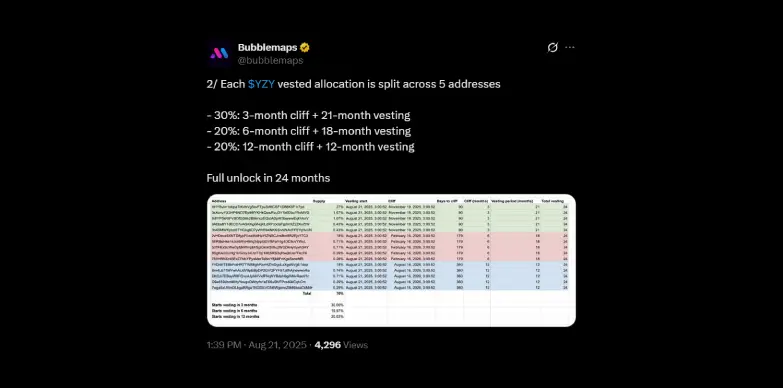

The $YZY token distribution has gained attention for both its transparency and controversy. According to the data visualized on Bubblemaps, the token distribution mirrors what is shown on Kanye West’s official site. According to Bubblemaps, each vested allocation is split across five addresses with tiered lock-up schedules:

- 30% with a 3-month cliff and 21 month vesting

- 20% with a 6-month cliff and 18 month vesting

- 20% with a 12-month cliff and 12 month vesting

This means that all the insider allocation will be fully unlocked within the next 24 months. Kanye West’s team is emphasizing that this structured roll out has been safeguarded against misuse.

However, on-chain data reveals that 90% of all $YZY tokens are held by just six wallets which has raised some eyebrows. This just indicates that there is heavy centralization with this distribution. In fact, 70% is locked under Yeezy Investments LLC, which technically, if you see, secures the supply but gives Kanye West’s entity full control.

Hype, Whales, and Windfalls

The trading frenzy following launch was explosive. At the token’s peak, it managed to surge 6,800% and reached $3.16 but then dropped down to $1.47. At press time, the price of the token stands at $1.15 with a downfall of 54.96% in the last 24 hours as per CoinMarketCap.

In this short window, one of the whales managed to make more than $6 million in profit according to blockchain trackers. This movement scared the retail investors and this move also reminded the retail investors of risks that are associated with such trades. Such moves are risky because early insiders may have benefited from privileged access or information.

Kanye West’s team attempted to curb bot-driven sniping during launch by deploying 25 contract addresses, only one of which was the actual $YZY token. While designed as an anti-bot defense, critics have noticed that insiders appeared to know which contract was the real one before the public did. This move, however, shook the confidence of the investors.

Building a “New Economy on Chain”

If you remove the trading volatility, Kanye West and his team are also pitching the token as a part of a broader economy under their brand. The platform has also introduced:

- Ye Pay, which is a crypto payment processor that promises 3.5% lower merchant fees. This move is set to position itself as a competitor to the traditional payment options.

- YZY Card, the team has also rolled out a debit-style solution that allows users to spend YZY or USDC globally without having to make any fiat conversions.

Yeezy’s online store will accept $YZY tokens for official merch, and Kanye West has been calling this as the start of a “new economy on-chain.”

Speculation vs Reality

While the idea sounds all great, many of the critics noted that the Ye Pay and YZY Card has no technical details and no delivery timelines explained. Moreover, no clear governance framework has been laid out yet for the token. The team also needs to define the voting rights, token use beyond merch and clarity around the regulatory hurdles. The irony here is that Kanye West has changed his own stance. A few months back he was the one who criticized celebrity tokens, saying that such tokens were hype designed to take advantage of the fans but now, he is doing the exact same thing.

Since there are many missing pieces in this project, the crypto community is suspecting that this could be another celebrity-fueled pump-and-dump scheme. Experts have advised caution because history has always reminded us that speculative frenzies often leave retail buyers holding steep losses. Whether $YZY matures into a legitimate ecosystem or fades like many of its celebrity-token predecessors remains an open question.

Also Read: StableStock Completes Incubation, Secures Seed Funding, Enters Beta