Binance Alpha Confirms GriffinAI Hack, Steps Up To Help Users

Key Highlights:

- GriffinAI (GAIN) was hacked via a LayerZero cross-chain exploit, similar to the recent Yala attack.

- The attacker minted 5 billion unauthorized GAIN tokens and dumped them, causing 90% price cash.

- Binance is supporting the project’s post-mortem and compensation plan.

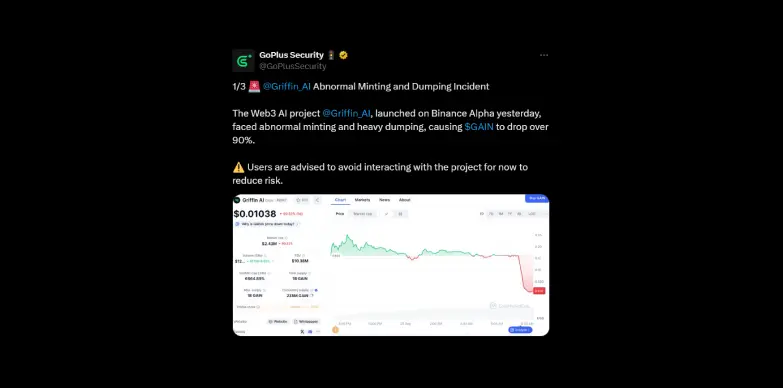

The Web3 AI project GriffinAI, which was launched on Binance Alpha just yesterday, September 24, 2025, has suffered a serious exploit that led to unusual token minting and a large-scale selling on the BNB Chain. Binance has confirmed the incident and said that it is taking necessary steps to protect the users while collaborating with the project team on recovery and the compensation.

What Happened to GriffinAI?

GriffinAI (GAIN) launched on Binance Alpha on September 24, 2025, with trading starting at 11:00 (UTC). Binance Alpha users could claim an airdrop of 800 GAIN tokens if they had at least 210 Alpha Points. However, within hours, the project saw extreme volatility and a sharp price drop and the token GAIN collapsed more than 90% after abnormal minting and heavy selling was observed.

According to blockchain security firm GoPlusSecurity, a staggering 5 billion GAIN tokens were minted and dumped, even though GAIN’s maximum supply was fixed at 1 billion. The compromised address, identified as 0xF3d173, had been continuously selling these tokens on-chain, which severely impacted the market price and trust in the project.

The Exploit: LayerZero Peer Manipulation

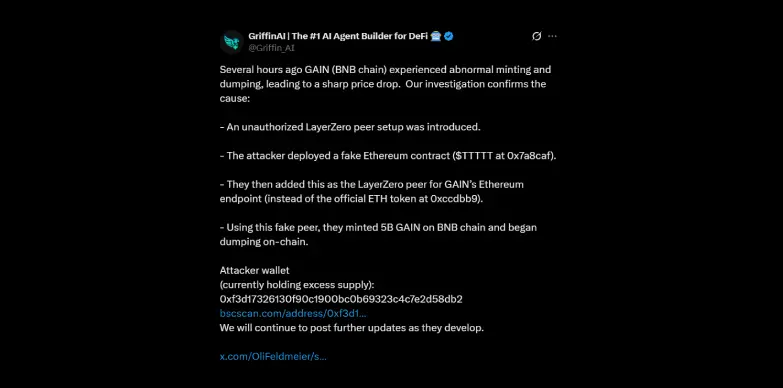

The GriffinAI exploit stemmed from a flaw in its cross-chain setup. Investigators found out that the attacker took advantage of the manipulated LayerZero peer configuration, which was similar to a recent Yala attack where similar unauthorized minting was carried out via manipulated cross-chain peers. The attacker added an unauthorized peer on Ethereum, then bypassed validation checks and was able to mint fake GAIN tokens, which inflated the token supply on the BNB Chain.

