Ethereum ICO-Whale Sparks Bullish Surge with $47M Buy

Key Highlights

- A major ICO-era ETH whale flips strategy.

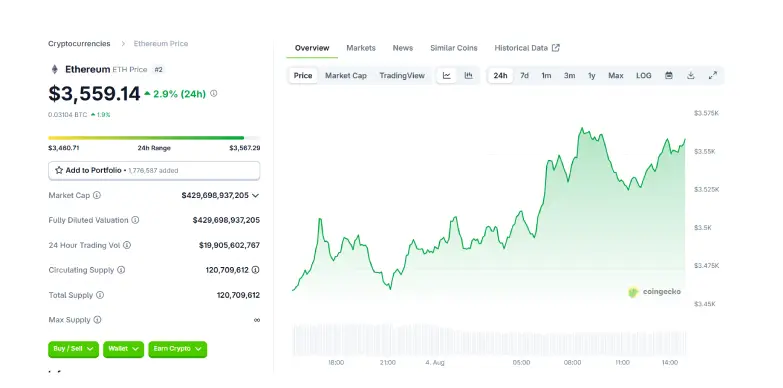

- Ethereum sees a 2.9% uptick as buzz builds.

- Timings suggests more than just coincidence.

Ethereum’s market is buzzing as an ICO-era whale is aggressively accumulating ETH. Over the past 24 hours, the token has also rallied 2.9%, according to CoinGecko, fuelling speculation that these two events are closely related as large holder activity usually increases price movements in the crypto market.

Accumulation of Ethereum by Whale Sparks Market Buzz

The recent accumulation of ETH by the ICO-era whale has been highlighted by blockchain analytics, market monitoring platforms and Ai Aunt on X (formerly known as Twitter). This accumulation was flagged after an ETH ICO whale (wallet address: 0x1C11BA15939E1C16eC7ca1678dF6160Ea2063Bc5), who after a full year of systematic selling, has moved on to aggressive buying. Over the past three weeks alone, this particular whale has withdrawn 13,600 ETH from various exchanges (which is worth around $47 million as per the recent market rates).

It is important to note that the timings are particularly striking as the whale executed their most recent withdrawal just minutes ahead of the latest market reports, securing Ethereum at an average price of approximately $3,456. This move can mean two things, either this could be a classic case of smart money positioning ahead of the broader market reaction or some very well-placed confidence.

Previously known for depositing assets onto the exchanges, at one point even sending 6,000 ETH to OKX, this whale now commands an on-chain wallet balance of 18.11K ETH, with holdings valued around $64.34 million by current prices. Holding a stash this massive does not just put this whale in the upper echelon of ETH whales but it also turns their every move into a market signal. When wallets of this size shifts, the entire crypto space notices and then follows the same path.

Price Surge: A Reflection of Whale Accumulation

As stated above, the price of Ethereum has rallied 2.9% in 24 hours to $3,559.14 as per CoinGecko. This rally could be attributed to overall market rhythms, multiple on-chain analytics and market sources support a direct correlation between whale accumulation and upward price pressure. Historically, when major whales start withdrawing ETH off exchanges in bulk, it’s not just noise but it is often a drumbeat before a rally. These moves have a knack for lining up with, or even front-running, sharp local price surges.

Historically, when ICO-era whales resurface with aggressive buying, it points towards a strong psychological signal across the market. This is something that is usually regarded as “smart money”. Their shift from years of net selling to fresh accumulation tends to increase confidence among retail and institutional players. For example, during late 2020 to early 2021, Ethereum’s bull run unfolded hand-in-hand with a spike in whale accumulation. On-chain data shows that mega whale wallets- those holding 10,000 ETH or more, increased their balances by around 4% between November and January. In the same window, ETH’s price shot from $460 to $1,220, marking a surge of 165% in just a few weeks. It was a textbook case of smart money leading the charge before the broader market could catch up with it.

Potential Risks

Whales are like double-edge sword in the crypto market. When they buy and stash Ethereum or any crypto token, the supply tightens, confidence increases and indicates a bullish momentum. However, when they start sending tokens back to exchanges, alarms go off. Just a few high-volume moves can trigger 10-15% drops in hours, spooking smaller investors and can also lead to full-blown sell-offs. Behaviour of whales is unpredictable and is usually driven by macro shifts or sentiment swings. That’s why it pays to stay alert and sharp as whale moves can make or break your position in a heartbeat.

Also Read: Innovation & Cybersecurity Meet at BFSI IT Summit Singapore 2025