Vanguard Prepares to Open Brokerage to Crypto ETFs

Key Highlights:

- Vanguard is preparing to allow access to third-party crypto ETFs on its brokerage platform.

- CEO Salim Ramji, who oversaw BlackRock’s Bitcoin ETF launch, is seen as an important person in this shift.

- Regulatory easing and strong client demand are driving this shift.

Vanguard, the world’s largest asset manager with more than $10 trillion in assets under management (AUM), is apparently preparing to allow cryptocurrency exchange-traded funds (ETFs) on its brokerage platform, according to a well-known crypto journalist, Eleanor Terrett. This move of entering the digital asset sector is important because Vanguard has been seen as one of the most resistant traditional investment firms on crypto exposure, but rising client demand and a friendlier regulatory environment seem to be changing the stance.

Vanguard Rethinking its Crypto Stance

If you look at the situation historically, Vanguard executives have openly expressed caution when it comes to digital assets. They have always pointed out the volatility, speculation, and weak fundamentals as long standing reasons to stay away from them.

The firm, known for its low-cost index funds, avoided the crypto trend even while competitors like BlackRock and Fidelity launched successful Bitcoin and Ethereum spot ETFs in 2024 and 2025. Vanguard’s leadership frequently emphasized a focus on “long-term value investing.” viewing crypto ETFs as outside the company’s core mission.

With this reported shift, Vanguard could also soon allow retail and institutional investors on its brokerage platform to purchase and hold crypto ETFs. This move could provide millions of Vanguard account holders with direct access to one of the largest-growing areas in the capital markets.

Drivers: Client Pressure and Market Shifts

The main factor behind this shift is a strong demand from Vanguard’s clients itself. Many investors, especially the younger generation who are tech savvy, have been asking for access to crypto ETFs through retirement accounts and regular brokerage plans. If the company ignores this huge demand, it might end up losing customers to its competitors.

The increased interest is directly reflected in record inflows into digital asset ETFs. For example, BlackRock’s iShares Bitcoin Trust (IBIT) has grown to over $80 billion since its launch back in January 2024, with net inflows exceeding $60 billion. Fidelity’s Wise Origin Bitcoin Fund has also drawn billions.

By staying out of this market, Vanguard risked losing investors to rivals. Vanguard’s new CEO, Salim Ramji, a former BlackRock executive who even led IBIT’s debut, has said the firm will not launch its own crypto ETFs but has not dismissed allowing access to third-party crypto products on its platform.

Shifting Regulatory Landscape

Another factor that is also driving Vanguard’s shift is the improving regulatory environment. U.S. regulators, including the SEC, are easing restrictions and introducing standards to simplify crypto ETF approvals, while global frameworks like the EU’s MiCA and Hong Kong’s retail ETF push add legitimacy. These changes reduce the reputational and legal risks that make the asset management company cautious. These shifts will in fact give the firm more confidence to explore crypto ETF access for investors.

Market and Community Reaction

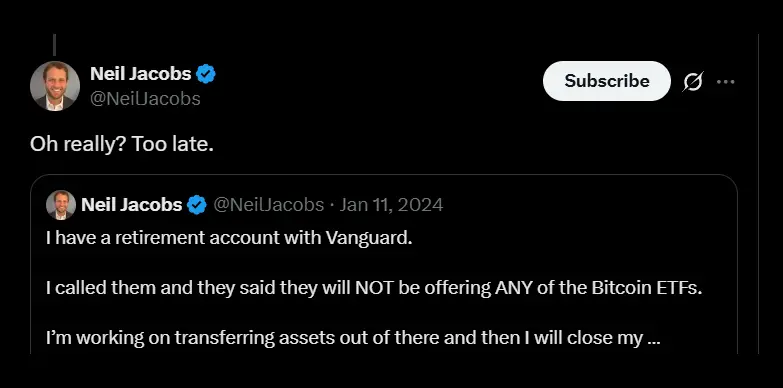

Vanguard’s potential entry into the crypto ETF market has sparked mixed reaction online. Some commentators like Niel Jacob, a Bitcoin marketing strategist and founder of FOMO21Shop, suggested that the firm might be late to the game, highlighting that rivals such as BlackRock and Fidelity have already captured the early momentum.

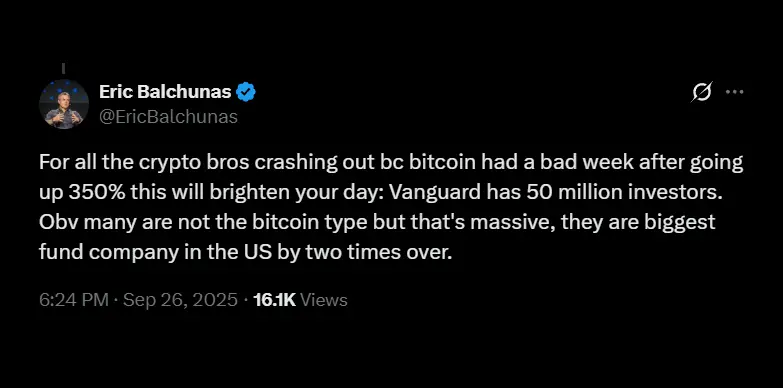

On the other hand, analysts like Eric Balchunas, a senior ETF analyst at Bloomberg, sees the move as strategic and potentially impactful.

In his X post, he pointed out that Vanguard’s CEO, Salim Ramji, helped launch BlackRock’s successful iShares Bitcoin Trust (IBIT) ETF, which gives him enough experience to guide Vanguard effectively. Balchunas adds that with Vanguard’s enormous client base of over 50 million investors which means that even with a recent “bad week” for Bitcoin after a 350% gain, the firm’s decision to allow crypto ETF access could drive massive adoption and validate digital assets.

Also Read: HyperVault Vanishes After $3.6M Drain, Rug Pull Fears Risk