To be specific, the attacker used a newly created Ethereum token (TTTTT, address 0x7a8caf), and minted just 12 hours before the attack, so that it could easily impersonate GriffinAI’s official Ethereum address. This trick then allowed them to trigger the LayerZero bridge and mint 5 billion GAIN tokens illegitimately on BSC.

Security experts have suggested that the attack could have involved insider access or social engineering, which compromised the LayerZero configuration and enabled the exploit.

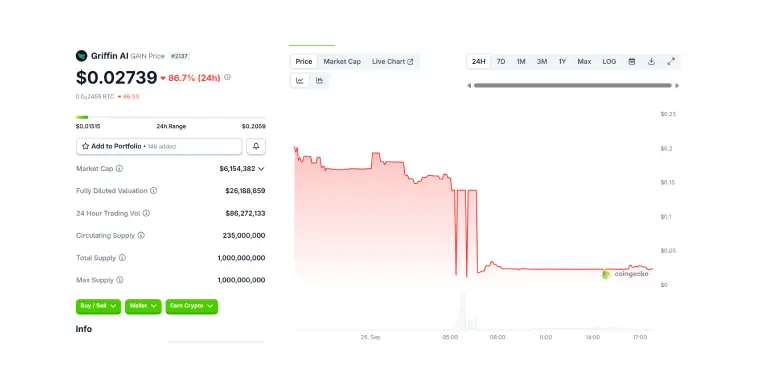

At press time, the price of the token stands at $0.02739 with drop of 86.7% in the last 24 hours as per CoinGecko.

Binance and GriffinAI’s Response

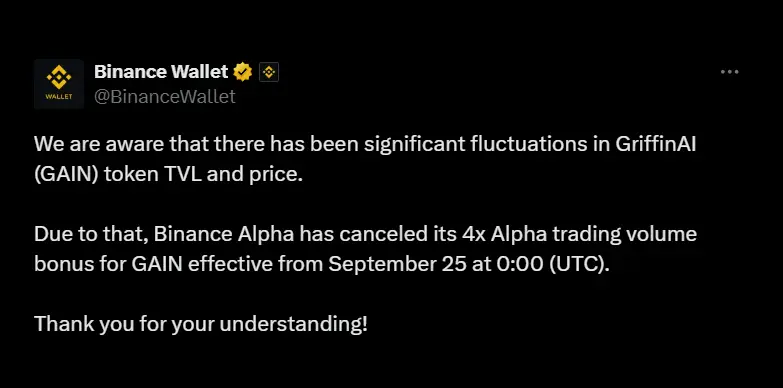

Binance confirmed the security breach in an official statement on X (formerly known as Twitter), saying that GriffinAI was hacked and its systems were exploited to create an excessive number of tokens. To protect Alpha users, Binance Alpha acted immediately, and implemented the following safety measures:

- Binance Alpha has cancelled its 4x Alpha trading volume bonus for GAIN, which has been effective from September 25, 2025 at 00:00 (UTC).

- The Binance team is in direct coordination with GriffinAI team to get to investigate the exploit.

- The Binance team will also be assisting with the project’s post-mortem review and compensating planning for the affected token holders.

The Griffin team on the other hand via its official account has stated that it has begun mitigation steps which includes removing official liquidity on BNB Chain to prevent any further losses. This move is a measure designed to protect remaining users from additional dumping by the attacker-controlled wallets.

Fallout and Risks for Users

The exploit has not only crashed GAIN’s price but it has also disrupted GriffinAI’s user base, hitting early investors and Binance Alpha participants who claimed the first airdrop the hardest. Binance has also warned users to be careful and avoid interacting with the contract for now. With this incident security experts highlight the risks of cross-chain protocols like LayerZero, which, while meant to improve liquidity and connectivity, can become highly vulnerable if misconfigured or accessed by malicious insiders.

Also Read: Asia-Pacific Leads Crypto Boom as Regulators Struggle to Keep Up