XRP Supply Shrinks as Investors Accumulate: Is This a Bullish Sign?

The XRP supply on exchanges has been declining steadily, with a notable drop in recent days. Over 149 million tokens have been found flowing out of centralised exchanges in a single day.

This unprecedented movement has sparked intense speculation among investors and analysts. As analysts track decreasing liquidity across XRP trading platforms, this sudden drop in exchange balances has significant implications.

With key events on the horizon, including the launch of multiple XRP ETFs, investor behaviour is largely aligned with accumulation strategies rather than short-term trading. As large XRP holders take firm positions and buying pressure builds, the decline in XRP supply on exchanges reflects strong conviction from investors who expect better performance in the coming months.

XRP Supply on Exchanges Dips; 149M Tokens Vanish in a Day

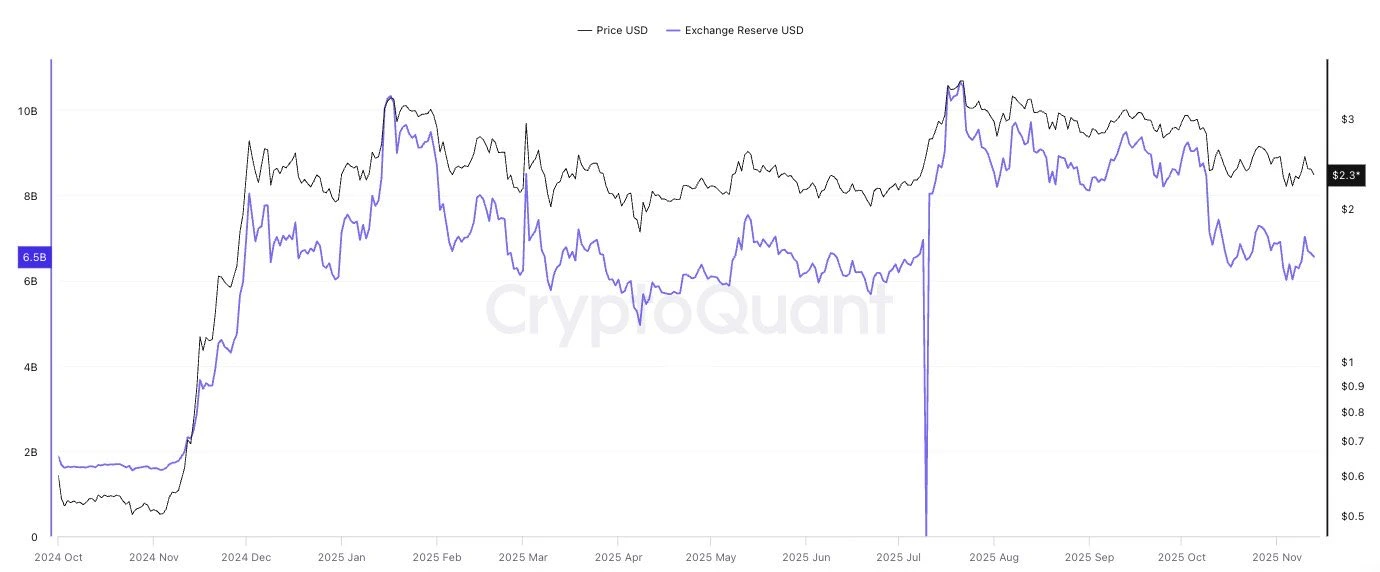

In a recent X post, market expert Pumpius shared a surprising development within the XRP ecosystem. According to his analysis, the XRP supply on exchanges has been collapsing over the recent days. This trend has become increasingly concerning as nearly 149 million tokens, worth $336 million, were removed in a single day.

This significant outflow has shaken the crypto space, with experts analysing the potential causes and consequences of this trend. While the community is closely watching to see what’s yet to come, the sheer scale of this withdrawal highlights the growing interest in the Ripple token among individual investors.

The chart highlights the sharp drop in XRP exchange reserves, with one of the largest single-day outflows. This indicates that traders are opting to secure their assets in long-term storage, reflecting confidence in XRP’s future price movements.

What Does This Reduced XRP Supply Mean?

This substantial reduction in the XRP supply signals a shift in market sentiment, where traders are seeking greater control over their assets. Many long-term holders are selecting private wallets to secure their funds, reducing the amount available for active trading.

This sentiment also highlights the Ripple community’s growing confidence in the cryptocurrency’s long-term potential. They believe that the altcoin could hit ambitious highs amid tighter supply. As more holders choose to self-custody, the market stabilizes, reducing the likelihood of sudden sell-offs.

Traders also expect reduced volatility and an enduring impact on the market. Large holders and whales are shaping the industry’s next phase through steady accumulation, potentially driving slow but consistent growth. This shift supports stronger fundamentals and creates a healthier supply structure for the upcoming months.

In addition, Canary Capital’s XRP ETF debut and anticipation of the upcoming Ripple fund launches have further contributed to the traders’ positive thoughts. Issuers like Franklin Templeton and Bitwise are expected to launch their ETFs in November.

How Will This Impact the XRP Price?

A dwindling exchange supply has historically been a precursor to significant price surges in major assets. If XRP spot ETFs successfully draw in institutional investments and exchange reserves continue to decline, the stage could be set for increased volatility and upward momentum. However, market experts caution that outflows alone don’t guarantee immediate price action.

As of now, XRP is trading in the red, taking a loss of 8% in a day. Currently priced at $2.25, the cryptocurrency has seen a 4.18% weekly surge despite a 9% monthly dip. The trading volume over the past 24 hours underscores the growing investor sentiment as it has surged by 31% to hit $7.7 billion.