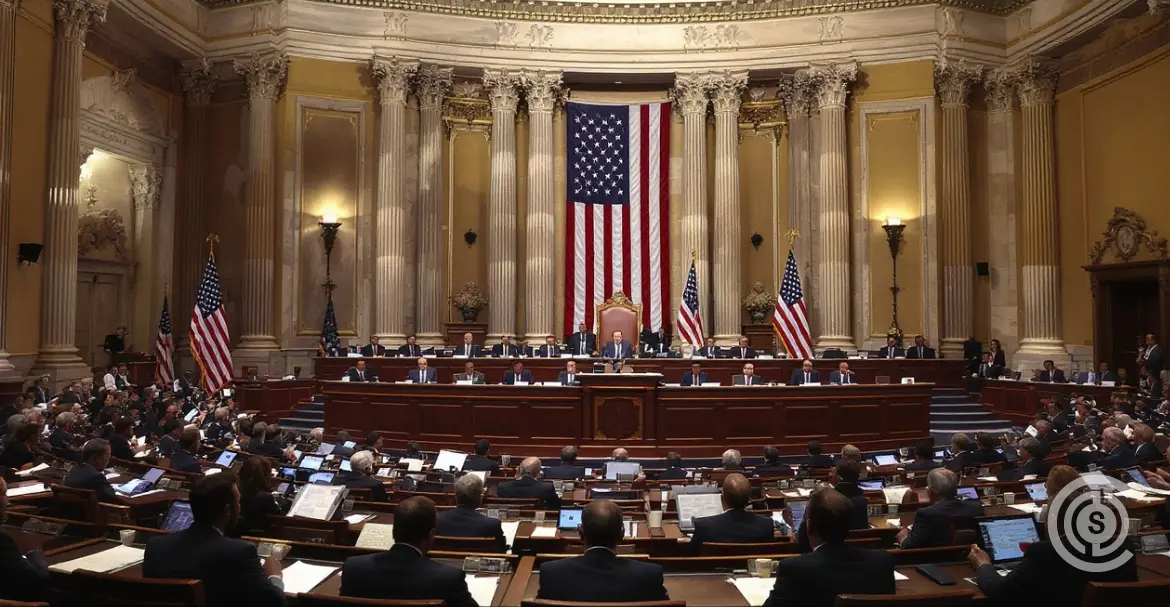

US Senate to Reopen Government: What It Means for Crypto Market?

After weeks of uncertainty and gridlock, the US Senate has finally taken a crucial step towards ending the longest government shutdown in American history. The long-awaited development has sent shockwaves through the industry, with prices surging on this latest development of renewed stability in Washington.

On Sunday night, the senators voted to invoke cloture on a bipartisan funding measure, setting the stage for the government to reopen by the end of the week. As the government prepares to resume its operations, the crypto market is bracing for a potential surge in activity from regulatory agencies, including the SEC and CFTC.

US Government Shutdown Ends This Week

Reportedly, the US Senate has approved a bipartisan deal to end the 40-day government shutdown after a group of Democrats joined Republicans in voting for the agreement, which will fund the government through January.

Notably, the deal still faces several hurdles, including a House of Representatives vote, before the government can reopen. However, the Senate’s approval is a crucial step after 40 days of deadlock, with further debate set to resume on Monday. Senate Majority Leader John Thune stated,

“I’m thankful to be able to say we have senators, both Democrats and Republicans, who are eager to get to work to address that crisis in a bipartisan way. We also have a president who is willing to sit down and get to work on this issue. So I’m looking forward to seeing what solutions might be brought forward.”

The US government shutdown, which began on October 1, has resulted in widespread disruptions to various services. About 1.4 million federal employees are currently working without pay or have been furloughed.

Crypto Market Rebounds Post Senate Vote

Driven by this major development, the crypto market has seen a significant rebound, with top cryptocurrencies experiencing notable gains. The market has reached $3.58 trillion, up 3.56%, marking a significant recovery from the October crash losses.

XRP is one of the top gainers, which exhibited a massive 12% surge over the past 24 hours. Other major players like Bitcoin, Ethereum, BNB, and Solana have also seen notable upticks of 2.9%, 3.3%, 1.5%, and 5.3%, respectively. This overall positive trend has sparked a renewed wave of optimism and hope as the community has been battered by weeks of uncertainty and anxiety.

How Will This Development Impact the Crypto Industry?

In a recent X post, Fox Business journalist Eleanor Terrett shared insights on the US government reopening’s impact on the crypto industry. As noted in the Crypto in America post, the SEC is poised to ramp up its activity with the government reopening, potentially leading to key decisions on ETF approvals, crypto regulations, and innovative exemptions. This renewed momentum is also expected to spur action from the CFTC, OCC, and other agencies overseeing the crypto space.

The Senate Agricultural Committee can now schedule a confirmation hearing for Mike Selig, the nominee to lead the CFTC, replacing Acting Chair Caroline Pham. It also clears the way for the Senate Banking and Agricultural Committees to potentially advance their market structure bills. However, with limited legislative days left before Thanksgiving, markups are likely to be pushed to December, pending the release of draft texts.

Crypto Calendar: Key Events to Watch This Week

As highlighted in the post, several key events are scheduled in the coming days. The Chicago Board Options Exchange (CBOE) plans to launch perpetual Bitcoin and Ethereum futures contracts on Monday, offering continuous market exposure. This coincides with Cantor Fitzgerald’s Crypto and AI/Energy Infrastructure Conference in Miami, featuring notable speakers like Eric Trump and the Winklevoss twins.

On Tuesday, Mining Disrupt, a major Bitcoin mining conference, kicks off in Dallas, Texas. Fed Governor Christopher Waller will discuss payments at the Federal Reserve Bank of Philadelphia’s Fintech Conference on Wednesday.

If Nasdaq gives the green light, Canary Capital’s XRP spot ETF could potentially start trading on Thursday at 9:30 AM ET. If launched, it comes following the debut of REX-Osprey’s XRP ETF.

Meanwhile, John Deaton, a former US Senate candidate, will make a special announcement in Worcester, MA, on Monday.