FTX to Distribute $1.6B to Creditors on Sept 30, Not $5B

Key Highlights:

- FTX will distribute $1.6 billion to creditors today, September 30, 2025.

- Claims above $50,000 will recover 78.2% today with May payout included, while smaller claims under $50,000 will receive 120.5% exceeding their original balances.

- U.S. claims will receive an additional 40% payout in this round, pushing their total recovery rate close to 95%.

FTX, once a leading crypto exchange that went bankrupt in late 2022, is ready to distribute $1.6 billion to its creditors today, September 30, 2025. This payout is its third major round of repayment in its ongoing efforts to resolve one of the biggest bankruptcy cases in the crypto industry. The plan has been designed in such a way that it provides liquidity relief to creditors, which include both small retail investors and large institutional claimants as well.

Detailed Breakdown of the Distribution

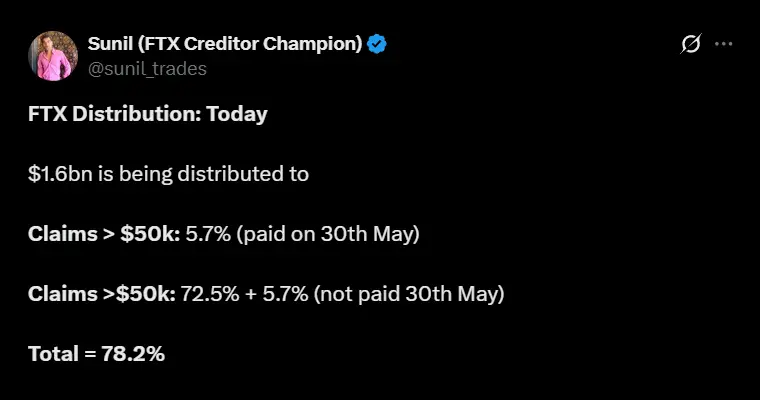

Sunil Kavuri, a well-known FTX creditor (also known as FTX Creditor Champion on X) explained the latest payout details in a social media post on X (formerly known as Twitter). In his tweet, he made it very clear that the distribution will be of $1.6 billion and not $5 billion as it is being rumoured to be. The creditor then moved on to provide a complete breakdown of the funds as below:

- Claims that were over $50,000 and were already paid on May 30 will get an additional 5.7% payout in this round.

- Claims over $50,000 will receive 72.5% in this round, adding to the prior 5.7% payout from May, totalling 78.2% recovery.

- Smaller claims that were under $50,000 and that were not paid before, will be reimbursed at a very high rate of 120.5%, which means that these creditors will receive more than their original claim.

- U.S. claims make about 40% of this distribution, raising their cumulative recovery to 95%.

All together, these numbers result in an overall recovery of 95% for the claims in this tranche.

The main reason for Sunil’s post is to clear up the confusion and set the record straight regarding the current payout which is of about $1.6 billion and not the incorrectly reported $5 billion. He wants the creditors and the public to understand the correct amount that is being distributed in this round.

Context of Bankruptcy and Recovery Process

FTX’s bankruptcy has been a long and complex legal process. Since its collapse in 2022, which was caused by liquidity problems and alleged mismanagement, the court-appointed FTX Recovery Trust, for selling off assets and returning funds to creditors. Since the incident, the trust has managed to carry out multiple rounds of distribution and has returned billions to its claimants.

The latest payout comes after recent court approvals, which includes a $1.9 billion reduction in disputed claims reserves. This freed up more funds to speed up creditor payments. Distributions are handled through verified service providers like Kraken, BitGo, and Payoneer, that will make sure that proper payments are made to the creditors who have completed the verification and onboarding processes.

Classes of Claims and Their Priorities

The payouts follow the usual bankruptcy rules, where bigger or more important claims get more priority and get paid first. Small retail claimants with less than $50,000 are getting a very good payout of over 120%, which can include interest or extra bonuses.

International creditors (creditors outside of the U.S.) are getting around 78%, including an extra of 6% for dotcom customers, those with accounts on FTX’s international site. U.S. creditors are getting a very strong 95%, due to special priority and settlement agreements.

General unsecured and digital asset loan creditors (two separate classes) will each receive a 24% payout in this round, which raises their cumulative recovery to around 85% and not 5%.

This third payment by FTX of $1.6 billion is a big step in efforts of returning money to the creditors and restoring confidence in the crypto market. While it may increase liquidity, some market swings can be expected as it will all depend on recipients if they decide to hold or sell their recovered assets.

Retail investors feel relief from the repayments but still remain frustrated by the long legal process and partial losses. However, legal and financial teams continue to work and recover more assets through ongoing litigation and negotiation.

Also Read: Crypto ETF Update: SEC Request 19b-4 Filing Withdrawal- What It Means?